Today, we have a very special issue. After months of hard work, we’re excited to announce the launch of our first investment fund 🙌

The Alts 1 fund is the modern way to diversify your portfolio. It’s truly the first of its kind, and we’re incredibly excited to bring it to life.

I’d love to tell you all about it.

Let’s go! 👇

Table of Contents

Why we launched this fund

A natural evolution for our company

Ever since Wyatt and I started this company, we’ve had requests from our community asking if & when we’d launch an investment fund. And why not? After all, it makes perfect sense.

If you’ve been following us, you know we’ve developed expertise in this space. We’ve been tracking alternative investing markets and making recommendations on the best alternative assets to invest in since 2020.

Now you can confidently access a meticulously-chosen blend of these assets, hand-selected by our team of analysts, led by our Co-founder and Chief Investment Officer, Wyatt Cavalier.

Yesterday, Wyatt and analyst Tully Ross recorded a special podcast where they discuss the investment thesis and what makes this fund so unique.

Check it out on YouTube or Spotify.

Superior research and analysis

It all comes down to our research. We do the hard work that nobody else wants to do. We dive deep on each asset we look at; finding recent comps, developing valuation hypotheses, and uncovering the Inferred Value for each one. This is what we do best.

In fragmented markets, returns follow data and analysis, and we think we have the best data and strongest analysis.

Since February 2021, we’ve analyzed 800+ deals across fractional platforms and made 111 buy recommendations. Of those, we’ve exited 70, with an average ROI of 82%. Insiders who receive these recommendations are already reaping the rewards.

Standing by what we believe

But as great as this is, it’s not enough.

Why should we limit ourselves to making recommendations for Insiders? If we know how to find alpha in these new markets, why not kick things up a notch, and let even more people benefit? Wouldn’t this be the single best way to stand by what you believe in?

So, we decided to put our money where our mouth is.

The Alts 1 Fund leverages our alternative investing expertise to stay one step ahead of the market. This isn’t your grandpa’s investment fund. Alts 1 is an actively managed, opportunistic fund designed to acquire assets larger funds don’t touch and achieve returns traditional funds can only dream of.Invest Here →

What will the fund invest in?

This fund aims to provide the broadest and best exposure to all these assets, without being so broad that it dilutes the returns.

Wyatt Cavalier

The Alts 1 fund will invest in diverse alternative assets across the markets we know best; where we have the biggest edge.

This is an opportunity to invest in a broad basket of alternatives uncorrelated to public equities. We choose assets specifically designed to diversify your portfolio and protect against inflation.

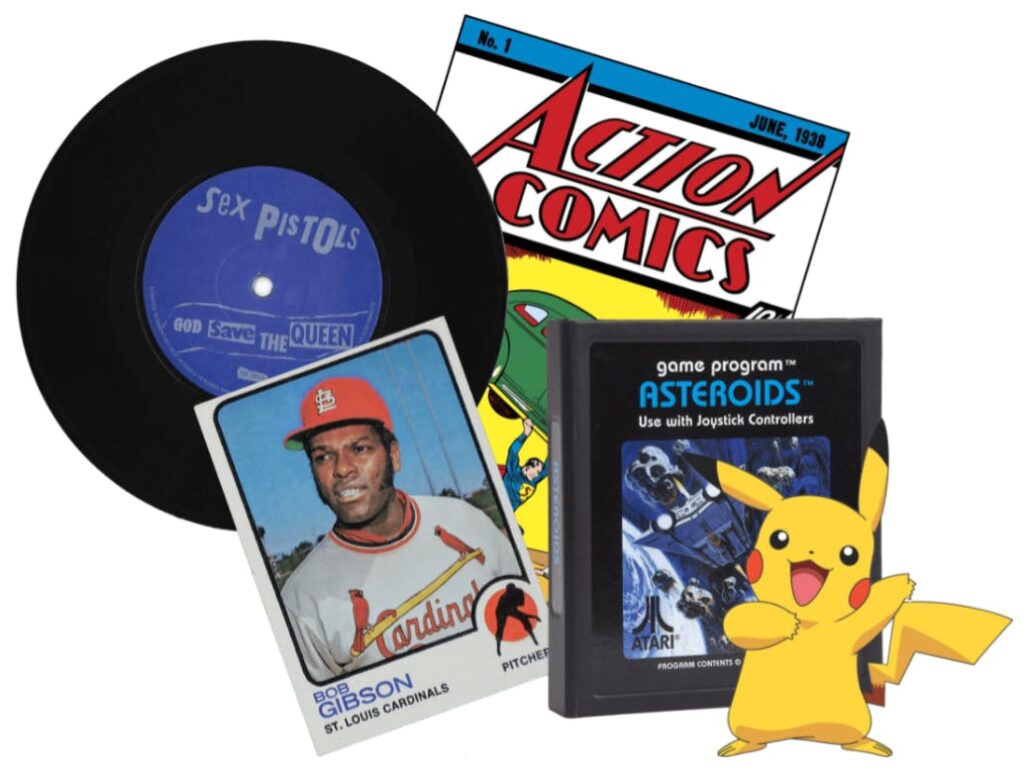

🏀 Collectibles and Culture

Collectibles are probably the asset class we know best.

Nostalgia is real. That’s why investors and collectors alike are flooding into these assets. From sports cards to vinyl, an entire generation wants to get involved. Our proprietary methodology ensures that we see trends develop before anyone else.

The last two in particular are interesting to us. Vinyl records and concert posters have one of the best risk/return profiles. We’ve been researching vinyl like mad, and are creating the first ever Vinyl Records Index.

🚀 Crypto and NFTs

Love them or hate them, there’s no denying that crypto and NFTs can be extremely profitable.

Our unique strategy makes the most of staking, liquidity pools, and play-to-earn dynamics across a mixed portfolio of blue-chip and up-and-coming assets.

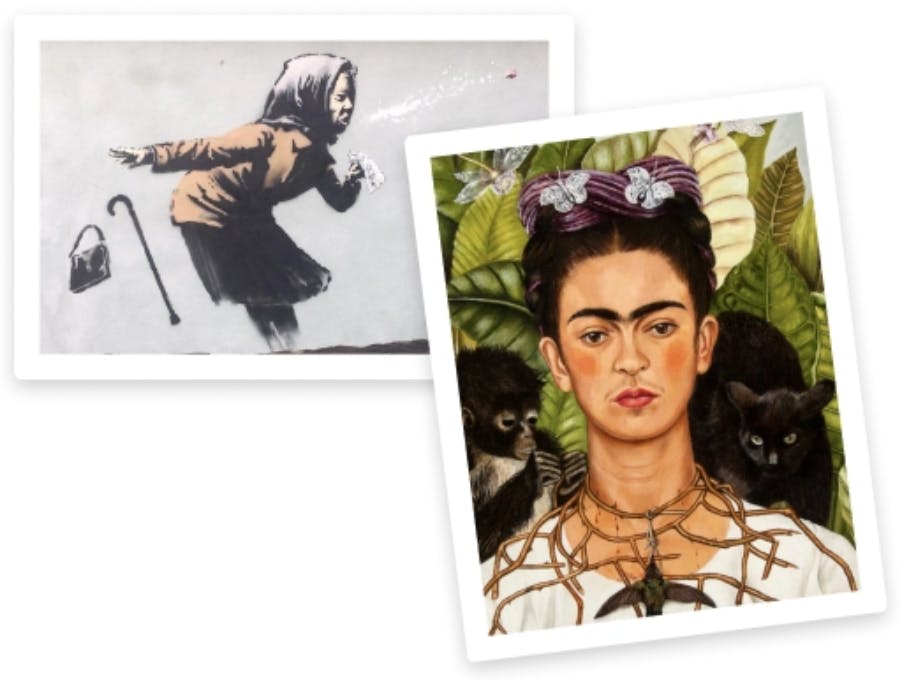

🎨 Fine Artwork

Art has always been a strong store of wealth, and it’s historically outpaced most equity markets. Our blended approach, investing in both Masters and Contemporaries, generates alpha returns while providing portfolio stability.

🎤 Music Rights

This one is probably my personal favorite.

One of the most exciting and underrated alternative asset classes out there, music rights yield immediate and reliably consistent cash flow. We’re working with industry experts to make under-the-radar, portfolio-stabilizing catalog investments.

🌴 Specialty Real Estate

There’s an entire world of real estate beyond multi-family homes and office buildings, and we’re here for it. We’ll take positions on assets such as holiday homes, farmland, and accessory dwelling units.

🍷 Fine Wine & Whisky

Both wine and spirits made record returns over the last two years, and whisky consumption will outpace vodka for the first time in 2022. We’re digging deep to find the next Karuizawa and unearth the most daring Bordeaux.

👟 Sneakers

Die-hard sneakerheads generate returns well above equity markets, and we’re working with the best. The ultimate diminishing asset, sneakers are only dead stock for so long.

Prospectus

Want more detail? Download our prospectus.

If you’d like to get into the weeds (hey, we understand) you can check out our PPM.

How actively managed will this fund be?

This will be a very actively managed fund.

Alternative investment markets are not set in stone; they are constantly evolving. We believe active management is the best way to address alternative assets’ volatility, immaturity, and rapidly-changing nature.

Remember, the vast majority of returns accrue to the top 10% of assets. Our goal is to acquire these assets at the right price and sell them at the right time

The cool stuff gets the headlines, but the money is made in the trenches.

– Wyatt Cavalier

We have a team of six analysts and researchers, led by Wyatt Cavalier, Co-founder and CIO. Together, we cover the major asset classes in the fund. For smaller, more niche classes (e.g., sneakers and music rights), we will be working with trusted experts from each industry.

Our portfolio team takes a long-term approach to investing while also taking advantage of the day-to-day inefficiencies in the market.

We’re also exploring ways to actively add value to the assets we’ve invested in. For example, say we acquire a painting from an up-and-coming artist, or a budding musician’s catalog of songs. How can we help those artists get more visibility? This thinking isn’t limited to the arts — the same principle applies across other asset classes.

A lot of the alpha we’re going to generate is by doing the in-the-weeds hard work where historically there hasn’t been lots of work done.

-Wyatt Cavalier

Frequently Asked Questions

What are your targeted returns?

We’re targeting 40%.

Over the past 2 years, our picks have consistently outperformed this, delivering 82% ROI. But we’d rather under-promise and overdeliver.

What’s your exit plan?

The Alts 1 Fund has a 10-year duration. All funds will be returned at the exit.

If you’d like liquidity before that, we anticipate allowing the fund shares to trade on a secondary market in 2023, after the one-year legal lockup period and pending regulatory approval.

Who can invest in the fund?

Alts 1 is a Regulation D fund for investors anywhere in the world.

If you are located in the US, you must be accredited and will be required to show proof. (If you are unsure about your accreditation status, our software can guide you, or you can contact your financial advisor.)

Due to the explosive growth and interest in alternative assets, we expect very high demand for our fund. However, the fund is limited to a maximum of 2,000 investors.

It’s interesting because as we know, there is lots of hype around DAOs — which in theory, anyone can invest in. We’re watching and learning rapidly as the space unfolds. But while it’s tempting to get distracted by something shiny and new, we’ve learned that the legal & accounting infrastructure around DAOs is severely lacking.

Thus we have opted to launch a Reg D fund under the Securities Act. This provides several exemptions from the registration requirements, allowing companies to offer and sell securities without having to register each offering with the SEC.

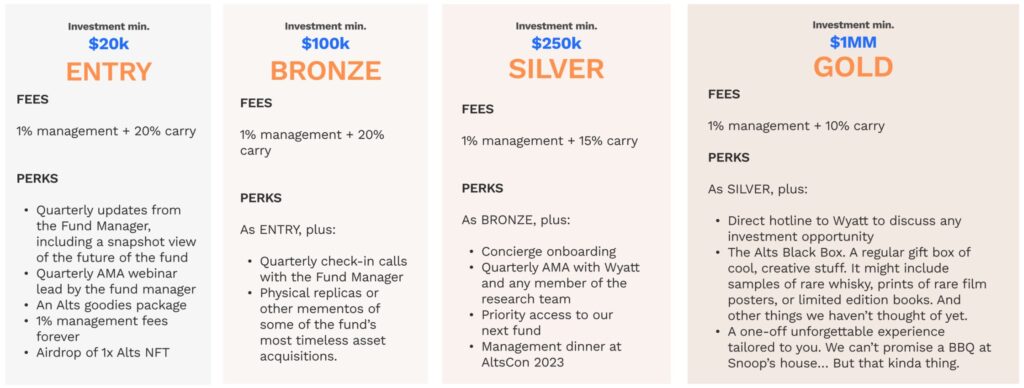

What are the minimums and fees?

The minimum investment is $20k. If that’s beyond your reach, get in touch and we’ll see if we can accommodate you.

Fees and perks vary based on the investment amount, but since this is our very first fund, we have a special debut offer.

Every investor will be given a lifetime 1% management fee. Not just for this fund but for all future funds. This 1% fee is paid quarterly based on the Assets Under Management (AUM) at the end of each quarter.

Can I speak with someone on the team?

Absolutely. Book a call with us today. Book a Call

Referral Rewards

Fees and perks vary based on the investment amount. We have several tiers — the more you invest, the more you get.

In addition, we’ve created a referral program: For every three friends you refer, we’ll bump you up one reward tier.

The first of many funds

This is truly an exciting moment for us. But I’d say there are two things that excite us the most.

The first is how unique it is. There is really nothing else like Alts 1 out there. We were the first to analyze many of these markets, and we’ve wanted to create a fund based on our expertise since we first started. It feels fantastic to bring this to you folks in our community, and to the world. 🥳

The second is that this fund is just the beginning. In the future we’ll have more funds for you, including funds with unique themes, funds laser-focused on specific asset types, and funds that are available for non-accredited investors.

Analyzing alternative investment markets & deals is what we do best. We’ve had a history of accurate market calls going back to 2020, and we’ll continue to analyze deals for years to come.

The Alts 1 Fund is single best way for us to showcase our expertise, and stand by what we believe in.

And now we can bring you along for the ride. 🚀

Quick links

- Invest in Alts 1 Now →

- Learn more about the Alts 1 Fund

- Download our Prospectus

- Book a call with a team member

- Download our Private Placement Memorandum (PPM)

- Learn more about our Referral Program

- If you’re a US citizen who’s not accredited, you can get notified when we launch a fund for everyone