READ TIME: ±4 minutes

Hello and Welcome to Alts Cafe for June 9th, 2022.

This is everything you need to know about what’s going on in the world of alternative assets.

Best enjoyed with your morning cup of coffee.

Let’s go!

Table of Contents

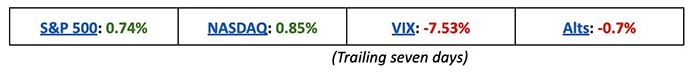

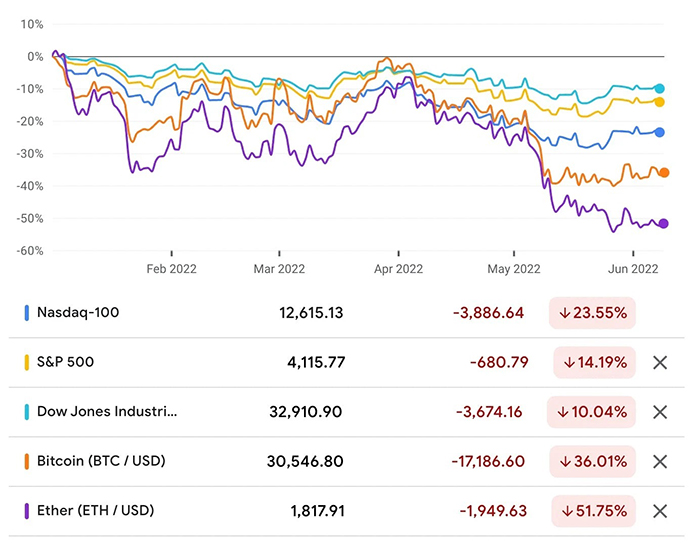

Pulse check: What’s the overall market doing?

Everything seems to have flattened out, more or less. It looks like investors are just a bit tired of losing money.

ETH is just a levered play on the Dow Jones these days.

What are we doing?

Fractional Alts picks

There are no changes to our picks this week.

ALTS 1 fund news

I honestly can’t remember if we already talked about this, but we bought the legendary White Album by The Beatles.

Our copy was allegedly given to John Lennon (we’re working to confirm that).

If you want to get in on this action, click below. 👇

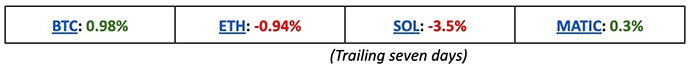

Crypto

Here’s what you need to know:

Bullish News

- Chipotle now accepts crypto as payment via the platform called Flexa. (TB)

- Japan passed a stablecoin bill on June 2, becoming one of the first developed nations to have a legislation policy around stablecoins. (B)

- Institutions are buying the crypto dip (D)

Bearish News

- Coinbase is continuing their “hiring pause” amid the crypto downturn. (Coinbase)

- Gemini, the crypto exchange, is laying off 10% of its staff ahead of a possible “crypto winter” (D)

- The Solana blockchain had a network outage. Their team had to restart the network. (TBC)

What to do with that info:

Bitcoin is starting to look stronger from an institutional point of view, while everything else is on the sidelines.

Real Estate

Here’s what you need to know:

The number of homes under construction has never been higher, but mortgage demand is the lowest for 22 years.

I went into the looming crisis in the US in yesterday’s The WC, so check that out if you’d like to know more.

What to do with that info:

If you own shares of any homebuilders, you may want to reconsider your position.

Rare Books

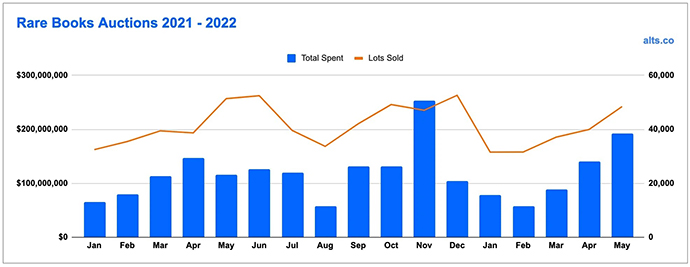

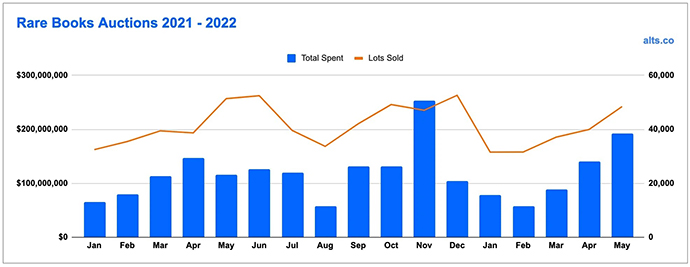

Here’s what you need to know:

It was a blowout May in the rare books world, posting the second-best month in over two years.

Following a solid April, this is a positive trend after a disappointing start to the year in February and March.

What to do with that info:

There are some steals currently available on fractional marketplace Rally.

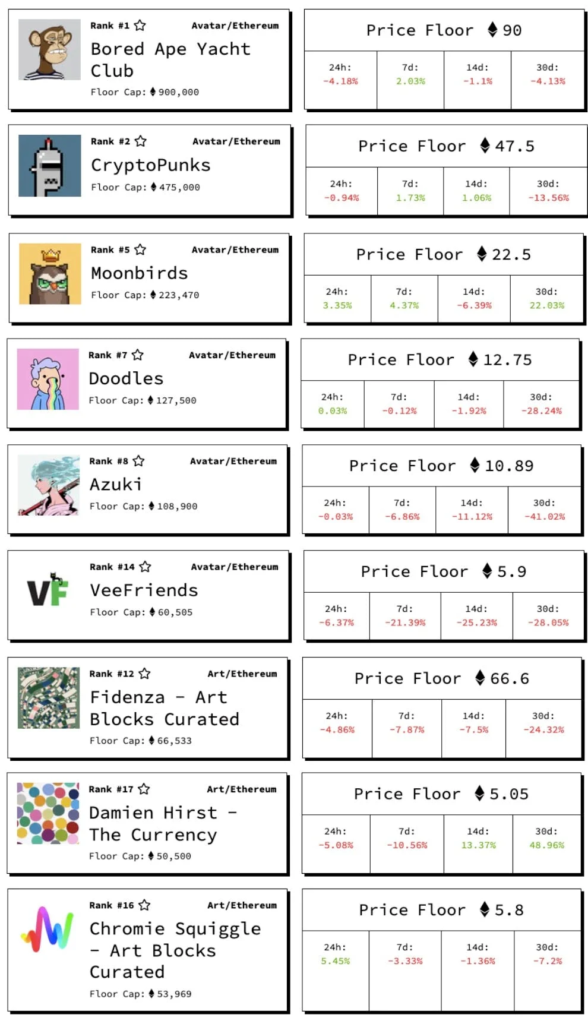

NFTs

Here’s what you need to know:

A lot more 7d green numbers than we’re used to seeing, particularly among the PFP projects. Moonbirds continues to recover slowly, while Gary V’s VeeFriends project is struggling.

Again, this broadly tracks what the rest of the markets are doing, so there’s probably nothing special going on with NFTs…just 1:1 correlation to everything else.

One bit of news from the week, though – there’s been yet another hack – the BAYC discord was hacked, allowing 200 ETH worth of NFTs to be stolen.

What to do with that info:

We’re starting to look at dipping into some of these projects again.

Projects we’re watching:

- Magma: This upcoming project aims to build an exclusive NFT club for enthusiasts, artists, launchpads, and VC’s. Founded by NFT Astra, the team also includes big names like Ali Sajwani, Daeglen, and NFT Llama. The WL is hard to access as you have to apply and be selected manually through a form on their Twitter page. This is definitely something worth keeping an eye on / trying to apply for. Other details TBA.

- NFT Sensei: This upcoming project is minting on June 11 at a mint price most people would likely consider to be absurd – 1.25 ETH. Despite this, some of the bigger players in alpha channels are looking forward to it and expect it will either make you more ETH than that or rise in value fairly quickly for a flip. Claims are that it will be the elite bot / trading tool once live, assuming they mint successfully.

Comics

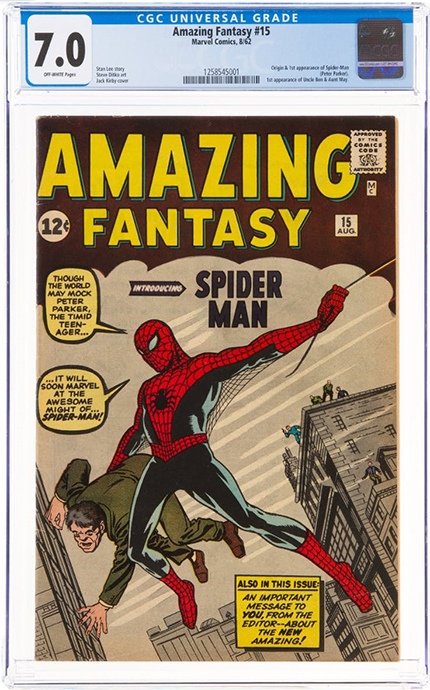

Here’s what you need to know:

We can finally stop watching all those Amazing Fantasy #15 comics at auction as the last one has finally hammered home.

- Amazing Fantasy 15 CGC 8.0 at Goldin (Ended at $450k) $490k was the price to beat

- Amazing Fantasy #15 CGC 8.0 at Comic Connect (Ended at $515k) $490k is the price to beat

- A CGC 7.5 copy at ComicLink (Ended at $270k) $280k was the price to beat

- And a CGC 7.0 copy at Heritage. (Sold for $240k) $210k was the price to beat

So we had two beats and two misses (all prices include buyer’s premium), ending even on balance, more or less.

Also, Motor City Comic Con took place this past week, and signals were a bit mixed. (GC) Attendance was strong → a good indicator for consumer interest/demand.

“The economy is down, but many fans indicated that would not stop them from buying books”. That said, GoCollect reported that more fans seemed to be interested in lower-end books this year. “Even known high-end buyers set their sights to lower targets”

Lastly, the much-anticipated trailer for Black Adam finally dropped this week.

The highest-graded copy of his key comic, Shazam! #28, can be had for around $5k. Here’s a CGC 9.6 for $3,500.

What to do with that info:

Many key comics for DC and Marvel film characters get a bump in the run up to the release. Now could be a good time to buy ahead of its October debut.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – respond to this email. Cheers,

Wyatt