Welcome to Game Trading Cards Insider – FREE Version. We use Moneyball tactics to discover undervalued, mispriced, and hidden gems across the world of Game Trading Cards.

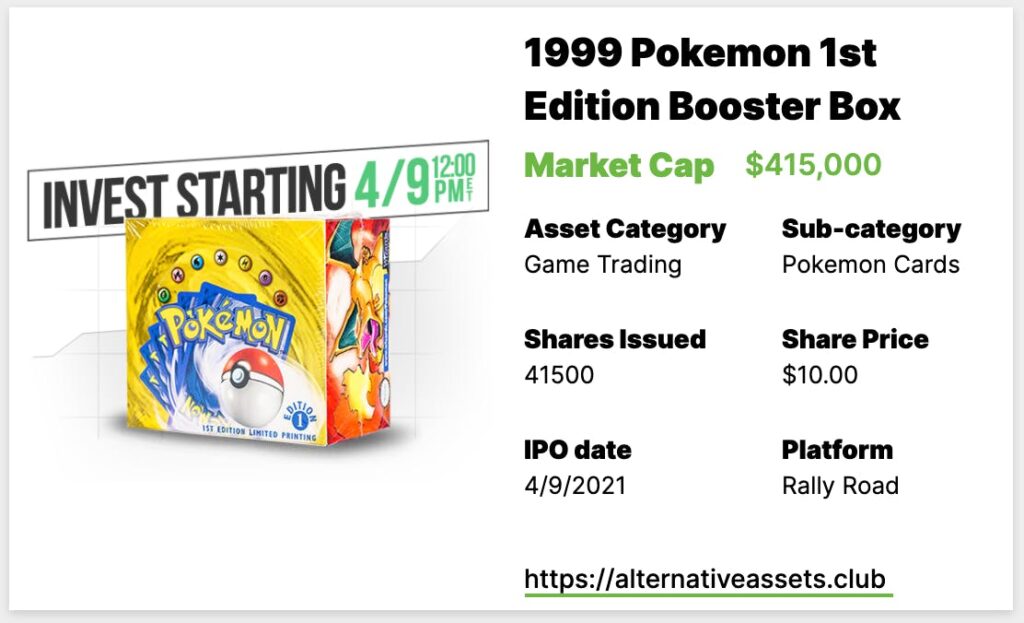

This week Adam’s done a deep dive into the 1999 Pokemon 1st Edition Booster Box that will IPO on Rally 9th April 2021 at noon EST.

Table of Contents

What is the 1999 Pokemon 1st Edition Booster Box?

This is a sealed, Pokemon 1st Edition Booster Box, originally released in 1999. It was the first edition of the base set for the Pokemon trading card game (TCG) and includes 36 packs of 11 cards each. Be aware when doing your own research that there is a 1st edition base set and an unlimited base set with the former being considerably more valuable.

The complete set is 102 cards (with a 103rd variant Pikachu card) with 16 rare holo variants, including the most valuable card in the set, the Charizard #4, which I wrote about here. The second most valuable card in the set is the Blastoise #2, which I wrote about here.

Rally purchased this specific box for $385,000 on January 27th.

The Pokemon 1st Edition Booster Box will IPO at Rally Road on Friday, April 9th at noon EST for $415k.

Add IPO to calendar

Cultural Relevance

We’ve covered the enduring popularity of Pokemon and the TCG in our previous writeups here and here. The First Edition Base Set is far and away the rarest and most valuable set, mostly because of the Charizard card, but some of the secondary holos sell in the five figures at the highest grades. I’ve used this analogy before, but if the Charizard is the Pokemon equivalent of the 1986 Fleer Michael Jordan, this sealed box is the equivalent of the sealed 1986 Fleer Boxes that have IPO’d on Rally and Collectable.

Inferred Value

[Detailed Valuation available to Insiders]

Category Strength

The game trading cards category has returned 80% ROI so far across the entire portfolio.

Subcategory Strength

Risk Profile

Asset Growth TTM

Growth Outlook and Future Catalysts

The value of the box is tied to two things — the value of the cards held within and the scarcity of the box itself. The value of the Charizard is going to be the main driver and any auction results for that card will tell a lot about the value of the box (just like the value of the Fleer 1986 box moves in lockstep with the value of the Jordan card). The box itself is more scarce than the later expansions and if people start to break them open, the remaining unsealed boxes could become that much more desirable.

Notably, there’s an auction scheduled in July at Heritage that will coincide very nicely with the end of the 90 day lockup period for this IPO and give a good gauge of the market value going into the first trading window.

Asset Liquidity

This will have a roughly 90 day lockup period then will trade quarterly.

Platform Risk

Intangibles

It’s a lottery ticket — a complete set graded PSA 10 already IPO’d on Rally and trades at a value of $600,000 and another one is scheduled to IPO in the future at that same $600,000 figure. There are enough cards in the box for three complete sets. Of course, if someone were to break open this box, the odds that the cards are PSA 10 are not high — of the 3051 Charizards that have been graded by PSA, only 122 (4%) have been graded PSA 10. The uncertainty of what’s in the box brings an element of excitement.

If you can bear all the cringe, spend 100 minutes watching Logan Paul open a box to get a feel for what the cards’ condition is likely to be.

Due Diligence Service

If you’re looking to make a big asset investment, we can help you perform due diligence. Stefan created and runs Flippa’s Due Diligence program, and can offer the same service to you.

Subscription Options

Start your free trial of Insider.

Deep research and investment insights, now on thirteen alternative asset classes.