30 August, 2022

Read time: ±6 minutes

Hello and welcome to Alts Cafe! This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Pulse check: What are the markets doing?

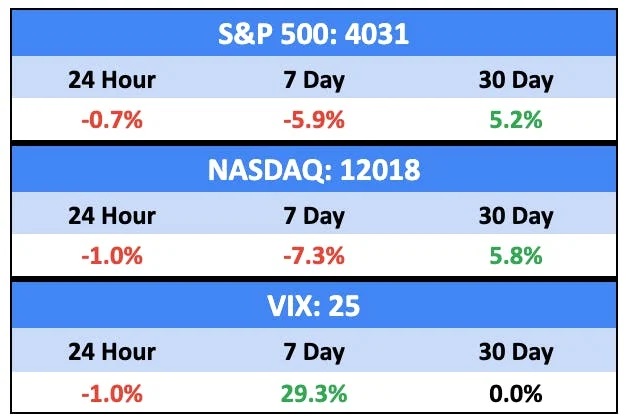

Volatility is up, equities are down, and no one (including the Fed?) seems to know what’s going to happen.

Wanna know what’s going on?

This guy’s got it:

Bullish News

- The US economy contracted less than analysts predicted in Q2.

Bearish News

- Stocks took a hit last week after Jerome Powell said in his Jackson Hole speech that the Fed won’t back off in its fight against inflation

- Prediction markets are (slightly) forecasting a 75bp interest rate hike in September.

- Former Treasury chief Larry Summers Summers expects unemployment to surpass 5% in 2024, well above the Fed’s projection of 4.1%.

With J Pow telling us to get used to the idea of pain, it’s unlikely rate hikes are going to stop anytime soon.

A full 100bps (1%) more through 2022 wouldn’t surprise me at all.

What are we doing?

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

We’ve got two boozy pickups this week

- Domaine Georges Roumier, Bonnes Mares Grand Cru 2014

- Le Pin, Pomerol 2021

Crypto

Here’s what you need to know:

Crypto is whipsawing along with equities for the most part (except more), though there was some divergence yesterday, as the two asset classes moved in opposite directions.

While we’re miles off the lows from a couple months ago (the fear and greed index was in single digits), we’re also now well off local highs.

Bullish News

- There are now over 320m crypto users worldwide.

Bearish News

- Public sentiment in the US has turned negative with over half of crypto investors saying it’s performed worse than they expected.

What to do with that info:

For me, crypto (like everything else) is a bit scary short term, but it looks like a good entry point long term.

Real Estate

Here’s what you need to know:

Things are getting bad everywhere. There are different exacerbating factors depending on the market, but Covid, Ukraine, interest rates, and inflation are all working hard to conspire against the real estate market globally.

Bullish News

- Hilariously disgraced WeWork founder Adam Neumann raised $350m to build Flow, a company that will perpetuate the infantilization of Generation Z.

- These guys think America is going to be pretty ok (I think they’re wrong)

Bearish News

- Prediction markets give a 40% chance that mortgage rates will top 6.5% in 2022.

- Blackstone will stop buying homes in 38 cities.

- Experts say we’re already in a housing recession.

- Home sales are forecast to fall over 16% year on year in 2022.

- Real estate company Compass lost over $100m in Q2 while their execs unloaded their equity in the company.

What to do with that info:

Keep watching consumer debt and defaults. That’s when this thing is going to really unwind.

From the Q2 Fed report:

Credit card balances saw a $46 billion increase since the first quarter – although seasonal patterns typically include an increase in the second quarter, the 13% year-over-year increase marked the largest in more than 20 years.

NFTs

Here’s what you need to know:

NFTs are just following the crypto markets, which are following the equity markets.

Bullish News

- Snoop and Eminem performed from the Metaverse during this year’s MTV Video Music Awards.

Bearish News

- Sales volume on OpenSea has decreased 99% since May 1.

