Hello everyone, and welcome to our first edition of Alts Academy

Alts Academy gives you the A to Z of our favorite alternative investments. It’s your playbook for alternative investing — how to start, what to do, where to look, how to win, etc.

Today, we’re kicking things off with a look into short-term rentals (STRs). What are they, why do we like them, what advantages do they have over other real estate, and most importantly, how to invest in them.

Let’s get to it!

Table of Contents

The current real estate market

The real estate market is all over the place right now. Interest rates are soaring in the United States, Australia, the United Kingdom , and Canada.

Property prices are falling all over the globe, and US mortgage rates are the highest in decades. The only way people are really making money now is from yield. And yields are likely to keep going up.

When we think of rental yield, apartment complexes, commercial warehousing, and office spaces jump to mind. But there’s another under-appreciated property class that outperforms nearly all of its peers – short-term rentals.

What are STRs?

Short-term rental is just a fancy word for saying “Airbnb”.

Okay, not quite. They are vacation properties that are only occupied for small amounts of time (less than six months). STRs are usually built in tourist destinations – think a condo in Miami or a penthouse in Tokyo.

For many, STRs are “holiday homes” that people rent out when they’re away.

STRs aren’t just for holidays though. The rise of “digital nomads” – people who work remotely while traveling – has led to an influx of +30-day Airbnb stays.

Expats who need somewhere to stay for a couple of months or renters who just want to try out an area are other potential customers.

How do STRs make money?

Short-term rentals make money like any other real estate investment. They just have different priorities.

Yield and appreciation

The primary source of income from STRs is rental yields.

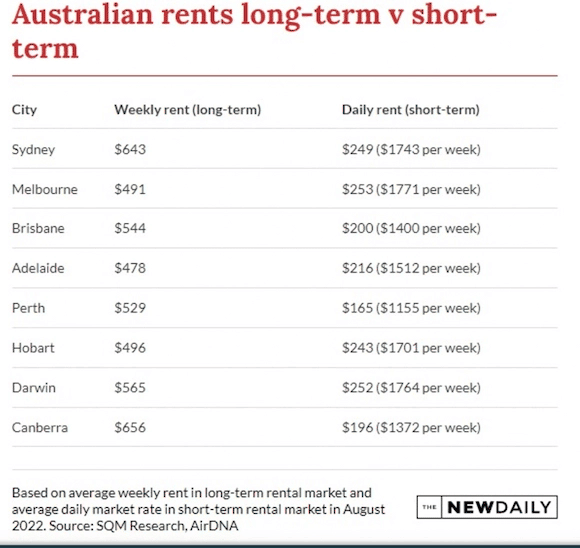

Short-term rentals can rake in premiums of over 100% compared to their long-term counterparts.

Short-term rental investors place less emphasis on capital gains. (And in this market, seeking price appreciation might be tough).

But properties in highly sought-after locations can still see plenty of growth. Emerging tourist markets are a great place to look out for – enough traffic that the STR won’t be vacant, but not enough for the investment to be too costly.