Today we explore FarmTogether, an investment platform for buying fractional shares of real, profitable farmland. (There are actually a few different ways to invest, but the platform’s fractional investment opportunities stand out the most.)

In addition, this issue contains a bonus podcast with founder and CEO Artem Milinchuk.

You can check out the podcast on YouTube, Spotify, or Apple.

Let’s go 👇

Editor’s Note: This issue is a sponsored deep-dive, meaning FarmTogether has paid Alts to write an independent analysis of their company. The FarmTogether team has agreed to give us an unconstrained look at their company & operations. FarmTogether is a sponsor of Alts, but our research is neutral and unbiased. This should not be considered investment advice, but rather as independent analysis to help readers make their own investment decision. We think you’ll find it informative and fair. FarmTogether has not reviewed this issue. All written opinions expressed here are ours and ours alone.

Table of Contents

Why Farmland?

We’ve talked about the virtues of owning farmland before. It’s not the sexiest asset class, but there’s a reason Bill Gates is the largest private farmland owner in the US, and one of the biggest in the world.

From its vital role in the global food supply to its historically strong financial performance, farmland can play a significant role in any long-term portfolio.

Since we’ve covered it before, we’ll skip some of the formalities and dive right into FarmTogether. But here are some refreshers on what makes farmland such an obviously great investment.

What is FarmTogether?

FarmTogether makes it simple to invest in US farmland by making it an investable and tradable asset class. They deal strictly with crop-producing farms, not animal or animal product farms.

CEO Artem Milinchuk has a simple thesis for FarmTogether as a foundational investment: people have to eat. 😀

Artem’s earliest experience with farmland goes back to his youth in the Soviet Union. He grew up with state-sanctioned food rations, where fully-stocked grocery markets were the stuff of western legend.

To make up for bare grocery shelves, the government gave rural Soviet families a “household plot” to grow crops like potatoes and maybe raise some chickens. This experience of manually removing bugs and tilling the soil made him realize that food and land were an immovable constant.

How did FarmTogether start?

In 2014, Artem worked at the Ontario Teachers’ Pension Fund, where lots of his work was attached to food, agriculture, and farmland. Despite being a $10 trillion asset class, he realized that farmland had few options available to small institutions and everyday investors.

Before starting FarmTogether, Milinchuk was the CFO and VP of Operations at Full Harvest, a business-to-business marketplace for “ugly” fruits and vegetables sold to juice companies and other processors who don’t care about the aesthetic appeal of produce.

Farmland as an alternative investment has increased dramatically in the past 10 years, thanks to low correlation to the stock market, resistance to recession (ahem), and the rise of ESG investing.

The increased awareness of climate change largely drives sustainability. Farmland has an important role as a potentially carbon-neutral industry and a model for efficient conservatorship.

In fact, just today, we discovered farm.vc — an investment platform focused on land stewardship. They’re looking to find undervalued land and restore it using native trees, plants, and wildlife. More to come on these guys.

How does FarmTogether manage its farms?

Farmland is not conducive to short-term flipping. This is a buy & hold business.

When FarmTogether creates a new offering, it buys the land intending to invest for future crop yield and land appreciation. The company typically has a target hold of 10 years.

With every acquisition, FarmTogether brings its on-site farm managers, farming systems, and accompanying technology to cultivate the land for its intended crop.

Most of the time, the farm managers are the same farmers who sold their land to FarmTogether, who then rent the land and share in the profits from the yearly harvest. The last thing you want when buying farmland is surprises. Poor soil, poor prior management, poor operations.

Many times, the farm has been in the family for generations. This creates a built-in advantage for FarmTogether, because they’re not just buying the farm; they’re buying the generational experience of working on familiar land.

Upon acquisition, one of the first land improvement projects undertaken by FarmTogether is to create high-quality soil. This can be a big upfront investment, but the company believes its approach can serve as a model for neighboring farms and eventually other parts of the country.

🌿 The soil

Everything begins with the soil.

Soil is the foundation upon which every farm and crop depends. Good soil is needed for good crops and has an important role in sustainability. Using organic matter increases the nutritional value of future crops and increases its water holding capacity.

A bulkier, healthier soil absorbs more water and slows evaporation. On top of that, the organic matter helps mitigate soil irrigation and buffer salts from reaching crop root zones.

Soil health is a big deal in farming — especially in drought-stricken areas like California, where water conservation has become extremely important.

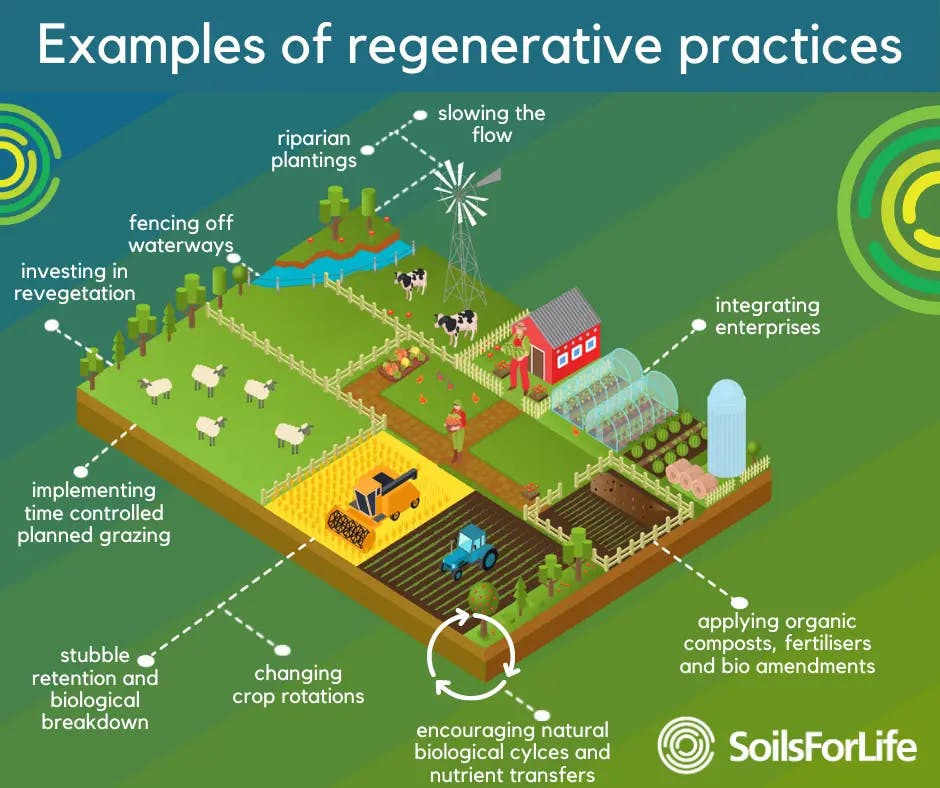

In addition, Milinchuk pointed out that quality soil can help trap carbon dioxide through relatively new form farming techniques called regenerative agriculture.

Regenerative agriculture

Many people don’t realize that agriculture is responsible for around 25% of all human-created emissions of CO2. When combined with methane (yes, from cow farts), these two harmful greenhouse gases are major contributors to climate change.

Regenerative agriculture is a growing agricultural movement that goes beyond organic. This farming method is about using sustainable farming practices to reverse topsoil depletion and lower CO2.

It improves soil health and biodiversity, watershed capacity, and quality of life. It’s one of our best shots at cooling the planet.

Farmland as an attractive investment

I know it’s tough to compete with the excitement of meme stocks and mooning NFTs. But in investing, you always, always want to consider an asset’s fundamental desirability and scarcity.

Considering that agricultural land produces basically all the food we need to survive, farmland ranks high on the desirability scale. But how about its scarcity? FarmTogether states there is an “increasing scarcity of farmland.” Is this true?

Scarcity of farmland

According to the 2017 Census of Agriculture, from 2012 to 2017, farmland in the US declined by 2%. Thirty-four states reported a decrease in cropland over that period, representing an overall loss of more than 14 million acres.

Since 1982, over 31 million acres of US agricultural land have been lost to urban expansion. Every hour, 175 acres of farmland & ranch land are lost to make way for sprawling housing and industry. This is like losing an area the size of Rhode Island every 187 days. That is insane.

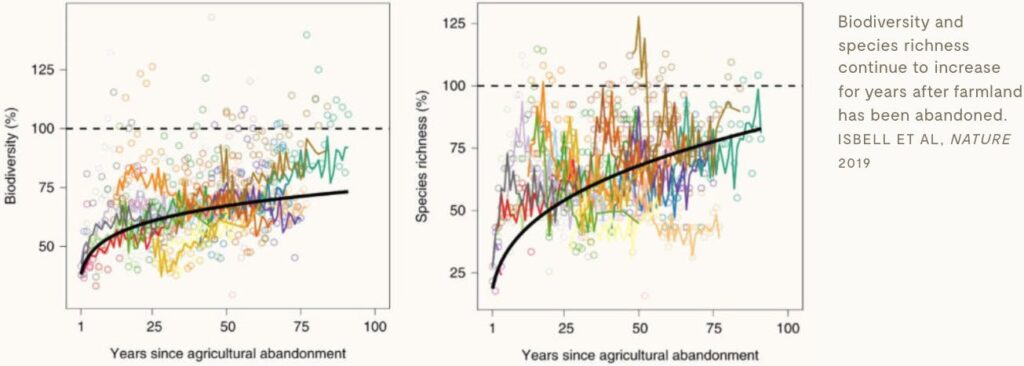

To be fair, a decrease in cropland also has unintended consequences. Some studies have argued that the decline in farmland has been a good thing for the environment. How?

Well, some of the lost cropland is not just overtaken by urban sprawl, but also includes abandoned land reclaimed by nature. In place of cropland, natural habitats have flourished.

Furthermore, the global food supply has actually remained unchanged. One of the reasons for this is that farmers have become much more efficient at producing crops.

The increase in efficiency can lead us to discuss the pros and cons of the global food supply depending on an increasingly centralized and shrinking amount of land. That’s beyond the scope of this article. But from an economic perspective, if there’s less land to produce food and that land generates greater yields, then by logic that land should become more valuable.

And let’s not forget that, as efficient as they have been, food supply chains can break down real quick in the face of global conflict. Ukraine and Russia are two of the world’s top wheat growers, producing an astounding 30% of the global wheat supply. The war and sanctions mean neither country can fully export, sending wheat futures to the moon.

Farmland returns through income and appreciation

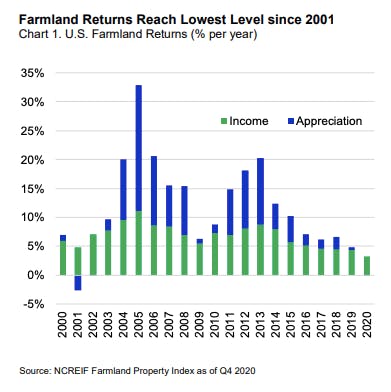

As attractive as farmland may be, it’s important to know that the returns aren’t constant. Some years can produce great returns, while others barely cover yearly inflation. (This is one reason FarmTogether has 5-12 year holding periods)

According to the NCREIF Farmland Index, a quarterly composite measuring the investment performance of farmland properties in the private market, there has been only one year with negative returns between 2000 and 2020.

In 2020, the market saw the second-lowest returns since 2001, with a total return of 3.1%. Much of this is related to the COVID-19 pandemic and disruptions in supply chains. From 2000-to 2020, there were 11 years with double-digit returns for farmland, but there haven’t been double-digit returns since 2015.

FarmTogether has a target hold of 10 years to mitigate capital risk and keep investors from prematurely taking their cash based on a few years of returns. As noted in the chart above, farmland returns primarily depend on land appreciation and income from crop yields.

How FarmTogether chooses farmland and crops

Some crops are ready to harvest in the first year after planting. But many types take much longer.

Almond trees take anywhere between 5-12 years to produce a harvest. Pecan trees take 6-8 years. Apple trees can take up to 8 years to begin producing fruit. And as we’ve looked at, Christmas trees take 8-15 years to mature. If there’s anything akin to beginning farmland investment, it would be whiskey distillers who wait 10+ years to start bottling.

FarmTogether says they buy bare land to prepare for planting, as well as turnkey yield-producing farms. However, to date, all of its offerings have been the latter — farms already growing crops. (Given the wait times, who can blame them?)

Their most recent farm offering, the Vista Luna Organic Vineyard, offers 142 acres of mature grapevines planted in 2006. The Vineyard will remain a USDA organic operation through the duration of its escrow and will be grown under regional sustainability guidelines called LODI RULES.

It’s not fun, but farms change the crops they grow quite often. When you’re selling commodities, you’re at the whim of the market, and conditions can change quickly. Some of the greatest returns in the next 12 months are expected to come from corn, soybeans, cotton, and of course, wheat. Fruits and nuts are expected to see a decline in returns.

In 2020, almonds saw a negative return resulting from overproduction, decreased demand, and negative marketing resulting from highly-publicized reports on how much water they use. (Growing a single almond requires 1.1 gallons of water. It’s honestly stunning almond trees are allowed to be grown in California)

Since FarmTogether views its investments as long-term holds, it’s not as concerned with the year-to-year fluctuations of the market. Almonds are down now, but China is developing a taste for almonds, and they may make a comeback.

FarmTogether has diversified its offerings and pivots when market conditions change. Their offerings include 12 different fruits, vegetables, and nuts. Its most popular crops are:

- Corn

- Soybeans

- Almonds

- Hazelnuts

- Pistachios

- Walnuts

- Pecans

Types of investment opportunities

FarmTogether offers three different tiers of investment opportunities:

- Crowdfunded farmland (i.e., fractionalized offerings)

- Sole ownership

- 1031 exchanges

Crowdfunded farmland offerings

To date, FarmTogether has put over 10 farms on its crowdfunding platform. The most recent offering was the Mount Clare Farm, a soybean and corn farm in Nebraska. Mount Clare had an expected 7% Internal Rate of Return, with a 2.5% cash yield.

At the moment, only accredited investors can buy shares of farmland, and there’s a minimum $15,000 investment. FarmTogether is working on its next steps to open up the market by admitting retail investors on the platform (though there is no firm date on when this will happen.)

Since farmland has a 10-year investment horizon, FarmTogether is also working on a secondary market for its current investors to provide liquidity.

Sole ownership offerings

FarmTogether also offers investors the opportunity to own an entire farm with a minimum buy-in of $3 million.

Obviously, this is out of range for most investors. But still — this option allows a potential buyer to utilize FarmTogether’s resources in a creative profit-sharing agreement.

1031 exchanges

Professional real estate investors are all familiar with the 1031 exchange. It’s a (somewhat controversial) scheme in the US whereby you can avoid paying capital gains tax if you reinvest your money from the sale of an investment property into a “similar” investment property.

Investors can use a 1031 exchange to become farm owners. The minimum investment for a 1031 exchange on FarmTogether is $1 million, and the replacement property must be of equal or greater value than the relinquished property.

But otherwise, this is good news for FarmTogether and investors who want to swap traditional real estate with farmland.

Conclusion

I can’t say enough good things about farmland. It’s overlooked as far as alternative assets go, and there’s no good reason why.

To be clear, farmland isn’t sexy. It isn’t very exciting, and it’s definitely not for short-term flippers. If you want to trade crypto or flip .jpegs, go for it. You can make a lot of money! You won’t make 300% in a month through farmland. If that’s your goal, farmland investing probably isn’t for you.

Meanwhile, the world’s smartest long-term investors are getting into farmland like never before. Bill Gates wasn’t alone in his land acquisition. Companies like Prudential, TIAA, Hancock, and UBS have all made substantial farmland purchases in recent years.

And now, the asset class is finally available to everyday investors. FarmTogether provides a platform to easily get into farmland. Yes, at the moment, only accredited investors can participate, and there’s a relatively steep $15,000 investment minimum, which is definitely a barrier.

However, as the company works to incorporate retail investors onto its platform, many more will have the opportunity to buy into one of the most stable and fundamental asset classes in the entire world.

Also, Artem mentioned on our podcast that FarmTogether is working on a fund allowing investors to gain exposure to multiple farms and crops. The fund will further enhance the platform’s accessibility as investors will get to invest across farmland in six different states and 12 different types of crops.

In the meantime, what I personally like most about FarmTogether is their mission to acquire world-class farms, focusing on organic, sustainable practices.

Their vision is brief and beautiful: “To ensure peace and plenty by investing in the sustainable agricultural revolution.”

I can get on board with that ☮️ ✌️