Hello and welcome to Alts Cafe

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

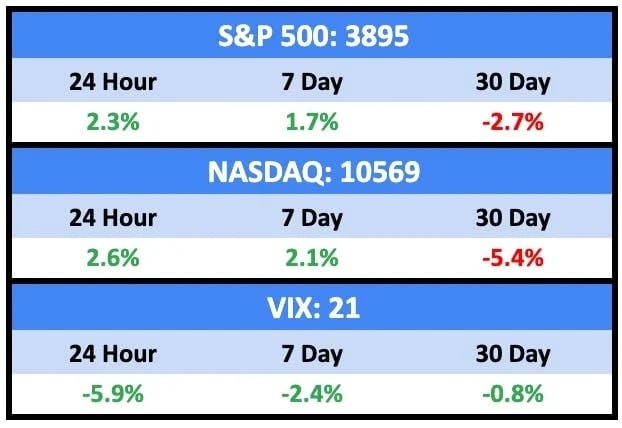

Macro View

While there was a raft of bad news last week, we also saw the first big positive inflation surprise of the cycle, with France coming in much lower than expected.

Inflation is the key to everything right now, at least as long as investors perceive low-interest rates as the norm and the current environment as an aberration.

Bullish News

- All officials at the Federal Reserve’s 13-14 Dec policy meeting agreed the US central bank should slow the pace of its aggressive interest rate increases.

- French inflation dropped significantly to well below 7%.

Bearish News

- The president of the Federal Reserve Bank of Kansas City, Esther George, said the central bank should raise interest rates above 5% and hold it there well into 2024 to bring inflation down.

- The top 5% of the world’s hedge fund managers are set to take 80-90% of investor inflows in 2023.

- British equity funds faced $10B worth of outflows in 2022 — a record. $57B flowed out of Asia.

- The jobs report came in hotter than expected, with 235k new jobs vs. 153k expected. The news sent markets tumbling.

- Toyota US auto sales were down nearly 10% in 2022.

What are we doing?

ALTS 1 fund news:

Nothing new here for now.

Real Estate

Here’s what you need to know:

Canada, where the median home price of C$777k ($568k) is more than 11x net median household income, has implemented an odd plan to reduce home prices. Aiming to reduce demand, they’ve banned foreigners from purchasing homes.

But it’s probably not going to work for two reasons:

- Foreigners own fewer than 6% of homes in Ontario and British Colombia, where home prices are highest.

- The fine for breaching the law is only C$10k ($7,500), or around 1.2% of the median sale price. It’s effectively a small tax that’s unlikely to deter many buyers.

New Zealand tried something similar in 2018. It didn’t work.

Bullish News

- I got nothing this week.

Bearish News

- Buyers received concessions (such as money for repairs and mortgage-rate buydowns) in a record 42% of home sales in Q4.

- Commercial lending (and borrowing) is expected to fall $700B in 2023, a 5% decrease.

- Pending home sales dropped 4% in November to their lowest since April 2020. They’re down 38% year on year.

- Homes for sale are spending almost two months on the market, nearly double the time they did in early summer.

- Compass laid off another swath of employees, its third in 2022.

- BlackRock and M&G are delaying redemptions from their UK-focused real estate funds after a surge in demand.

- Foreigners are now banned from buying homes in Canada.

- Manhattan home prices declined 5.5% year over year in December 2022.

How to invest in real estate right now:

Sit on your hands or chase yield.

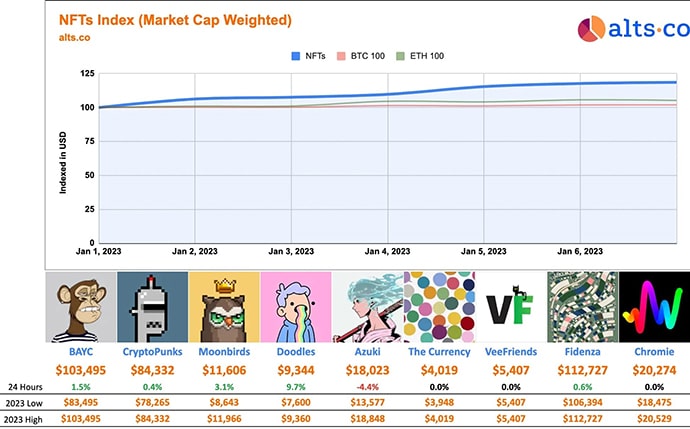

Crypto & NFTs

Here’s what you need to know:

[Note: We’ve decided to combine the Crypto and NFT sections.]