- Sales volume for metaverse land was down 22% last week with prices off 1.5%

- The Sandbox kicked off its new Alpha Season 3 Wednesday which is its most extensive, longest and most accessible yet. Nevertheless, the Season launch failed to elicit any rally in the LANDs trade, the week witnessing significant decreases in volume (-32%) and sales (-22%), putting downward pressure on prices (-12.6%).

What to do with that info:

NFTs are just gonna follow everything else for a bit.

Now’s a good (long-term) time to pick up projects you believe have a good track record and a solid road map.

Startups

Here’s what you need to know:

Things still look sort of okay if you squint, but job cuts are coming hot and heavy, and it’s going to get worse before it gets better.

Bullish News

- Bill pay app Ramp has scaled to over $1b in annualized volume in less than a year.

- It was a record-setting Q2 for Canadian seed stage investing.

Bearish News

- Proptech startup Reali, which was apparently unaware that real estate is cyclical, is shutting down a year after raising $100m. Several other proptech startups are laying off significant chunks of their workforce.

- More than 80% of tech IPOs valued at >$10B since 2017 have generated negative returns. The average is -32.5%.

What to do with that info:

Now is a great time to invest in startups you think have the best potential to survive the bear market.

Quick Hits

Sports Cards

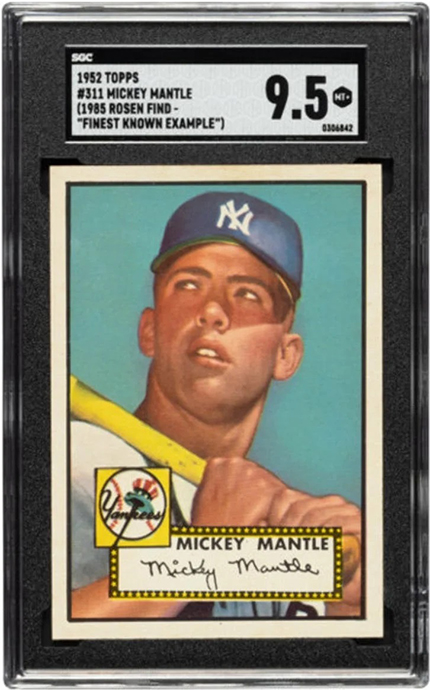

A nearly perfect copy of Mickey Mantle’s iconic 1952 Topps rookie card sold for a record-breaking $12.6m over the weekend. That’s more than $5m more than the previous record – $7.25m for a T206 Honus Wagner.

Coming in at 90% less than the Mantle card, one of only two 1979 Topps Wayne Gretzky PSA 10 cards sold for $1.2m.

An excellent bat used and signed by Babe Ruth from 1918-1922 fetched nearly $1.7m, rounding out an excellent event for Heritage despite the sports cards bear market.

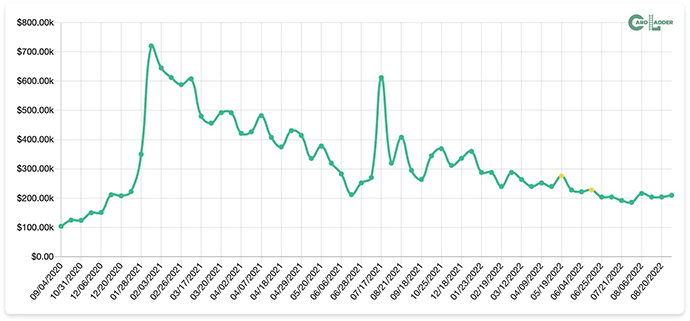

That bear market is best represented by the 1986 Fleer Michael Jordan rookie card, which has been around $200k for a couple of months. You may remember one sold for $720k 18 months ago.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Now, for something completely different – there’s some suspicion that the recent run up on Serena Williams cards (130% over the last twelve months!) is propped up entirely by her husband. A bit weird (romantic?) if true… What do you think?

Cheers,

Wyatt