Hello and welcome to Alts Cafe

This is an all-killer, no-filler email–your bulletin of everything to do with alternative investing.

A quick favor – if you find this useful, interesting… Please spread the word for us. It costs nothing and helps us a lot.

Today’s spoiler alert: Lots of bearish news, in a surprise to no one. But, a few cool opportunities if you know where to look.

Caffeine up, and let’s go.

Table of Contents

Macro View

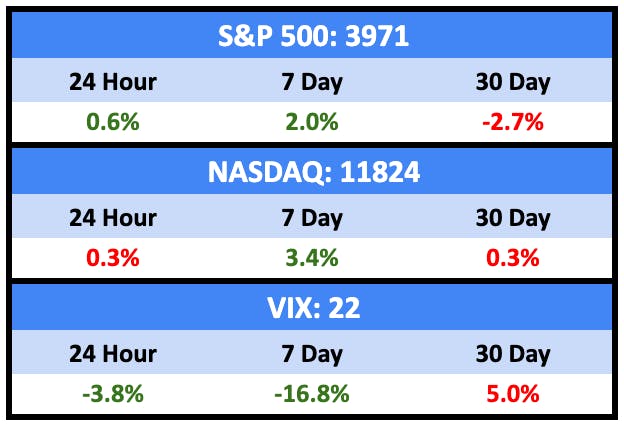

The calm before the storm?

Bullish News

- The Fed raised rates by a quarter point last week, as expected. Markets rallied on whispers there may be no further rate hikes in the near term. The next Fed meeting is 3rd May, and markets are pricing in around a 20% chance of another raise. Here’s my take:

- I think that’s going to get higher.

- The Fed ain’t done raising rates this year.

- Gym spending is up despite macro worries. Perhaps people aren’t working from home as much as their bosses would like to believe?

- Thanks to a tight labor market, real wage growth grew 9% for the lowest decile of Americans, the biggest boost for any demographic. On the other hand, the average wage for the bottom decile is $12.57/hr, which is not considered enough for one person to maintain an adequate standard of living anywhere in the US.

Bearish News

- The Bank of England raised rates again — 25bps. Inflation topped 10%.

- Switzerland raised rates 50bps as well.

- More than 400 people lost their billionaire status last year, most from China.

What are we doing?

ALTS 1 fund news:

No news.

Real Estate

Bullish News

- Home sales rose 14% from January, mostly due to home prices taking a tumble.

- Between 2020 and 2021, over 28,000 residential apartments were created from 11,000 former office buildings.

- American home delinquency rates are broadly down year over year. Louisiana looks to be in the most trouble.

Bearish News

- Housing prices dropped year over year for the first time since 2008.

- Six of the ten most overpriced real estate markets are in Florida.

- According to this chart of real estate returns by decade, home values will be flat through the rest of the 2020s.

- The U.S. office market could be saddled with 330 million square feet of obsolete space by the end of the decade. Most of it is ill-suited for conversion to other uses.

- Single-family rent growth was up 5.7% YoY in January 2023, the slowest appreciation rate since the spring of 2021.

- More data that remote working is smashing office rents.

- The impending commercial real estate tsunami is going to hit smaller banks the hardest.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

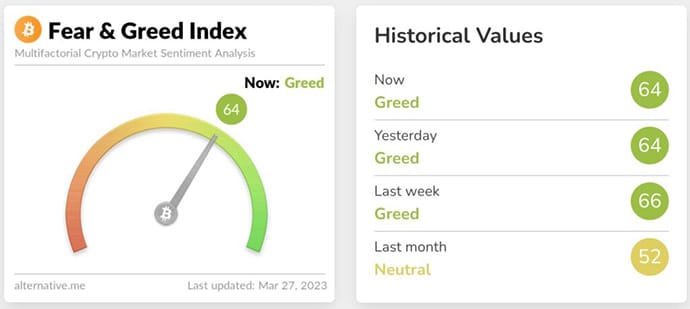

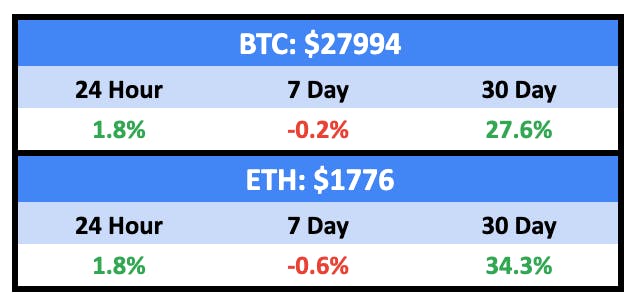

Mixed to flat. Crypto is taking a breather.

Just off slightly, consistent with the broader marker.

NFTs look like they’re decoupling from crypto a bit.

Bullish News

- Do Kwon was arrested in Montenegro.

- The SEC is targeting Lindsay Lohan and Jake Paul for crypto pump schemes. Yes, really.

- Analysis by crypto services provider Matrixport shows that American buyers are leading the safe haven bid for the cryptocurrency. Bitcoin has rallied by over 40% in the last 10 days, reaching a nine-month high above $28,000.

Bearish News

- The SEC is planning a lawsuit against Coinbase.

- Coinbase told its customers on Wednesday that it will no longer offer Algorand token (ALGO) rewards.

- Belgium’s financial regulator is requiring virtual currency firms to add a punchy disclaimer to their advertisements: “The only guarantee in crypto is risk.” How reassuring.

How to invest in Crypto & NFTs right now:

If you believe things will get worse (more bank failures, etc) before they get better, crypto looks solid.

Startups

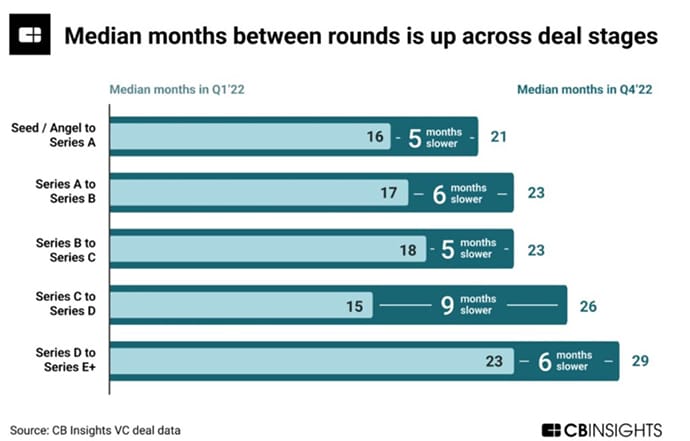

CB Research Briefs put out a slightly obvious but useful analysis of how SVB’s collapse can (and will) affect startups over the next several years. Most of the downstream consequences stem from a lack of access to venture debt, but that’s not all.

I read it so you don’t have to:

- Lower tech valuations and more down rounds to come

- Higher startup mortality with less good money to follow bad available

- Intensifying layoffs. Underwater equity + reduced runway = rats fleeing or being kicked off the ship

There’s a lot of good data viz in the piece, but this chart stood out to me.

The chart shows it’s taking startups significantly longer to raise a round than it used to, and this only includes companies that were actually able to raise.

The reality is probably much worse.

Closing it out, here’s the scariest quote from the report: “Startup cash burn remains ~2x higher than pre-2021 levels.”

I would say winter is coming, but it’s already here, and these guys just haven’t realised yet that they’re freezing to death.

Bullish News

- Tech valuations in Q4’22 for Series C deals were actually up 20% over full-year 2020 levels. Valuations for Series D+ deals were up 30% vs. 2020.

- The crypto venture capital (VC) market has shown resilience amid a downturn, signaling a potential comeback for the sector in the near future.

Bearish News

- As of this week, the combined market cap of the 50 largest tech IPOs since 2020 is down 59% vs. the day they IPO’d. Of the top 20 tech IPOs since 2020, 90% (18 of 20) currently trade lower than their IPO valuation.

- 86% of unicorns (456 out of a sample of 531) have increased headcount since Q1’22. In fact, 37% (198/531) of unicorns have grown headcount by more than 50% vs. this time last year. My (apologies, very depressing) take: You’re dead and don’t even know it yet.

- Shortseller Hinderburg Research released a scathing report into Block (formerly Square), lifting up the skirt on a company that’s probably not doing as well as it would like to present. The money shot:

“Our 2-year investigation concludes $SQ systematically exploits the demographics it claims to help. The magic behind $SQ has not been innovation, but its willingness to mislead investors, facilitate fraud, avoid regulation & dress up predatory products as revolutionary tech.”

- TikTok was in front of congress last week, and it didn’t go well.

How to invest in startups right now:

If you can find the companies short on runway but long on product market fit, who are genuinely raising money to scale and dominate, you’ll get excellent terms right now.

Quick Hits

Vintage Autos

One-of-a-kind 1955 Mercedes-Benz 300SL headed to auction.

Unveiled in 2021, the current-generation Mercedes-Benz SL traces its roots to a race-bred coupe that has become incredibly sought-after. The 300SL stunned the world with its gullwing doors when it landed in 1954, and a one-of-a-kind example is about to cross the auction block.

One of 1,400 units built from 1954 to 1957, it’s reportedly the only example finished in Mittelgrün (Medium Green to you and me) with a gray leather interior.

It’s expected to sell for anywhere between $1,850,000 and $2,000,000. And I LOVE IT.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

If you have any comments, questions, or concerns – let us know.

And really, please forward. The markets are messy, and we genuinely want people to get good info. If you know someone who’s into any sort of investing, we’d really appreciate the shout out.

Cheers,

Wyatt

Disclosures

- This issue was sponsored by our very smart friends at GenesisAI

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- I dream of owning a car with wings.