Crypto is off to a slow start, following equities down, as a number of 2022’s problems moved toward their conclusion.

The most binge-worthy news saw SBF plead not guilty, even though the rest of the exec team is cooperating, but bankruptcy filings, redemptions, and fines throughout other major players will continue to ripple through.

Through all that, crypto investors have held steady, though the Fear & Greed Index is down ever so slightly week on week, sentiment has been remarkably resilient for the last two months:

NFTs had a great week, with our blue-chip index up 18% so far in 2023.

Say it quietly, but volumes are also up, with trading activity last week double the autumn 2022 lows:

Not really news, but here are some noteworthy facts regarding VeeFriends:

- Gary V himself owns 973 VeeFriends NFTs or 9.5% of all outstanding items.

- At their peak, the project’s floor was $65,205. Today, it’s $5,400.

- 973 x (65,205 – 5,400) = 58,190,265

Gary V has (on paper) seen $58m wiped out from peak to trough on this project.

Those 973 items are still “worth” $5.2m, but it would take him nine months to liquidate them all at current volumes (assuming no one else tried to sell).

Bullish News

- China is launching a state-backed NFT marketplace.

- Hong Kong launched its first two exchange traded funds for cryptocurrency futures on Friday.

Bearish News

- SBF pled not guilty. Sorry not sorry.

- Crypto lender Genesis laid off 30% of its workforce and is considering bankruptcy.

- Crypto-focused bank Silvergate saw clients pull over $8B worth of deposits in 2022. That’s more than 2/3 the bank’s total balances. Shares fell 43%.

- Coinbase reached a $100m settlement with New York.

How to invest in Crypto & NFTs right now:

I’ve been saying it for a couple of weeks now, but it feels like a good time to begin accumulating.

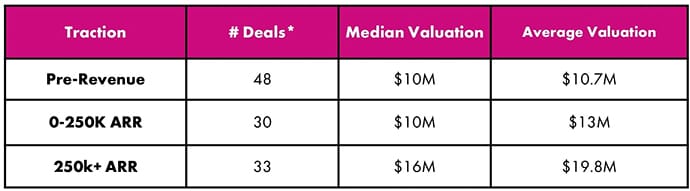

Startups

Here’s what you need to know:

Fundraising platform Stonks surveyed over 80 VCs on the state of pre-seed and seed fundraising. Here are the highlights:

“58% of respondents believe seed valuations will go down in Q1 2023, 38% believe they will stay the same, and only 4% believe valuations will go up.”

Most deals done were either pre-revenue or under $250k ARR, with a sweet spot of around $3m to $7m.

The top three industries invested in were:

- Fintech (20%)

- Future of Work (11%)

- Healthtech (13%)

“The sentiment among the respondents is that the current market conditions are disproportionately affecting underrepresented founders.”

Anecdotal, but that chimes with a tweet from Stevie Cline at Vol 1 Ventures over the weekend:

This is an alarming flight to perceived safety that’s not only racist and sexist, but also stupid.

Women and minorities are far more capital-efficient than their white male counterparts, and woman-led companies yield higher returns.

Fortune also surveyed VCs. You can read their predictions for 2023 but there’s a paywall.

In last week’s edition of The WC, I said that I thought AI investing is 2023’s bubble, but there are going to be some startups in this space that are worth looking at. This is one of them.

Bullish News

- Last year wasn’t that bad. From Pitchbook:

“Venture investors still deployed $238.3 billion. US-based VC funds raised a record $162.6 billion. Even as deal value declined each quarter, with Q4’s figure falling back to pre-pandemic norms, our estimates put deal count for the final period of the year at just under 4,000, which is the most active quarter outside of the past two years.”

Bearish News

- Hackers stole the email addresses of more than 200 million Twitter users and posted them on an online hacking forum.

- Meta got fined again. This time it was $419m by Ireland.

- Tech layoffs are happening faster than at any time during the pandemic. Last week saw Vimeo (11%), Salesforce (10%), and Amazon (5% or 18k workers), and ByteDance (hundreds) all shed jobs.

How to invest in startups right now:

Valuations will keep coming down for the most part, but they’re not miles away from bottom at early stages. It’s a good time to start looking for deals, particularly with underrepresented founders.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – let us know.

Cheers,

Wyatt