Welcome to Sports Cards Insider – FREE Version. We use Moneyball tactics to discover undervalued, mispriced, and hidden gems in Fractional Investing.

Today is a deep dive into two very similar assets:

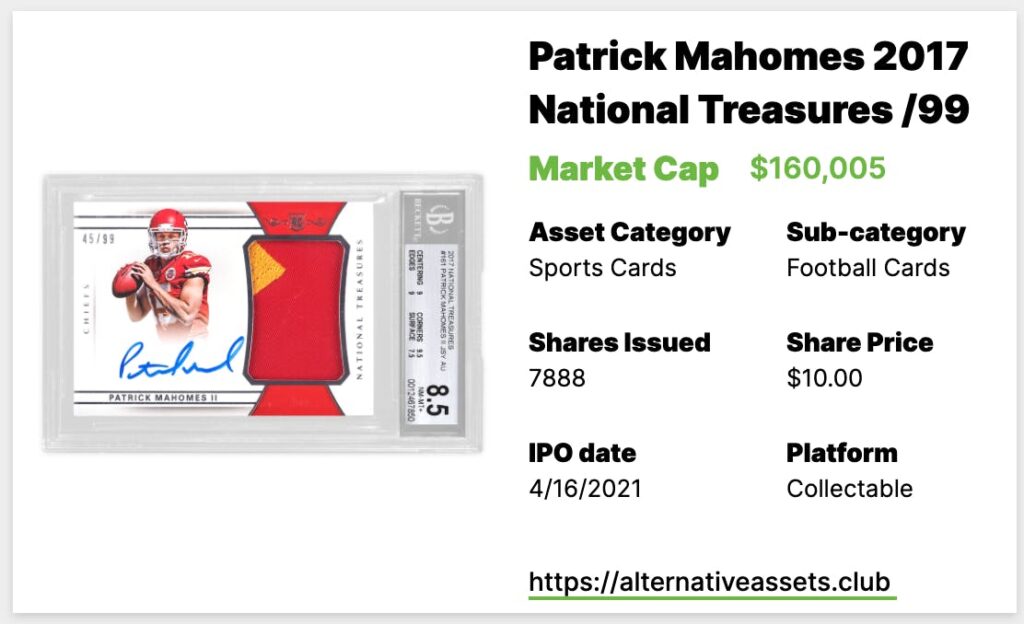

- Patrick Mahomes 2017 National Treasures /99 RPA BGS 8.5 – IPOs 16th April on Collectable

