22 August, 2022

Read time: ±6 minutes

Hello and welcome to Alts Cafe! This is everything you need to know about what’s going on in the world of alternative assets. Best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Pulse check: What’s the equity market doing?

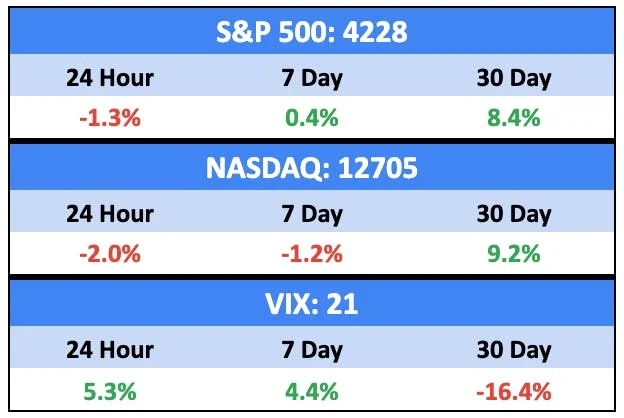

Markets were flat last week as volatility ticked up slightly.

Bullish News

- Unemployment claims were slightly down – 250k last week vs 252k the week prior.

- US retail spending ticked up slightly in July.

Bearish News

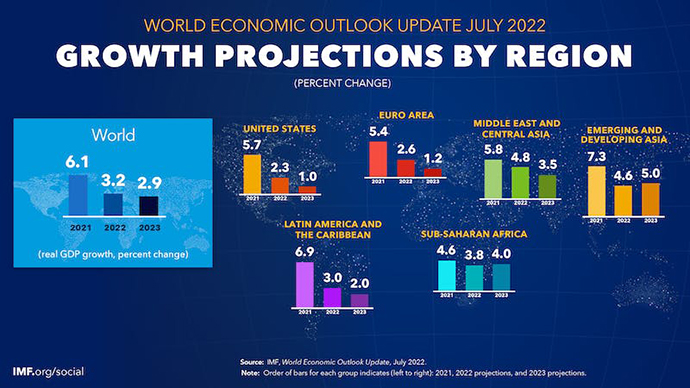

- The IMF revised global inflation due to food and energy prices, as well as lingering supply-demand imbalances. It’s anticipated to reach 6.6% in advanced economies, and 9.5% in emerging market & developing economies in 2022.

- China released a slew of economic data earlier this week, and it was not pretty. Industrial output, property investment, and retail sales all missed estimates. The data also showed that the jobless rate for individuals aged 16-24 climbed to roughly 20%, an all-time high.

- UK inflation rose to 10.1% in July, up from 9.4% in June.

- SPAC activity in July reached its lowest level in five years.

- Cotton prices are rising sharply due to droughts.

The IMF’s entire report (first bearish link above) is pretty dire, with the biggest growth decline in 80 years forecast in advanced economies..

What are we doing?

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

Nothing to see here for now.

Crypto

Here’s what you need to know:

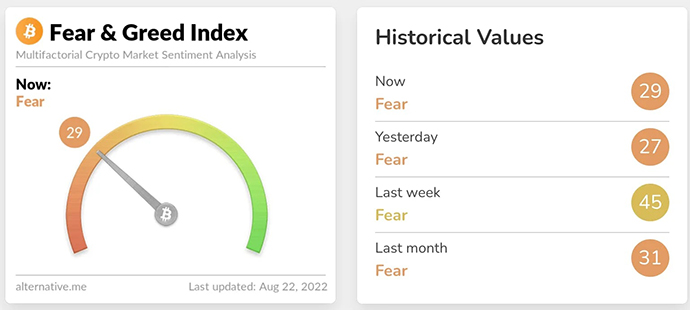

Crypto markets fell sharply last week but ticked back up slightly over the weekend.

A huge decline in the fear and greed index, as it shed 18 points in just seven days.

Bullish News

- FTX generated more than $1 billion in revenue last year

- PayPal users can now transfer, send, and receive Bitcoin, Ethereum, Bitcoin Cash, and Litecoin

Bearish News

- Bitcoin traders were hit by $210 million worth of long liquidations on Friday

- Crypto exchange Crypto.com quietly let go of hundreds more employees after publicly laying off 260 employees in June

- Crypto broker Genesis slashed 20% of its workforce and will replace its CEO

What to do with that info:

Choppy markets make me happy to DCA.

Real Estate

Here’s what you need to know:

American and Chinese real estate is bad and getting worse.

Bullish News

- 🤷

Bearish News

- Fuelled by real estate giants defaulting on their debts, China’s real estate market has been crumbling. Compared to the same stretch in 2021, residential property sales have plunged 31% in 2022. New floor space has also fallen off a cliff, dropping 45% this year alone.

- Data on Thursday revealed that U.S. existing-home sales fell for a sixth month straight in July. The report showed sales fell 22.4% year over year, the largest annualized drop since 1999. Contract closings for previously-owned homes also fell 6%, sliding to its slowest pace since May of 2020.

- This recent negativity is shared by U.S. home builders. On Monday, The National Association of Home Buyers announced its gauge, which measures home builder sentiment, fell 6 points in August. This drop pegs home builder sentiment at its lowest point in two years.

- Available home inventory is up over 50% since February, and new housing starts are down by 25%.

What to do with that info:

Keep a close eye on foreclosures and consider investing in self-storage units.

NFTs

Here’s what you need to know:

Everything is in the red for the 7-day and 30-day charts.

Bullish News

- Sotheby’s has announced a new partnership with Metagolden, a top NFT company, to launch NFT jewelry.

Bearish News

- Bored Apes Face Liquidation on BendDAO.

- OpenSea volume sunk to a 13-month low in July.

What to do with that info:

We’re watching the market closely here; there could be significant opportunities over the next two weeks, including picking up a Bored Ape at a discount if they’re liquidated.

Startups

Here’s what you need to know:

The startup and VC markets are still sorting themselves out while most of the industry frolics around Europe for the summer.

Bullish News

- Despite an overall slowing, there have been at least six eight-figure funding rounds announced by crypto and web3 companies already in August.

- Andreessen Horowitz gave disgraced WeWork founder Adam Neumann $350m to build WeWork again – except condos this time.

- Shima Capital has raised $200M to invest in early-stage blockchain companies.

- Stage 2 Capital raised a $150M Fund III to invest in early-stage B2B software and marketplaces.

- While F-Prime’s Fintech index is off 75% for the year, it’s up nearly 23% over the last month.

Bearish News

What to do with that info:

Invest in emerging markets. (Not financial advice / DYOR)

That’s all for this week.

Hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt