READ TIME: ±4 minutes

Hello and Welcome to Alts Cafe for June 17th, 2022.

This is everything you need to know about what’s going on in the world of alternative assets.

Best enjoyed with your morning cup of coffee.

Bit of a short one this week, as we’ve just had a death in the family. I’ll do better next week.

Let’s go!

Table of Contents

Pulse check: What’s the overall market doing?

All public markets continue to slide with no real end in sight.

The S&P 500 slid into an official bear market this week, which didn’t help.

What are we doing?

Fractional Alts picks

There are no changes to our picks this week.

ALTS 1 fund news

No changes this week, but we’re hot on the trail of a few assets so stay tuned.

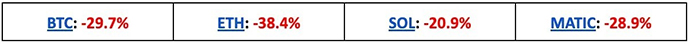

Crypto

Here’s what you need to know:

The Bitcoin Fear and Greed Index bounced off seven (a three-year low) yesterday to the heady heights of nine.

Bullish News

- PayPal launched two new services on its platform: the ability to withdraw crypto to external wallets and the ability for users to send and receive crypto between themselves. (TD)

- Unlike most crypto firms, Binance is hiring and investing during the downturn. They have the means to do this, thanks to their previously frugal/conservative approach. (Bbg)

Bearish News

- The SEC is investigating Terraform Labs. This comes on the heels of South Korea’s own investigation into Terraform and its prosecution of Do Kwon for fraud. (D)

- The user base for metaverse platforms, such as sandbox and decentraland, have declined significantly. (B)

- Celsius, a major crypto lender, is experiencing a run on the bank. The firm put out a statement saying that they are pausing all withdrawals and transfers “Due to extreme market conditions”. (C)

- BlockFi is laying off about 20% of its employees, and Crypto.com is laying off 5% of its corporate workforce. (DC). Coinbase is laying off 18% of its employees. (TC)

What to do with that info:

I’m waiting for what looks like a bottom, then we’ll DCA into the markets.

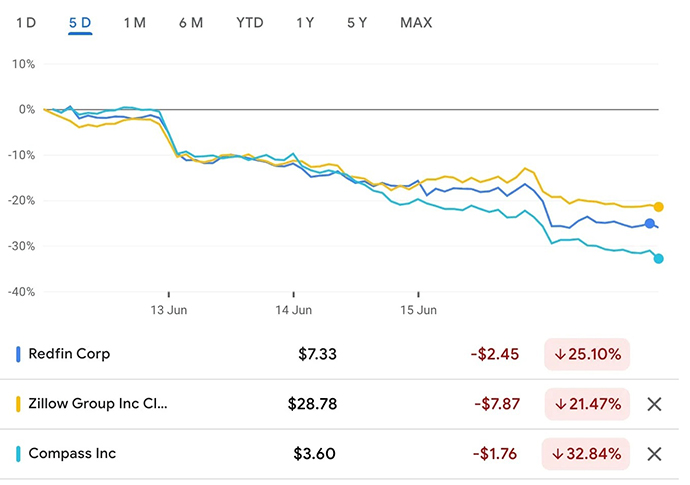

Real Estate

Here’s what you need to know:

Some more troubling data points in the US residential real estate market:

- Housing starts and building permits were a lot lower than expected for May. Starts were down 14% MoM and 3% YoY. Permits were off 7% on the month and flat year over year.

- Single-family was the hardest hit for both, with mortgage rates having doubled so far in 2022 from 3% to 6%. Builders have had to drop prices because of this, and there’s a big backlog of unfinished homes.

- Real estate companies Redfin and Compass each laid off around 10% of their workforce this week.

That said, home prices are still up 20% year over year.

What to do with that info:

We mentioned getting out of housing stocks last week. Let’s see how they’ve done since then.

