October 31, 2022

Read time: ± 6 minutes

Hello and welcome to Alts Cafe

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

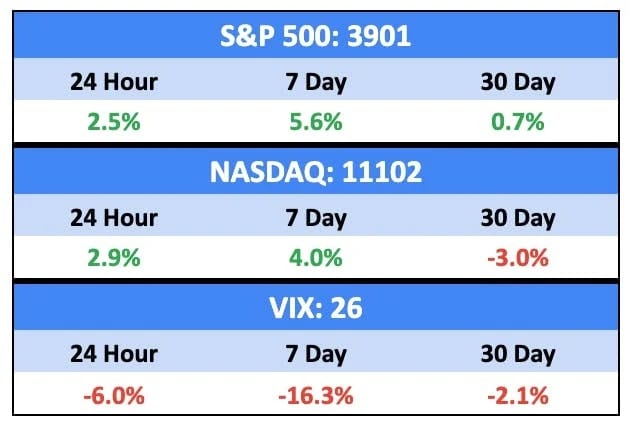

Tech stocks got curb-stomped, as most of the big players reported awful earnings.

The Fed meets on Wednesday, and is expected to hike rates another 75bps.

Bullish News

- The Bank of Japan kept ultra-low interest rates on Friday and maintained its dovish guidance, cementing its status as an outlier among global central banks.

- The US economy rebounded strongly, with 2.6% GDP growth in the third quarter, amid a shrinking trade deficit.

Bearish News

- US jobless claims rose slightly last week.

- Domestic demand in the US was the weakest in two years.

- Germany dodged a recession, but inflation jumped to 11.6% in the third quarter.

- The ECB hiked rates by 75 bps on Thursday and promised more hikes to come.

- The Bank of Canada announced a further 50 bps hike, its sixth in a row.

What are we doing?

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

Nothing new this week.

Crypto

Here’s what you need to know:

It was a huge week for ETH — up 16.6%.

Bullish News

- Digital banking firm Revolut is adding a crypto spending feature that will enable customers to use their crypto balance to pay for everyday purchases.

- According to a Fidelity survey, 74% of institutions plan to buy crypto.

- BNY Mellon reported that 70% of institutional investors surveyed would be interested in crypto if they had services from firms they trust.

- Crypto exchange operator FTX could launch its own stablecoin through a partnership.

- Dogecoin had a strong weekend, at one point on Saturday surging nearly 90% since the Tesla CEO became the Twitter CEO on Thursday.

Bearish News

- Core Scientific Inc., one of the world’s largest miners of Bitcoin, warned that it might run out of cash by the end of the year and could seek relief through bankruptcy protection.

- Hong Kong is planning to regulate retail crypto trading in 2023.

- In India, drug smuggling through the darknet and cryptocurrencies has increased, as has terrorism financing.

What to do with that info:

We’re waiting to see if BTC can smash through around $22,500.

Real Estate

Here’s what you need to know:

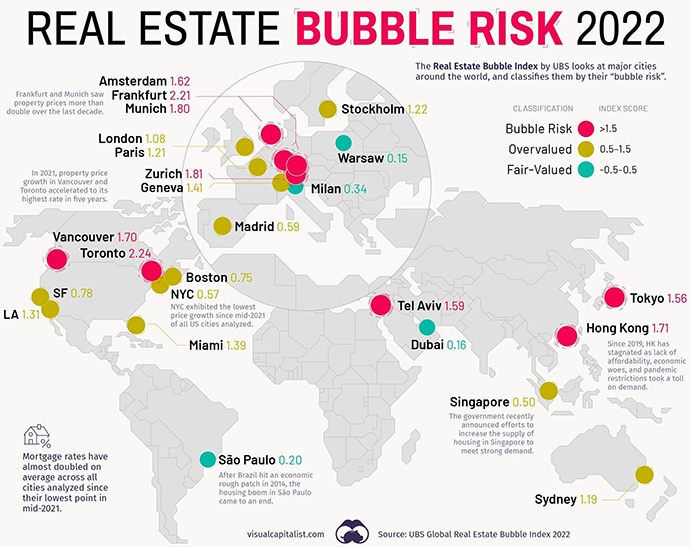

Most of the major global cities are at risk of the real estate bubble popping (h/t briefcase).

Canada, central Europe, and east Asia look the most vulnerable —

Bullish News

- The median home price in Long Island was actually up in Q3.

Bearish News

- One economist is predicting a 20% decline in home prices in 2023 (sounds about right).

- Home flippers are getting rekt.

- In September, home sales declined 11% MoM and 18% YoY. Pending sales are down 30.4% from a year ago.

- Mortgage demand has dropped to its lowest in 25 years.

What to do with that info:

Housing (and commercial) prices will continue to fall, and there are going to be opportunities to pick up great assets at a discount early next year.

NFTs

Here’s what you need to know:

NFTs popped last week, led by art pieces like The Currency and Chromie Squiggles —

Trading volume continues its lethargy — October was the lowest month since June 2021.

Bullish News

- Twitter announced that it will let users buy, sell, and display NFTs directly through tweets.

- Metaverse landcaps were up 14% last week on the back of ETH’s climb, and many projects saw a 25% to 50% boost in trading volume.

- A Singaporean High Court declared that NFTs are considered property.

- The first-ever NFT vending machine is going live next week.

Bearish News

- Following a successful first collection, the Baby Shark franchise has announced the second NFT drop of its second collection, with the assets going on sale on November 09, 2022.

What to do with that info:

We’re in the middle of a midterm rally, which tends to show positive returns in October and November of off-cycle election years during bear markets. Typically, momentum doesn’t hold through December, though…

Startups

Here’s what you need to know:

Napkin math published a thought-provoking piece on how broken venture capital is. We recommend reading the entire piece, but here are the highlights.

- There are too many funds chasing too few grand-slam deals.

- Founders are forced to take insane risks to achieve VC-approved results.

- It is likely that many of the funds deployed over recent years will be some of the worst-performing of all time.

- Just 0.12% of the venture dollars deployed in Q3 this year went to Black entrepreneurs.

But Evan proposes a solution, and it’s one we happen to agree with:

This is a market ripe for disruption. As venture funds continue to target larger and larger outcomes, there is a ton of opportunity left on the table that no one is seizing. You could invest in businesses that have an 80% chance of being worth $300M, rather than a 1% chance of being worth $80B. This strategy is an obvious opportunity to make a ton of money. Start by serving the underfunded, slowly move upmarket, and then, suddenly, you’ve disrupted the entire industry.

Bullish News

- Crowdfunding platform StartEngine is acquiring a rival platform — SeedInvest from Circle, best known for the USDC stablecoin, pending approval from the Financial Industry Regulatory Authority (FINRA).

Bearish News

- Crypto exchange Blockchain.com is raising a 70% down round bringing its valuation from $13B to $3B.

- Only $5.5 billion was invested in crypto startups from July through September, marking the lowest quarter for investments this year.

What to do with that info:

Start a fund specializing in doubles and triples. Or invest in one.

Quick Hits

Wine, whiskey & spirits

Last year was the 12th consecutive year in which spirits have taken away market share from beer in the total US alcoholic beverage market.

The top five spirits by revenue growth in 2021 were vodka (4.9%), tequila/mezcal (30.1%), American whiskey (6.7%), Brandy & Cognac (13.1%), and cordials (15.2%).

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – let us know.

Cheers,

Wyatt