Alts Academy: How to Invest in Art

Today, we’re looking at how to invest in art. Regardless of your budget or portfolio size, we’ve got something for you.

Today, we’re looking at how to invest in art. Regardless of your budget or portfolio size, we’ve got something for you.

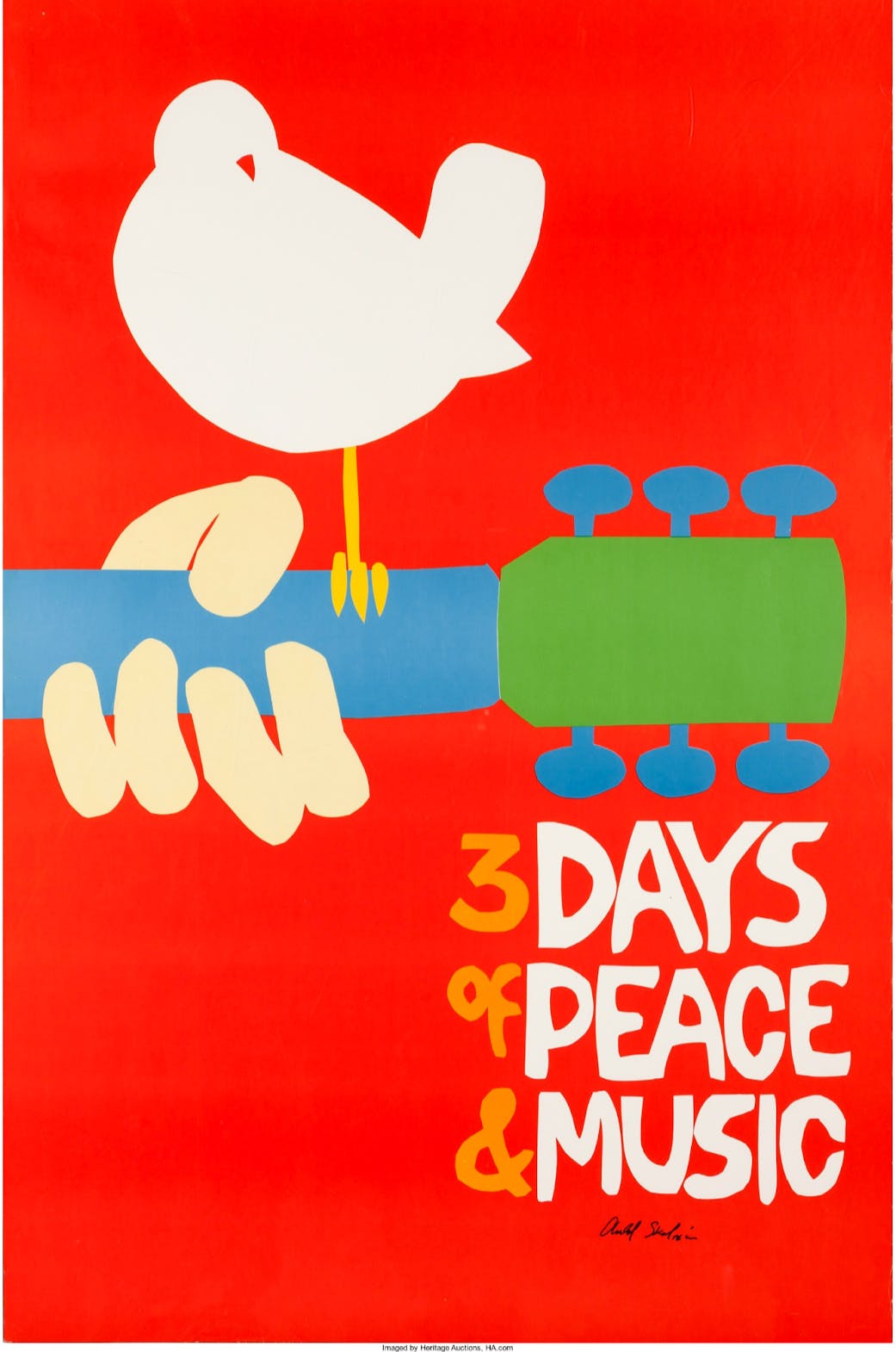

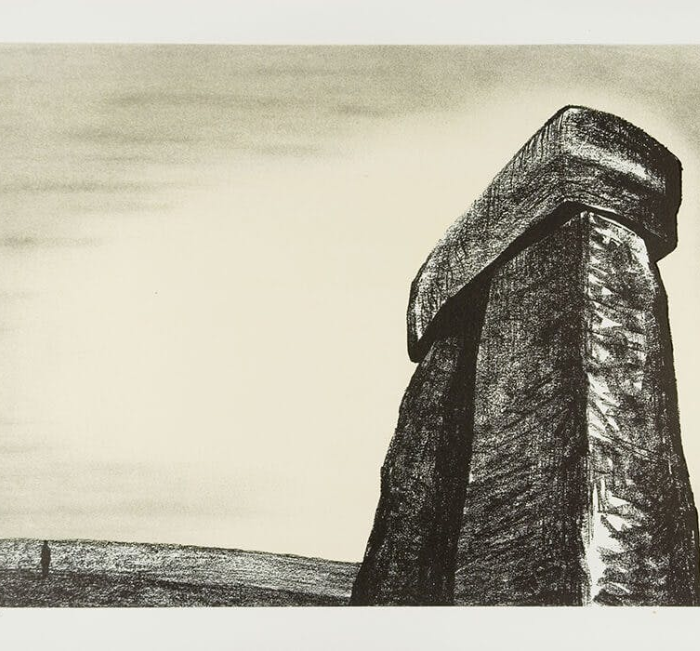

High-end originals tick all the right boxes from a nostalgia point of view, and they’re damn nice to look at.

Today we’re talking about art prints. The art world is made up of a series of niche markets, and one of the most underrated (and misunderstood) is the print market.

Today, we’ve prepared another issue by Nicholas Shorvon, our favorite art investment expert and advisor.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |