READ TIME: ±6 minutes

Hello and welcome to Alts Cafe for August 15, 2022.

This is everything you need to know about what’s going on in the world of alternative assets. Best enjoyed with your morning coffee.

Let’s go!

Table of Contents

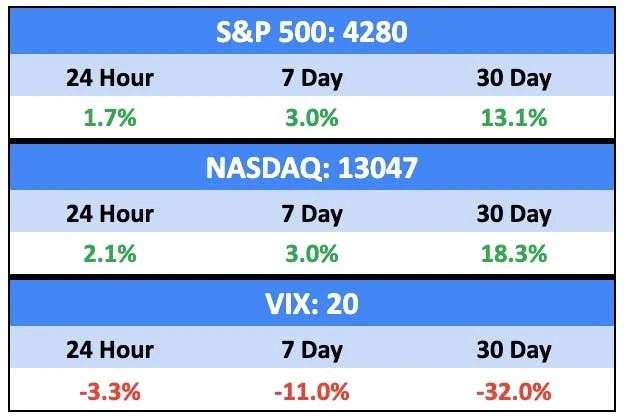

Pulse check: What’s the equity market doing?

The S&P 500 bounced back big, ending the week up 3% after several days in the red:

This is largely off the back of positive inflation-related news:

- The PPI decreased to 9.8%, which was the first month-over-month decrease since April 2020.

- July’s CPI report (inflation) was 8.5% year-over-year, slightly below expectations, and 0.6% lower than June.

- Gas prices dropped to under $4 per gallon. (Fuel where I live remains well over $7 per gallon.)

It wasn’t all good news, though:

- 262k Americans applied for unemployment benefits last week, the highest so far in 2022.

- Public pension plans had their worst year since 2009.

- Berkshire Hathaway lost 43.8B loss in Q2.

What are we doing?

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

Nothing to see here for now.

Crypto

Here’s what you need to know:

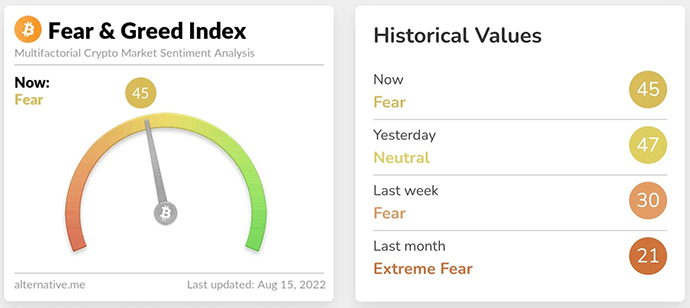

Crypto continued to be a levered play on equities, as both BTC and ETH were up last week:

The Fear & Greed index is the highest it’s been for months, rising 50% over the last week:

Bullish News

- Crypto startups raised $30.3B in the first half of 2022, more than all of 2021.

- The Ethereum merge is still on for September.

- BlackRock deepened its partnership with Coinbase, launching a Bitcoin trust, with Coinbase serving as the trust’s custodian.

- Australia’s central bank is launching a digital currency pilot.

Bearish News

- Billionaire (for now) Mark Cuban is being sued for promoting Voyager, which went bankrupt in July.

- RenBridge was used to launder half a billion dollars since 2020.

- Crypto exchange CoinFlex, which is facing an $84M shortfall, is filing for restructuring.

- The US Treasury sanctioned web3 mixing service Tornado Cash for helping North Korean hackers launder cyber crime money.

- Binance-owned exchange WazirX’s bank balances have been frozen by Indian authorities while awaiting the results of a money laundering investigation.

What to do with that info:

Stop laundering money!

But really, the markets continue to head up, despite significant legal and regulatory headwinds. Believers gonna believe.

Real Estate

Here’s what you need to know:

Not a lot of good news this week:

- 30-year fixed mortgage rates increased back up to above 5%.

- Consumer confidence in the housing market hit its lowest level in over a decade.

- Median home prices rose by more than 10% in 4/5 of the largest metro areas in the US.

I’ll be discussing the real estate situation more in The WC this Wednesday, but there’s a historic glut of real estate agents right now, and that’s going to be a real problem when commissions start coming down in the back half of 2022.

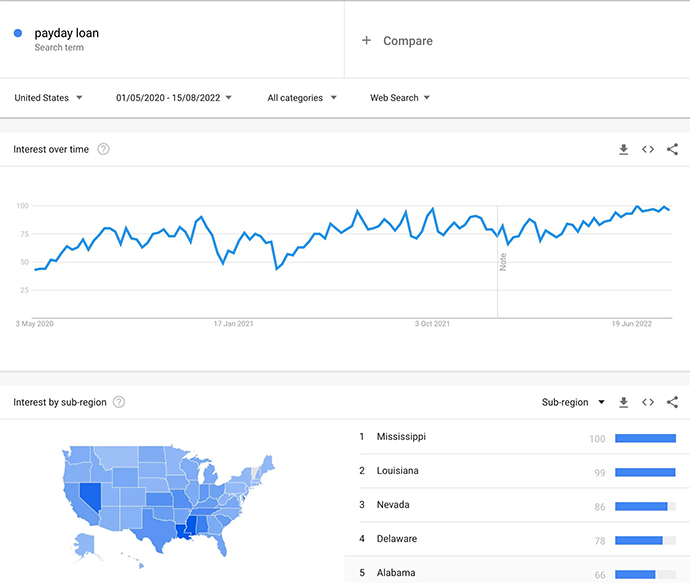

On a possibly related note – the search volume for “payday loan” is up 50% since the start of the year.

What to do with that info:

If you’re a mediocre estate agent (you know who you are), it’s probably time to look elsewhere.

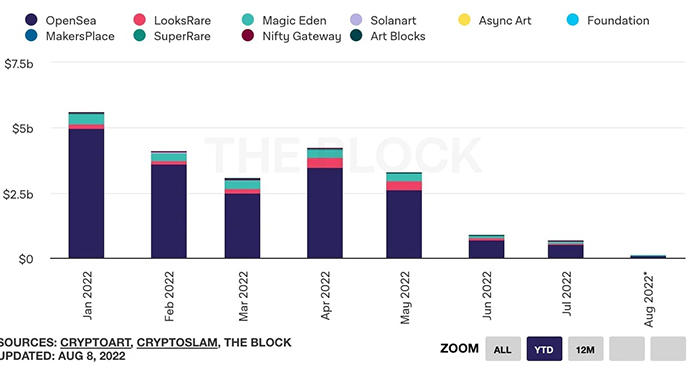

NFTs

Here’s what you need to know:

NFTs are treading the line between BTC and ETH, up over 6% last week, and 30% on the month.

All the money is in blue chip projects, though, as investors (and speculators) are still hesitant to dip into new stuff.

What to do with that info:

For us, it’s an attractive time to get into great projects (which is why we invested in The Currency and in a PROOF Collective NFT). It all depends on how tethered the crypto and NFT markets stay to the overall market, though.

Startups

Here’s what you need to know:

Pitchbook released its Q2 report on startup funding, and it’s a mixed bag:

- Early-stage median pre-money valuations showed signs of contractions, recording their first quarter-over-quarter decline in more than two years, falling 16% in Q2 to $52 million.

- Seed-stage investment has held up better than any other stage, with deal counts and sizes remaining elevated and median pre-money valuations up 33% this year over 2021.

- Nontraditional investors have concentrated their more cautious behavior at the top end of the market. The top quartiles of deal size participation and valuation both fell by more than 13% in H1, but such declines aren’t present at the medians.

- Only 10 public listings for companies valued at over $1 billion were recorded through June 30, compared to more than 100 in 2021, as the public market climate continues to put pressure on exit valuations.

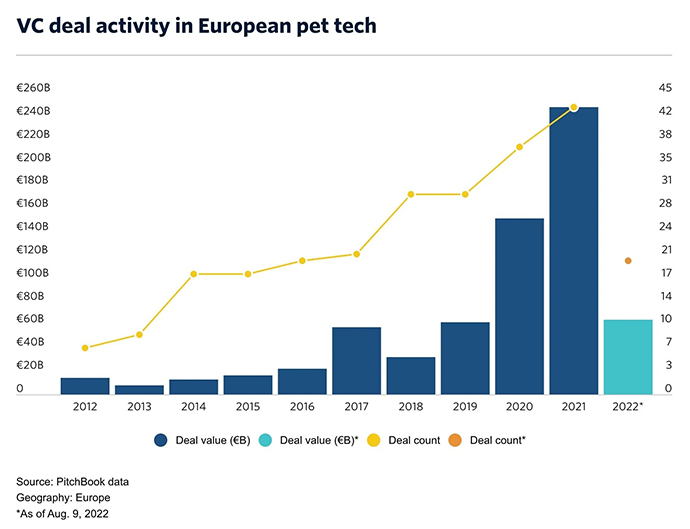

What else? Investors are selling off their PE and VC funds at a record pace, and Covid-darling pet tech is having a rough go of it in 2022.

But things in Africa continue to look good.

What to do with that info:

I’m starting to hear more and more about the startup scene across Africa, and it’s definitely worth a deeper look.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt