READ TIME: ±4 minutes

Hello and Welcome to Alts Cafe for June 3rd, 2022.

This is everything you need to know about what’s going on in the world of alternative assets.

Best enjoyed with your morning cup of coffee.

Let’s go!

Table of Contents

Pulse check: What’s the overall market doing?

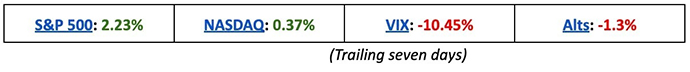

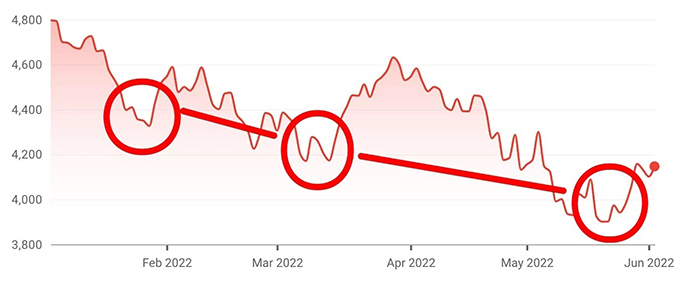

Markets are up, volatility is down. Is the Great Recession of 2022 over? Or is it more of the same?

What are we doing?

Fractional Alts picks

No changes this week

ALTS 1 fund news

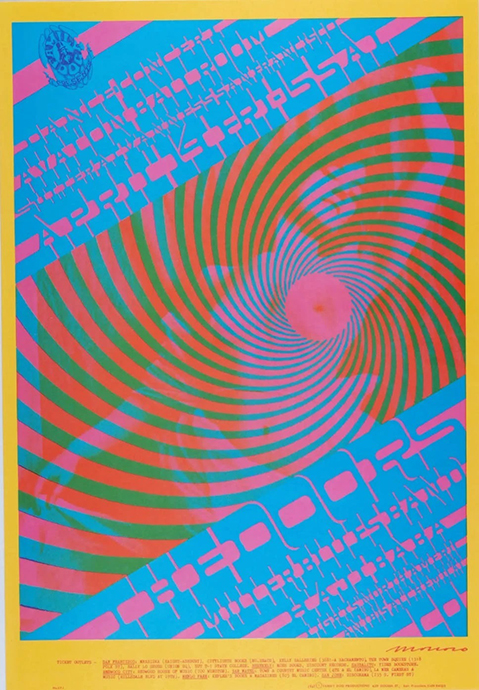

Last week, ALTS 1 acquired three fabulous new vintage concert posters:

- FD-57-OP-1 – The Doors at Avalon Ballroom April 14, 1967 CGC 9.9 for $7,667 (we value it at $9,450)

- BG-23-OP-1 – Jefferson Airplane & Grateful Dead The Fillmore 1966 CGC 9.9 for $7,667 (we value it at $9,000)

- FD-27-OP-1 – Howlin’ Wolf at Avalon Ballroom 1966 CGC 9.9 for $7,667 (we value it at $10,500)

[We’re sharing the ALTS 1 acquisition info until the collection closes. After that, only investors will get these updates]

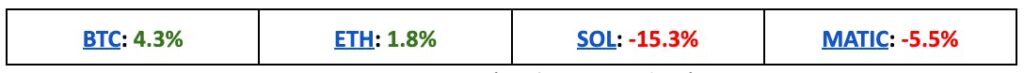

Crypto

Here’s what you need to know:

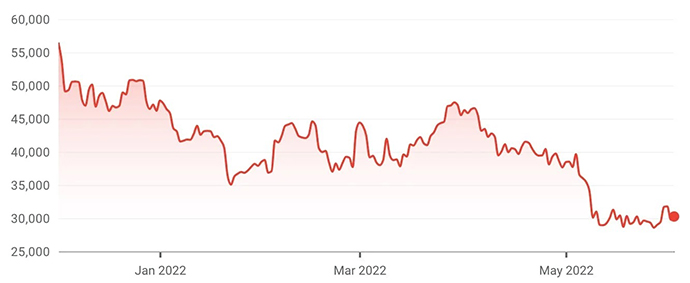

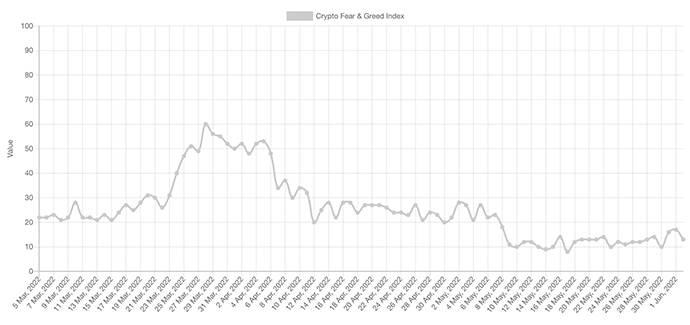

Crypto seems to have bottomed out for the moment – it’s pretty much just going sideways these days.

But there’s a bit of possible positive sentiment under the radar. if you squint a bit, the Crypto Fear and Greed Index is trending up for the first time in awhile.

Bullish News

- “Overall crypto market capitalization has recovered 10% to $1.37T after hitting a low of $1.24T on Friday, according to data from CoinGecko.” (TD)

- JP Morgan released a note to clients on 5/25 recommending crypto over real estate as a “preferred alternative asset”. (Forbes)

- It’s pretty huge that one of the biggest and most prominent banks is recommending crypto over RE to its very large client base

- VC money also seems to be pretty active in the space: “Ethereum scaling startup Starkware raised $100 million at an $8 billion valuation and venture giant Andreessen Horowitz announced a $1.5 billion allotment for crypto investments as part of its larger $4.5 billion fund.” (TC)

- DraftKings may accept crypto in the future: “People Want It, We’re Working Towards It” (D)

Bearish News

- Luna 2.0 plunged by 80% after its debut, only to recover 97% two days later. (F)

- Reminder that down 80% then up 97% means you’re still down.

What to do with that info:

I’m flip-flopping back to saying it might be time to start averaging back into crypto, but I’d be cautious about it.

Real Estate

Here’s what you need to know:

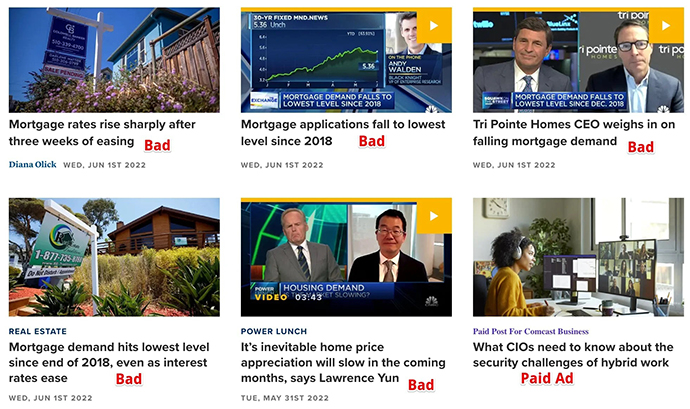

Time for your weekly screenshot of CNBC’s real estate news page

I’m actually in the US this week for a funeral, and I’ve heard several radio ads from “we’ll buy your distressed house QUICK” types of people. Totally anecdotal but that doesn’t inspire confidence.

It’s worth noting my opinion seems to be in the minority based on the comments I got from this tweet.

How’s American real estate doing these days?

— Wyatt Cavalier (@itiswyatt) June 2, 2022

From the @CNBC real estate news page pic.twitter.com/zvT0LJAkJZ

What to do with that info:

History doesn’t repeat, but it does rhyme. Consider a refresher. Or ignore me!

NFTs

Here’s what you need to know:

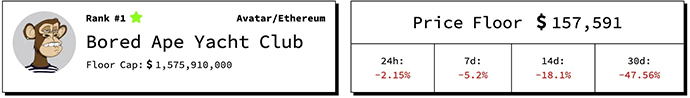

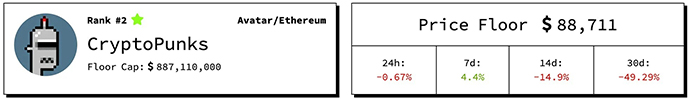

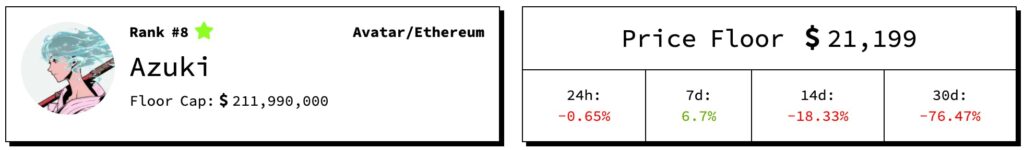

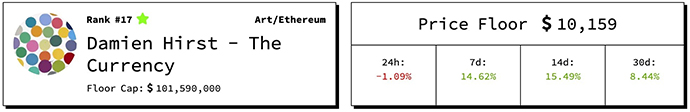

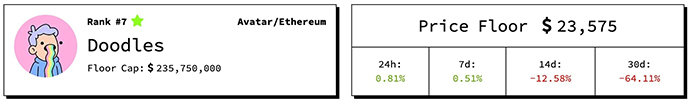

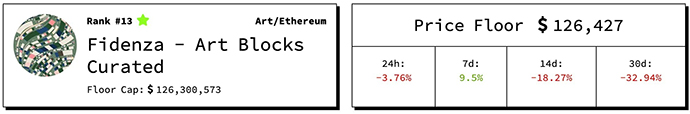

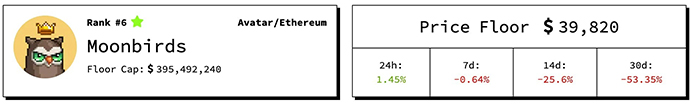

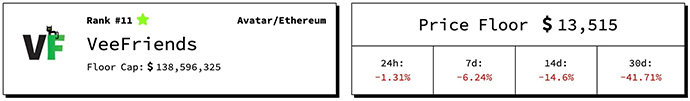

With the exception of Bored Apes and Vee Friends, it looks like most of the more notable NFT projects seem to have found a floor.

