READ TIME: ±4 minutes

Hello and Welcome to Alts Cafe for April 28th, 2022.

This is everything you need to know about what’s going on in the world of alternative assets.

Best enjoyed with your morning cup of coffee.

Let’s go!

Table of Contents

Pulse check: What’s the overall market doing?

It’s been a rough week (year) on the markets as tech giants (and others) continue to disappoint. Volatility is going through the roof.

Our picks in the alts space are doing well, though.

What are we doing?

We received some super useful feedback on our first Alts Cafe issue (thank you all). One of the things you asked us to clarify was who exactly are we referring to when we say “we bought this” or “we are bidding on that”. So, to make things super clear:

Whenever we talk about What we’re doing (bidding/investing/etc), “we” stands for our ALTS1 Fund.

Now that that’s out of the way, we (ALTS1) are bidding on an Action Figure on eBay. The auction ends tonight.

There are no changes to our fractional Alts picks this week.

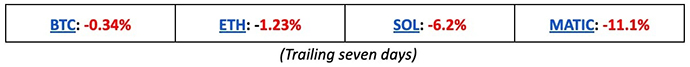

Crypto

Here’s what you need to know:

Crypto is mostly going sideways, but alt coins are struggling a bit.

The biggest and most bullish news this week comes from Fidelity. They announced that they will allow people to put 20% of their 401k retirement savings in bitcoin later this year, which could have a seismic impact on crypto demand.

Here’s what to do with that info:

For now, this is just a piece of bullish news, but expect demand for BTC to swell later in the year when this goes live.

Investor opportunities:

It could be a good time to go long BTC and forget about it.

NFTs

Here’s what you need to know:

Conflicting news coming from Moonbirds this week.

- The Sandbox Game official OpenSea account paid $1m for Moonbird #2642 six days after someone else paid $300k for it. They’ve now spent around 450 ETH ($1.35m) on Moonbirds.

- The Moonbirds COO left to start an NFT fund, which has led to accusations of insider trading and pump and dump.

- The Moonbirds floor is off 25% to 30% on the news.

Also, Bored Apes was hacked again.

Here’s what to do with that info:

If you’re bullish on Moonbirds long-term (I am), this could be a great entry point provided you’ve got 26 ETH ($75k) handy. If you don’t, fractional platform Rally is dropping one at some point in the (probably near) future.

Shares there are $5 each with a market cap of $75k.

Investor opportunities:

- All the talk this week has been around the Otherside land mint Saturday April 1st. Rumor has it that each parcel will cost 300 $APE + ETH for gas. APECoin has nearly doubled in the past 9 days, rising from ~$11 to where it currently sits at $19.54 (USD). $6,000 per parcel could look like a bargain in a few months.

- Bear X announced a partnership with Binance yesterday. Could be a short-term opportunity here.

Silliest NFT drop of the week:

This one. (Though this is a close second.)

Sports Cards

Here’s what you need to know:

Everything in sports cards looks good on the surface.

But I worry there are problems below. From this week’s Sports Cards Insider:

The high-end index continues to slide. This was the last holdout of positivity as lower and mid-range cards slid in early 2022. This could mean the whales have finally given up.

All year, I’ve been saying I’m bullish on vintage sports cards (especially football, soccer, and basketball), but I’m not so sure anymore.

I think F1 may have peaked (though I’m reserving judgment for now).

Has Formula 1 peaked in the US?

— Wyatt Cavalier (@itiswyatt) April 26, 2022

Also, there’s only one state where Max Verstappen is more popular than Lewis Hamilton.

See if you can guess which one before expanding the second image. pic.twitter.com/KKSc4Z9Pv4

What to do with that information:

Sit on the sidelines? That’s what I’m doing for now.

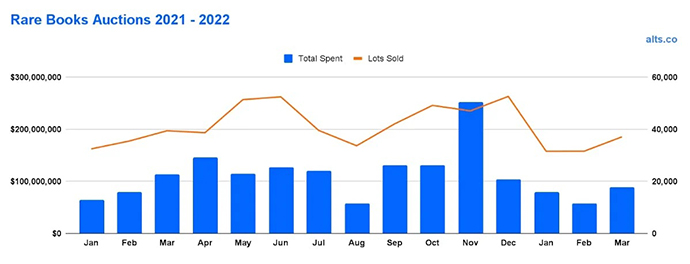

Books

Here’s what you need to know:

Books had a great 2021, but there are signs of the market is slowing down a bit.

Both February and March 2022 are down relative to 2021. The recent Fine Printed Books and Manuscripts auction at Sotheby’s was mostly in line with estimates.

Most auction houses aim to have roughly 70% of lots beat estimates, so that could be a warning sign.

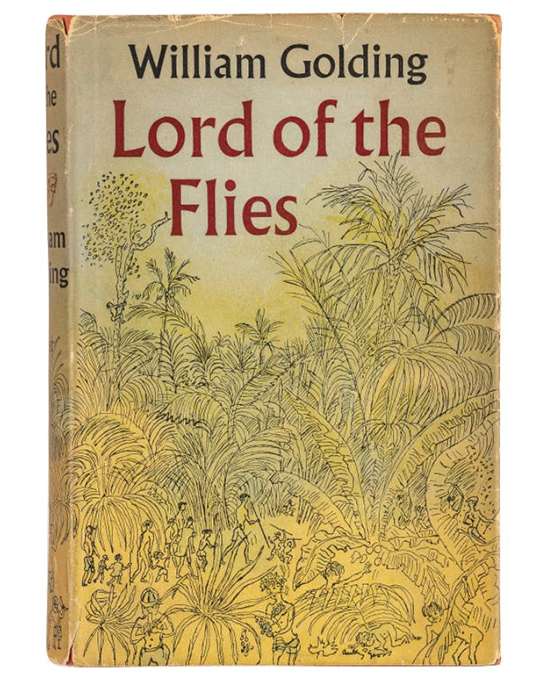

Investor opportunities:

Limited Editions are a great way to get started with book investments. Here are a couple of my favorites right now:

- David Hockney: 220 for 2020: This is a compilation of over 220 iPad sketches by the English painter. It’s quite stunning. €2,000.

- Robert Heinlein’s Starship Troopers limited artist edition: the classic is available on eBay at a very reasonable price. $275

- A first edition Lord of the Flies is at auction now with an estimate between $3k and $5k.

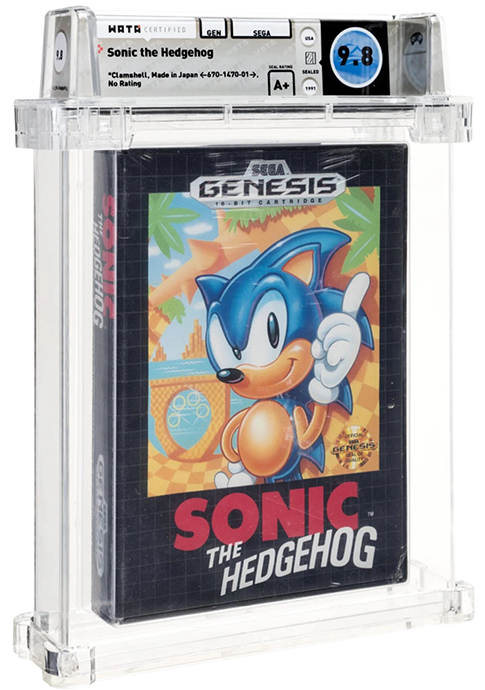

Video Games

Here’s what you need to know:

A stunning WATA 9.8 A+ copy of Sega’s Sonic the Hedgehog sold for $360k over the weekend.

That’s a record for a Genesis game, as far as I know.

Here’s what to do with the information:

Honestly, the video games market is all sixes and sevens right now.

I’m on the sidelines but adding this as an important data point.

Whisky

Here’s what you need to know:

Sotheby’s auctioned off a Karuizawa 36 Views of Mount Fuji Full Set, and it hammered at $175k. The most recent sale, in November 2021, was right around $145k. That’s a 20% gain in five months.

Investor opportunities:

Vint.co recently fractionalized and sold off an identical set, valuing it at $187k, which is $12k above the auction price. I don’t know when or if they’ll open the shares for trading, but now would be a good time.

We passed on it at the time… and that was probably a mistake.

Real Estate

Here’s what you need to know:

- Housing prices rose 20% in February, with Florida and Arizona showing the biggest gains.

- Permits and starts are also up year over year, while mortgage rates are going parabolic.

- Mortgage applications declined for the second week in a row.

What to do with the information:

Remember 2008? I do. History doesn’t repeat, but it rhymes. Refresh your memory: