Ethics in AI, a way to avoid regulation? | Financing circular buildings

What new regulations do we need on Crypto-assets and AI? Some regulators spoke about it during the 3rd Annual FinTech Conference in Brussels. In this newsletter a summary of two of these speeches from the Dutch regulator and the chairman of ESMA. Furthermore a new approach on financing circular buildings.

This week we focus on the status of Alternative Finance in Greece with Dr. Spyros Arsenis.

Further news this week:

- New financing needed to accelerate circular built environment

- ESMA chair: “Crypto-Assets: time to deliver”

- Ethics in AI, a way to avoid regulation?

- Progress on Altfinator project – publications on best practices

- ECWT Review with : Milda Mitkute – Vinted

Table of Contents

New financing needed to accelerate circular built environment

The ‘Building Value’ report launched today demonstrates the radical potential in the built environment to accelerate the circular economy. The industry should re-think how to calculate value in buildings and how to finance them.

This report identifies key reforms to current methods of valuation and financing to stimulate circular construction. An alternative pathway is mapped from a case study of the Fridtjof Nansenhof social housing project in Amsterdam, due for redevelopment in 2020.

The report is a collaboration between Circle Economy, Sustainable Finance Lab, ING, Allen & Overy, Eigen Haard, The Royal Netherlands Institute of Chartered Accountants (NBA), Alfa Accountants and Advisors, Madaster, Arcadis, Arup, and DOOR architecten, co-funded by Nederland Circulair! The participants formed a Community of Practice (CoP), to develop relevant, transferable tools to guide circular construction.

Rethinking Construction: one building, six layers

The report argues that each building should be conceived as six individual layers, each with their own lifespan. Applying circular principles, strategies can be developed to maintain the value of each layer.

The EPM hierarchy

Value can be maintained within each of the six layers by prioritizing reuse in this order: elements, products, materials (EPM). New business models, such as Product-as-a-Service, enable effective reuse of EPMs.

Market for reusable elements

Prioritizing reuse will require a developed market for building elements. Technology has enabled actors within the built environment to increasingly collect, store and exchange data. Reliable governance of EPM data is essential to respect privacy, security and transparency.

The business case

Accurate valuation of individual layers and EPMs is key. The Community of Practice conducted a scenario building exercise to compare the long term (financial) performance of circular features for two building layers. The business case is shown to be highly dependent on assumptions for factors including depreciation, discount rates, lifespan and market development.

Valuing circular construction

Distinguishing between building layers, when realizing the value on the balance sheet, is necessary to explicitly show the value of layers and EPMs as part of the overall value. The traditional emphasis on location value as part of the total value has eclipsed the importance of building layers and EPMs. These factors should be reported separately on the balance sheet to guide investment decisions.

“Separating location and building elements on the balance sheet should result in a different way of valuing and financing buildings when the developing market for repurposed building elements is more established.”

Jan van der Doelen, Sector Banker Building & Construction, Real Estate at IN

Bringing future value into present financing

Financiers play a crucial role in identifying and mitigating risks in the transition to a circular economy. Circular business models capture value over a longer time horizon, reflected in higher future values. Investment decisions should assess this future value: “The business case of a circular construction project is based on the ambition to reduce our demand for natural resources. If a small extra investment results in increased flexibility of the building in the long-term, then it is a smart investment. This long-term investment vision could be further incentivised if financiers make circular construction an investment criterium.” says Dries Wijte, Manager Back Office Finance at Eigen Haard.

ESMA chair: “Crypto-Assets: time to deliver”

Steven Maijoor, chairman of the European regulator ESMA, once again expressed the position during a Fintech event in Brussels that stricter regulations for ICOs should be introduced. For crypto-assets where the value depends on the value of the company or the profit of the company, according to him it should fall under the European MiFID regulation.

In general, I certainly agree with this. I regularly see companies that want to raise funds to set up an ICO / STO to avoid the existing regulations. However, it is important that the legal framework is properly set up, not to stop the innovation in the market immediately and to prevent crypto providers from having to deal with outdated, legacy legislation that is not applicable in the current financing landscape.

His entire speech can be read here (PDF).

Ethics in AI, a way to avoid regulation?

At the same event, AFM board member Hanzo van Beusekom spoke about the possibilities and risks of artificial intelligence. His main message was that any regulations should as much as possible be in line with existing legislation.

Duty of care versus privacy

In his presentation, he responded by describing a fictional case about a bank manager who asks the AI specialists to make a predictive model or to keep clients complying with their obligations for a mortgage. Because the greatest risk occurs in people who lose their job or get divorced, the model is developed based on these assumptions. As a result, the bank can indicate in its example that the probability that the customer is going to divorce is 68% and that is why the risk is too high to take out a mortgage. Do you want this as a society?

Turing test for AI

He proposes that ethical agreements and solutions must be put in place in order to be ahead of and to support legislation. However, it is difficult to distinguish actual ethical solutions from “fake” solutions.

An innovative solution for this, introduced by Hanzo van Beusekom, is setting up a “Turing test” specifically for AI. Although the reference to the Turing test goes a bit far in my opinion, the 5 starting points are nevertheless interesting to determine whether it really yields an ethical solution:

- Independent oversight (no black boxes)

- A link to existing legal frameworks (use hard law where we have it)

- Clear responsibilities (no outsourcing to Cambridge Analytica)

- Practicable approach (no pie in the sky, but clear case examples)

- Non-arbitrary outcome (different staff get similar results)

Certainly for Fintech providers who provide financing on the basis of algorithms, it is important to actively seek a dialogue with the regulators on this subject. In the coming years it will in any case be an important theme for the various regulators.

The full text can be read on the blog of the AFM.

Progress on Altfinator project – publications on best practices

After the first 6 months, our European Commission project Altfinator is speeding up and delivering the first results. This month the first overview of activities is send to a wide network of interested stakeholders.

Some of the first activities include:

- Public webinar on current state of Crowd Investing in Europe – A presentation by myself on latest insights and trends in Europe

- Bridging the gender gap in Europe in regard to access to financing – Focus on bridging the gender gap in financial industry and promoting financial inclusion

- Capacity Building Strategy validated to foster the usage of alternative financing among SMEs

- An in-depth report on alternative financing ecosystems

- Identifying and analysing best practices of alternative financing

All publications can be found on the website of Altfinator.

ECWT Review with : Milda Mitkute – Vinted

Milda Mitkute, Co-founder & Head of Performance Marketing @ Vinted, Lithuania. Milda co-founded the clothing exchange platform together with Justas Janauskas in 2008. Mitkute sees as her mission “to make second hand the first choice worldwide”!

Today 4 million women are actively buying, selling and swapping clothes on Vinted each month and the company is today the world’s largest second-hand fashion mobile marketplace with 22.3 million items listed and with a community of 12 million users in 10 countries and 75% of its businesses happening mobile!

Vinted’s offices are based in Berlin, Prague, Vilnius and Warsaw. These spots operate Vinted in 9 markets: USA, France, Germany, UK, Poland, Czech Republic, Lithuania, Spain and the Netherlands.

In 2014 Vinted has secured a $27 million Series B investment led by Insight Venture Partners with participation from existing investor Accel Partners.

In 2015 Hubert Burda Media led the Series C funding along with Accel and Insight Venture Partners when Vinted has attracted 25 M €uro.

To become more profitable Vinted changed the business model in 2016. Since then, monthly sales have grown by 230% with Vinted breaking even for the first time in 2016.

Advised by Thomas Plantenga (then a strategy consultant, now Vinted CEO) the platform shifted away from mandatory sales fees into a free product with the option of additional paid services (like the promotion of your closet).

Between January and December 2017, Vinted processed $360m of sales, with company revenue growing 5x to hit nearly $14 million.

In 2018 Vinted has attracted additional 50 M €uro venture capital investment (through Sprint Capital and Insight Venture Partners), making it the biggest publicly-known financial injection in the history of Lithuanian start-ups.

For 2018 Milda Mitkute predicted that Vinted will see $500,000,000 sales!

Founded in 1983, Accel Partners has a long history of partnering with outstanding entrepreneurs and management teams to build world-class businesses. Accel today invests globally using dedicated teams and market-specific strategies for local geographies, with offices in Palo Alto, London, New York City and Bangalore, as well as in China via its partnership with IDG-Accel. Accel has invested in over 500 companies, many of which have defined their categories, including Angry Birds (Rovio), Atlassian, Cloudera, ComScore, Dropbox, Facebook, Groupon, Imperva, Kayak, Playfish, QlikTech, Spotify, Supercell, and Wonga. For more information, visit the Accel Partners web site at www.accel.com

Insight Venture Partners is a leading global private equity and venture capital firm investing in software, Internet, and data-services companies. Founded in 1995, Insight has raised more than $7.6 billion and made more than 200 investments worldwide. Insight’s mission is to find, fund, and work successfully with visionary executives who are driving change in their industries. Insight provides them with practical, hands-on growth expertise to foster long-term success. For more information on Insight and its investments, visit www.insightpartners.com

URL of campaign : https://www.burdaprincipalinvestments.com/investments/vinted/

Expert of the week : Dr. Spyros Arsenis (Greece)

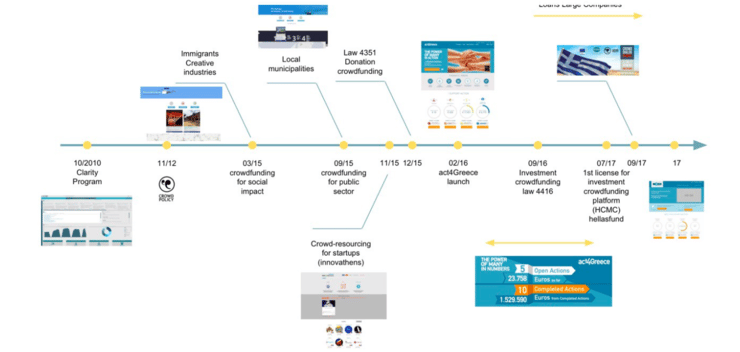

What is the current status of Alternative Finance?

Donation-based crowdfunding is becoming a trend in Greece, with one major platform (act4Greece) and three other smaller initiatives operating, of which one is based in the US although targeting the Greek market. The size of the market is €1.5m-€2m. Donation-based crowdfunding was regulated in 2015.

Microfinancing was also active in 2017 with small volumes of €0.4m-€0.6m. In 2018, €40m have been allocated by National Bank of Greece for amounts up to €25,000 backed by EIF guarantees.

One equity crowdfunding platform has been already operating and two more crowdfunding platforms, one for debt and one for equity, have been announced and are expected to operate by end-2018. Equity and debt crowdfunding was regulated in 2016.

Can you give us an inspiring case from your country?

Act4Greece is certainly the best practice project and a pioneering initiative. Act4Greece is supported by National Bank of Greece in strategic cooperation with foundations of international standing, such as the Alexandros S. Onassis Foundation, the John S. Latsis Foundation, the Bodossaki Foundation.

The last two years of operation over €2.1m have been collected through 26,800 donations for 16 actions.

The latest action is about the relief of victims of Attika wildfires. The target is €1.5m and an amount of €1.04m has already been collected.

What are the biggest obstacles for growth?

Lack of awareness is a major issue for crowdfunding; also, inadequate knowledge or misunderstanding of the economic mechanisms behind a platform can represent a limit/barrier for fundraisers.

Maturity of business plans in terms of revenues is a key obstacle for microfinancing.