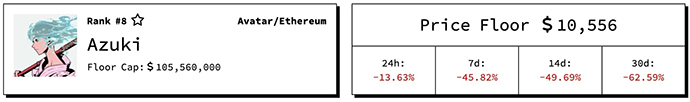

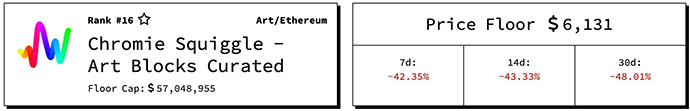

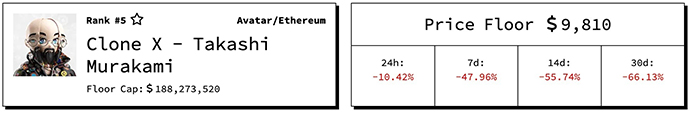

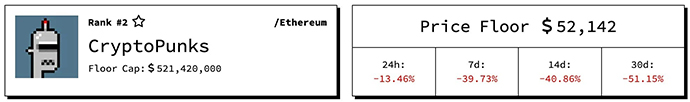

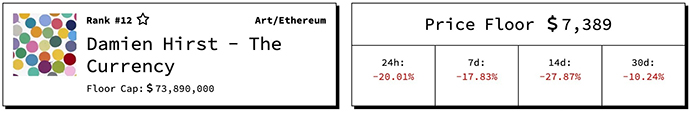

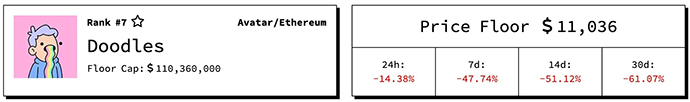

NFTs

Here’s what you need to know:

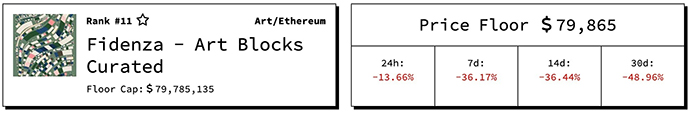

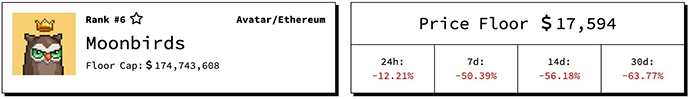

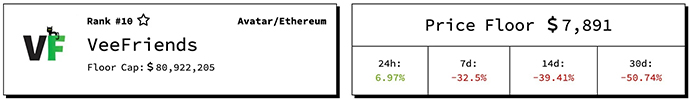

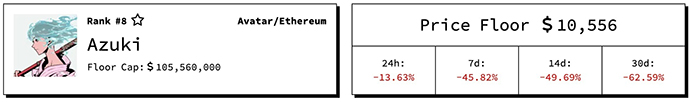

Everything is off big, but a huge percentage of the decline is tied to the drop in ETH over the last seven day.

If you toggle to show the price of many of these projects priced in ETH, a few are actually in the green – most notably The Currency, VeeFriends, and Fidenza.

What to do with that info:

Who knows…look for a bottom or find projects whose utility alone is genuinely worth the floor price?

Comics

Here’s what you need to know:

Marvel recently revealed that it is working on a movie based on the copper age Thunderbolts comic series.

Prices for 9.8 graded Thunderbolts #1 jumped after the news. (GC)

Their story is a compelling one, and if it’s done well, I can see the film(s) really taking off:

‘Despite presenting themselves as worthy successors to the Avengers, the Thunderbolts are hiding a dark secret that’s revealed at the end of The Thunderbolts #1. They’re all villains in disguise. Citizen V is actually Captain America’s nemesis Baron Zemo. Many of Zemo’s teammates are former Masters of Evil members using new costumed identities. Even 25 years later, that twist ending is widely regarded as one of the most memorable moments in Marvel Comics’ history.’

There are only 649 books graded 9.8, which is actually a reasonably low number for a book from 1996. If they turn into a real franchise, $700 could look a real bargain.

Get up to speed on all 31 (31!!) planned Marvel films and series to get ahead of the comics game.

What to do with that info:

Many key comics for DC and Marvel film characters get a bump in the run up to the release.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – respond to any.

Cheers,

Wyatt