Let’s light all our money on fire

Being Bill Ackman, An MRI revolution, Auction Action, and What’s the ROI of the War on Woke.

Being Bill Ackman, An MRI revolution, Auction Action, and What’s the ROI of the War on Woke.

Young Americans are doing quite well (if you squint), Multifamily rental rates are falling, Startups are secretly filing for IPOs, Blackstone targets French retail investors, and More.

Capital Hill… The New Wall Street, A Brewing Crisis for American Colleges, Analyzing Stocks: How Many Factors Are Useful, Do Any Countries Actually Like Their Leaders, and More.

After a raft of holiday calamities, Boeing is at risk of becoming a meme stock only taken seriously by the Wall St Bets crew lurking on Reddit.

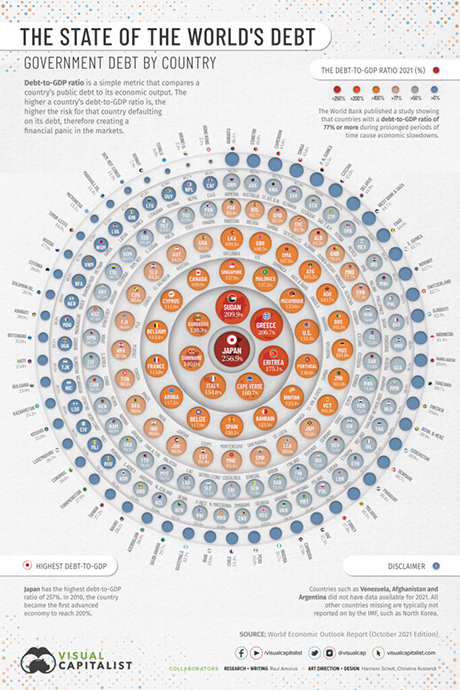

The weirdest AI thing I’ve seen, Altea, All Access and Auerbach, US Debt, and Global Debt.

Sustainable investing surge, AI startup unicorns, and record farmland sale, IMF growth outlook, Crypto settlements, Luxury goods trends, and More.

The Global Sand Mafia, Millennials and Gen Z Might Be Wealthier Than You Think, The U.S. Economy’s Resemblance to the ’90s, Major Real Estate Lawsuits & More.

How will the world look in 2034, You’re getting duped. Let’s drink to Underground Cellar, Lifting up the skirts at SVCF, and More.

Yellen is Bullish, CRE is still struggling, ElevenLabs hits unicorn status, Oil and gas returns are hurting, MetaMask launches staking, BAYC wins a legal battle, and tons more!

How These 7 Streaming Giants Print $$$, Pessimism Might Actually Harm GDP, The Next Inflation Threat, AI Job Displacement Is Overhyped, and More.

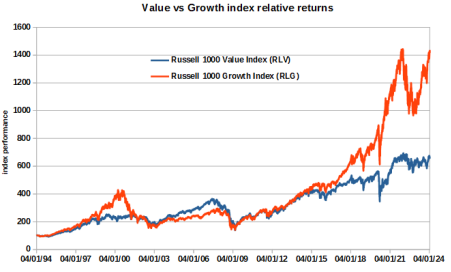

Today, we’re looking at options (get it) to hedge against a market correction in 2024.

What’s a rabbit companion, and do you need one, California Forever is a bad idea., America is super violent, Just how bad is Google, and More.

Disclaimer: The authors of Alt Assets, Inc. are not finance or tax professionals. They are self-taught accredited investors, sharing information, research, and lessons learned. The published content is unique, based on certain assumptions and market conditions at the time of publishing and is intended to serve solely as research, not financial advice. Alts I LLC (the “Fund”) is an affiliate of Alt Assets, Inc. and the Fund has conducted a private placement offering under Rule 506(c) of Regulation D of the Securities Act of 1933, as amended. The Fund may invest in one, several or all of the alternative asset classes that Alt Assets, Inc. publishes content on its site. Any published articles on Alt Assets, Inc. that an alternative asset has a “buy”, “pass”, “overvalued” or “undervalued” designation does not factor into the asset classes that the Fund through its manager ultimately invests in, and thus, any of the Fund’s investments that have positive designations on the Alt Assets, Inc.’s site are purely coincidental as the Fund is actively managed and guided by its own investment parameters as summarized in the relevant private placement memorandum.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |