Hello and welcome to Alts Cafe

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

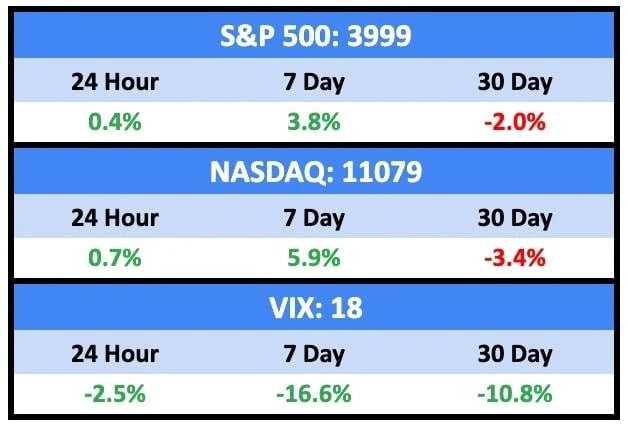

It was a good second week in the markets, with a positive CPI print Thursday.

Bullish News

- Oil was up 8% last week; gold was up 2%; and aluminium is up 12.6% so far in 2023.

- US inflation fell to 6.5% for December, the lowest since late 2021.

Bearish News

- The Manheim Used Vehicle Value Index was down 14.9% from a year ago. This was the largest annualized decline in the series’ history.

- The Swiss National Bank posted an annual loss of 132 billion Swiss francs ($143b) in 2022, its biggest in 115 years.

- The FAO’s food price index hit a record high of 143.7 points in 2022, up 14.3% from 2021.

- Global equity funds saw net outflows for a ninth straight week, while US equity funds saw their seventh week of outflows in a row.

- Argentina’s inflation rate for 2022 was 94.8%, the highest since the 1980s.

- US consumer debt continues to be an underreported sinkhole threatening to swallow everything it touches.

What are we doing?

ALTS 1 fund news:

Our quarterly report is out for Q4.

Check your inboxes.

Real Estate

Here’s what you need to know:

Real estate values are slowly (sometimes quickly) melting down.

If you’re sitting on an asset, hoping to sell later this year when prices rebound, you may find yourself disappointed.

Bullish News

- Chinese property companies raised a total of 101.8b yuan ($14.9b) in December, up 33.4% year on year, driven by more state support for the highly indebted sector.

- Off the back of this state support, China’s property sector is expected to see home sales fall 8% in 2023, a slower rate than in 2022.

- The value of Canadian building permits rose by a 14.1% in November from October.

Bearish News

- Pending US home sales dropped 32% YoY to their lowest level since at least 2015. Las Vegas, Phoenix, and Austin each saw declines greater than 50%.

- Housing inventory is up 55% YoY.

How to invest in real estate right now:

Sit on your hands or chase yield.

Crypto & NFTs

Here’s what you need to know:

[Note: We’ve decided to combine the Crypto and NFT sections.]

From the Morning Hark:

The move was a classic crypto one with the main move up coming with a big Asian green candle at the start of the weekend. Reports suggest the move was due, in the main, to purchases of around $4bn worth of bitcoin futures.

Speaking of FTX, this thread from the former FTX US president is fascinating:

With last week’s pump, we saw the Fear & Greed index follow (a lagging indicator this time).

This is the highest it’s been in a long time.

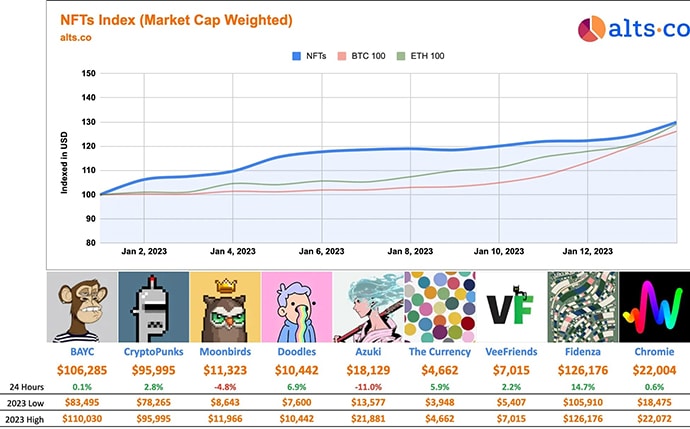

NFTs followed, with our Blue Chip index up over 30% for the year already:

