Today we’re taking a look at Yieldstreet, an alternative investment platform with $2.2b worth of investments.

As we get closer to launching our own fund, we feel it’s important to analyze existing offerings in the market and share thoughts on the pros & cons of different alternative investing strategies.

Let’s go!

Editor’s Note: This is an independent analysis of Yieldstreet, who agreed to give us an unconstrained look at their investment fund and operations. Yieldstreet is a sponsor of Alts, but our research is neutral and unbiased. All opinions and content are ours and ours alone. This should not be considered financial advice.

Table of Contents

Introduction

As you probably know, we’ve been working hard on bringing our fund to life, and we’re getting close. It’s only a matter of time before we can start giving more details.

In full transparency, we continue to dive into existing alternative asset funds to ensure that you (and we!) have a clear picture of the different investment strategies out there.

Today, we’ll be looking at Yieldstreet. From our surveys, we know that Yieldstreet has some popularity among our community members.

It’s one of the more popular alternative investing platforms out there, and I’ve been looking forward to exploring it more deeply.

What is Yieldstreet?

Yieldstreet is an alternative investment platform that provides exposure to a solid, diverse range of funds, assets, and structured notes.

Founded in 2015, they’ve managed $2.2b in alternative investments with a net IRR of 10.58% — almost identical to the S&P’s long-term average of 10.43%

They have several investment options to choose from, including an art-focused fund, thematic/specialized real estate, and a multi-class blend open to non-accredited investors, called the Prism Fund, which we’ll get into later.

Like so many others in this space, Yieldstreet’s vision is to put power back into the hands of everyday investors.

A noble mission

If you’re reading this newsletter, it’s tough to remember that most Americans don’t invest.

