Welcome to Cultural Assets Insider for March 16th, 2022 – FREE Edition.

Each week we give you the scoop on undervalued, mispriced and hidden gems in Alternative Investing.

Table of Contents

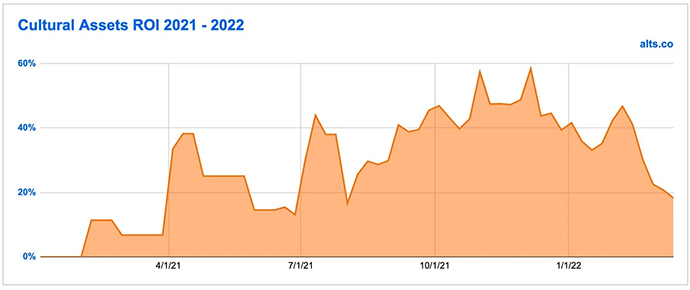

Cultural Assets performance in 2022

Cultural assets continue their slide down through 2022, after a strong 2021. The rate of decline looks to be slowing as the category tries to hold onto gains from 2021.

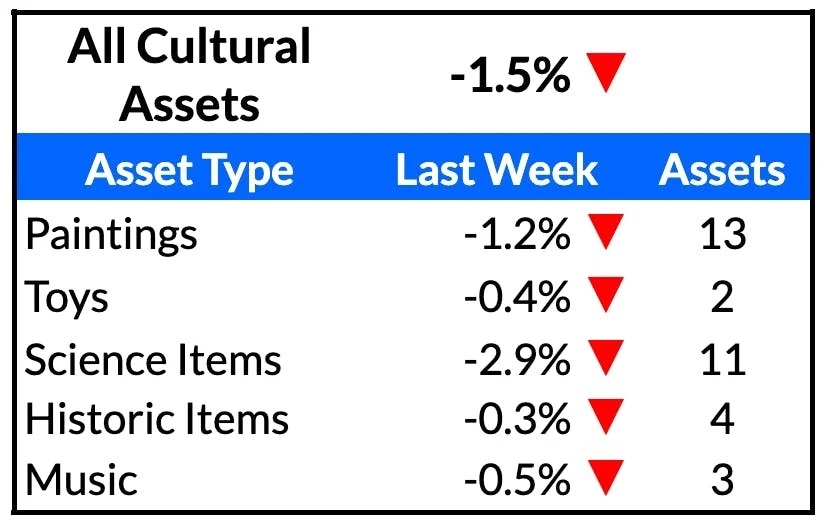

Last Week in Cultural Assets

Fractional secondary markets

Last week I said the market was looking to capitulate. I got that wrong. The slide continued across the board, though we’re *probably* near a bottom.

Auctions

Over the weekend, Heritage realized several stunning results in their vintage vinyl auction. The average hammer price was over 40% above estimates, and our top ten picks went for over 70% more than their most recent sale.

The vinyl market is volcanic right now, and it’s only going to get hotter.

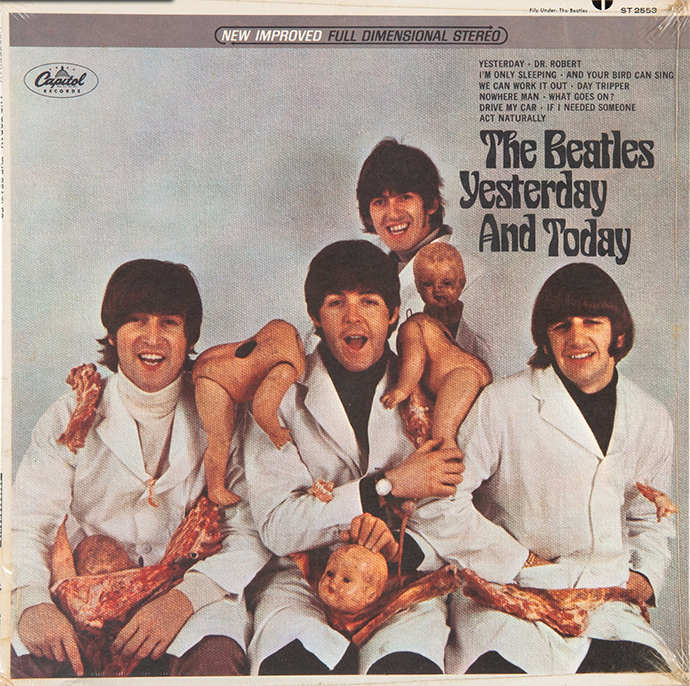

The big winner was a sealed copy of a vinyl grail, the Beatles’ Butcher album, which hammered for $112,500. It’s unclear whether the fab four were protesting Vietnam or their label, Capital records, which they’d previously said were butchering their albums. Either way, it freaked people out, and they quickly replaced the cover with a far tamer shot of the chaps stood around a bunch of suitcases (the trunk cover).

Five of the top seven sales at the auction were Beatles albums – a pretty clear sign where investors see blue-chip albums at the moment.

Four different Beatles albums went for more than $10k, proving that albums need not be sealed still to be valuable. But my favorite loose LP is this beauty from Bob Dylan, which sold for $10k.

Albums as art make such a compelling case for collecting vinyl. Beyond the claims that vinyl sounds better than Spotify (which they can), it’s hard to argue that we don’t lose something without the tactile and aesthetic experiences vinyl convey.

David Bowie’s The Man Who Sold the World is stunning as well.

Watch this space. Vinyl is about to explode.

This Week in Cultural Assets

Fractional IPOs

Just the one fractional IPO this week:

‘49 NIKON ONE CAMERA

- Market Cap: $28k

- Inferred Value: $21k

- Drop Details: 3/16/22 on Rally

- Our view: [INSIDERS ONLY]

At Auction

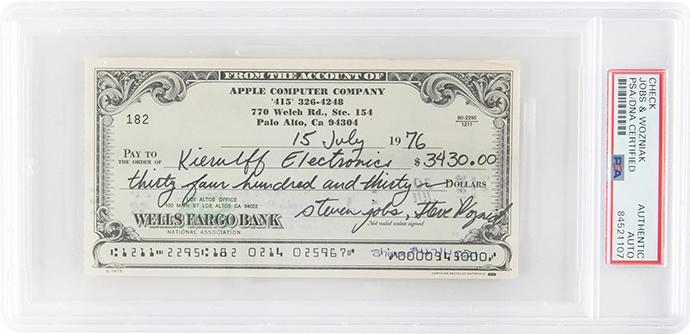

RRAuctions doesn’t disappoint this week as they bring us a trunkful of Apple/Steve Jobs/Atari collectibles, including the Jobs/Wozniak signed check above.

The big winner so far, though, is a half-assed job application from Steve Jobs to Atari from 1973. Have a look at this and tell me (with a straight face) how much harder our parents had to work.

It’s currently at $81k. RR Auctions gives us this scathing anecdote from Jobs’s time at Atari:

Now employed at Atari, Jobs put his technical skills to work while relying on the help of his friend Steve Wozniak. Jobs famously farmed out the engineering of the ‘Breakout’ prototype to Woz, who implemented several innovative cost-savings circuit designs-earning a $5000 bonus for Jobs, who reportedly kept it a secret.

Nice guy.

The winning bid also gets an NFT of the application.

One item to note for the fractional investors here is a Steve Jobs signed copy of Macworld #1.

There’s a similar copy on Rally right now with a market cap of $225k, though it also includes a signature from Woz. Current bid is $54,545.

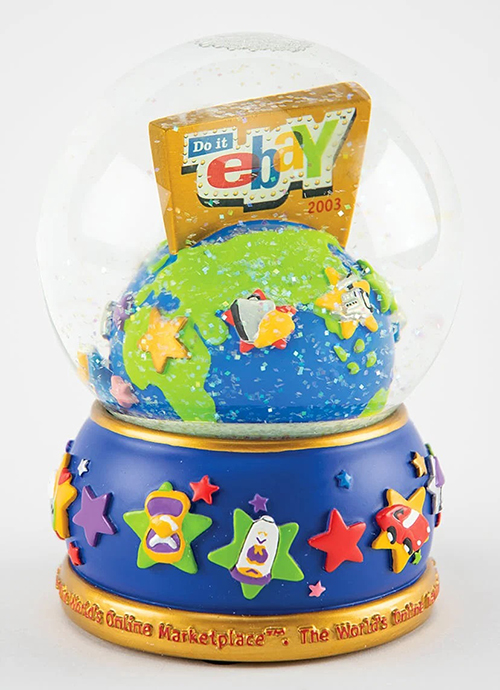

My favorite item from the auction is this eBay snow globe signed by Meg Whitman. Because why not.