Changing landscape of firm financing in EU, US, Japan

Today and tomorrow Utrecht is the centre for research on alternative finance in Europe, with 50+ academic researchers coming over to discuss latest insights and starting research partnerships.

To kick-off the event I gave last week an interview to discuss the main Alternative Finance trends in Europe.

This week I’ve asked Michal Gromek to provide an overview of the status of Alternative Finance in Sweden.

Further news this week:

- Blockchain and Tokenization: Beyond the Hype

- The changing landscape of firm financing in EU, US, Japan

- ICO funding is growing again

- Interview: Trends in AltFin / FinTech in Europe

- Expert of the week: Michal Gromek (Sweden)

Table of Contents

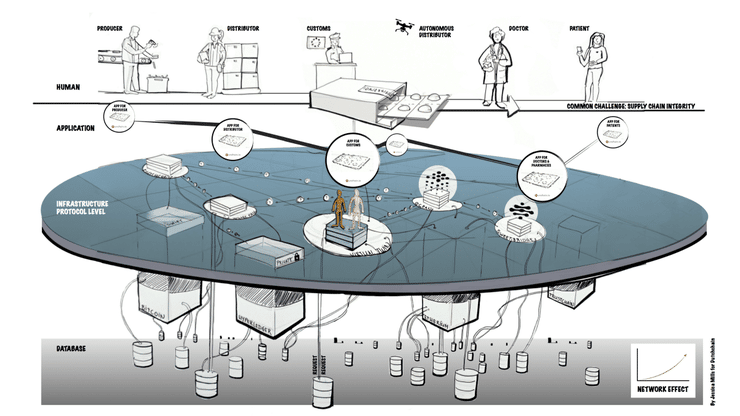

Blockchain and Tokenization: Beyond the Hype

Last week we had a large Blockchain event in The Netherlands (Future of trust), hosted by the Dutch government. 150 international and national experts on blockchain discussed the real potential of Blockchain and looked beyond the hype. I was participating and speaking on financing through blockchain technologes (ICOs, tokens). As an introduction for the event, the organizer (Rutger van Zuidam) posted an interesting insight on the future of trust in Blockchain: Commonization.

Based on real-world examples and hackathons

The organization organized a large number of events and hackathons in the past years and researched the Blockchain eco-system. There most important finding were:

Lesson 1: Blockchain is an Ecosystem Solution – Therefore, valid use cases for distributed ledger technology (blockchains) are logically limited to situations where there can not or should not be a central entity (or a trusted third party). The interesting thing is that everyone working in the blockchain space knows this part more or less. But then we can ask: why is almost 99% of the current projects aimed at building private, permissioned, proprietary solutions?

Lesson 2: Blockchain is a Solution to a Shared Problem – “The commons” can be global or very local, but should solve a shared problem. It means that blockchains must address major, widely felt needs. “Blockchains for the common good” must be the rule, not the exception.

Lesson 3: A Token is an Organization – A token ecosystem is more than a blockchain or “coins”. It is an information (also value) carrier. An economic structure where multiple parties, often with conflicting interests, coordinate their actions coherently — without any formal organization in the conventional sense of the word. All coordination is literally encoded in the protocol, including the governing and regulatory aspects. Once launched, a token ecosystem can be a self regulating organization. No one is in charge, and it is owned by itself. We know relatively little of the needs of this kind of organizations. Should it have a specific legal framework? It’s own regulatory framework? What kind of standards will it adopt or reject and why? How will it fund itself?

Lesson 4: Blockchains and Tokens are Part of the Digital Commons – One of the most interesting aspects of open blockchains especially, is that something (code, data, protocols) has come into existence that is not owned by any private or public entity. In the digital domain, the commons have been brought up as an alternative to what has been dubbed data capitalism, platform capitalism or even surveillance capitalism.

Commonization

As a summary of this article you can conclude that the real value of blockchain and tokens lies in the possibility to “commonize” important parts of the digital infrastructure. This can be used to build stable eco-systems.

An interesting and provoking idea. Offering a potential solution to the current risks of the platform capitalism industry.

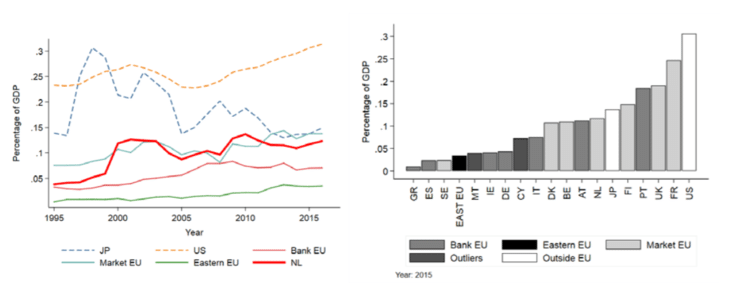

The changing landscape of firm financing in EU, US, Japan

The Dutch research centre CPB did a large macro-study on the changing landscape of firm financing in the EU, US and Japan. Main outcome was the shift from bank financing to market financing, especially the growth of corporate bonds.

It also shows the steady growth of alternative finance in all countries, although the size of this industry is still very small. They also did an in-depth review of the Dutch market and find a strong growth specifically in factoring.

The full report can be downloaded directly here (pdf).

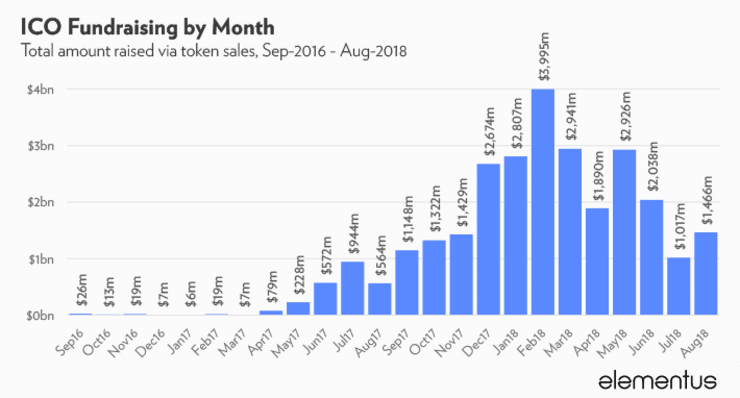

ICO funding is growing again

Last month I wrote about a decline in funding by ICOs in the first half year of 2018. It looks like the bottom is found and slowly more funding is raised by (better) ICOs now.

$1,4 billion raised (44% growth since July)

The ICO market remains robust and only in August around $1,4 billion was raised, an increase of 44% over the prior month. It looks like the funding is now getting back into the market.

This would be a good sign, but other reports are not showing these new trends yet, so we keep an idea on these numbers in the next couple of months.

Maturing ICO market

But all signs point to a maturing ICO market: fundraising grows more competitive, more established companies wade in, and security tokens show their first signs of life. It is also interesting to see that Singapore hosted more ICOs than the U.S. for the first time.

Interview: Trends in AltFin / FinTech in Europe

As introduction to our European Alternative Finance Research Conference I was interviewed by Crowdfundinsider, the main online news platform for alternative finance, to provide an overview of the current status of Alternative Finance and Fintech in Europe.

Next phase of growth

The alternative finance market in Europe is currently preparing for the next growth phase with EU wide regulations, launch of new initiatives backed by large institutional funders and public support for cross-border investments.

EU regulations

I am very positive about the initiative from the European Commission to create a pan-European crowdfunding/p2p-framework, but I am skeptical about the implementation.

The idea of launching a completely new framework for crowdfunding / peer to peer lending investments outside existing European regulations is a good move. This way new regulation can be implemented soon and will most likely be available around March 2019.

The current draft of the proposal is, on the other hand, not very ambitious and It has a few main flaws in it, making it not interesting for existing platforms to apply for a pan-European license.

Full interview, including comments on ICOs and Brexit can be read here.

Expert of the week : Michal Gromek (Sweden)

What is the current status of Alternative Finance?

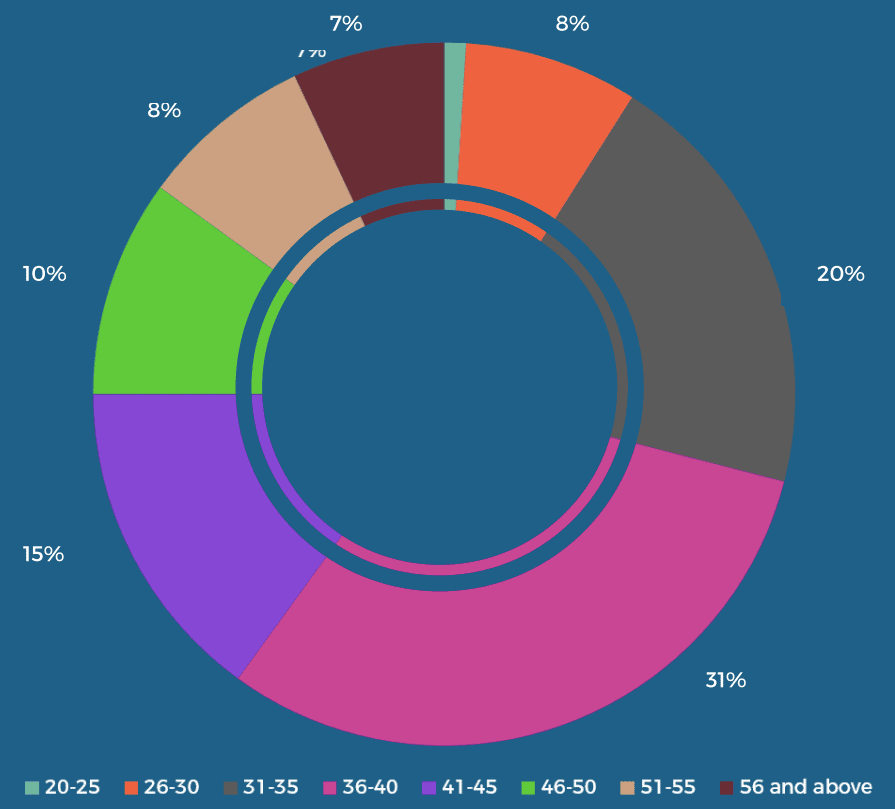

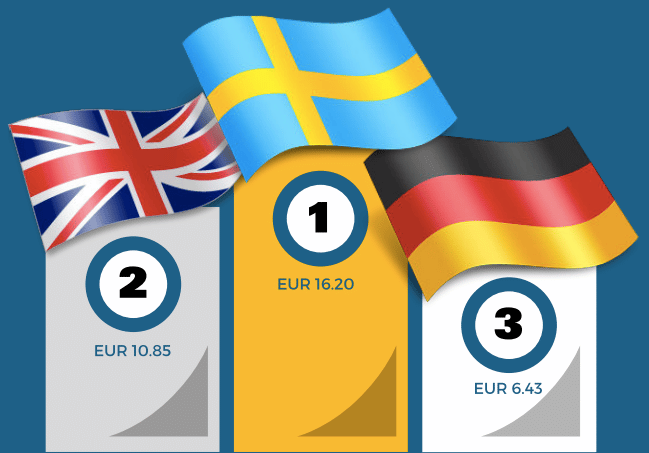

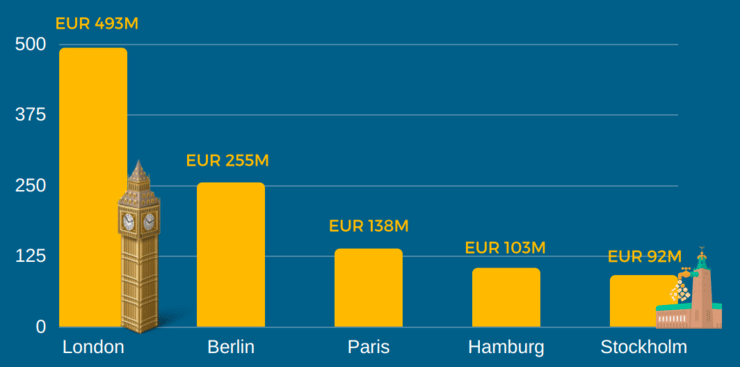

Following the Stockholm Fintech Report 2018, the average age of a Swedish FinTech Founder is 42 years, with only 6% of founders being female. Even treating the 2.2 billion USD investment of PayPal into the Swedish unicorn Izettle, reflecting on the per capita investments into FinTech companies, Sweden, with its 10 million inhabitants, and a substantial investment inflow, remains at the European peak.

