Hi

Welcome to Game Trading Cards Insider for March 8th, 2022 – FREE edition.

Table of Contents

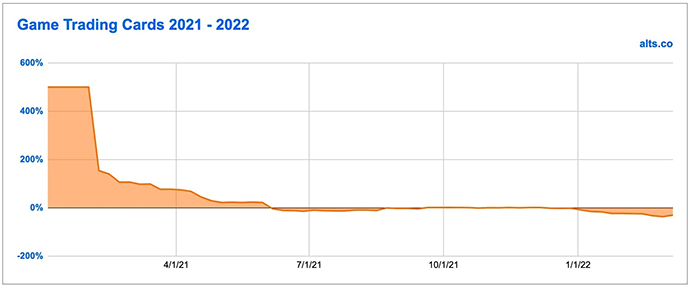

Game Trading Cards in 2022

Game trading cards on fractional marketplaces like Rally and Otis are off around 20% this year, which tracks with a downward trend among other asset classes on those platforms.

*Note the big initial bump was for a single asset that 6x immediately on the secondary market before coming back down to earth. Sorry it sort of messes up the chart.

In the broader market, though, game trading cards (mostly Pokemon) are up around 1.5% on the year so far according to CardLadder.

That basically tracks with the index over at OnlyAlt, which shows Pokemon cards up around 6% over the last three months.

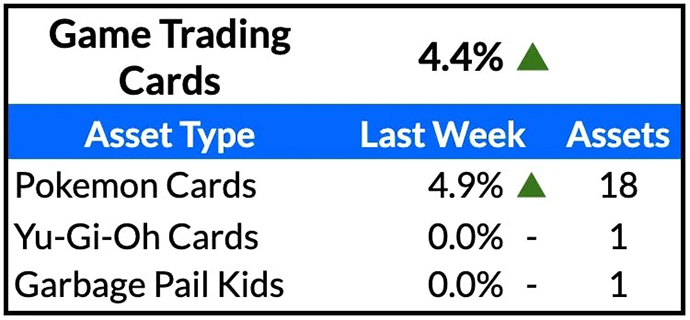

Last Week in Game Trading Cards

Fractional secondary markets

The Pokemon cards trading on the secondary markets popped last week with an overall bump of nearly 5%. This *also* tracks with other assets on the platforms indicating we may have found a bottom. Could be a good time to buy.

Auctions

Big one last week as Heritage wrapped up its signature game trading cards auction, and it delivered some tasty results.

The headline result was a $336k result for a 1999 Pokemon Holo 1st Edition Charizard, which is a big improvement over recent results. We’ve had buys on the copies on both Otis* and Rally recently, and this is a fantastic sign that Pokemon cards may be rebounding. Incidentally, the Rally copy is trading at $206k right now.

An unopened booster box from the same set sold for $288k, which is also a big improvement over results, though it’s still shy of our inferred value of $341k.

I’m super bullish on this set…but I’m less bullish (for now) on other Pokemon cards.

The 1999 1st edition holo set is undeniably the grail for Pokemon cards, and it makes sense that they’ll lead the charge back up the charts. For now, tier two blue chip sets are holding steady but not doing very much. Each of these was more or less flat:

- First edition NeoGenesis booster box

- First edition Jungle booster boxes

- First edition Fossil sealed boxes

- First edition Rocket sealed boxes

- First edition Gym Heroes sealed boxes

Though they’re still flat, most of the above are still trading at a discount on Rally if you’re looking for a bargain.

Tier one Magic the Gathering (MTG) did well too. A starter deck sealed box from 1993 sold for $168k, up from $156k in November 2021.

The chase card from that set is the Alpha Edition Black Lotus. With only 1,100 ever printed, it’s one of the most scarce (and the most powerful) cards available. A CGC 4.5 version sold for nearly $53k.

A BGS 9.0 version sold in November 2021 for $156k. That this — far inferior — grade sold for more than 1/3 the price of a BGS 9.0 indicates the market is moving swiftly up for MTG.

There are only six PSA 10s of this card out there somewhere. I suspect it could go for > $1m sometime soon should one ever come to auction.

* Disclaimer: I also own 1,000 shares of the Otis asset personally.

This Week

Assets dropping on marketplaces

One new drop this week.

’85 GARBAGE PAIL KIDS WAX BOX (SEALED)

- Market Cap: $25k

- Inferred Value: $18k

- Date: 3/8/22 on Rally

- Our View: [INSIDERS ONLY]

Auctions

We’ll find out right away if that Charizard sale from Heritage was an outlier or the start of an upswing. PWCC’s monthly premier auction features an identical version with the current bid at $100k.

The same auction features a beta version of the MTG Black Lotus graded BGS 9. An identical copy just sold at Heritage for $66k, so that’s the price to beat.

Keep an eye on Goldin’s Elite auction. They’ve got a 1999 Pokemon Game 1st Edition #2 Blastoise Holo – PSA 10 on offer. It’s the (IMO) second-most desirable card from the fabled set containing the Charizard mentioned above.

Goldin sold an identical card February 24, 2022 for $32,400, so that’s the price to beat there. Otis has a copy trading around $32k if you’re looking to pick up a few shares*.

*Disclaimer: I own a princely 12 shares there.