READ TIME: ±4 minutes

Hello and Welcome to Alts Cafe for May 26th, 2022.

This is everything you need to know about what’s going on in the world of alternative assets.

Best enjoyed with your morning cup of coffee.

Let’s go!

Table of Contents

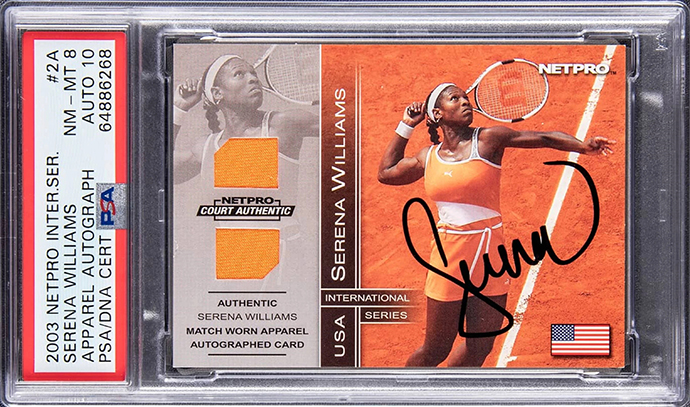

Pulse check: What’s the overall market doing?

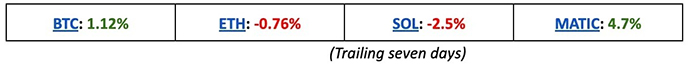

Markets rebounded (and calmed slightly) this week as Chairman Powell downplayed talk of super-aggressive rate hikes.

What are we doing?

Fractional Alts picks

This week we put two BUYs on new fractional IPOs for our Alts Index:

- ‘78 KENNER STAR WARS SET on Rally @ $10/sh

- ’67 ANDY WARHOL MARILYN MONROE PRINT (SIGNED) on Rally @ $10/sh

And one sell:

- Cristiano Ronaldo 2003 Panini Mega Craques PSA 10 on Rally @ $12/sh (-17%)

ALTS 1 fund news

Last week, ALTS 1 acquired one new asset:

- The Beatles: “White Album” UK 1st Mono Pressing No. 0000002 for $50k (we value it at $80k)

[We’re sharing the ALTS 1 acquisition info until the collection closes. After that, only investors will get these updates]

Crypto

Here’s what you need to know:

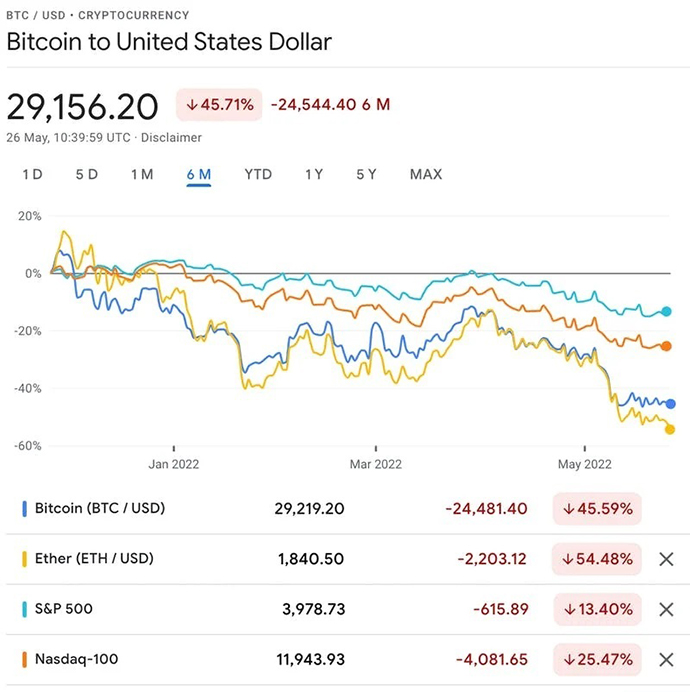

We’ve got some green on the board, but that covers up some ugly charts. You can never pick the bottom, but I think crypto is still in falling knives territory.

What’s more, while equities and crypto used to be wholly uncorrelated, they’re now tracking each other on a near 1:1 basis.

Want a 4x levered play on the S&P? Buy ETH.

