Current State of Crowd Investing in Europe

This week the newsletter will have a focus on equity crowdfunding. In this newsletter there will also be the offer for a free online consultation on equity crowdfunding on May 23 by a specialist.

This week we start with our European review on the Status of Alternative Finance in Georgia with Nathan Rose.

Further news this week:

- Indiegogo Has Quietly Exited Equity Crowdfunding

- Equity Crowdfunding in Malaysia

- Alternative Finance is Booming in Latin America

- Current State of Crowd Investing in Europe

- Free online training on equity crowdfunding

- ECWT case study with : Elina Berglund – NaturalCycles

- Expert of the week : Nathan Rose (Georgia)

Table of Contents

Indiegogo Has Quietly Exited Equity Crowdfunding

Indiegogo, the second largest rewards-based platform in the US, has quietly exited equity crowdfunding.

Indiegogo entered the securities realm in November of 2016. The platform partnered with Microventures, a Texas-based broker-dealer, to create First Democracy VC – a FINRA approved funding portal.

At the time of the launch, a few months after the Reg CF securities exemption became actionable (May 2016), Indiegogo CEO David Mandelbrot stated:

Our mission has always been to make it easier for individuals to raise money for projects they are passionate about and this is the latest way we’re helping entrepreneurs access the financing they need while also giving backers the chance to invest in new companies. Since Indiegogo first launched we’ve wanted to offer these sort of investments, and we’re very excited to be officially giving the millions of people who visit our platform every month the chance to get involved with equity crowdfunding opportunities.

The entrance by Indiegogo into the investment crowdfunding sector was viewed, by some, as a significant validation of online capital formation for smaller issuers and non-accredited investors.

To issue securities under Reg CF, created by Title III of the JOBS Act, platforms must be approved by FINRA or be a broker-dealer. The partnership between Microventures and Indiegogo created one of the earliest funding portals – a number that now stands at over 40 FINRA approved sites. The platform has since been removed from the list of FINRA regulated funding portals and discontinued. While Microventures continues to offer Reg CF securities as a broker-dealer there is no need for the funding portal license.

Indiegogo was always envisioned as a securities platform. Founder Slava Rubin frequently mentioned this fact when he was championing the company’s mission. He would tell an audience that it was only when they discovered that rules that allowed for online securities offerings did not exist that Indiegogo followed a path of perk-based offerings.

In 2017, Rubin predicted continuous growth for equity crowdfunding.

“If you look at how Indiegogo grew in the early days… if you look at how Crowdcube grew in the UK. I think we are seeing the same type of growth.”

At their one year anniversary of equity crowdfunding, Indiegogo claimed that over $7.5 million had been raised by 30 different companies. Indiegogo proudly stated that more than 11,000 investments had been made with issuers raising, on average, $318,000. Not only are investors part of bringing new products and ideas to life, but they are also part of the journey in an even bigger way, stated Indiegogo.

Of course, during 2017 the initial coin offering (ICO) market became red hot.

Largely unregulated and borderless, issuers of digital tokens raised phenomenal sums of capital to launch businesses that were mostly little more than concepts and a white paper. Many of these ICOs were effectively acts of fraud.

Indiegogo looked to enter the digital asset fray with the listing of the Fan Controlled Football League (FCFL) during the summer of 2018. The “ICO,” being issued as a SAFT, quickly raised over a million with Indiegogo stating on their blog:

“Today, we’re taking the next big step. We’re incredibly excited to announce that you can now invest in the first Initial coin offering (ICO) pre-sale with Indiegogo and MicroVentures.”

But after changes in regulations, IndieGoGo had to cancel the ICO and repay the investors and dropped out the ICO market. Now they are completely leaving the equity crowdfunding market.

Equity Crowdfunding in Malaysia

The equity crowdfunding industry in Malaysia is just starting. Since its introduction, 50 SMEs have raised RM 48.87 million through equity crowdfunding. More than half of the investors on the platform are retail investors, signalling a positive participation from the general public.

35-45 year old investors

Unsurprisingly the largest age group that are investing in equity crowdfunding are around the age 35-45 year old. A sweet demographic sweet spot of disposable income and a level of comfort with technology.

A lot more details about the equity crowdfunding market in Malaysia can be found here: “How is Malaysia’s Equity Crowdfunding Scene Doing in 2019?“.

Alternative Finance is Booming in Latin America

The Cambridge Centre for Alternative Finance (CCAF) Americas Report showed a growth of 94% from $342 million in 2016 to $663 million in 2017.

The countries that contributed the largest to the volume were Brazil, Mexico, Chile, Colombia, Argentina, and Peru. The rest of Latin America & Caribbean (LAC) countries and territories contributed only $35 million to the total volume.

Business funding

While in other region a lot of the growth comes from financing of consumers, LAC is all about business:

“Just over 85% of all volume came from debt, equity, and non-investment-based activities to businesses across the [LAC] region. Business lending in LAC grew by 142% between 2016 and 2017, amounting to $565.7 million in 2017. Debt-based models made up the largest share of business finance, accounting for 92% of volume ($522 million), followed by 7% from equity-based models ($39.4 million) and just shy of 1% from non-investment models ($3.8 million).”

Predictions for the alternative finance sector in LATAM for 2019?

Diego Herrera (Financial Markets Lead Specialist at the Inter American Development Bank):

“We expect that alternative finance will keep on growing in the region for the following years. However, we are predicting two major trends.

First, the internationalization of firms is unavoidable in the sense that with few exceptions, individual country markets are still small to reach scale. As a matter of fact, many of the most established platforms are moving across borders in and outside of the region. Mexico and Brazil seem to be two of the favorite destinations for entrepreneurs, mainly because of the size of the potential market but also because of regulatory certainty.

Secondly, we are predicting a transition from mono-product to multi-product platforms as another way to create scale and to reach broader markets. This comes accompanied by alliances and mergers with traditional financial institutions or the transition to open banking, depending on the markets.

$1 trillion for Micro SMEs

There is a huge opportunity in creating products and services for Micro SMEs. A gap of over $1 trillion needs to be filled and a study on Mexico and Chile shows that alternative finance platforms are a very viable alternative to provide financial services for Micro SMEs.

That means not only financing, but also opportunities for alternative credit scoring, identity, business management, and many other types of platforms.

Fintech should be in the agendas of regulators and policymakers as it is a relevant tool for financial inclusion.

Current State of Crowd Investing in Europe

The European Commission’s Altfinator project held its first internal training webinar on Alternative Financing . I was asked to provide a webinar on the Current State of Crowd Investing in Europe earlier this year. The webinar was recorded and is now available for view on-demand.

€10 billion industry

The Alternative Financing industry has grown rapidly in the past years. In 2018 roughly €10 billion was already raised. In this webinar you will learn the different types of alternative finance and which countries in Europe are most successful in using Alternative Financing.

Alternative Finance Maturity Model – building the sustainable eco-system

This webinar is also useful for policy makers because it introduces the Alternative Finance Maturity Model to map growth obstacles and solutions to support the growth of Alternative Finance in the entrepreneurial eco-system in a country.

Role of Financial advisors

Finally, latest research results are presented from Dutch research on the role of financial advisors for SMEs.

Free online training on equity crowdfunding

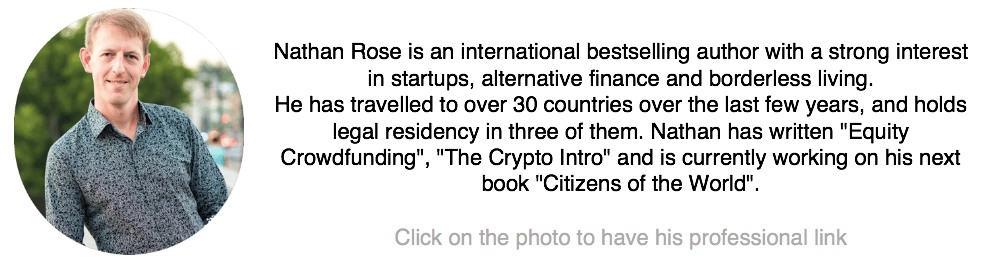

The expert of this week (Nathan Rose) is a specialist in equity crowdfunding and author of “Equity Crowdfunding: The Complete Guide For Startups & Growing Companies“. He offered to host a free online training for readers of my newsletter.

His explanation about the topic:

Equity crowdfunding can be a great option for early-stage ventures that need money to grow and expand. But, as you can imagine, there’s quite a lot to learn:

- Which kinds of businesses is it suitable for?

- What do successful campaigns have in common?

- What is the first step to take, if you want to actually do it?

He is hosting a free online training class on Thursday May 24, to provide the answers. Click here to see the available times and save your spot.

ECWT AltFin case : Charlotte Aschim – TotalCTRL

Elina was part of the team of the European Organisation for Nuclear Research (CERN), that discovered the Higgs Boson particle, one of the most significant discoveries in particle physics.

Her husband Raoul Scherwitzl also has a background in particle physics and had always aspired to be an entrepreneur, using his knowledge of physics to make an impact in society. In 2013 they left their job to co-found and develop the NaturalCycles algorithm and app.

Details about funding

What are the types of alternative finance that are used?

Venture capital series A and B are used.

What is the amount of funding raised?

In 2017-2018 raised the largest amount of funding in the Swedish healthech sector. NaturalCycles raised a total of $37.5M in 2016-2018 over 3 rounds: first a $1.5 million seed, followed by a $6 million Series A funding round, that was led by Bonnier Media Growth, the venture arm of the Swedish media business. This was followed by a $30 M Series B international investment in 2018 led by EQT Ventures fund, with participation from existing investors Sunstone, E-ventures and Bonnier Growth Media.

Can you give us a description of the fundraising campaign?

NaturalCycles is the first FDA, US approved digital birth control app, classified as a medical device in Europe by the inspection and certification company Tüv Süd in 2017. The idea of Natural Cycles came about when our founders, Elina and her husband Raoul were themselves in search of an effective method of natural birth control. Their subscription product, now has 500,000+ users across 160+ countries. Elina and Raoul see as their mission “to empower women to take control of their fertility – whether that’s to prevent or plan a pregnancy”.

Expert of the week : Nathan Rose (Georgia)

What is the current status of Alternative Finance?

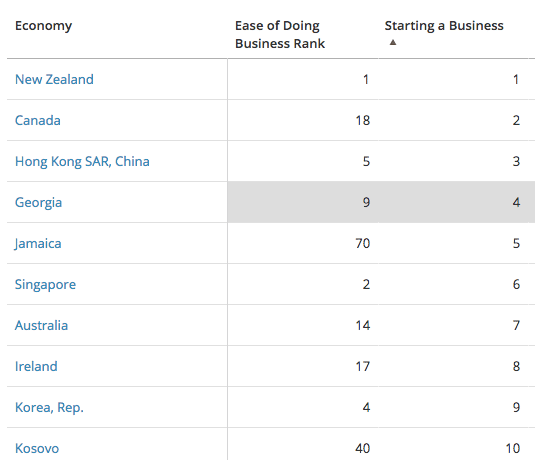

Georgia is a safe, developing free-market democracy. The World Bank ranks Georgia as the 4th best in the world for ease of starting a business (and #1 in Europe).

Concrete figures on alternative finance investment flows are difficult to come by, but anecdotally, equity crowdfunding and peer-to-peer lending activity in Georgia is currently negligible. A few platforms have tried launching, but have met with limited success. Partly, this is because of the strength of the local banking sector. Some of the drawbacks that other countries suffer with the traditional financial sector are less of a factor in Georgia.

The most popular form of alternative finance in Georgia is cryptocurrency, which does not rely on a regulatory framework. We are seeing Bitcoin ATMs opening across Tbilisi, and a growing number of merchants accepting this alternative form of digital money as payment.

Can you give us an inspiring case from your country?

Bitfury, one of the world’s biggest miners of Bitcoin, has a substantial presence in Georgia. Bitcoin “mining” comes from an analogy of digging for gold : expending effort to try and get something valuable. Proof-of-work miners like Bitfury support the maintenance of the global Bitcoin network and get rewarded for their efforts through receiving freshly minted Bitcoin.

How The Tiny Nation Of Georgia Became A Bitcoin Behemoth

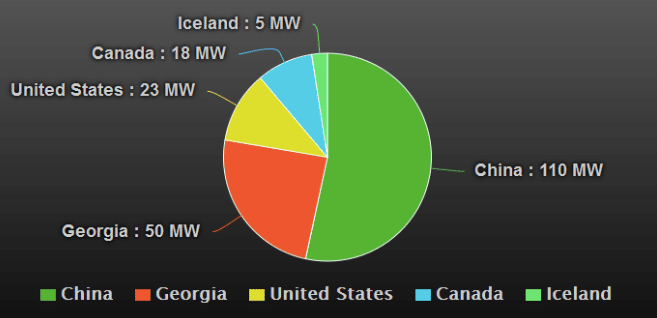

The largest ongoing cost of Bitcoin mining is electricity, and Georgia benefits from plentiful access to cheap, renewable hydroelectricity power. As a result of the investment over the last few years, Georgia has grown to become one of the largest sources of cryptocurrency mining in the world.

What are the biggest obstacles for growth?

Georgia has a relatively low GDP-per-capita compared to other European countries. This means that residents here have lower disposable incomes to dedicate to alternative asset classes such as peer-to-peer lending, equity crowdfunding, or cryptocurrency. This lack of local demand for alternative finance solutions is probably the biggest thing holding the industry back.

In 2016, Georgia signed an Association Agreement with the European Union, creating a framework for co-operation between them. However, a deeper connection between the EU and Georgia would substantially strengthen the ability for investment money to flow between Georgia and the single market. For example, the well-known fintech company Revolut is only available to residents of the EU / EEA. If Georgia were to join, it would quickly make much greater access to alternative finance possible to those who live here.