November 7, 2022

Read time: ± 6 minutes

Hello and welcome to Alts Cafe

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

As expected, the Fed raised US rates by 75bps last week. The Bank of England followed suit with its biggest hike in 33 years. Likewise, UAE, Saudi Arabia, Bahrain, and Qatar.

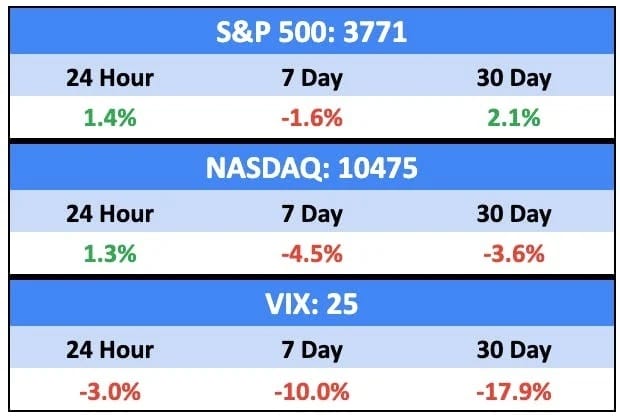

American equities slid for 4 out of 5 days last week, as tech stocks took the brunt of the punishment. Volatility is up.

The dollar hit a two-week high against the super volatile pound. Speaking of volatility, the Hong Kong index was up nearly 12%.

Bullish News

- Fed Chair Jerome Powell indicated rate hikes may slow “as soon as the next meeting or the one after that.”

- Job openings increased 437,000 to 10.7 million in September, mostly in the hospitality sector.

- Private payrolls rose 239,000 in October, better than expected, while wages increased 7.7%. This could be seen as bearish as well, if it contributes to more rate hikes.

Bearish News

- The Bank of England predicted a two-year recession with -1.9% GDP growth in 2023, and -0.1% in 2024. That will be the longest in a century.

- US manufacturing was activity the slowest in nearly 2-1/2 years

- Russia’s economy shrinks 5% year-on-year. This could be bullish if it contributes to the war ending sooner.

What are we doing?

ALTS 1 fund news:

Nothing new this week.

Crypto

Here’s what you need to know:

It was a super active week, as BTC climbed to the $22,500 resistance point.

Bullish News

- Ark’s Cathie Wood thinks Twitter will introduce a crypto wallet.

- One VC firm says ETH could hit $15k by the end of the decade.

- Zipmex, the embattled Asian cryptocurrency exchange, is in advanced talks to receive a financial lifeline from one of its investors.

- Goldman Sachs is bringing some order to crypto via an institution-friendly classification system.

- Fidelity is bringing forward a new crypto offering, featuring commission-free trades (though with a 1% spread).

- Indonesia wants to use the blockchain to increase the efficiency of carbon markets.

Bearish News

Not a great week for crypto earnings reports:

- Coinbase revenue came in at $590 million, missing the analyst estimate of $641 million. Its overall loss narrowed, with EBITDA coming in at -$116 million. Monthly transacting users fell to 8.5 million from Q2’S 9 million. Retail + institutional trade volume also declined.

- Block is at $37 million in gross bitcoin profit for the period, and $1.76 billion in bitcoin sales for Q3 (compared to Q2’s $1.79 billion).

- 97% of Uniswap tokens are ‘Rug Pulls’.

- Three crypto ETFs will be delisted in Australia.

What to do with that info:

All the bullish news above indicates the crypto markets are maturing.

Good news for holders as institutions look to get more involved.

Real Estate

Here’s what you need to know:

Markets everywhere continue to soften, both in the US and abroad. Very few sectors are safe right now.

Bullish News

- Borrowers’ demand for mortgage loans declined at a slower pace last week.

- Home sales in the midwest and southwest are doing relatively ok.

Bearish News

- While CPI rent won’t begin to decline for another 12 months, it’s already coming down in real terms.

- Reports of 70% new build cancellation rates out of Phoenix.

- Mortgage volumes at Wells Fargo are down 90% YoY, sparking concerns that the lender will need to cut more employees.

- Data center REITs are having an awful 2022

What to do with that info:

Housing (and commercial) prices will continue to fall, and there are going to be opportunities to pick up great assets at a discount early next year.

NFTs

Here’s what you need to know:

Our index is up over 15% over the last thirty days, outpacing both crypto and equities.

Last week saw the highest levels of trading volume since May 2022 due mostly to the Art Gobblers mania.

Bullish News

- The new Art Gobblers NFT project generated over $12m sales in its first day (the floor price has halved since the first day of trading, though).

- Game of Thrones NFTs are coming.

- NFTs are coming to Instagram.

Bearish News

- There’s been significant backlash against the Art Gobblers project after it was revealed that many of the best NFTs were given out to influences. Many argue the game is rigged.

- Steve Aoki’s NFT collection is down $1.2m over the last two months.

What to do with that info:

Go back in time and mint an Art Gobbler.

Startups

Here’s what you need to know:

The news is mixed, as investment activity is picking up slightly.

Firms and strategic partners are sitting on dry powder and licking their chops.

Bullish News

- While all the layoffs below are bearish for the companies themselves, the available talent pool for new startups is suddenly very deep.

- Serena Williams and Justin Timberlake are among big-name investors in Tiger Woods and Rory McIlroy’s sports venture.

- Browser company Mozilla has launched a $35m venture fund, focusing on responsible startups.

Bearish News

- VC funding of virtual reality and augmented reality is off significantly in 2022.

- Robinhood announced solid earnings overall, but the 13% drop in MAU worries us.

- Bankers expect a surge in tech M&A, as startups give up on IPOs.

- European VC dealmaking fell significantly in Q3.

- Venture funding was down big in China too.

- Layoffs everywhere:

What to do with that info:

Start (or invest in) a company helping laid-off tech workers to find new jobs.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – let us know.

Cheers,

Wyatt