Read time: 6 min

October 25, 2022

New here? Read up on our past Real Estate issues to get the most from this post.

ISSUE HIGHLIGHTS:

- A look at the state of commercial office space

- The current markets in Cincinnati and Nashville

- A couple of new opportunities to consider

Let’s go!

Table of Contents

Real Estate in 2022

We’ve already spent a lot of time talking about the US residential real estate market, so there isn’t much more to say about that.

Instead, let’s talk about a sector that’s doing worse than residential real estate — commercial office space.

In 2019, Juul paid $397m for its office space in San Francisco, over $1000 per square foot. Today, they’re trying to unload it for a fraction of that — $174m. That’s a 56% loss in three years. 😬

Why the decline?

Office vacancy rates in San Francisco have gone up 6x from pre-pandemic levels, and are now at 26%.

San Francisco went from 5% office vacancy to… 23%.

— [email protected] (@Jason) October 14, 2022

it's getting worse and worse… and it's not going to get better folks.

Start the process of converting these offices into residential folks. Remote work is here to stay for tech. pic.twitter.com/hLjEEzhB5l

So, what happens when you’ve got sky-high vacancy rates, coupled with rising interest rates?

The people who've been telling you "office will be fine" for the last 2.5 years are either lying or don't know their business. https://t.co/QZHCLwYTqY

— John Belitsky (🏢,🏢) (@JohnBelitsky) October 17, 2022

Bankruptcy happens.

Surely San Francisco is an isolated case, though, right? Well, the national stats are better, but not by much:

- Rents are down over 2% year on year

- Vacancy rates are up 180BPS year-on-year at 16.6%

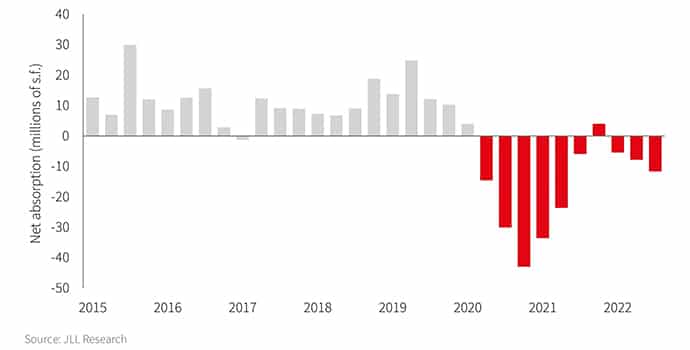

Net absorption, which is the sum of square feet that became physically occupied, minus the sum of square feet that became physically vacant, remains negative nationwide.

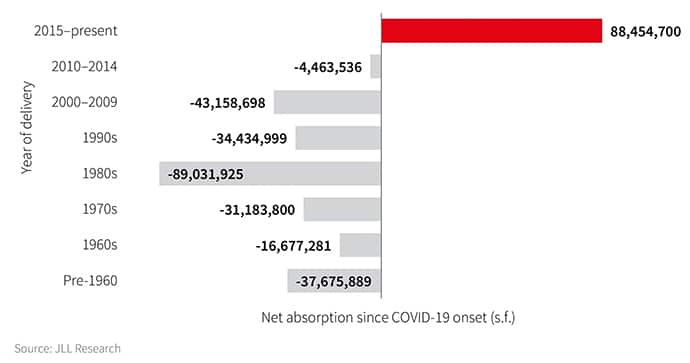

Net absorption (and thus, vacancies) are skewed by building age.

Vacancy rates by geography don’t seem to follow any sort of pattern I can identify.

The highest are:

- Houston

- Atlanta

- Chicago

- Brooklyn

- San Francisco

- Denver

- Nashville

- Dallas

- New Jersey

- Austin

And the lowest office vacancy rates:

- Boston

- Miami

- Charlotte

- Twin Cities

If your’e looking to make moves here, new build offices in Boston, Miami, Charlotte, and the Twin Cities are where it’s at. As for everything else…

Opportunities this week

This time, we’re digging into the Nashville and Cincinnati markets, and analyzing some properties from Arrived.com:

Last two years’ performance

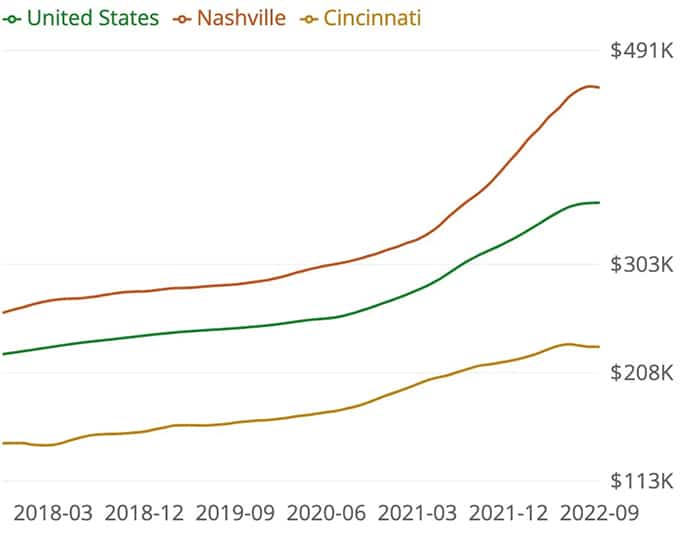

While both Nashville and Cincinnati have seen an increase in property values over the last two years, Nashville enjoyed a gaudier run-up:

- Nashville: 49%

- Cincinnati: 17%

- US Average: 36%

Current markets in Cincinnati and Nashville

Since its peak in June 2022, Cincy has seen an 8% drop in median sale price, and the median sale price is only around 5% higher than it was twelve months ago. Both sales volume (14%) and active listings (18%) are down significantly year over year.

Nashville hasn’t seen a correction yet, with median prices only off 2% from the peak a few months ago.

Volume (14%) and listings (6%) are both off, but listings are still relatively more robust.

Both metros have similar unemployment rates, though Nashville has the edge at 2.8% vs Cincinnati’s 3.8%. The national average is around 3.5%.

Nashville is adding around 1,500 new residents per year, while Cincinnati is seeing slight outflows.

Given the inflows and superior unemployment rate, it’s easy to see why the median home in Nashville appreciated more than their counterparts in Cincinnati. But was it enough to justify the delta between the two?

Probably not, and given Cincinnati has already come back to earth a bit, that’s the metro I’d bet on going forward.

The properties

The Marcelo

- List price – $338,093

- Zillow estimate – $269,000 – $298,000

- Monthly Rent – $1,595 (Zillow estimates $1,895)

- Dividend Yield – 3.2%

The Braxton

- List price – $380,134

- Zillow estimate – $330,000 – $368,000

- Monthly Rent – $1,820 (Zillow estimates $2,265)

- Dividend Yield – 3.6%

The Braxton looks like the safer bet here, given the tricky market.

It’s not going to double your wealth overnight, but there’s a significant opportunity to increase rent over the next few years, and it is the safest bet in a murky situation.

That’s all for this week.

Have you seen a real estate deal, fund, or opportunity you’d like to share with the community?

Cheers,

Wyatt