European Parliament Drafts ICO Regulation Proposal

In this edition I focus on some international ICO/Blockchain developments and the need for cross-border collaboration for regulators and policy-makers.

This week we will also focus on the Status of Alternative Finance in France with Florence de Maupeou.

Main news items:

- European Parliament Drafts ICO Regulation Proposal

- 12 regulators (incl FCA) are collaborating on global sandbox

- World Bank Launches World-First Blockchain Bond

- Standard disclosure template for SME alternative finance

Table of Contents

European Parliament Drafts ICO Regulation Proposal

The European Parliament Committee on EMA (Economic and Monetary Affairs) published last week a draft proposal (PDF) mentioning the possibility to include Initial Coin Offerings in the new crowdfunding regulation.

Crowdfunding via cryptocurrencies with a maximum of €8 million

Although ICOs are supported by several jurisdictions such as Switzerland, Gibraltar and Malta, a clear lack of regulations and frameworks is still going on. The proposal is part of a wider EU-wide proposal to support pan-European crowdfunding. The new additions will enable crowdfunding service providers to raise capital through their own platforms via cryptocurrencies.

The proposal is made by Ashley Fox, a Member of the European Parliament (MEP) representing the UK. He has noted that the proposed EU regulation gives a chance to ICOs to prove their legitimacy as well.

“This Regulation gives the opportunity to ICOs that want to prove their legitimacy to comply with the requirements of this regulation. Whilst this regulation may not provide the solution for regulating the ICO market, it takes a much-needed step towards imposing standards and protections in place for what is an excellent funding stream for tech start-ups,” Fox noted.

The full proposal can be downloaded here (PDF).

12 regulators (incl FCA) are collaborating on global sandbox

The FCA is collaborating with 11 financial regulators and related organisations on a new ‘global sandbox’ in a new network called the Global Financial Innovation Network (GFIN).

Framework for co-operation between countries

The network will seek to provide a more efficient way for innovative firms to interact with regulators, helping them navigate between countries as they look to scale new ideas. It will also create a new framework for co-operation between financial services regulators on innovation related topics, sharing different experiences and approaches.

FCA’s Global Sandbox Consultation

The creation of the GFIN follows the FCA’s consultation in February 2018 on the idea of a ‘global sandbox’. Key themes were:

- Regulatory co-operation: Respondents were supportive of the idea of the initiative providing a setting for regulators to collaborate on common challenges or policy questions firms face in different jurisdictions.

- Speed to market: Respondents cited one of the main advantages for the global sandbox could be reducing the time it takes to bring ideas to new international markets.

- Governance: Feedback highlighted the importance of the project being transparent and fair to those potential firms wishing to apply for cross-border testing.

- Emerging technologies/business models: A wide range of topics and subject matters were highlighted in the feedback, particularly those with notable cross-border application. Among issues highlighted were artificial intelligence, distributed ledger technology, data protection, regulation of securities and Initial Coin Offerings (ICOs), know your customer (KYC) and anti-money laundering (AML).

Open consultation

The consortium started a new consultation to receive input on the future goals and activities of the consortium focusing on the three main functions of the GFIN:

- act as a network of regulators to collaborate and share experience of innovation in respective markets, including emerging technologies and business models;

- provide a forum for joint policy work and discussions; and

- provide firms with an environment in which to trial cross-border solutions.

GFIN Membership

The current regulators are part of GFIN:

- Abu Dhabi Global Market (ADGM),

- Autorité des marchés financiers (AMF)

- Australian Securities & Investments Commission (ASIC)

- Central Bank of Bahrain (CBB)

- Bureau of Consumer Financial Protection (BCFP, USA)

- Dubai Financial Services Authority (DFSA)

- Financial Conduct Authority (FCA, UK)

- Guernsey Financial Services Commission (GFSC)

- Hong Kong Monetary Authority (HKMA)

- Monetary Authority of Singapore (MAS)

- Ontario Securities Commission (OSC, Canada)

- Consultative Group to Assist the Poor (CGAP)

The consultation document (deadline October 14) can be found here: GFIN Consultation FCA (PDF).

World Bank Launches World-First Blockchain Bond

The World Bank has priced the world’s first public bond created and managed using only blockchain in a A$100 million ($73.16 million) deal designed to test how the technology might improve decades-old bond sales practices.

Bondi-bond

The prototype deal, dubbed a “Bondi” bond – standing for Blockchain Operated New Debt Instrument as well as a reference to Australia’s most famous beach – is being viewed as an initial step in moving bond sales away from manual processes towards faster and cheaper automation.

Best of old and new financial world

An interesting development to see a traditional financial instrument (public bond) being launched and traded on a blockchain interface. Slowly the old and new financial world are finding ways to combine best of both worlds.

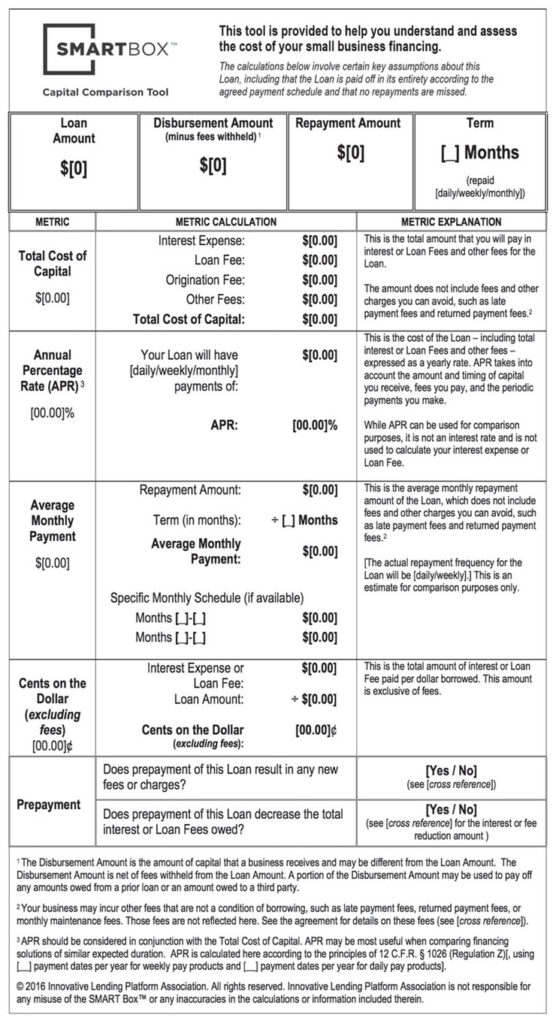

Standard disclosure template for SME alternative finance

The Innovatie Lending association has launched “The SMART Box” with several standard models for disclosure of costs for alternative finance for SMEs. This will help the SME (and their advisor) to make a better informed decision.

Three models with standardized language

There are currently three different versions of the SMART (Straightforward Metrics Around Rate and Total Cost) model for disclosure – for term loans, lines of credit, and merchant cash advances — that take into account the differences between the products while still utilizing common pricing metrics and calculations, as well as standardized language.

Cor features

The core features of the SMART Box include an outline of the basic elements of the finance option in question (including amount financed, funds disbursed, total repayment amount, expected term and frequency of repayment).

There are then four common pricing metrics: total cost of capital (TCC), annualised percentage rate (APR) (which is estimated for merchant cash advances), the average monthly payback, and the cents on the dollar cost of the funding option.

Need for standard disclosure models

These models are a very good step to standardize offering for SMEs. ILPA is an American association, but their model should be an inspiration for associations in other countries. The SMART model is also part of their Code of Ethics, a detailed code how to work with SMEs.

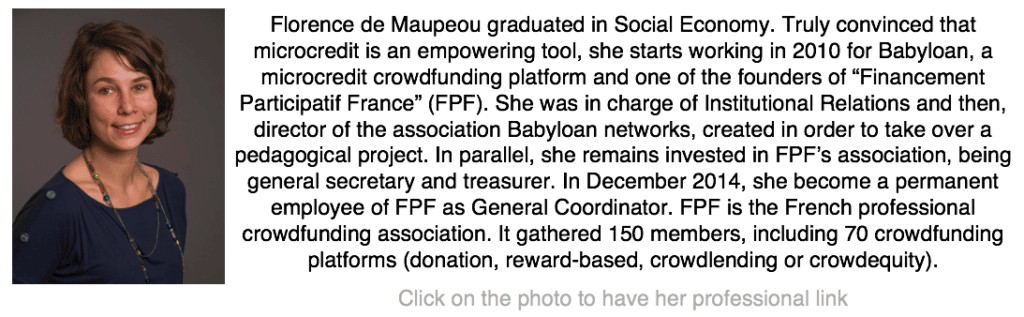

Expert of the week : Florence de Maupeou (France)

What is the current status of Alternative Finance?

Equity crowdfunding now open for all startups in Australia

Equity crowdfunding in Australia has finally been extended to proprietary companies after the government passed legislation through Parliament. This is important, because until this change equity crowdfunding was only allowed for “unlisted public companies”, while most startups are private companies.

2 years of discussion

Legislation for equity crowdfunding first passed in Australia in May 2017 after more than two years of consultation and debate, however at the time, the only companies eligible for the niche form of capital raising were public unlisted companies, meaning the method was highly restrictive in its application.

There are still some restrictions. The company should have a turnover or gross assets of no more than $25 million to use the funding method, and will be able to raise a maximum of $5 million a year. This is largely in line with current European regulations on average. In Europe the maximum amount will most likely be raised to €8 million in 2019 in several European countries and in the pan-European crowdfunding regulation.

Equity crowdfunding already very popular

In the first year equity crowdfunding was already successfully used by several public companies, including raises of $2.5 million for DC Power Co and $2.16 million for Xinja, an Australian neobank.

The legislation will come into effect in 28 days. Full document with regulations can be downloaded here (PDF).

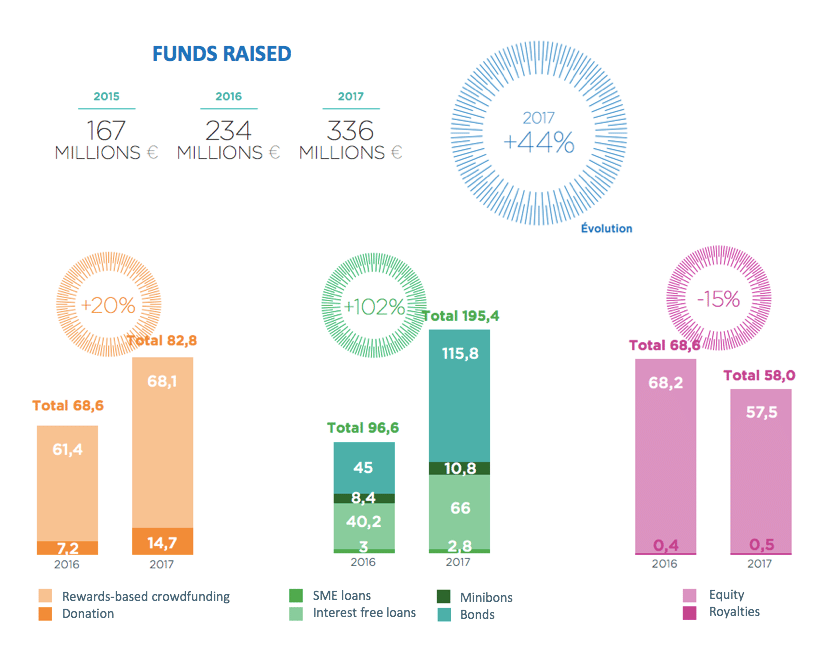

France is the biggest market in the Continental Europe, with € 940 million collected by the alternative finance actors in 2017. A 50% increase compare to 2016.

- €336 million for the crowdfunding sector (reward crowdfunding, crowdlending and crowdinvesting)

- €231 million for peer-to-peer consumer lending platforms

- €215 million for online lending funds

- €155 million for personal fundraising and group gifting website

- €3 million for check-out donations and payroll giving

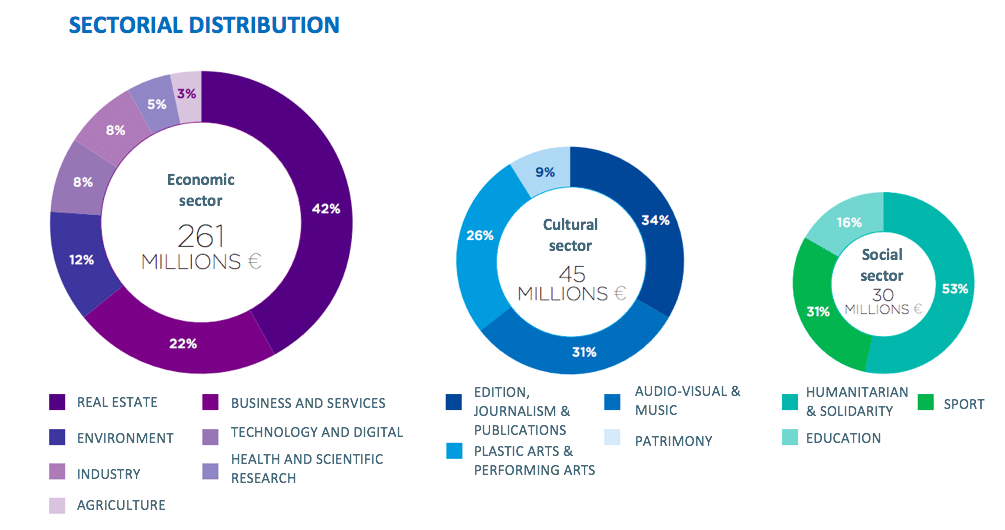

A diversity of alternative platforms emerged in France, creating a wide spectrum of innovation in the finance sector. We observe an important diversification of the sectors financed by alternative finance. Back in 2010, the cultural and social sectors were the prevailing sectors in crowdfunding industry. Now, the economic projects take the first position. Especially the real estate sector, which gathered almost 110 million of Euros, followed by the local shop and services with 57 million of Euros and by environmental projects and renewable energy with a collect of 31 million of Euros. We also observe the apparition of the agricultural sector.

The number of crowdfunding platforms is also significant. France lists about 170 platforms, including group gifting website, donation or reward crowdfunding, business crowdlending, crowd investing, royalties crowdfunding, real estate crowdfunding …

Pioneer in crowdfunding regulation

France has been a pioneer in the setting up of a crowdfunding regulation. Through the impulsion of the French crowdfunding association the government created two statutes in October 2014 :

• The crowdfunding intermediary (in french Intermédiaire en Financement Participatif (IFP)), supervised by the “Autorité de contrôle prudentiel et de résolution” (ACPR), for lending platforms and donation platforms or rewards-based crowdfunding. 120 IFPs are listed in the Orias register, the single register for intermediaries in insurance, bank and finance.

• The Participating Investment Advisor (in french Conseiller en Investissements Participatifs (CIP)), supervised by the Authority of financial markets (AMF), for the platforms intermediating specific financial instruments and minibons. Some 50 CIPs are listed in the Orias register.

Can you give us an inspiring case from your country?

Financement Participatif France (FPF) is the representative professional association of the French crowdfunding sector. Created in August 2012, it now gathers 150 members, including 70 platforms of all crowdfunding categories. One of the project implemented within its self-regulation mission was the creation of a common table, readily-accessible on crowdlending websites. This table boasts the data reflecting bad debt rates and returns performance according to a methodology defined by FPF. It allows a comparison between the different platforms and more transparency of the sector.

Another good practice is the creation of a label, initiated by FPF with the French Ministry for the Ecological and Inclusive Transition : a “Crowdfunding for Green Growth” label to promote projects which contribute to the ecological and energy transition. By allowing to qualify the crowdfunding projects, the Label will help shift funding towards low-carbon economy. To receive this label a project must meet several criteria: eligibility, transparency of information and proof of its positive impacts. The project must, therefore, be involved in green and be subject to transparent information practice internally and document its environmental and social impacts. The label is granted by the platforms that have been allowed by the label governance body.

Finally, France is the first state to have taken the initiative to include blockchain (distributed ledger technology) in the regulation. Some experimentations are running, as the one launched by the “Caisse des Dépôts” and FPF to create an open blockchain for the emission of minibons. The objective will be to create and facilitate a second market for crowdfunding.

What are the biggest obstacles for growth?

The alternative finance knows a great dynamic in France but it evolves in a framework characterized by a lack of flexibility regarding the regulators that can be reluctant to adapt the rules to a digital business; and the uncertainty of the crowdfunding platforms’ business models.

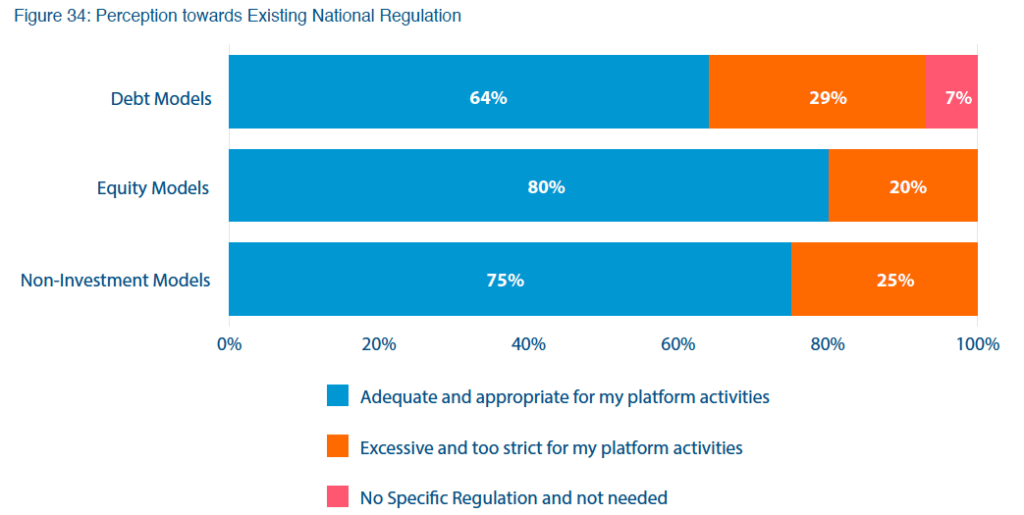

Most of the actors find the existing regulation appropriate for their activity regarding the 3rd European alternative finance industry report – Expanding horizons – published by the Cambridge Centre for Alternative Finance. Moreover, between 20 and 30% of the respondents answered that is excessive and too strict.

Indeed, while the French regulatory framework is particularly and rightly provided with regard to advice and information for investors, it takes insufficient account of the specific characteristics of an activity operating through an internet platform (customer relationships carried out exclusively through digital channels, very significant number of investor clients for small individual amounts, …) and slow down the operating processes of the crowdfunding platforms.

Furthermore, in order to strengthen their business models based on applying relatively low margins to large collection volumes, the French crowdfunding platforms are looking to the European market to extend their activities. But the cost and the time it takes to adapt to the local regulation is significant.

Therefore, French crowdfunding sector supports and encourages the implementation of a harmonized European regulation of crowdfunding. But the proposition published by the European commission – with a threshold of 1 million of Euros where in France project owner can collect up to 2,5 million of Euros, and perhaps tomorrow 8 million – is far from being satisfying for French actors.