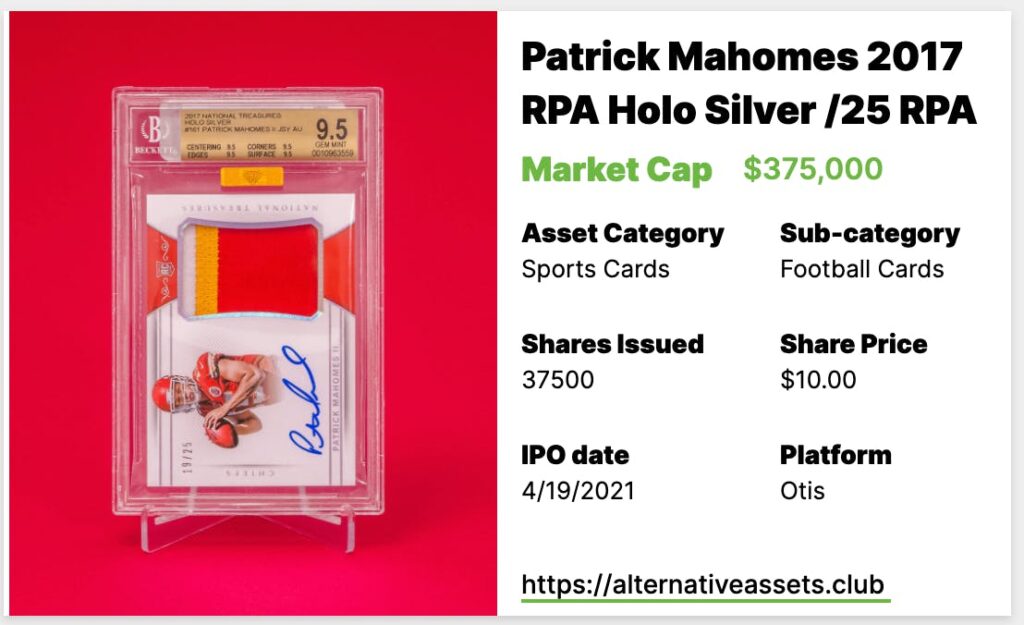

- Patrick Mahomes 2017 National Treasures Holo Silver /25 RPA BGS 9.5 – IPOs 19th April on Otis

Table of Contents

What is the Patrick Mahomes 2017 National Treasures /99 RPA BGS 8.5?

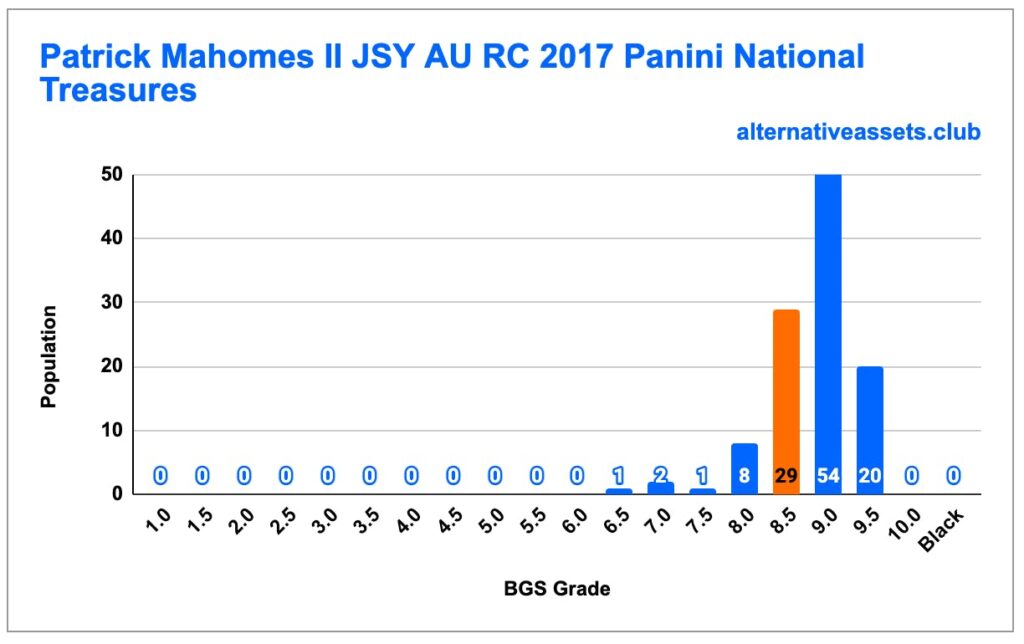

This is a limited run /99 rookie card for Patrick Mahomes II. Graded 8.5, it’s on the lower end of the spectrum for these cards, though it’s impossible to say just how low.

There are 115 cards registered with BGS, which means that several, perhaps dozens, of the numbers there are duplicates. Sometimes someone will submit a card for grading, get it back, and be unhappy with the result. They’ll then resubmit the card hoping for a higher grade. Unfortunately, that results in double (or triple, etc) counting of cards. There are also 21 at PSA, so…lots of double counting.

It IPOs on Collectable 16th April for $160k with $81,125 retained equity (50.7%). Note: based on the shares available, the share price, and the retained equity, the total market cap actually comes to $160,005. Not sure what’s going to happen to the extra fiver.

Add IPO to calendar

Cultural Relevance

You can read about Mahomes here. We covered him when Rally Rd IPO’ed a (/5) of these cards 5th March 2021 for $300k.

Inferred Value – < $150k

[Detailed Valuation Available to Insiders Only]

Category Strength

The sports cards category returned a 60% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Recent Growth Trend

Growth Outlook and Future Catalysts

While Mahomes obviously suffered a bit of a setback this year, he’s well on his way to being the best quarterback of his generation. He has a lot of room to run.

Asset Liquidity

This will have a roughly 90 day lockup period then will trade daily.

Platform Risk

Intangibles

Too much retained equity…

What is the Patrick Mahomes 2017 National Treasures Holo Silver /25 RPA BGS 9.5?

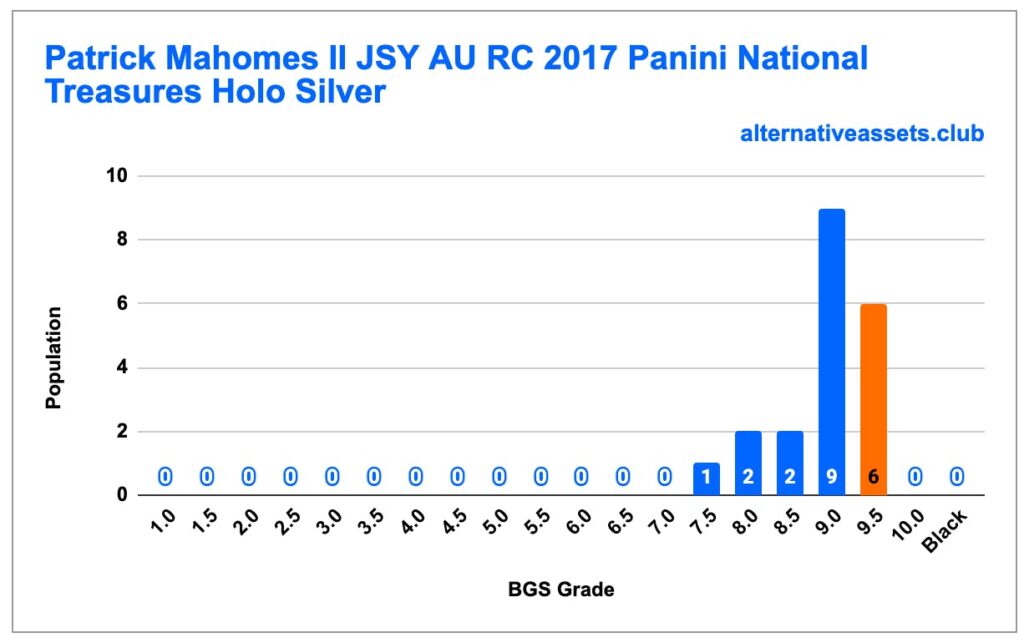

From the same series as the card above, this is a limited run /25 Patrick Mahomes rookie card featuring his autograph and a patch of jersey. In terms of both grades and scarcity, it’s a superior card to the one above.

Graded 9.5, there are none higher even within subgrades.

It IPOs on Otis at noon 19th April 2021 for $375k and will have no retained equity.

Add IPO to calendar

Cultural Relevance

See above

Inferred Value – $250k to $350k

[Detailed Valuation Available to Insiders Only]

Category Strength

The sports cards category returned a 60% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Recent Growth Trend

Growth Outlook and Future Catalysts

While Mahomes obviously suffered a bit of a setback this year, he’s well on his way to being the best quarterback of his generation. He has a lot of room to run.

Asset Liquidity

This will have a roughly 30 day lockup period then will trade daily.

Platform Risk

Intangibles

During his rookie season, Mahomes II and his girlfriend were robbed at gunpoint, and his wallet was stolen. The culprit got 12 years on jail. The suspect, Michael Pinkerton, didn’t know who he was robbing. Bad luck, that.

Due Diligence Service

If you’re looking to make a big asset investment, we can help you perform due diligence. Stefan created and run Flippa’s Due Diligence program, and can offer the same service to you.

Enquire about Due Diligence Packages

Start your free trial of Insider.

Deep research and investment insights, now on thirteen alternative asset classes.