Combined with the broad market strength and crypto possibly finding a bottom, it’s easy to see this as a third data point to support a recovery, but is it? We saw last week that all these markets are correlated to each other now, so it’s probably only one data point spread across three asset classes.

What to do with that info:

I think it’s probably time for me to start averaging into these projects. I would possibly start with Currency and look at Moonbirds next. I need to do more research on that project first, though.

Startups

Here’s what you need to know:

It’s a buyer’s market in startup land after every VC on the planet simultaneously decided to slash valuations by around 50% a couple of weeks ago.

This is, of course, off the back of flailing public markets. The pain for founders has rolled downhill as Series C and D companies have struggled to go public.

The average public listing valuation fell to $993.1 million in Q1. While the figure is still elevated on a historical scale, it represents roughly one-third of 2021’s $2.8 billion.

Another troubling data point:

More than 120 unicorn companies went public in 2021, the highest number on record. But so far in 2022 the IPO markets have stalled, with only nine unicorns going public.

And if VCs (or more specifically, the LPs) can’t get their money out, they can’t invest in new companies.

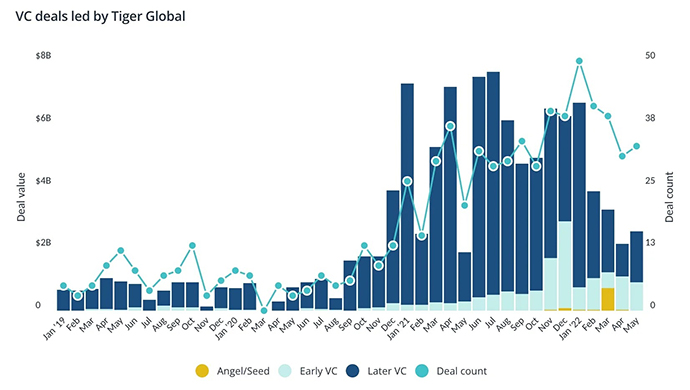

Even Tiger Capital, which invests in more deals than most firms, has put the brakes on in Q2.

According to Crunchbase, Tiger has actually led or co-led more private rounds through roughly the first five months of this year than in the previous two, but total dollar amounts in those rounds have been down.

And (gasp) some mega investors are having to mark down deals.

What to do with that info:

It’s a great time to be an investor. Some of the best companies are built during recessions, and most startups raising right now are willing to take a big haircut on what they would have demanded even a few months ago.

Comics

Here’s what you need to know:

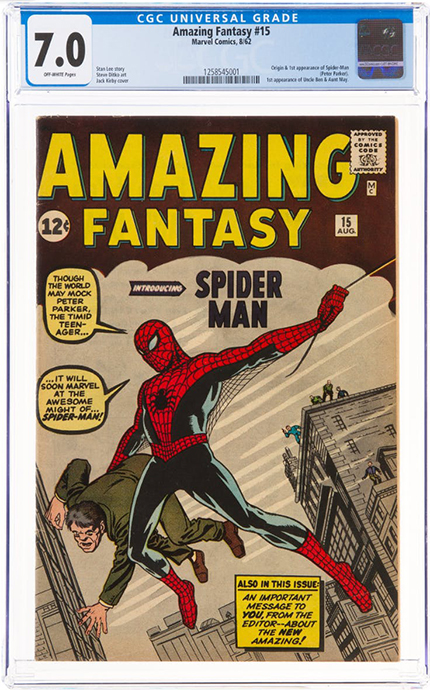

We’ve been monitoring four copies of Amazing Fantasy #15 up for auction. They’re going to tell us a lot about the blue-chip comics market. One has closed, and three are still open.

- Amazing Fantasy 15 CGC 8.0 at Godlin (Ended at $450k) $490k was the price to beat

- Amazing Fantasy #15 CGC 8.0 at Comic Connect ($330k with 5 days to go) $490k is the price to beat

- A CGC 7.5 copy at ComicLink (Ended at $270k) $280k was the price to beat

- And a CGC 7.0 copy at Heritage. (Sold for $240k) $210k was the price to beat

On further reflection, it probably wasn’t the best idea to sell so many copies of a very similar high-value comic at the same time.

What to do with that info:

If you can afford one, this could be a good time to get a copy of a top-tier comic at a discount.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – email us.

Cheers,

Wyatt