New here? Read up on our past Crypto issues to get the most from this post.

May 26th, 2022 | ± 5 minutes

CONTENTS:

This issue will be a different one. If, like me, you’re huge on crypto, but sceptic on NFTs, you might want to hear about my journey from doubter to believer (or at least someone who can see the value of them as an investible asset). And if you’re already into NFTs, I’m be preaching to the choir, but it might be interesting to see if any of this journey resonates with you.

Let’s go!

Table of Contents

NFTs are Dumb Cool…

I’ve written about my experience of going to in-person NFT events, but I haven’t written about NFTs or my views on them in depth.

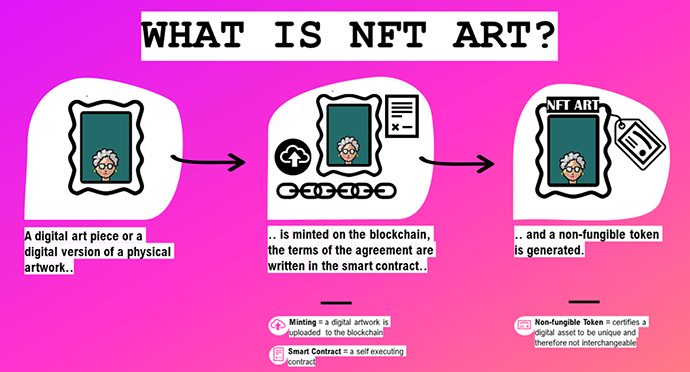

I’m not going into the raw basics of what NFTs are. You can read this article if you need to catch up. Instead, I’ll explain what I’ve grown to believe is actually great about them (the good ones).

And although I’m going pretty hard into NFTs now, this wasn’t always the case. I thought they were pretty stupid at first… However, as you’ve probably inferred, my stance has changed since.

I first heard of NFTs with the rise of Bored Ape Yacht Club (BAYC) around July of 2021, and quite frankly, I thought it was ridiculous that people were paying five figures for jpegs.

But had I been more open-minded, I certainly could have some more valuable assets since the floor price of a BAYC now is 91 $ETH. Even with $ETH being at a local low of ~$2,000, that’s still roughly $182,000.

… and here’s why:

1. Utility

While I still might not be 100% convinced NFTs are the future, I now see the value in quality projects, especially those that provide utility or real-world use cases.

Some examples of NFT utility that owners may get include anything from getting branded apparel to revenue share of the company behind the NFT.

Utilities like that come with varying levels, depending on who you are, what’s your investment (and a few other variables):

If you’re paying $100,000 for an NFT, then a branded hoodie isn’t exactly the most exciting real-world benefit that you could get, right? But if you pay $100 for an NFT and get a hoodie, then that isn’t so bad.

Now back to the $100,000 NFT – what if you got revenue share from the company behind the NFT at $1,500/month? At an 18% annual ROI, that’s not bad at all + the value of the NFT itself could increase.

However, not all NFTs provide utility – it depends on the goal of the NFT and the company or people behind it. Below, I’ve listed some examples of why NFTs might get created.

2. Fundraising

Traditionally, if a founder is looking to raise money from investors, the founder usually has to pitch to angel investors or venture capitalists. It’s an arduous process, and, on the individual level, in most cases, only accredited investors can help provide funds.

However, NFTs have made investing and supporting entrepreneurs more accessible. NFT founders can develop communities and build audiences, and rather than going the traditional route, they can raise funds through their community.

Funds can be raised through NFTs. Let’s say there are 10,000 NFTs available from the company. If the company “mints” or sells each NFT with a moderate price of .05 $ETH, then a company can raise 500 $ETH if all 10,000 NFTs sell. Even at the current price of $ETH, that’s still $1,000,000.

Additionally, the company can raise funds when their NFTs are sold on secondarily platforms like OpenSea and LooksRare through royalties.

When the company’s NFT is sold, they control what royalties they get in the form of the percentage of the sale price. So, if an NFT is sold on OpenSea for 10 $ETH and their royalty is set to 5%, they would get .5 $ETH.

Owners of NFTs of these kinds of projects are essentially investors, and the team behind the projects chooses how to reward their ‘investors.’

Common rewards include:

- Apparel

- Revenue share

- Opportunity to get additional NFTs in the form of airdrops or allowlists/whitelists

3. Artist collections

One great thing about NFTs is that making NFTs is a way for traditional artists (mostly visual artists) to create art and make a living. Many argue this was the original intent of NFTs.

Artists can take the same approach as a company by creating a collection of NFTs and setting a mint price. Selling art through a mint allows artists to get rewarded quickly for their work on a collection, and they can also get passive income in the form of royalties.

Royalties are a novel concept in visual art and have been a topic of debate for years. Historically, artists do not get royalties for their paintings, sculptures, etc. I’m sure Da Vinci’s heirs wouldn’t mind getting royalties for every Mona Lisa sale. However, with NFTs, this is changing and allowing artists to live off their art more easily.

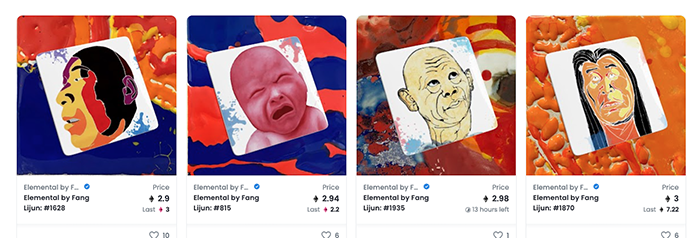

One example of a collection is Elemental by renowned artist Fang Lijun, with royalties set to 7.5%. In 4 months, there have been about 3,800 $ETH in sales, which means ~285 $ETH (~$570,000) has been generated from royalties.

In this case, collections from artists aren’t selling utility or real-world value apart from owners owning a piece of art to collect.

That said, common rewards still include airdrops or allowlists/whitelists to future collections, and apparel.

4. Metaverse

I’m not going to dive deep into the definition of what the metaverse is as I’m sure most of you are already familiar with it, but essentially, it’s virtual reality.

There are different metaverses for different purposes, and I argue that video games like World of Warcraft and The Sims have had their own metaverses.

Many people and companies are excited by the metaverse. I’m less bullish on it overall, but I do get the appeal.

A company that leverages NFTs to build a Metaverse is actually not too different from a company just looking to raise funds.

And while building a solid community is important for every successful project, it’s absolutely essential for metaverse-focused projects.

The best example of a project building the metaverse is a BAYC.

Now, they weren’t always trying to build the metaverse. Apparently, the NFT collection was created by four friends who “set out to make some dope apes, test [their] skills and try to build something (ridiculous).

However, the company behind BAYC (and other NFT collections), Yuga Labs, has certainly pivoted to creating their metaverse. They’ve laid the groundwork for their metaverse with several collections, in order of release:

In this case, BAYC owners received the other 3 NFT releases for free and received $APE coin.

Wrapping Up

I’ve come a long way from when I first heard about NFTs.

I was never a big believer in the digital art aspect or owning an NFT to use as a profile picture. However, as the NFT world has progressed from simply art to being able to provide tangible, real-world benefits, I’ve certainly changed my stance on what NFTs could be.

NFTs as a concept are still in their infancy, and new utilities and problems are being addressed daily, but thanks to dedicated communities and passionate creators, the future is starting to look pretty promising.

See what Colin is working on and follow him on Twitter at @seo_colinlma

That’s it for this week’s Crypto Insider. Did you find it useful?

If you have any questions or would like to discuss anything about this issue (or about crypto/NFTs in general), feel free to respond to an email. We read everything, as always.

Thanks,

Colin