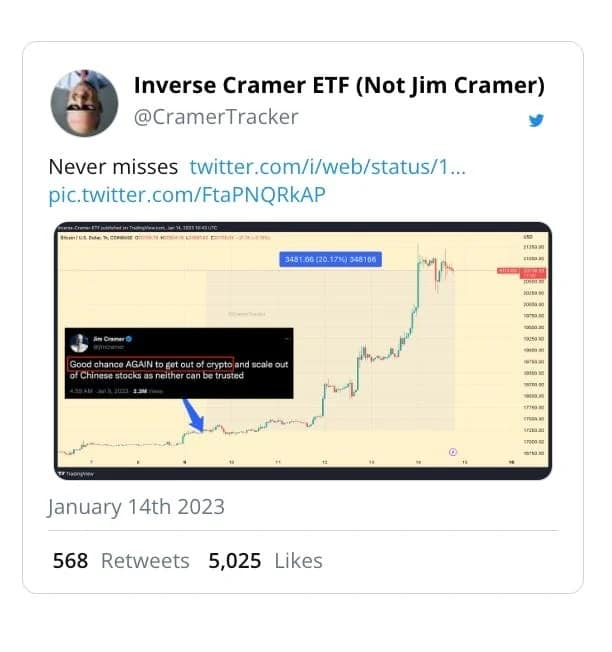

If you’re not already subscribed to our new Inverse Cramer newsletter, you should be.

Bullish News

- Bitcoin’s reserve risk is at its lowest point ever.

- Binance is planning to increase staffing by 15%-30% in 2023, while Coinbase and Crypto.com have already cut 1,600 jobs.

Bearish News

- Crypto lender Nexo is being investigated by authorities in Bulgaria on suspicion of money laundering, tax offenses, banking without a license, and computer fraud.

- The SEC accused Gemini and Genesis of selling unregistered securities.

- Coinbase is cutting 20% of its workforce, roughly 950 employees, as part of a restructuring plan. This is the exchange’s third round of layoff.

- Illicit use of cryptocurrencies hit a record $20.1b last year.

- Genesis owes creditors more than $3 bln.

How to invest in Crypto & NFTs right now:

Over the last couple weeks, I’ve been saying that it’s a good idea to begin accumulating crypto.

I think that still holds.

Startups

Here’s what you need to know:

Monique Woodward launched a fascinating venture fund called Cake Ventures. Cake invests exclusively in startups taking advantage of global demographic change. Companies skating to where the puck is going, rather than where it is now. Some of the shifts they’re looking at:

- Aging and longevity: By 2034, Americans over 65 will outnumber those under 18.

- The billion-dollar female economy: Women are the original influencers and they’ve become the consumers that drive growth. We also wrote about Women in investing not too long ago.

- The shift to majority-minority: The rising New Majority are early technology adopters who drive internet culture.

The fund has already invested in a dozen companies, including fractional sneaker platform Rares, but my favorite is Guaranteed. It’s a company focussing on compassionate tech solutions to end-of-life (hospice) care. Hospice care is underfunded and underappreciated, and I’ll be cheering for them.

Beyond the insight that investing in changing demographics is sensible and probably profitable, Monique also highlights under-appreciated stats every venture investor should know:

Cambridge Associates found that new and developing firms are consistently among the top 10 performers in the venture capital asset class, accounting for 72% of the top returning firms between 2004–2016.

Greenspring Associates found that across 180 partnerships, their investments in emerging managers “outperformed relative to their established counterparts”, delivering net IRR 0.87% above established managers.

Investing in emerging funds, many of which are led by diverse fund managers, also unlocks additional alpha as diverse fund managers outperformed the median performer in 11 of the 14 years studied.

Bullish News

Bearish News

- Startups raised $238.3b last year, 31% lower than the record of $344.7b in 2021.

- British IPOs fell 90% in 2022 to 1.6b GBP.

- Even Chamath is feeling the pain, significantly scaling back his new fund.

- Stripe cut its internal valuation by 11% (to $63b).

How to invest in startups right now:

Have a look at an emerging manager.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – let us know.

Cheers,

Wyatt