Let’s drink wine (while we can)

Why the public doesn’t care about contemporary art anymore, Another triumph for women’s sports, Something to wine about India’s ticking time bomb, & More.

Why the public doesn’t care about contemporary art anymore, Another triumph for women’s sports, Something to wine about India’s ticking time bomb, & More.

Today we’re doing an issue on Vinovest: A wine investing platform I personally use and love.

A changing climate will affect the wine industry within our lifetimes. Industry leaders weigh in on what the biggest issue in wine means for production and investing.

Today’s Alts Cafe covers the last of 2022’s first half, bullish and bearish crypto insights, the housing market, our NFTs index, venture funds, and so much more!

Today’s a dive into wine fractional secondary markets, auctions, wine assets dropping this week, a podcast of Anthony Zhang (CEO of Vinovest), and so much more!

Today, we’ve got a packed issue for you.

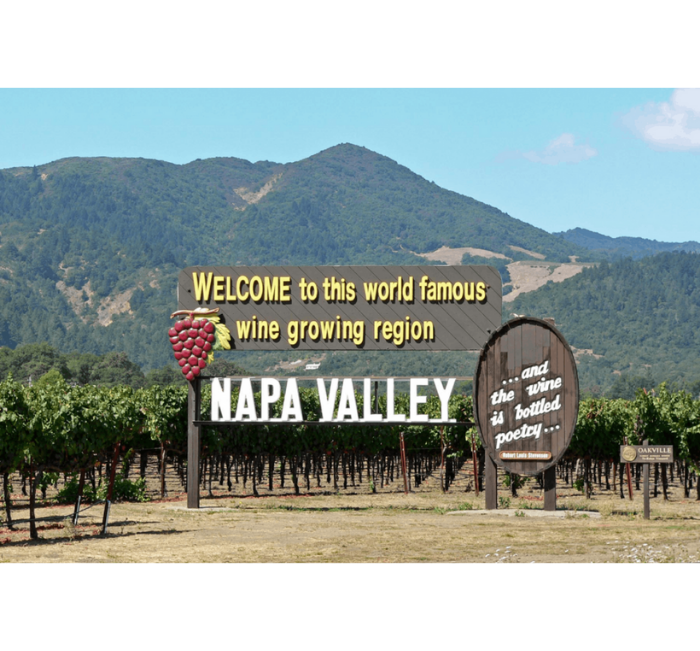

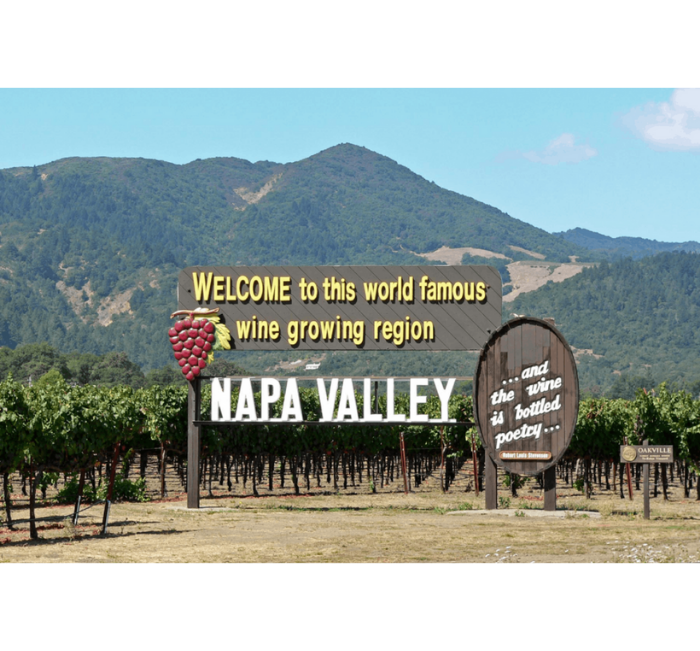

-First, we analyze the The Napa Valley 2018 Collection on Vint

-Next, we have a new podcast with Vint’s own Billy Galanko

-Finally, we finish up with a look at the Karuizawa 50-year old whisky on Rally, including a super deep pricing analysis

Today, we’re looking at the Spanish Collection, available Wednesday on Vint.

Once the domain of the rich and famous, tech is now democratizing wine.

Unemployment claims last week fell by 11,000, Blackstone’s apartment REIT goes private, The space economy is on the rise, Q1 saw an uptick in leveraged buyouts, and More.

Macro: US added 303,000 jobs in March, Real Estate: Detroit’s housing market beat Miami’s, Startups: Nvidia chips are up for rent, and thirteen more insights on different asset classes.

Nigeria raised rates by 200 basis points, Brookfield takes a $100 million loss, Pepsi is afraid of Liquid Death, Infrastructure debt set records, and More.

Could the S&P hit 5500, A 9.5% increase in home sales, Roblox launched a creator fund, Bridgewater is having a good year, BlackRock launched a tokenized fund, and More.

Why the public doesn’t care about contemporary art anymore, Another triumph for women’s sports, Something to wine about India’s ticking time bomb, & More.

Today we’re doing an issue on Vinovest: A wine investing platform I personally use and love.

A changing climate will affect the wine industry within our lifetimes. Industry leaders weigh in on what the biggest issue in wine means for production and investing.

Today’s Alts Cafe covers the last of 2022’s first half, bullish and bearish crypto insights, the housing market, our NFTs index, venture funds, and so much more!

Today’s a dive into wine fractional secondary markets, auctions, wine assets dropping this week, a podcast of Anthony Zhang (CEO of Vinovest), and so much more!

Today, we’ve got a packed issue for you.

-First, we analyze the The Napa Valley 2018 Collection on Vint

-Next, we have a new podcast with Vint’s own Billy Galanko

-Finally, we finish up with a look at the Karuizawa 50-year old whisky on Rally, including a super deep pricing analysis

Today, we’re looking at the Spanish Collection, available Wednesday on Vint.

Once the domain of the rich and famous, tech is now democratizing wine.

Unemployment claims last week fell by 11,000, Blackstone’s apartment REIT goes private, The space economy is on the rise, Q1 saw an uptick in leveraged buyouts, and More.

Macro: US added 303,000 jobs in March, Real Estate: Detroit’s housing market beat Miami’s, Startups: Nvidia chips are up for rent, and thirteen more insights on different asset classes.

Nigeria raised rates by 200 basis points, Brookfield takes a $100 million loss, Pepsi is afraid of Liquid Death, Infrastructure debt set records, and More.

Could the S&P hit 5500, A 9.5% increase in home sales, Roblox launched a creator fund, Bridgewater is having a good year, BlackRock launched a tokenized fund, and More.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |