Welcome to Inverse Cramer by Alts.co.

New here?

- See fund performance and holdings (SJIM and LJIM)

- Read past issues

- Sign up for the Inverse Cramer newsletter

Is there anything more awkward the an Cramer helling over callers when they call in?

“Hey Booyah Jim this is Tom from Philly, hope you’re doing w- I’M DOING GREAT TOM HOW ABOUT THOSE EAGLES?!”

::awkward silence ensues::

..Luckily, we watch Mad Money so you don’t have to.

Let’s go

Table of Contents

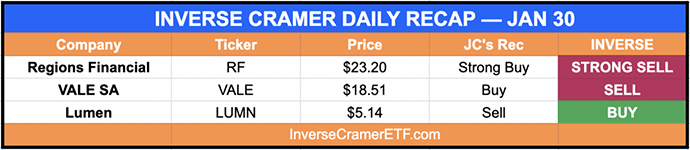

Monday Jan 30

JC kicked off the day by declaring the FAANG acronym dead.

He’s right about the acronym – it’s outdated as hell.

But boy is Meta doing his head in.

Meta is now up a remarkable 85% since Jim gave up on it. Insane. pic.twitter.com/eH1Fh5iITq

— Inverse Cramer ETF (Not Jim Cramer) (@CramerTracker) February 1, 2023

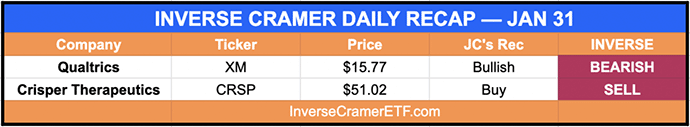

Tuesday Jan 31

BOOYAH! pic.twitter.com/IABo8MOdvU

— Inverse Cramer ETF (Not Jim Cramer) (@CramerTracker) January 30, 2023

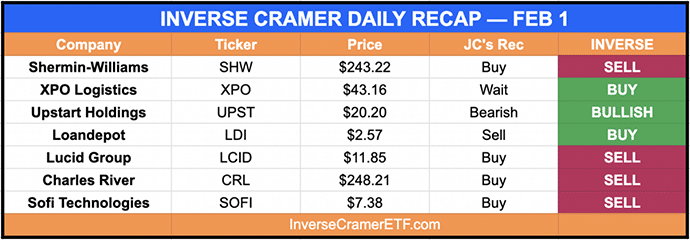

Wednesday Feb 1

Some drama as Jim got called out by Dave in Illinois over Upstart Holdings.

Apparently Cramer called the stock “uninvestable due to questionable business strategy and capital allocation choices.” Recently however the stock has been storing, up 50% on the year. Cramer doubled-down and called Upstart “a coiled spring.”

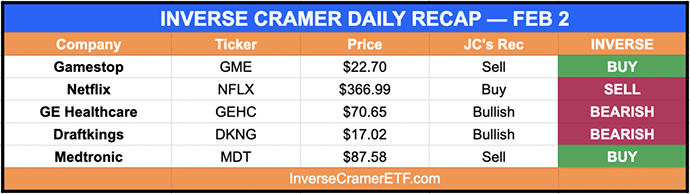

Thursday Feb 2

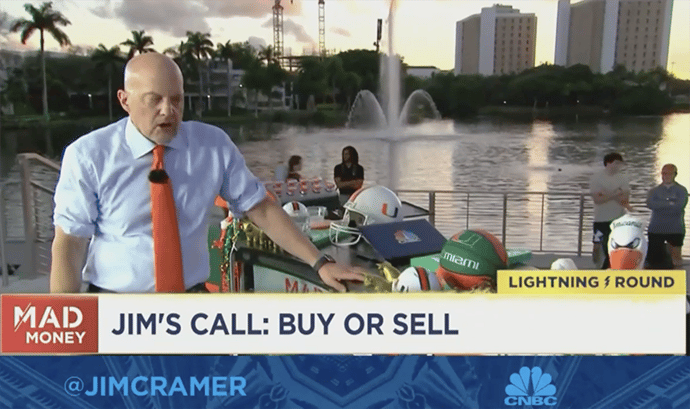

JC did a special live “Back to School” edition with students The University of Miami. So naturally the first question was about Gamestop.

Don’t know if it was the questions or the heat, but boy was JC sweating like a pig 🐷

Friday Feb 3

They’re just not making enough money. They need a merger.

– Cramer on Zoom

Jim’s timing is impeccable pic.twitter.com/0O9oTDoLEJ

— Inverse Cramer ETF (Not Jim Cramer) (@CramerTracker) February 3, 2023

Weekend Bonus

1. Defraud $27.4m from investors

— Inverse Cramer ETF (Not Jim Cramer) (@CramerTracker) January 29, 2023

2. Charge $1800/hr for consulting pic.twitter.com/NCCTyz2Zdg

Grifters gonna grift. But you gotta admire the hustle!*

*Note: You do not actually have to admire the hustle

My .0186 cents (inflation)

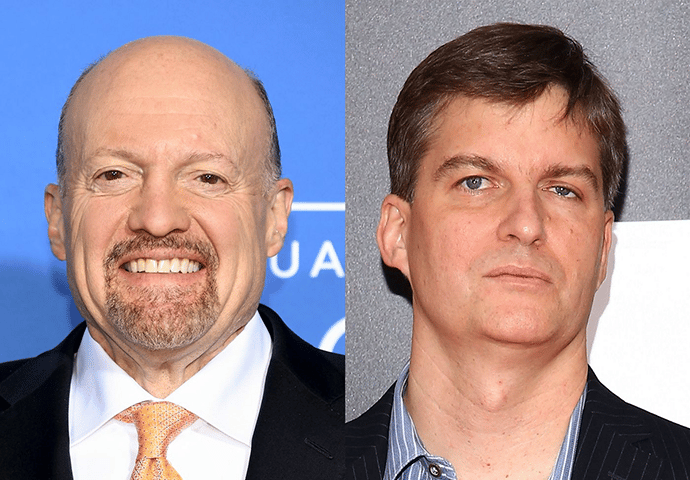

The big news this week was when Michael Burry, the hedge-fund manager at Scion Asset Management who correctly forecast the 2008 financial crisis, sent out a one-word tweet: “Sell.”

Burry didn’t elaborate, but it’s not hard to fill in the blanks.

The problem is, this is the exact opposite advice from JC, who on that very same day (just 26 minutes later!) announced the bull market is ON.

My oh my, what ever shall we do?

Hear me out for a minute: Could it be possible neither Burry nor Cramer are correct? That they’re both validation-hungry demagogues looking for a score?

I happen to like Michael Burry. His position on investing in water rights has been misconstrued, and aside this week’s ominous warning, rather than an annoying loudmouth, he’s remained a somewhat quiet brainiac since 2008.

Don’t get me wrong: If a guy who successfully predicted & profited from the ’08 crash speaks, I’ll listen.

But the key is, as always, to think critically.

Don’t follow anyone blindly – not Cramer, not Burry, and certainly not us.

— Inverse Cramer ETF (Not Jim Cramer) (@CramerTracker) February 1, 2023

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy your week.

-IC