When it comes to services offered within the last 18 months, Swedish Fintech companies have increased their vertical and horizontal growth on the value chain. After a saturation in the payment sub-field, incumbents started to offer complex customer-centric solutions from many domains. An example of such new development is a crowdfunded Blockchain-based car insurtech company that combines the different FinTech subfields for the end-user. Such a trend has been more visible in the segments connected with individual customers more than corporate accounts.

Within the past months, the activity of state institutions within Sweden in field of FinTech have been observed. Primarily, the Financial Supervision Authorities of Sweden (Finansinspektionen – FI) have launched a FinTech Innovation Center. It was followed up with the creation of separate email address (Fintech@) dedicated purely to Financial Technology companies.

Moreover, FI performed an inquiry in the field of adjustment towards FinTech. On the other hand, the Ministry of Finance conducted an analogical inquiry on the field of Crowdfunding. These initiatives resulted in new regulatory proposals that are currently being reviewed.

On the downside, after a growth of the Stockholm Fintech Hub into others locations in Sweden, due to a varies administrative challenges like the lack of board supervision regulations and cash-flow maintenance, did fill in for bankruptcy.

Book : The Rise and Development of FinTech : Accounts of Disruption from Sweden and Beyond

This comprehensive guide serves to illuminate the rise and development of FinTech in Sweden, with the Internet as the key underlying driver.

Can you give us an inspiring case from your country?

Stockholm School of Entrepreneurship – Elective FinTech Course. Due to the interdisciplinary character of FinTech, which is placed between Finance, Technology, Management, Design, Psychology, and Sociology, it is difficult for traditional academic institutions to provide academic training due to the silo-like heritage. The Stockholm School of Entrepreneurship will offer the first FinTech-based elective Master Course, a joint project between five different universities in Stockholm.

Stockholm FinTech Report 2018 and, connected to it, the InsurTech & RegTech Reports – Provides a suggested typology for FinTech as well the InsurTech and RegTech fields. Due to the different definitions of FinTech, national and international reports reflecting on the progress of the industry can only be marginally compared due to a different view ; what can and can not be defined as FinTech, InsurTech or RegTech. Due to the dynamic character of FinTech, the report used the social media platform LinkedIn as a nearly real-time indicator of the quality of the regionally available HR pool.

Crash courses in programming – Due to the need for 40,000 programmers in Sweden, there have been several initiatives which allow individuals to graduate from 12-24 IT courses and get connected to local companies in order to close the IT gap and enable companies to continue to accelerate.

What are the biggest obstacles for growth?

Based on historical heritage, Swedish retail and corporate customers have quite limited possibilities to choose from regarding internationally available services and providers. Such a lack of Neo Banks limits the choices for customers and decreases nationwide competition. Most substantial innovations, like Swish (instant nationwide peer-to-peer payment system) or BankID (Electronic identification tool), have been developed and owned by the banks.

Since the publication of the proposed changes in the area of Crowdfunding regulation, it remains to be seen which part of the regulation might or might not be implemented, leaving things in a state of regulatory uncertainty, which will not be resolved quickly, due to the national parliament election period.

The FinTech Innovation Center, as well as Financial Supervision Authorities, remain both understaffed and underfinanced to proactively compete as an alternative to a regulatory SandBox.

Perhaps as a result of above, there is a lack of dedicated ICO regulations or even a dedicated pathway toward ICO regulation.

Last, but not least, in recent years we have been experiencing a housing problem in Stockholm that has been getting incrementally worse, which makes it difficult for companies to attract much-needed experts.