EU Financial Ministers: ICOs Can Be a Valuable Tool for Access to Funding

Last week the financial ministers from the European Commission discussed the need for European ICO regulation. It will be one of the important topics to be discussed during the current Austrian presidency. In this newsletter I will discuss some of these ICO plans.

This week we will focus on the Status of Alternative Finance in Romania with Mirel Borodi.

Further news this week:

- European Financial Ministers: ICOs Can Be a Valuable Tool for Access to Funding but No Rules Yet

- First multi-million dollar artwork tokenised on the blockchain

- ICO Financing Grinds to Halt in September, Nearly Half of Startups Fail to Raise Funds

- Parliament of Australia Approves Proprietary Firms to Utilize Investment Crowdfunding

Table of Contents

European Financial Ministers: ICOs Can Be a Valuable Tool for Access to Funding but No Rules Yet

At the meeting of EU financial ministers in Vienna last week, Austria’s Minister of Finance Hartwig Löger said that Europe is working on rules and regulations for crypto assets to support the development of the sector.

Unregulated market

Löger said that Europe currently lacks uniform rules for the handling and trading of crypto assets;

“Currently, this market is largely unregulated, particularly in comparison with other sectors. For us, it is a question of clear rules of the game for companies, customers and consumers in order to make crypto assets usable as financial instruments, and not a question of excessive regulation. With a vision for Europe, we want to make the location more attractive for crypto assets and develop a European plan to position ourselves more strongly in this emerging segment”

High quality ICOs

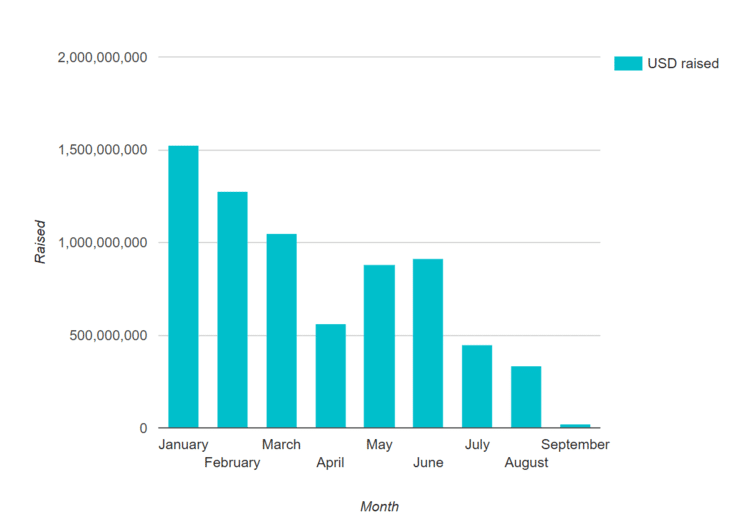

Funding via ICOs reached a volume of more than US$ 7 billion in March 2018 but the decline in ICOs has been rather dramatic since that peak (later in this newsletter I will discuss this declining trend in more detail).

Löger believes that growth-promoting regulation should tap this potential for European companies as a serious financing instrument and enable stable market development.

He envisions the investment universe will be expanded by high-quality ICOs, and consumers gaining access to alternative investment opportunities: “Close coordination between legislators, regulators and industry is crucial for the development of these promising markets.”

ICO’s regulated in crowdfunding regulation

A few weeks ago, I already wrote about a new proposal (pdf) that was drafted by the UK MEP Ashley Foxin the European parliament to add ICO regulation to the new crowdfunding regulation. During the public discussion of the proposal (live streamed) it was clear that there was much support for the initiative from the industry and policy makers.

“In order to allow for a competitive Union framework, crowdfunding service providers should be permitted to raise capital through their platforms using certain cryptocurrencies. Initial Coin Offerings (ICOs) offer new and innovative ways of funding but can also generate substantial market fraud and cyber security risks to investors. Therefore, crowdfunding service providers that wish to offer an ICO through their platform, should comply with specific additional requirements under this Regulation.”

New regulation will be ready Q1 2019

MEPs had until September 11th to submit any changes to the proposed crowdfunding rules and they are currently being discussed in parliament. If enacted, the legislation will come into effect in March 2019.

If this will also include the new proposed ICO regulation, will be decided in the negotiations in the next months.

First multi-million dollar artwork tokenised on the blockchain

Many investors choose to explore the fine art market due to its perceived lower volatility when compared to other investment opportunities such as stocks. The high prices make it difficult for retail investors to participate in this market.

The startup Maecenas has a solution and sells a fine art product (such as a painting) to a group of investors and stores the ownership on the blockchain, making it easier for investors to trade their part of the painting.

Any Warhol

The first product being sold via their auction was a painting by Andy Warhol named “14 Small Electric Chairs (1980)“. The auction raised US$1.7m for 31.5% of the artwork at a valuation of US$5.6m. 100 participants were hand-picked to participate in the auction from 56 countries and in the end 34 invested in the painting.

ICO Financing Grinds to Halt in September, Nearly Half of Startups Fail to Raise Funds

Recent research from Greyspark shows that nearly half of ICOs fail to raise any funds, while 40% raise more then $1 million. the total amount of funding raised is back to the level of summer 2017. Good projects still got funded, but are more conservative.

Scams

Several reasons put off retail investors from buying into ICOs. Exit scams like Centra caused extra vigilance, as well as the crash of the Confido ICO, when the team simply disappeared and the price tanked by 99% overnight. Some research suggests that approx $100 million was lost in these scams already. The stricter KYC procedure also made consumers skeptical of sending their personal data to startup projects.

40% raises over $1 million

That doesn’t mean ICOs are dead. Still a number of companies did a successful ICO in the last months. 40% of them raised>$1 million and in August they still raised $337 million. This is much lower then the peak at the end of 2017 and begin of 2018 in which months on average $1 billion was raised. At this time it is back at the amount of funding raised in June-August 2017.

In the beginning of 2018 some of the ICOs were sold out within minutes. This is not happening anymore. Now, projects are becoming more conservative, as the easy securing of funding has dwindled. Startups using the blockchain model are either wildly successful, or fail in raising capital, based on GreySparks analysis.

Legal framework

The initiative of the European Commission to include the ICO regulation in the new pan-European crowdfunding regulation (see earlier post in this newsletter) will be very beneficial for the next generation of ICOs. This will ensure that platforms that will facilitate these offerings need to do proper due diligence on the ICOs.

Expert of the week : Mirel Borodi (Romania)

What is the current status of Alternative Finance?

The Alternative funding “crowdfunding” took place in Romania in 2012, when the first platforms have publicly offered their services (multifinantare, mindfruits, crestemidei). A current in this market was created and 3-4 platforms appeared relatively quickly. But the enthusiasm couldn’t hold very long and the reality of today, after 6 years and over 200 projects, most crowdfunding platforms are inactive. So the latest trend is survival until better days.

The market size is very low, maybe 50 projects are posted in a year, with an average of about 1,000 euros / project.

The bill on crowdfunding is brought to the attention of the Financial Supervisory Authority and the last meeting on this subject took place last year in June.

Can you give us an inspiring case from your country?

I can’t say that we have seen innovative things in our crowdfunding environment. Our market follows the trends that are developed in mature markets .

The last crowdfunding platform that was opened last year, uses a collaboration that could be successful for projects. The name of the platform is Startarium and they are partner of ING Bank. They use the social responsibility funds of several banks to finance their projects. But this is not something new for the EU.

What are the biggest obstacles for growth?

Most of the people don’t have the investment culture, they don’t have a collaborative experience. So, in my opinion, these two things have a huge contribution to the low level of crowdfunding development. The real problem is that the elimination of these obstacles requires many years.