Bullish News

- Another luxury clothing line, Balenciaga, started accepting Bitcoin and Ethereum as payment. Gucci made the same announcement just weeks before. (D)

Bearish News

- The South Korean police are attempting to freeze Luna’s assets. (CD)

- The founder of Terra, Do Kwon, was fined $78 million for tax evasion. He is also under investigation by the government for the crisis surrounding TerraUSD. (CP)

What to do with that info:

I’ve been saying it might be a good time to DCA into crypto, but those charts are UGLY…

Real Estate

Here’s what you need to know:

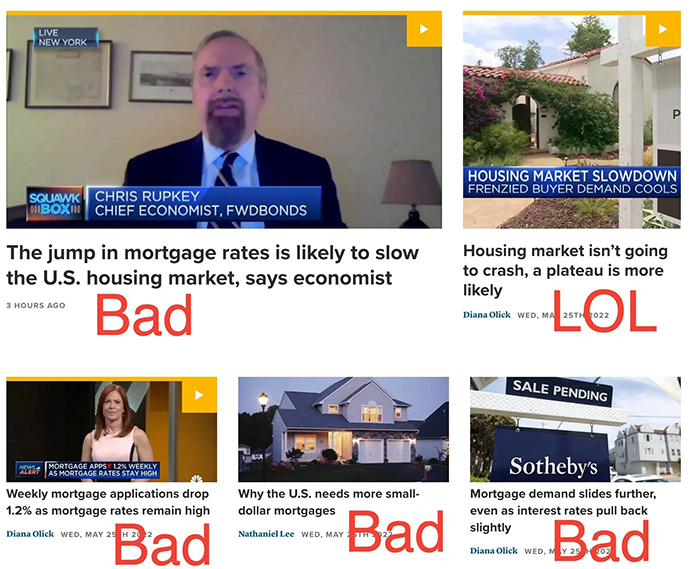

This screen-grab of CNBC’s real estate page says it all:

What to do with that info:

I wouldn’t take out a variable rate 5% LTV mortgage on a home in Florida or Arizona anytime soon.

NFTs

Here’s what you need to know:

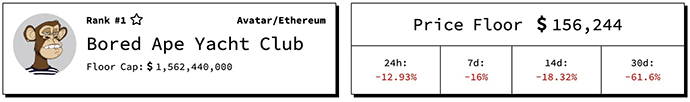

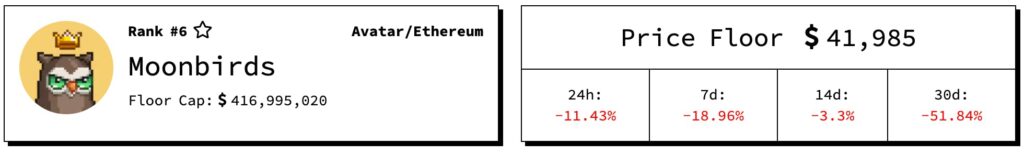

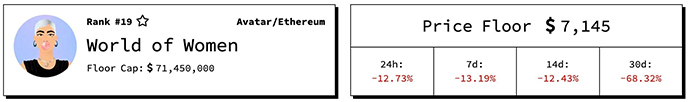

Speaking of ugly charts, check these out (yes, they’re tables, not charts, shut up):

NFT Scandal of the Week:

The creator of Milady PFP project was outed as a Nazi groomer. The floor price is now off (only) 80%.

What to do with that info:

Is it a generational buying opportunity to pick up fantastic assets at a bargain price? Or are NFTs done?

Or, more likely, are NFTs just a levered play on ETH right now? Same direction as everything else, except more?

If you think it’s the latter, there’s an opportunity, as soon as you think the market’s bottomed.

Some projects to watch [via Mythia]:

- Akumu Dragonz: Sentiment for this project is extremely bullish. Despite market factors, loads of people are trying to get WL however possible, some even buying BloodMoon BOKU (45 SOL FP) to secure one.

- Azra Games: Attention is growing for this fairly early-stage project that just closed a $15M seed round. Azra Games is composed of the creators of the popular mobile game Star Wars Galaxy of Heroes. SOLBigBrain, who has a great track record of getting in early on projects, joined earlier today as both an advisor and investor. Details about what’s to come are somewhat scarce, but their Genesis Collection will mint this summer.

- LOREM: This early-stage project is starting to gain some attention. The artist, Sina, is a well-known Thai artist with a big following across South-East Asia. IRL, he worked in fashion and partnered with several brands in SEA throughout; Sina also uses his art for political activism and to promote freedom of speech. He is a member of the CERD club (Cool Nerd Club), as was the artist behind 3Landers.