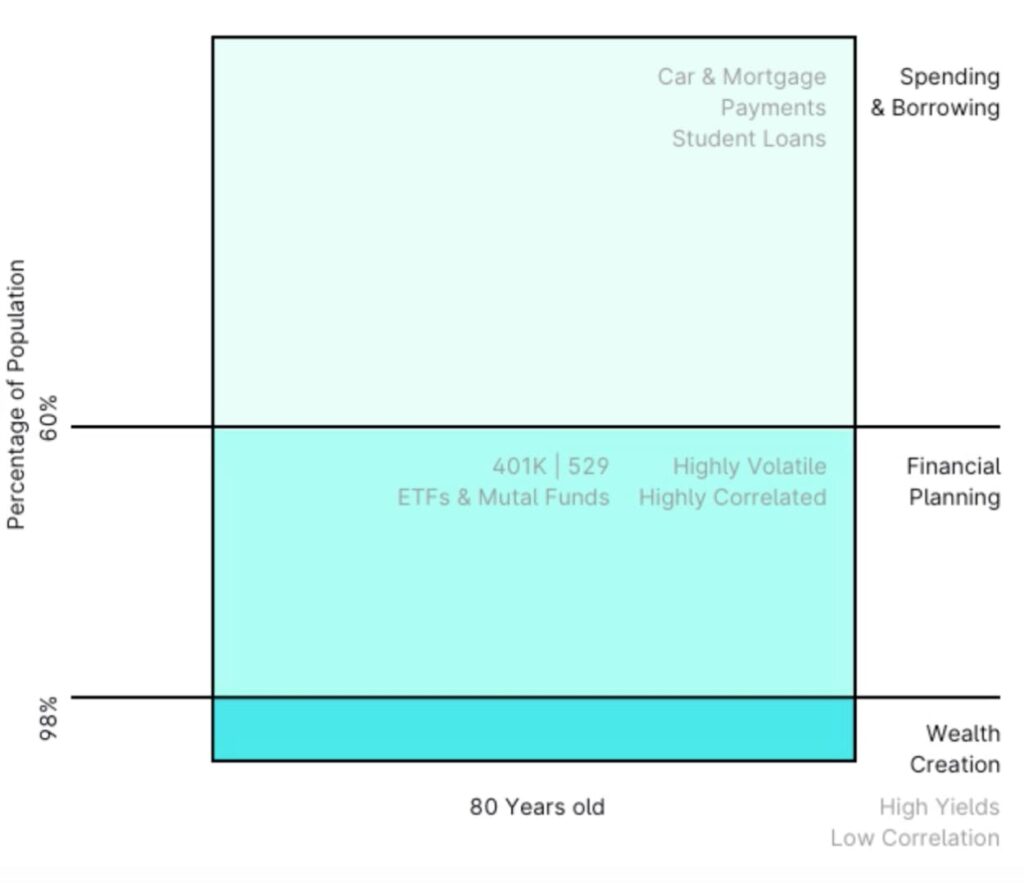

Only 32% of Americans have a 401k. Stock ownership peaked in 2002, when 67% of Americans owned stock, and has been falling ever since. Today, under 50% of US households own stock directly or indirectly.

But we’re talking alts here, not stocks. Emotion makes alternative investing fun, but diversity is what really matters.

As we’ve seen over the past few weeks, equity markets have been getting hammered. The NASDAQ is on pace for its worst month since 2008, and far from being a hedge against the stock market, bitcoin is basically trading in tandem with stocks. If your portfolio is too tightly correlated with the stock market, or if you’re just piling into the same tech stocks/crypto as everyone else, where’s your advantage?

Yet traditionally, only high net worth individuals were able to get exposure to stuff with high yield and low correlation. And the share of their wealth they put towards alts is high. Ultra-high-net-worth investors (net worth of $30m+) have 50% of their assets in alternative investments — mostly private equity and real estate.

Yieldstreet’s mission is to make these options accessible to not just the top 1% of investors, but to anyone interested. We can get behind that.

History and team

Yieldstreet was founded in 2015 in New York City. They’ve raised $329m across seven funding rounds, with backers including famous billionaire George Soros. They are very active in the NYC scene, hosting events, parties, and forging partnership deals with the New York Giants.

Key executives include:

- Milind Mehere. As founder and CEO, Mehere has a strong history in the tech entrepreneurial space, helping grow Yodle into a $300 million business. He also supports the NE Patriots, which makes him okay in my book, but may be a showstopper for others 😉

- Michael Weisz. Michael is the President and is largely responsible for the investment strategy. He was previously Vice President at a credit opportunities hedge fund with $1.2b under management.

Evolution of Yieldstreet

From debt to equity

In the early years, Yieldstreet’s funds looked nothing like they do today. This is because the business started out with a focus on financing debt.

Business owners often need to raise money to grow. There are two main ways companies raise external capital: debt financing and equity financing.

As opposed to selling equity shares of a company, debt financing is when a business borrows money from a lender and agrees to pay back the funds in the future, with interest. While this limits the lender’s upside, it also protects from the downside. If the borrower defaults on the loan, the lender gets paid back first, before anyone else.

Yieldstreet began by providing debt financing to deserving borrowers who backed the loan with collateral. But while these private debt deals delivered investors with a solid, stable return (about 7-12% yield), it wasn’t quite enough. There was a lack of diversity, and investors were hungry for investments with more upside. In response to this demand, Yieldstreet evolved and moved into equity.

Growth

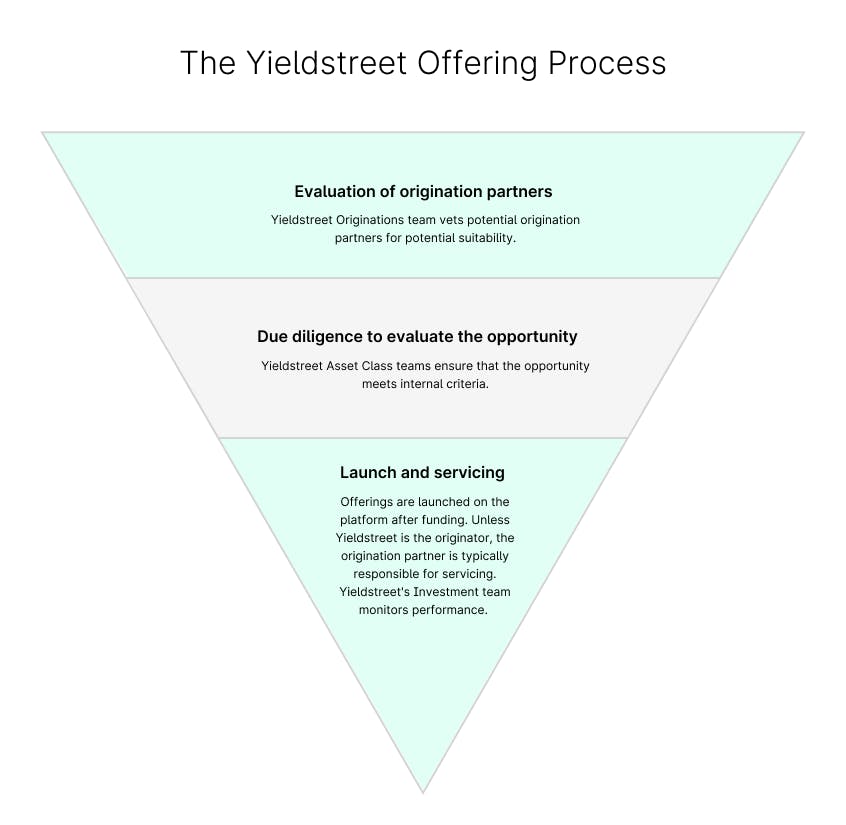

Yieldstreet was able to rapidly provide investors exposure to real estate, artwork, and financing deals by partnering with third-party funds and originators.

An ‘originator’ is a catch-all term for the mix of institutions that source and review deal opportunities. Think of originators as a type of reseller. These are well-connected individuals and companies that Yieldstreet works with to identify and approve the opportunities that end up on Yieldstreet’s platform.

But the company hasn’t left the debt world completely. They still provide loan servicing for some businesses — but only those with good collateral and a solid plan.

Demographics

Correlation isn’t always a bad thing. Yieldstreet’s portfolio growth has grown in line with its userbase.

2021 was their most successful year to date. In 6 months, they saw as many new investors join the platform as all of 2020, and saw $300 million poured into offerings, nearly matching 2020’s total.

But what’s more interesting is the demographics of these new investors. According to Weisz, it used to be that the average age of those investing in alternatives was around 60-65. Yet, most newcomers to the Yieldstreet platform are now in their 30s.

(Note: This is something we’re seeing here at Alts as well. 28% of our community is between 25-34 years old, and 2/3rds are under 45)

What does Yieldstreet invest in?

An interesting irony with Yieldstreet is that, despite their mission to level the playing field, most of their funds aren’t particularly accessible to the 90% of the US population who isn’t accredited. Of all of Yieldstreet’s offerings, only the Prism Fund is open to non-accredited investors.

Now, the minimum entry for structured notes used to be around a million bucks, and Yieldstreet gives investors exposure for as little as $15k. So to be fair, they are living up to their ideals.

Yieldstreet focuses on three key investment types for their accredited options: Artwork, Real Estate, and Structured Notes.

Artwork

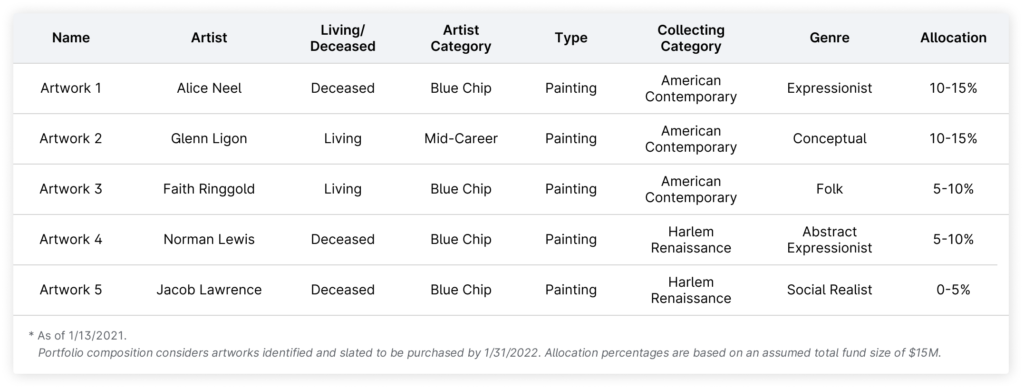

Yieldstreet’s most recent fund is the Artists of Harlem offering

The Harlem Renaissance was a cultural movement from New York City’s African–American population in the 1920s-30s. The community explored their identity through music and art, and significant cultural artifacts remain from the era.

Artists include Alice Neel, Glenn Ligon, Jacob Lawrence, Norman Lewis, and Faith Ringgold.

I think what’s cool about this portfolio is the diverse representation. People of color are often ignored and under-represented in the artistic and investment space.

- Target return (annual): 13–17%

- Minimum investment: $10,000

- Investment term: 5 years

Real estate

Yieldstreet has been investing in real estate ever since its inception. The platform offers both equity and debt in the real estate sector; however, only equity investments are available at the present.

Many of their recent property investments are in multifam residential. Multifam stands for “multiple families”, and is a common nickname for apartment complexes.

Residency rates are often over 90%, which means high yields and quarterly payments for investors. The annual returns are consistently in the 12-17% range, over 3-5 year terms.

Their three current RE offerings are:

- Sevona Avion, a high-end multi-fam complex in Dallas, TX

- The Eliot on Ocean, a new complex in Revere Beach, MA (Or as the locals call it, “REVEAH”)

- Harbor Group Multi-Family Eq Portfolio II, a series of complexes in Columbus and Cincinnati, OH

Structured notes — Debt securities

Structured notes are a complex derivative that performs relative to an underlying basket of assets — mostly stocks. They have less risk than buying stocks outright, but are shorter-term and have less room for growth.

In simple terms, think of them like an IOU with some downside protection. This protection assures a nice risk-adjusted return. Over the years, structured notes have developed so much that they can provide returns even if the market is declining.

Yieldstreet has structured notes available in three sectors:

- Media. Stocks tracked include ViacomCBS, Match Group, and TakeTwo. Estimated yield of 11-12% p.a. Minimum investment is $15k.

- Diversity. Stocks tracked include Align Technology, United Rentals, and Dr. Horton Inc. Estimated yield of 11-12% p.a. Minimum investment is $15k.

- Consumer Goods. Stocks tracked include Etsy, Tapestry Inc, and Bath & Body Works. Estimated yield of 12.5-13.5% p.a. Minimum investment is $15k.

Structured notes — Short term

Yieldstreet also offers a six-month structured note to provide customers easy liquidity. These ‘Note Series’ funds target a 4% annualized return, and investors are paid out monthly.

The yield is low, but it’s a good option if you’re looking to park some cash for six months.

The Prism Fund

Yieldstreet’s flagship offering is the Prism Fund. With $87.6m in assets, the fund provides a multi-asset blend across various asset classes.

A massive selling point of the prism fund is that it’s open to anyone in the US. The minimum is just $500, and non-accredited investors in the US can invest. (But non-US residents cannot)

