READ TIME: ±6 minutes

Hello and welcome to Alts Cafe for August 8, 2022.

This is everything you need to know about what’s going on in the world of alternative assets. Best enjoyed with your morning coffee.

Let’s go!

Table of Contents

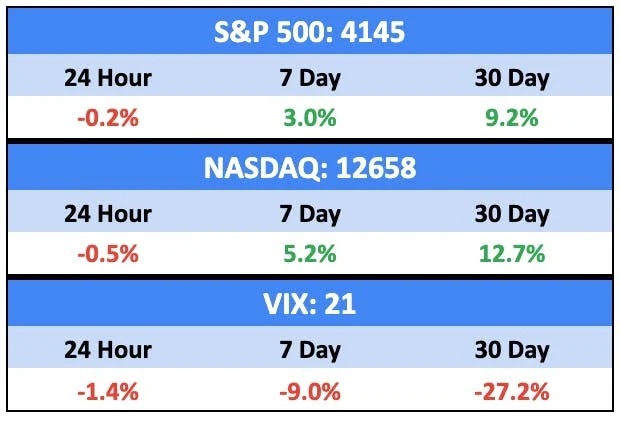

Pulse check: What’s the equity market doing?

Markets rose for the third week in a row, as a surprisingly strong jobs report buoyed equities.

This is in contrast to significant layoffs in the tech sector, which gives us a sort of two-sided economy at the minute.

What are we doing?

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

Last week, we announced we were averaging into BTC and ETH.

This week, I’m happy to say we’ve acquired PROOF Collective NFT.

This is a fantastic project with significant utility and multiple catalysts in the next few months.

Crypto

Here’s what you need to know:

No one is quite sure what to do with this market, so it’s mostly going sideways.

Pretty steady with the Fear and Greed index as well.

Bullish News

- Beanstalk stablecoin relaunches four months after $182 million exploit.

- Michael Saylor said he’s going to step down as MicroStrategy CEO. Shares were up 10% on the news.

Bearish News

- Crypto lending platform Hodlnaut halts withdrawals and is working on a recovery plan.

What to do with that info:

Things feel pretty stable.

Whatever happens to the equity markets will drive prices here, though.

Real Estate

Here’s what you need to know:

Two huge investment funds were raised for different reasons. (H/T the Briefcase)

Blackrock pulled together $30B in just two months to prey on distressed assets over the next year or two. Taking advantage of good deals when everyone else is broke – that’s an easy sell (if you’ve got dry powder).

China raised over $40B to secretly bail out its struggling real estate sector. It’s being marketed as a distressed/opportunistic fund, but it’s really just the government propping up the market.

Regardless of intent, it’s about to become a target-rich environment.

“With debt now more expensive and low cap rates (higher prices), there will be real estate projects that implode from a lack of funding, a reduction in values, as well as ongoing supply chain and labor issues. Distressed prices will mean that groups like Blackstone can go bargain shopping.”

Some real estate stats to get you through the week:

- 30-year fixed-rate mortgages fell below 5%, their lowest level since April, down from 5.30% a week ago in their steepest weekly drop since March 2020.

- The median price for a single-family home in the United States surged to over $450,000 in June, after already jumping over 20% between May of 2020 to May of 2021.

- Nearly 90% of private-sector mortgage servicers and government-sponsored enterprises (GSEs) expect foreclosures to spike this autumn.

What to do with that info:

Hope you’ve got some dry powder handy. It’s time to splash the cash.

NFTs

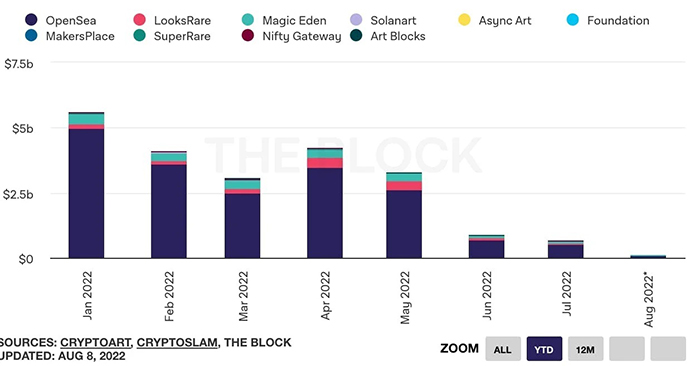

Here’s what you need to know:

Everything was pretty flat last week, as markets took a break.

And that was reflected in the stats. Based on early numbers, volume for August will be even lower than it was for July.

PROOF Collective are airdropping Grails II mint passes to their members today (and to some Moonbirds holders). The first edition of Grails was well-received, with many pieces fetching five figures. The catch with these pieces is that holders can choose any one of 25 works of art, but you don’t find out who the artist is until the end.

What to do with that info:

There’s so little liquidity in the NFT market right now, you’ve got to be really sure of any moves you make.

You may not be able to unwind them.

Startups

Here’s what you need to know:

Robinhood laid off 23% of its staff (just 3 months after letting go of 9% of its workforce). The retail broker is faring better than Tiger Capital, though, which is off nearly 50% on the year.

That’s not to say VC is slowing down. The industry has already raised $137B in 2022, just $4B below 2021’s record numbers.

PitchBook released its Q2 report last week and… didn’t have anything good to say:

“On the heels of a breakthrough year for fintech investment, VC activity in the sector is simmering down.”

In Q2 2022, “VC investment in fintech companies fell 17.8% from the previous quarter” to $24.1 billion, the largest percentage drop since Q3 2018.”

YCombinator reduced the number of startups in this year’s batch by 40%. Though the 250 or so companies it’s “mentoring” is still significantly more than historic trends when the accelerator was more exclusive.

Last week, they sent a helpful email to founders with a top ten listicle focused on thriving surviving during a market downturn.

The list was a bit wordy, so I’ll sum each up here:

- It’s bad out there.

- It’s going to get worse.

- If you’re screwed, raise money if you can, regardless of the terms.

- If you’re screwed and no one will give you money, figure out how to unscrew yourself.

- If you have a sh*tty company, you won’t be able to raise money.

- If your company is still sh*tty a few years from now, you still won’t be able to raise money.

- If you have a sh*tty company, you won’t be able to raise money. [Same message, reworded.]

- Don’t raise money right now.

- Just stay alive.

Some may view the above points as impractical and often contradictory, but I did really enjoy tip number nine, so here’s the full text of that:

Remember that many of your competitors will not plan well, maintain high burn, and only figure out they are screwed when they try to raise their next round. You can often pick up significant market share in an economic downturn by just staying alive.

Good luck out there.

What to do with that info:

Either raise money or don’t. Both are good/terrible ideas.

Quick Hits

Sports cards

It was a good week for Goldin’s private sales team, shifting two seven-figure cards:

- A 2003 Topps Chrome LeBron James Gold Refractor /50 #111 PSA 10 (pop 9) set an all-time high when it sold for $1.2m.

- A T-206 Honus Wagner SGC 2 sold for $7.25m, which was a record at the time.

🚨 BREAKING: Goldin Shatters Record for Most Expensive Trading Card Ever With $7.25 Million Private Sale of Honus Wagner T-206 Card 🚨

— Goldin (@GoldinCo) August 4, 2022

The T-206 Wagner is one of the undisputed pinnacles of trading cards, with fewer than 50 authenticated copies on earth.https://t.co/0UwSHKLSFx pic.twitter.com/bs4WpAJqq9

I say “at the time,” because the Mickey Mantle rookie card I mentioned last week has already surpassed that figure with nearly three weeks to go.

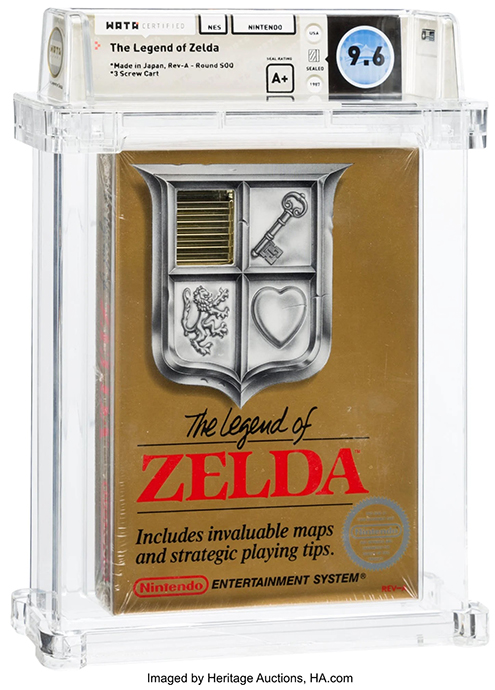

Video Games

A mid-production (I believe 3rd version) Legend of Zelda game graded 9.6 sold for $384k over the weekend via auction at Heritage.

There are only five of this game at this rarified grading standard, so this price feels a bit low to me, compared to another 9.0 graded version that was one production run earlier.

That copy sold over a year ago, though, and the market has changed a lot since then.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – respond to this email. Cheers,

Wyatt