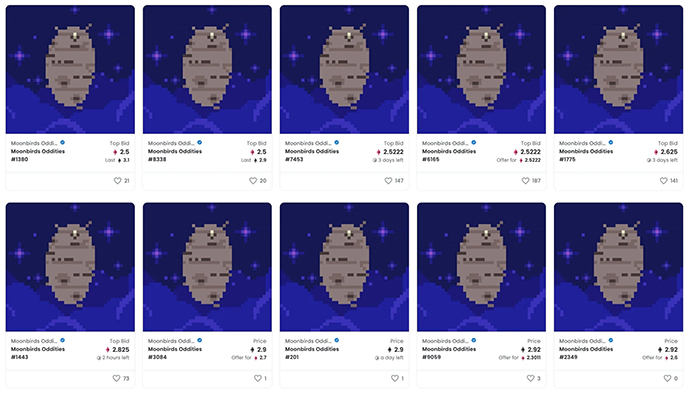

- Moonbirds Oddities: Although details about the future utility of these ‘Moonbird Pellets’ airdropped to Moonbirds holders, Kevin Rose has hinted at some future utility. Speculations are that they will come into play for their metaverse.

Sports Cards

Here’s what you need to know:

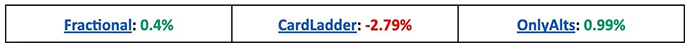

Sports cards on fractional markets are still up slightly for 2022, though they don’t look like doing much (either way) anytime soon.

The picture on the broader CardLadder index looks less positive, with nearly all sports down for the trailing 30 days. The CL 50 is off more than 7% on the year.

The high-end market softened further with the close of a couple of big auctions last weekend, but there were a couple of bright spots:

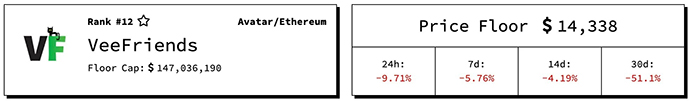

Goldin’s Elite auction wrapped over the weekend as well, and the big news there (for me anyway) was another record-setting sale for a female athlete. Serena Williams’ 2003 NetPro Int’l /100 card sold for $266,400, the most for any female athlete ever.

This 1986 Fleer Kareem Abdul-Jabbar sticker set records with its $240,000 sale in the PWCC May Premier Auction. According to public data, it is the highest price ever paid for any Fleer sticker and the highest price for any non-rookie Abdul-Jabbar card. It’s also now worth more than the set’s Michael Jordan rookie.

What to do with that info:

I’m staying far away from sports cards for now.

Comics

Here’s what you need to know:

Last week we highlighted four copies of Amazing Fantasy #15 up for auction. They’re going to tell us a lot about the blue-chip comics market. One has closed, and three are still open.

- And also at Godlin (Ended at $450k) $490k was the price to beat

- Amazing Fantasy #15 CGC 8.0 at Comic Connect ($240k with 12 days to go) $490k is the price to beat

- A CGC 7.5 copy at ComicLink ($149k with five days to go) $280k is the price to beat

- And a CGC 7.0 copy at Heritage. ($108k with 7 days to go) $210k is the price to beat

Another week, another trailer!

Remember this bit of awfulness from last week?

The She-Hulk trailer release didn’t affect comic prices, but it did affect sale frequency: “While there were no record sales in the high grades, in terms of volume, this book absolutely exploded.

67 graded copies of The Savage She-Hulk #1 sold on eBay the first five days after the trailer was released, with 23 of those being sold on May 17 alone.”

What to do with that info:

Weep for our future.

Video Games

Here’s what you need to know:

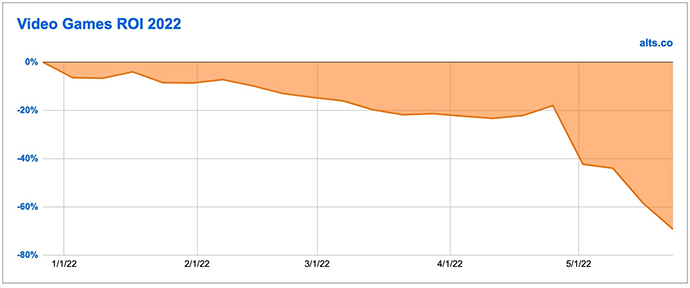

It was an awful week for sealed video games at Goldin’s Elite auction. Everything was off 20% to 50% comps from recent months. The asset class is in free-fall.

This tracks what we’re seeing in the fractional markets on Rally and Otis.

What to do with that info:

I’ve moved the video games allocation in our ALTS 1 portfolio to zero.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – respond to this email. Cheers,

Wyatt