October 25, 2022

Read time: ± 6 minutes

Hello and welcome to Alts Cafe. This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

The Macro Picture

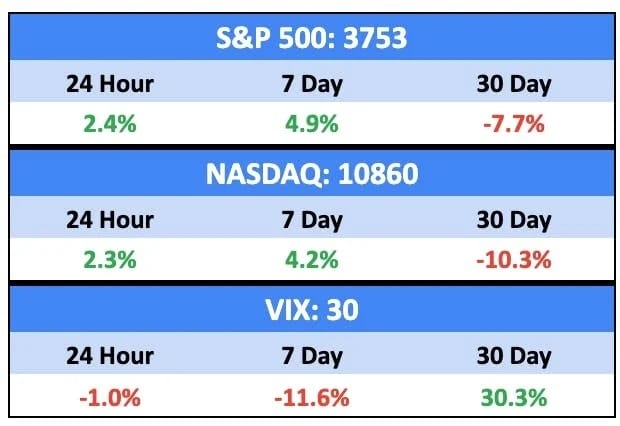

It was the best week since June for American equities:

It was a pretty quiet week after an eventful early October. Interest rate hikes are doing their jobs, the UK has a new prime minister (again) who might last slightly longer than a head of lettuce this time, and housing is coming back to earth.

Bullish News

- Treasury yields fell from their highs after a report that some Fed officials are concerned about over-tightening with large rate hikes.

- The pound rallied on news that Rishi Sunak will become UK PM. Liz Truss was the shortest-tenure UK PM ever.

- Inflation in Canada has begun to tick down (meanwhile, it hit a 40-year high in the UK).

Bearish News

- Retail investor portfolios are down 44% YTD.

- Turkey cut interest rates by 150 basis points for the third consecutive month, from 12% to 10.5% — despite Turkish inflation sitting at more than 83% at the moment.

What are we doing?

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

We bought six 200L barrels of 100% pure agave tequila. We’ll age it and report back in a few years.

Crypto

Here’s what you need to know:

Crypto is up slightly, while equities are down.

Bullish News

- The UK is now the largest crypto economy in Europe.

- Europe’s $9 billion digital bank N26 launched a crypto trading service.

- Fidelity’s Crypto Platform will add ether trading for institutional clients.

- Buffett-backed digital bank Nubank is launching its own cryptocurrency in Brazil.

- Israel will begin to use the blockchain to sell government bonds.

Bearish News

- Nothing here this week.

What to do with that info:

Is crypto decoupling from equities finally? If so, it could be a good hedge again.

Real Estate

Here’s what you need to know:

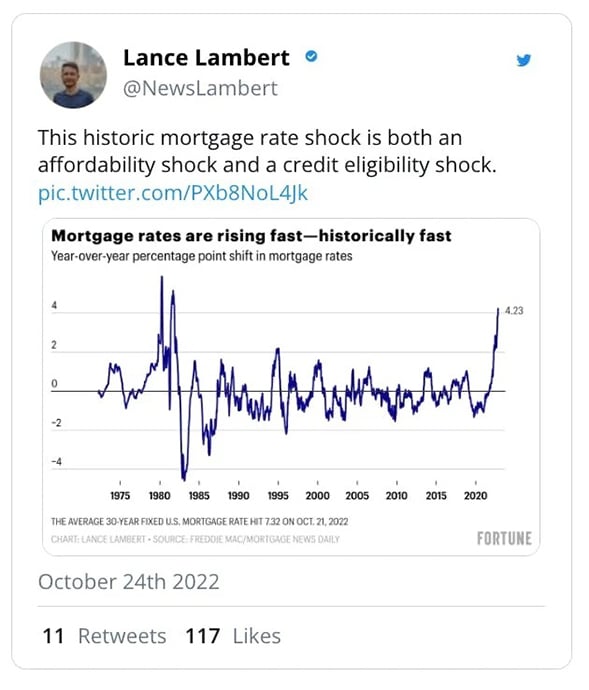

The change in YoY interest rates is nearing a historic high, and will shatter recent records, as rates continue to rise through mid-2023.

Going light here this week, as we’re dropping a Real Estate Insider in a couple of hours.

Bullish News

- Sorry, we’ve got nothing.

Bearish News

- Existing US home sales fell to a 10-year low in September.

- Canadian home prices posted the largest monthly decline since the index was launched in 1999.

- US single-family home starts fell to the lowest level in more than two years.

- Homebuilder sentiment dropped to half of what it was six months ago, the lowest since 2012.

What to do with that info:

Dry powder.

NFTs

Here’s what you need to know:

Art and collectible NFTs continue to slide sideways, providing a remarkable store of wealth over the last month, as the NASDAQ tumbled more than 10%.

It’s possible, however, that these prices remain as steady as they are because there’s simply no market.

Bullish News

- Ethereum NFT creators have earned $1.8B in royalties to date.

- The 1,000-piece NFT collection released by Anthony Hopkins sold out in around ten minutes.

Bearish News

- Valuations and volumes in the metaverse continue to look ugly.

What to do with that info:

There’s just not much going on here at the moment.

We’re using our PROOF Collective NFT access to get into free mints and the like (some of which may pay off in the future).

Startups

Here’s what you need to know:

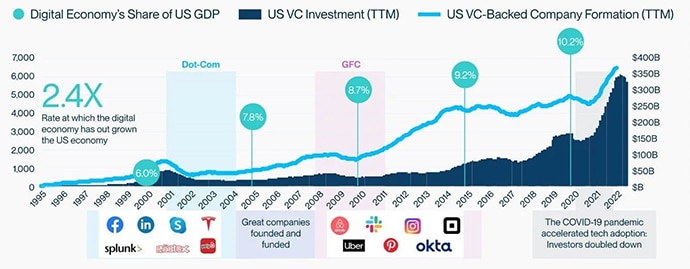

While deal volume is down, the best deals continue to get done, especially at the seed stage.

Median valuations by stage are down a bit but are still robust:

Web3 deals have finally fallen from the top spot, with Fintech claiming a plurality of capital deployed.

AI and ML are making moves.

And lest you despair, here are some great tech companies that rose from the ashes of previous downturns:

We’ve given you the highlights, but this entire thread is worth the read:

Lots of hot takes right now on where early stage startups and VCs are at on funding, valuations, and more.

— Andrew Oddo (@A0ddo) October 20, 2022

Well, here's first party data from @AngelList + @SVB_Financial based on thousands of early stage startups in Q3 + my own takes. Here we go 🔥😨

1/n

Bullish News

- Elon Musk plans to sack 75% of Twitter’s workforce if his acquisition goes through, which will be a significant talent injection into the startups ecosystem.

- BeReal apparently raised $60m at a $600m valuation earlier this year, well above Series B stats above.

- AI companies are hot hot hot.

- Soccer superstar Lionel Messi is creating a holding company to invest in sports, media, and technology globally.

- JPMorgan is launching a platform that aims to connect startup founders with venture capital investors to simplify the fundraising process.

- The US will award $2.8 billion in grants for projects to expand US manufacturing of batteries for electric vehicles.

Bearish News

- Snapchat is in trouble.

- The SEC is trying to reduce fees hedge funds can charge investors.

- VC investments in space tech have fallen 80% this year.

- Blackrock is facing a significant backlash against its ESG funds.

What to do with that info:

If you work at Twitter, it may be time to brush up on your AI skills.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe. ☕

Any comments, questions or concerns – let us know.

Cheers,

Wyatt