Today’s Deep Dive is a very special one. It’s the first time we’ve done a Deep Dive on a company we’ve personally invested in through our ALTS 1 Fund, a company we’ve come to know quite well over the past few months.

That company is Nucleus

In August, we explored Investing in Psychedelics for the very first time. It was a great way to dip our toes into an industry that’s as alternative as it gets. But since weren’t very familiar with the topic, we reached out to a well-known psychedelic expert — a man named Dustin Robinson.

Dustin is the co-founder of Nucleus, and not only was he a tremendous help on the issue, but it was clear this guy was seriously knowledgeable when it comes to psychedelic science, law, and investing.

The more we learned about the space, the players, and the promise of psychedelic treatment, the more we became convinced to invest in Nucleus ourselves.

Let us show you why

Quick Summary

- Investment type: SAFE (future equity)

- Requirements: Open to both accredited and non-accredited investors

- Minimum investment: $200

- Hold period 3-8 years (exit strategy may be IPO, acquisition, or sale)

- Website Link: withnucleus.com

- Investment Link: https://wefunder.com/nucleus

Disclosures

- We have invested $25,000 in the Nucleus crowdfunding round through our ALTS 1 Fund.

Table of Contents

The mainstreaming of psychedelics

If you feel like this stuff is going mainstream, you’re not alone.

On his podcast, Joe Rogan routinely talks about DMT. And Michael Pollan’s book and Netflix series, How to Change Your Mind, has done exactly that for millions of people.

But media attention alone isn’t what’s going to move the needle. Forget that celebrities are talking about it. Forget that negative perceptions are fading and acceptance of recreational use is increasing. What’s really going to move the ball forward is therapy. Health. Especially mental health.

If you can show these drugs are therapeutic, you can prove their medical value. And that’s just what research institutions & companies are starting to do.

What is Nucleus?

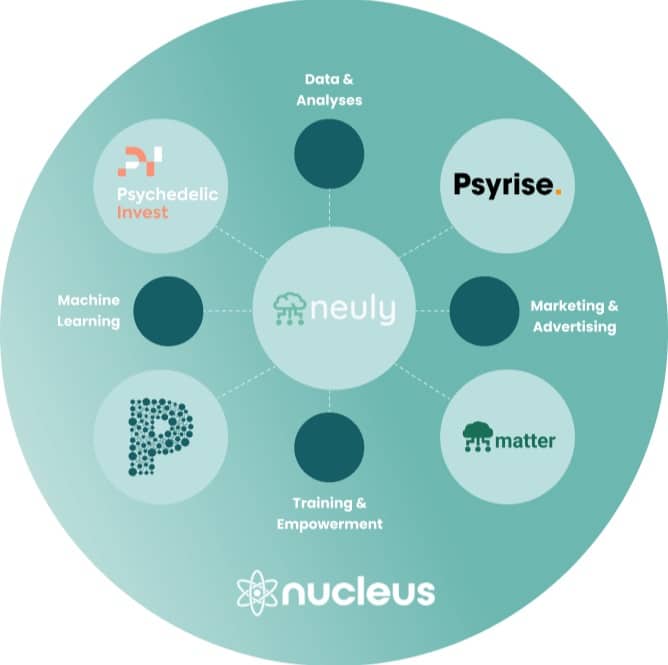

Nucleus is a venture studio investing in an ecosystem of groundbreaking companies in the psychedelics industry.

They launch, acquire or support businesses that develop alternative medicines that harness the power of entheogens.

And that’s pretty much what they’ve done so far, achieving six figure page views per month, 50k subscribers, and growing revenue by providing effective solutions to their partners.

The company is built on three core principles:

- Partnerships. Nucleus is all about forming partnerships. Other companies in the space aren’t just competitors – they’re part of an ecosystem trying to change how we care for people.

- Integrations. The Nucleus team has developed a proprietary tech stack. Third parties can connect to the Nucleus API and improve how they deliver and receive data.

- Community. An important element of the Nucleus framework is its public-facing entities. Their mission is to connect new people to the thrilling world of psychedelic therapy.

We all know there is a “disconnect” between the psychedelic industry and broader society. Ultimately, Nucleus’ mission is to rewire the disconnect. By aligning the needs of everyone in this space, they believe the gap will close, and the medical potential will shine through.

Most of all, they want people who have searched their whole lives for alternative care to know there’s hope.

Backstory

The Nucleus story started in April 2021, when co-founder Dustin Robinson launched his $20m VC fund called Iter Investments. The goal was to invest in psychedelic medicine – but there was a problem.

The Iter VC team realized there was a massive disconnect between the psych meds industry, the people they serve, and the rest of society.

It’s hard to deny the potential benefits of psychedelic drugs. But separating the therapeutic possibilities from the stigma of hippies “tripping” was a bridge that needed to be crossed.

So that’s where Nucleus comes in.

The team

Investing in a company is ultimately investing in people. The team is pretty much everything, and we love these guys.

These three founding members form the…well, nucleus of Nucleus. (I’m so sorry):

What companies are in the Nucleus ecosystem?

Nucleus features three fully-functioning startups under its umbrella:

Neuly

Neuly is one of the Nucleus studio’s flagship projects.

Designing a network that incorporates all elements of an industry can’t succeed without relevant, digestible data.

That’s what Neuly exists for.

The highly accessible data is fed from real-time industry resources and records, with uninformative data stripped before it ever reaches the main database.

Imagine an independent medical clinic ordering a batch of psychedelics for treatment – companies using Neuly would know about it almost immediately.

Neuly’s data storage and distribution is a big part of Nucleus’ ecosystem. It allows the team and everyone else in the community to perform better due diligence. Without them, the industry’s decision-making would be partially blind.

In May, the Neuly team will begin an overhaul project that will include the following:

- An update to the formatting of the database and all source materials

- Re-factoring of data presentation

- Additional product feed and dashboard deployments

- Implementation of AI models and automation

Alongside this project, Nucleus has identified KPIs that will truly move the needle for Neuly as a business by year’s end:

- 1,000+ active users

- 100 paid customers/subscribers

- Piloting at least 3 unique revenue streams

Psyrise

Psyrise is the marketing arm of the Nucleus world and the first end-to-end marketing platform built exclusively for practitioners.

Psyrise serves as the on-ramp for patient and subscriber activations for both the Nucleus ecosystem and Psyrise’s many paying customers (which range from ketamine clinics to retreats to even drug development companies in the space).

Here’s a useful video about the platform:

The Psyrise platform just launched officially and is now pretty well-positioned to build upon the psychedelic medicine movement and connect people with the industry.

Through Psyrise, Nucleus helped match 187 people with ketamine treatment in Q1 alone. That equates to over $400,000 in value for our practitioner partners. Considering how lean they are currently operating, these numbers tease the exciting growth opportunities we have with Psyrise alone.

Of the three main Nucleus brands, Psyrise has become an area of focus in Q1. And rightfully so. It will have a big impact on revenue creation, and it’s also become clear the good that it is serving the world.

A really cool documentary on the therapeutic powers of Ketamine is called Hamilton’s Pharmacopeia.

Psychedelic Invest

Psychedelic Invest is a platform made by investors, for investors.

Think of it as a one-stop shop for potential psychedelic health investors.

The website lists hundreds of companies in the industry, follows important market data, and has the first-ever index tracking the psychedelic market.

Nucleus prefers to think of their “competitors” as friends and allies, but it would be silly for us not to monitor behaviors that might better inform our decisions as a company.

A great example of this is their constant awareness of the search landscape within the psychedelics industry. Psychedelic Invest is fortunate enough to be well-positioned for organic traffic across thousands of search terms.