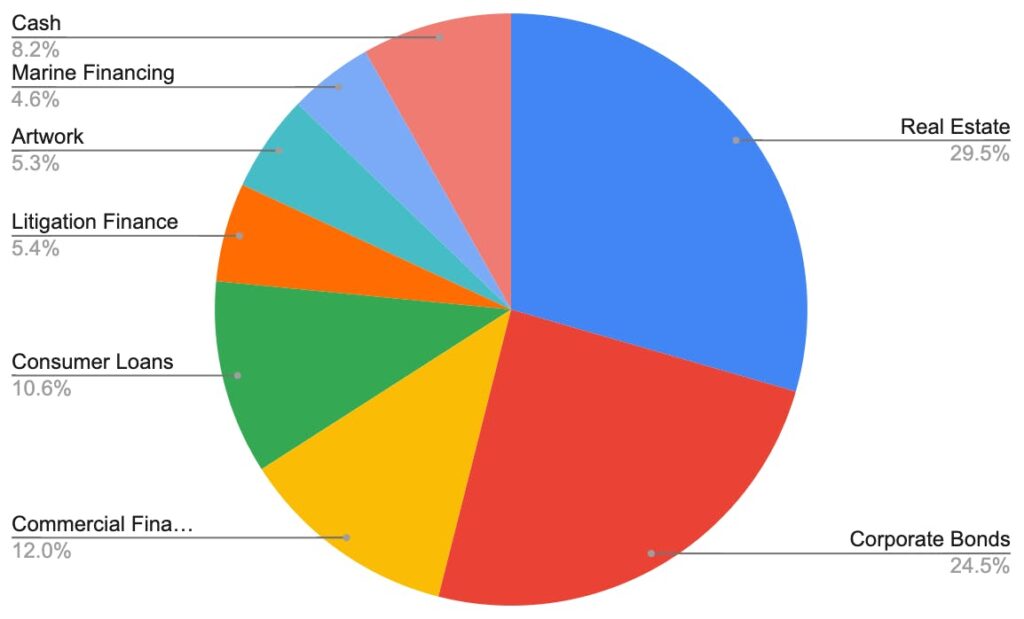

The fund allocates across eight asset classes:

🏡 Real estate (29.5%)

$4.5 million of the fund is dedicated to a mortgage loan, secured by over 1,000 residential lots and the cash flow from two single-family rental (SFR) communities. This alone has a target yield of 10.86% and comprises over 5% of the Prism fund.

The rest of the real estate component is mostly made up of REITs and multifamily units across America.

🏦 Corporate bonds (24.5%)

Nearly a quarter of the fund invests in preferred corporate bonds, mostly from big investment banks like JP Morgan and Charles Schwab.

🚚 Commercial financing (12%)

Small business equipment loans and auto financing are the key drivers of Yieldstreet’s commercial investments. One of the bigger investments is a $5 million loan for a company that leases ultra-exotic and luxury vehicles.

🤝 Consumer loans (10.55%)

Yieldstreet picks up subordinated portions of large consumer loans and receives regular interest payments. These investments can return yields of ~13% p.a.

⚖️ Litigation finance (5.4%)

The servicing of loans for plaintiffs and law firms is an important element of the Prism fund. Legal finance is typically shorter-term, but the investment periods can balloon out to 3+ years on occasion.

🎨 Artwork (5.3%)

The fund’s exposure to Art is pretty much entirely tied up within one investment — a pool of fifteen blue-chip artworks, secured by Athena Art Finance Corp, a company they bought from the Carlyle Group in 2019.

🚢 Marine financing (4.6%)

Yieldstreet’s investments into marine financing landed them in hot water (pun intended) after a dozen ships used to secure the loans actually went missing.

Yieldstreet claimed they were defrauded by a rich shipping family, which resulted in losses of around $90 million. This meant that investors went without principal/interest payments for over a year. Even the FBI got involved.

💵 Cash (8.2%)

The cold, hard stuff. Every good portfolio needs it, just in case.

Prism’s Performance & Fees

Yieldstreet’s Prism fund targets an annualized 8% distribution, paid quarterly. If the fund underperforms, the principal may be used to make up the 8% distributions.

The fund is set to terminate in March 2024. However, it may take 12 months beyond this date for all assets to be liquidated.

The fund charges a 1.5% flat fee on capital invested. This does not affect your distributions.

What makes the fund unique?

The Prism fund offers exposure to typically high-barrier alternative assets to pretty much anybody that can put together $500.

Another selling point for Yieldstreet is its liquidity events. The Prism fund has a lot of illiquid components with fairly high risk (as demonstrated by the shipping debacle). But Yieldstreet offsets this risk with a willingness to buy back shares quarterly.

They will only buy back up to 20% of an investor’s portfolio per year (so up to 5% per quarter). But this helps solve illiquidity issues that can plague alt funds.

Conclusion

Yieldstreet’s growth over the past few years has been impressive. Their renowned Prism fund is a great bridge for those looking to dip their toes into the alts space and receive consistent dividends.

I think the next step for Yieldstreet is to provide more opportunities to non-accredited investors. If their goal is truly to bring alts to the masses, they’ll struggle if the vast majority of their offerings are open solely to accredited investors and 10-15k minimums.

They do plan to introduce more options to those without accreditation in the coming years.

A little fun

We all know there’s a Wall Street.

But I was curious to see if there was an actual street called “Yield Street” anywhere in the US.

It turns out there is one in South Carolina!