Read time: 5 min

September 23, 2022

New here? Read our primer on farmland investing.

We analyze deals across FarmTogether, AcreTrader, FarmFolio, and other platforms.

Today, we’re looking at a new offering from AcreTrader – the Vineland Farm in Polk County, MN

Let’s go!

Table of Contents

Offering at a glance

- Name: Vineland Farm

- Platform: AcreTrader

- Available: 23 September 2022, 1pm CT

- Location: Polk County, MN

- Crop type: Soybeans, Sugar Beets, Wheat

- Gross cash yield: 3.6%

- Farm price: $963,200

- Total acres: 160

- Price per acre: $6,020

- Min. investment: $10,836

- Average net cash yield (after operating exp.): 2.2%

About the farm

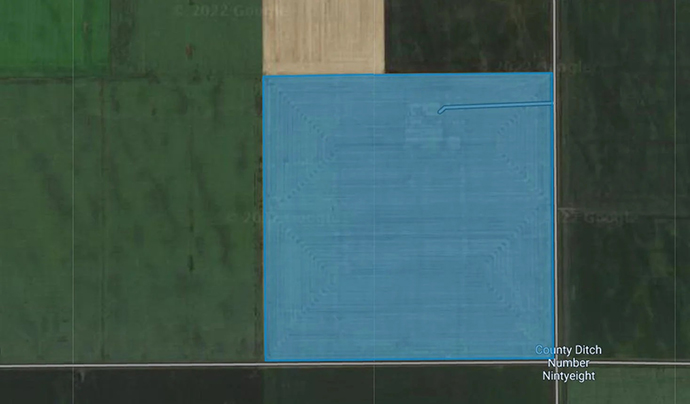

Vineland Farm is a 160-acre soybean, wheat, and sugar beet farm in Polk County, Minnesota. The farm sits in the heart of the Red River Valley near the border of Minnesota and North Dakota.

This is a smaller offering, both in total dollar amount and acres, than some of AcreTrader’s recent offerings in the US South.

The Red River Valley has unique soils. As it used to be covered, as the name implies, by a glacial river, this made the region’s soils deep and nutrient-rich. This allows for wider crop diversity than other nearby Minnesota farmland.

The region typically produces soybeans, wheat, and corn. In addition to soybeans and wheat, the clay loam soils at the Vineland Farm allow for the production of sugar beets and beans. Sugar beets are a premium crop. Farms that can produce sugar beets typically command rental premiums.

$30,000 of the offering proceeds will be used to make capital improvements to the property. The improvements will be focused on the drainage system. The rich, heavy soils of the Red River Valley hold water effectively, but excess water retention (standing water in times of heavy rain) can damage the crops. This necessitates well-maintained drainage systems using drainage tiles.

Similar to most AcreTrader offerings, an investment does not give direct exposure to the underlying crops on the farm. Returns are driven by tenant farmer rent payments and capital appreciation of the land. The strength of the farm’s crop markets and the farming experience of the operator have an impact on the expected returns.

The current tenant farmer will continue to operate the farm on a 3-year term. This should help reduce any disruptions that could occur with operations turnover.

The Red River Valley is an up-and-coming area for soybean processing, one of the Vineland Farm’s outputs. There are numerous soybean crushing plants, including a new one in a nearby town. Strong local processing infrastructure like this helps farmers command higher prices for soybeans, as it reduces the time and cost of shipping soybeans to distant facilities.

Our view

What we like

- Crops – Soybeans and wheat are two staple crops with large markets and constant demand; sugar beets are a premium crop that may allow for a flex lease component in future years (additional rental upside).

- Land Appreciation – The projected annual land appreciation of 5.9% appears reasonable when compared to the 20-year historical return of 7.2% for Minnesota farmland (irrigated and non-irrigated).

- $30,000 improvement budget (improve drainage); planned drainage improvement, which (if successful) will increase future resale value of property and improve crop yields.

- Soil – Rich fertile soil that allows for diversity of crops and high yields.

- Local infrastructure – The nearby soybean processing facilities help increase the local price basis for soybeans. The region also has processing facilities for sugar beets and wheat.

- Stable operations – The current farmer will continue to operate the farm with a lease already in place for 2023.

- Lower minimum investment – The $10,836 minimum investment is lower than recent AcreTrader offerings, making this a good first-time farmland investment.

The potential risks

- There’s potential for time and cost overruns for planned capital improvements; capital improvements may not be successful in cost-effectively improving drainage on the farm.

- Non-irrigated. From the information provided by AcreTrader on their website, the farm does not appear to be irrigated. This risk is partially mitigated by the rich soils that retain rainfall and the need for drainage to drain away too much water.

That’s all for today.

Thanks,

Brian