Of the top 12 informational outlets within the industry, Psychedelic Invest is sitting pretty:

- 6th in domain authority

- 4th in organic traffic

- 7th in total backlinks

Investment opportunity details

Nucleus is raising $500k on WeFunder.

Minimums are low. For as little as $200, investors can purchase future equity in Nucleus’ company.

This is one of the lowest barriers to entry of any startup we’ve covered.

Investment type

Participants are buying a Future Equity Agreement (SAFE). The pre-raise valuation of the company is $12m.

So basically, if you invest in Nucleus now, you’re betting the company will be valued at more than $12M when (or if) they secure professional financing or sell.

The risk here is that Nucleus may never receive future equity financing, so the securities will never actually be converted. Or, of course, they may sell for less than $12m.

Fundraising amount

Nucleus’ cap raise goal is $500K, with a maximum offering of $3M. Each security (share) is valued at $1, so investors will receive 200 future securities at a minimum.

Fundraising goals

WeFunder is taking 7.5% of all proceeds – a fairly hefty margin. Beyond this, the specific distribution of the cap raise will depend on how much money comes through.

With this capital, Nucleus will apply a sweeping tech update to their platforms and infrastructure that will hopefully breathe new life, and capital, into psychedelics.

When the $500k goal is hit:

- 30% will go towards scaling and improving the Neuly (database) project.

- 32.5% towards content and marketing.

- 20% towards industry data and research.

- 10% towards operational improvements, such as new hires, automation, and optimization.

- 7.5% towards other

A main area of improvement will be the Neuly platform and the underlying tech of Nucleus’ ecosystem.

The idea is to build it out further, with more automation. So instead of relying more on human curation for every data point, pre-engineered patterns will tackle machine learning head-on so that Nucleus doesn’t compromise the amount of data they’re able to ingest while maintaining integrity and data hygiene.

Holding period

Future equity is usually an illiquid asset. They are convertible shares, so they can only be sold once Nucleus secures financing. The team’s goal is to complete its exit strategy in the next 3-8 years.

An exit opportunity might be an IPO, acquisition, or the sale of Nucleus assets.

There are many different ways an acquisition of Nucleus could play out. The most probable buyer would be a behemoth operating d2c in the growing mental health care space. Anything from a demand-driven marketplace like Zocdoc or Cerebral, or a drug manufacturer looking to own data and infrastructure, to a media conglomerate working in an adjacent industry (like Emerald Events, Marketwatch, or Morning Star).

Who can invest?

At a minimum investment of $200, the Nucleus raise is extremely accessible.

Both accredited and non-accredited investors can invest.

What we like

- Psychedelic interest is growing. Wielding the therapeutic power of psychedelic drugs without the “risks” of tripping is a growing and exciting industry. Google Trends show 5M+ searches per month in 2022.

- Strong core team. The Nucleus team is brimming with experienced, professional entrepreneurs with years of industry experience and multiple exits.

- An industry that needs disruption. Addressing global mental health issues is becoming a growing concern . A medical change is necessary, and psychedelic therapy could become a core component of treating various problems.

- Shifting tides of public opinion. Similar to the early days of marijuana decriminalization a decade earlier, there are isolated sectors of softening public opinion of psychedelic use across the US. Oregon decriminalized psilocybin in 2020, and various municipalities subsequently did the same. The US Department of Defense’s budget recently had a provision to allow funds to be used in studies to determine the effectiveness of psychedelics in treating post-traumatic stress disorder (PTSD).

- Company traction. Nucleus hasn’t been around for too long (it didn’t fully launch in January) but is growing quickly. They have exceeded $10K in MRR, 100k monthly website visits, and a community of 50k+.

- Web of assets. Instead of being exposed to the risks of one subsector, Nucleus is building a diverse ecosystem that addresses all requirements of the psychedelic treatment industry. They’re a top-to-bottom solution.

- “Picks and shovels” play. Nucleus focuses on the infrastructure components of the psychedelic industry (data, marketing, network platforms), which carries less legal risk of investing directly in psychedelic manufacturers or clinics while still giving exposure to the space.

- Fast action. Thanks to strong datasets, excellent leadership, and a tried-and-true development method, the Nucleus team can quickly act and react to failing or stalling ventures to prevent excessive loss.

- Low minimum investment. It’s easy for investors to mitigate their risk by only investing a small amount into the cap raise.

- Backed by Iter Investments. They’re one of the largest VC firms in the industry.

- A strong sales pipeline. We’re talking ±200 psychedelic companies.

- A diverse developing portfolio. Currently, eight brands, with more on the way.

- A growing network of ±3k care practitioners.

Potential risks

- Startups are risky. This one is just a given – startups of any nature are inherently risky.

- Illiquidity. Although Nucleus has comprehensive exit strategies in place, none of these are guaranteed. There is a possibility the Future Equity distributed via the raise never comes to fruition, amounting to a total loss of investment.

- Legality issues. While the potential for life-changing impacts of psychedelic therapy is there, governments and the law are yet to catch on fully. These drugs are recreationally illegal nearly everywhere, and access can still be archaic for research and medical use. Governmental crackdowns, perhaps spurred by new administrations or shifting political viewpoints, could severely impact the industry’s growth trajectory.

- Government regulation. Medical psychedelic drug developers will need to obtain Food and Drug Administration approval in the US before commencing commercial sales. These trials can often last several years and require large sums of capital with a high degree of uncertainty of final approval (there is only one trial that has completed Phase III in the US) – continued failures to launch approved drugs would impact the psychedelic market overall and Nucleus indirectly.

- Black market competition. The clients Nucleus serves could face a similar challenge as players in the cannabis industry: competition from the black market. Legitimate psychedelic companies have higher regulatory and operating costs than black-market drug providers, which can cause them to price their products higher and create profitability challenges.

- Stigma. Much of society still demonizes psychedelics and believes them to be nothing more than harmful drugs. Breaking the barrier between the general public and psychedelic therapy will naturally be met with some resistance.

- Early days. While there have been some promising early studies showing the benefits of controlled and monitored psychedelic use, the research base is still very young and has been the subject of debate within the medical community (as noted above, there are only a handful of studies that have even progressed to Phase II or III in the US). If conflicting studies questioning psychedelics were published or large, well-respected medical organizations spoke out against the use, momentum in the industry could falter.

- Market penetration. There will be many more players entering the psychedelic treatment space. In particular, big media brands like Vice and so on may take attention away from companies like Nucleus.

Final thoughts

Drug destigmatization (and decriminalization) is gaining momentum in both the US and abroad (especially here in Australia!) It’s a matter of when, not if, psychedelics will catch up to marijuana and other beneficial substances.

Nucleus is a venture studio, meaning they’re taking several swings at the space rather than putting all their eggs in one basket (or subsector). Their various ventures have so far all been “picks and shovels” plays — marketing, data, and directories. And stuff that will rise alongside the psychedelic tide is a much safer bet than picking one specific drug or therapy to bet on.

Will Nucleus be a homerun in three years? Perhaps. Will it double or triple? We think it could. And that’s why we chose to invest $25k in their WeFunder campaign.

In fact, Nucleus is the only startup we have ever invested in.

This fundraising round closes on April 30

Further reading

- CEO Logan Lenz on Masters Decoded

- 2022: The Year in Psychedelics

- Alts.co issue on investing in Psychedelics

- Psychedelics and AI

- Alts.co Fireside Chat with Logan Lenz

- Psychedelic Investment Landscape

Disclosures

- We have invested $25,000 in the Nucleus crowdfunding round through our ALTS 1 Fund.

This issue has been a sponsored deep-dive, meaning Alts has been paid to write an independent analysis of Nucleus. Nucleus has agreed to offer an unconstrained look at their business & operations. Nucleus is a sponsor of Alts, but our research is neutral and unbiased. This should not be considered investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.