READ TIME: ±6 minutes

Hello and welcome to Alts Cafe for July 21, 2022.

This is everything you need to know about what’s going on in the world of alternative assets. Best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Pulse check: What’s the overall market doing?

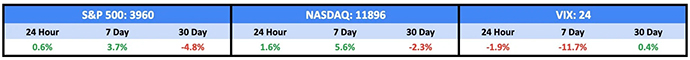

Markets are up, and volatility is down, as some earnings have come in slightly less terrible than expected..

What are we doing?

Fractional Alts picks:

No changes here for now.

ALTS 1 fund news:

We acquired two copies of Damien Hirst’s ‘The Currency’, each for around $9k.

Crypto

Here’s what you need to know:

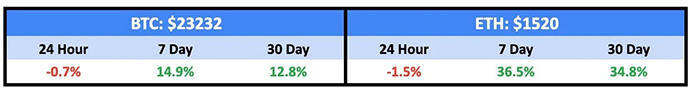

Crypto ripped over the last seven days, led by Ethereum, which is surging on supposed news that the ETH 2.0 is imminent.

The Fear and Greed index is also pumping, though it looks like a lagging indicator right now.

Bullish News

- Andorra is considering issuing its own crypto token.

- The US SEC chief hinted strongly that regulation of cryptocurrencies is coming soon.

- A tentative date of 19th September was mooted for the long-overdue Ethereum merge.

Bearish News

- South Korean authorities raided several crypto exchanges.

- Tesla sold off 75% of its BTC stake, despite claiming it would retain its entire stake.

What to do with that info:

We’re still on the sidelines.

Real Estate

Here’s what you need to know:

The average mortgage payment in America has doubled over the last two years.

2 years ago, the 30-yr mortgage rate was 2.90% & the median existing home price in the US was $294k.

— Charlie Bilello (@charliebilello) July 20, 2022

Today the 30-yr mortgage rate is 5.71% & the median existing home price is $416k.

With a 20% down payment, that’s a 98% increase in the monthly payment (from $978 to $1,933).

Which is obviously unsustainable.

To wit, housing price cuts have now topped 50% in a few major markets, with more to come.

Price reductions are becoming more common. I’m not expecting a crash like 2008, but we can expect at best stagnation for the foreseeable future, and price cuts from unreasonable/unaffordable levels are unavoidable. #housingmarket pic.twitter.com/1zYov3d35E

— PassedPawn.eth (@passedpawn) July 20, 2022

Things in Europe are less overheated… but still frothy.

Given record inflation both inside the US and elsewhere, a residential price crash (or stagnation, if you’re more positive) feels imminent.

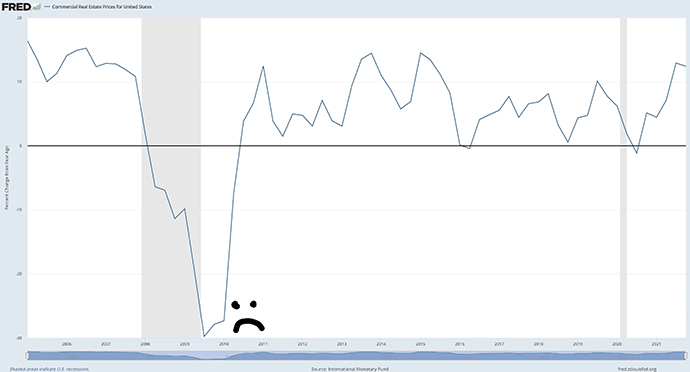

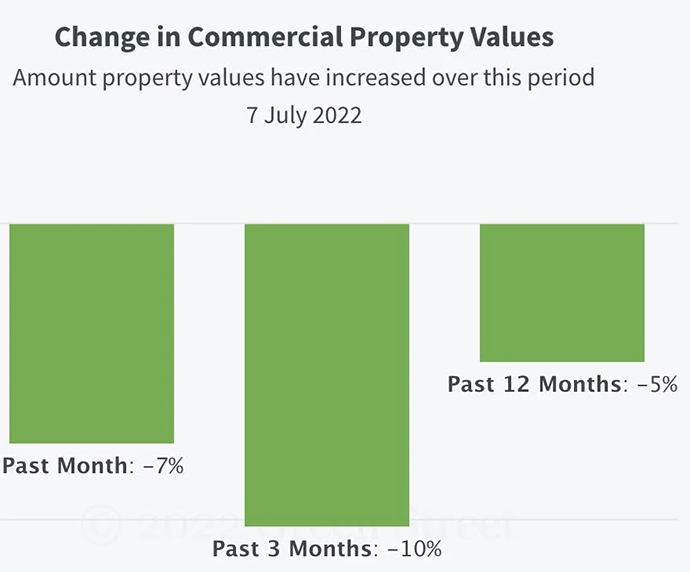

I’ve not really talked about it much, but commercial real estate is a worry for me too. Current prices are still at near-record levels, and you’ve only got to look at what happened in 2008 to get a feel for a worst-case scenario here.

It’s worth noting that European prices have already taken a big hit this year.

But the real worry for me is consumer debt.

It’s nearing a record $4.5T, and credit card defaults ticked up ever so slightly in Q1 2022.

If consumer debt starts to default, that’s going to be a big problem for commercial real estate (and everything else).

What to do with that info:

I’m still avoiding single-family homes. There could be opportunities in multifamily.

And watch these numbers.

NFTs

Here’s what you need to know:

NFTs have caught fire in the last 30 days, with all projects save The Currency up big.

But volume is still very, very limited, and the asset class had its worst month in a year in terms of volume, unique buyers, and average sale price.

It’s worth noting that while monthly volume is down over 90% from the heady days of 2021, the number of unique buyers is only down around 50%.

A lot of people got flushed out, but not as many as you’d expect. Many, many people have stuck around and are just spending less.

What to do with that info:

Last week we mentioned dipping toes into projects with a track record and utility (like Moonbirds and The Currency), and one of those is up 53%. The, uh, other one isn’t…

Startups

Here’s what you need to know:

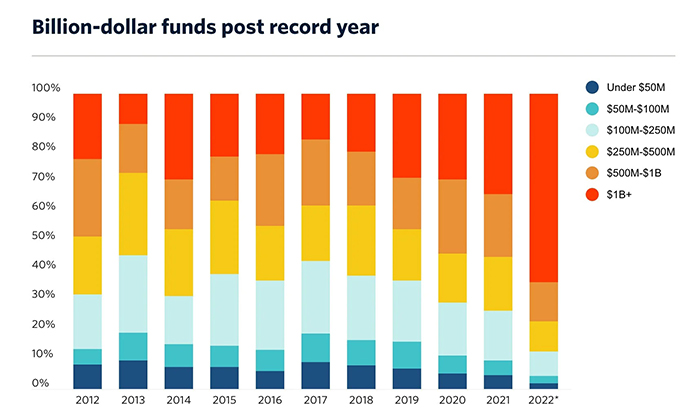

Ultra-mega-giant VC funds have taken over in 2022, with $1B funds comprising the majority for the first time ever.

But there’s trouble under the surface, as many of these funds report significant challenges closing.

The consensus is that too many big funds have tried to raise too quickly, with the median interval between fund rounds decreasing from a historic average of ±2.4 years to 1.6 years.

There’s not enough VC allocation to go around for all these funds, so many are struggling.

Things are looking worse for founders, as both deals and dollars are off around 50% since Q4 for most round sizes. The worst hasn’t come through yet for early stage because it lags, but it’s on its way.

Europe is only off around 10% so far. Let’s see if that lasts.

What to do with that info:

If you’ve got dry powder, startups are on sale.

Quick hits

Wine & Spirits

$1.7m worth of stolen wine was recovered in Croatia after a “Mexican Beauty Queen”, and her Dutch-Romanian accomplice led authorities on a nine-month manhunt across southern Europe.

Sports Cards

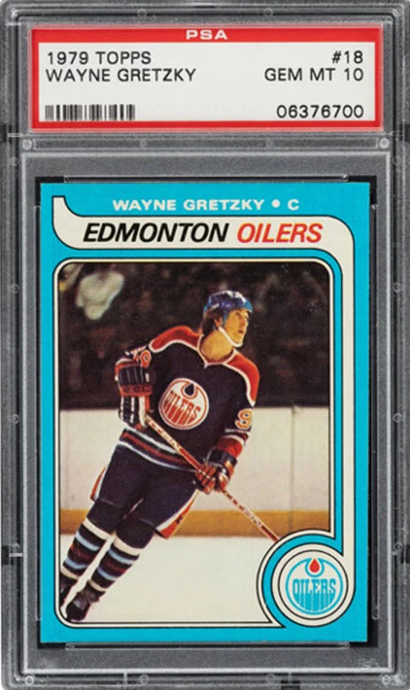

Heritage has released the catalog for its platinum summer auction, kicking off in early August.

There are four separate items with guide prices over $1m, but the pick of the litter is this Wayne Gretzky rookie.

It’s one of only two PSA 10 graded cards in existence.

The O-Pee-Chee is valued around 3x what this will probably fetch, but I love this card.

Art

Phillips held its first-ever generative art auction last week, and it did… well, it did terribly.

It generated only 1/4 its low estimates, and less than half of the lots were sold.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt