Hi!

And welcome to our Crypto Insider for February 11th, 2022 – FREE edition. By popular demand, we’re bringing you the smartest insight, analysis, and investing tips for all things Crypto.

Today’s is a special issue. Having gone pretty deep on a few coins (check out those issues here), today’s content is intended to be a pragmatic guide for those who want to invest, but don’t know where to start.

I’ve even included two example investment plans, one safe and one more aggressive, and I’ll go into the merits (and risks) of both approaches.

This is a more in-depth version of something I prepared for friends and family a few months ago, and everyone raved about it. So while this particular issue might be pitched too low for your knowledge/interest level, if you do agree it’s a useful resource for someone who’s just getting up to speed with this space, please consider forwarding it on.

Table of Contents

Podcast

If you’re interested in crypto, you’ll enjoy this recent episode of the Alts.co podcast. Last week, Horacio sat down with Jacob Beckley, founder of CURE Token and the Beckley Foundation, a non-profit childhood cancer research center.

Jacob created CURE Token, a cryptocurrency, in the middle of the COVID-19 pandemic amid a steep decline in charitable donations. Hear about his novel approach to fundraising, and get his take on other charitable projects that turned out to be scams. Really interesting (and inspirational) stuff.

Introduction

Many people who are interested in cryptocurrency feel it’s too late to get started.

While it might be too late for most crypto investors to 100x their investment, I still believe that even safer crypto investments will yield much higher returns than typical returns on the stock market.

A quick note on my bias here: I have been investing in cryptocurrency since 2016. I’m not an expert. I’m not a financial advisor. I am LONG crypto, so I don’t day trade, and I only invest in projects that I believe are good for the long term. Investments I make have varying levels of risk. So don’t follow any of my suggestions here blindly; please research before you invest.

But here’s my take on it – the crypto market has followed the stock market and fallen pretty hard in 2022, making it a solid opportunity to buy. I intend on making purchases, dollar coast averaging (DCA’ing) into buys I am long in. I don’t try to time the bottom of the market, nor do I expect to.

Even though the cryptocurrency market has gone up the past few days, I believe this is a great time to buy. We’re still about 25% down from all-time high, even with the recent bump.

Where do I like to buy?

You need access to a centralized exchange (CEX) to buy cryptocurrency. CEXs have to perform some know your customer (KYC) process for tax and legal purposes.

There are many CEXs, and their availability depends on your country. Most, if not all, take a fee based on the amount of each transaction.

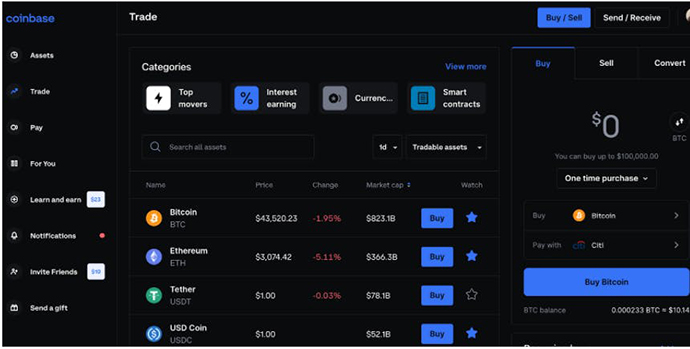

One of my favorites is Coinbase. It’s user-friendly and reliable:

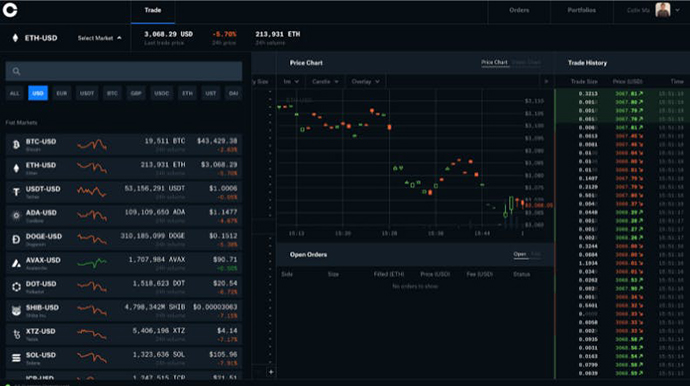

I’d also recommend Coinbase Pro. The UI & UX isn’t as good, but it has lower trading fees:

There are plenty of other CEXs out there, and here are some others you might want to check out:

- Crypto.com

- Kucoin (not available to those in the US)

- Celsius

- Binance (non-US)

Boring but necessary reminder: ALL exchanges, centralized or not, carry risk. Exchanges can be hacked. That said, I’ve personally held funds in Coinbase for over six years without any issues.

As someone from the US, my very favorite CEX is Coinbase Pro. It takes about 15 minutes to sign up, and once you do, it might take 3-5 days for Coinbase to process your account to make sure everything is good and legit. That said, they’re all fine to use as long as they work with your country.

Once you’re approved to start trading, you can pay in a couple of ways.

Some other tips:

- We recommend not buying through credit cards because there are significant fees

- Instead, you should connect your bank account and ACH your funds into your Coinbase account (no fees)

- Although it takes a few days to ACH, you can start trading immediately on Coinbase. You just can’t move your cryptocurrency off the platform until Coinbase receives your funds.

Note: Coinbase & Coinbase Pro sometimes have issues if you have 2FA set up with your bank account

Thoughts on NFTs

I am unwilling to spend much time on NFTs, so I don’t buy much. I usually hold anywhere between 5%-10% of my portfolio in NFTs.

However, I would not mess with NFTs if I am just starting my crypto journey – it takes so much research to understand the NFT market, and the NFT market often moves even faster than the cryptocurrency market.

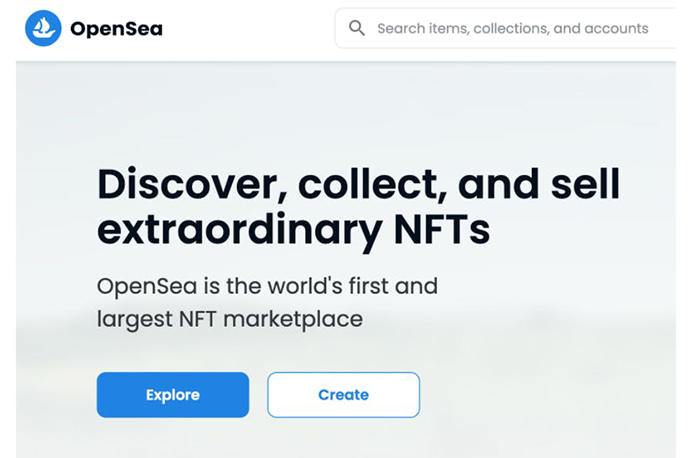

The most popular NFTs are on Ethereum, and the biggest marketplace is OpenSea, which only has Ethereum NFTs but will soon start selling Solana NFTs in addition to Ethereum NFTs.

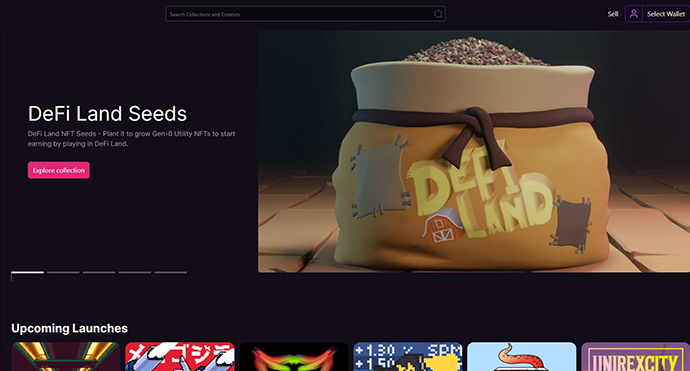

Solana is another network similar to Ethereum. Solana NFTs are not quite as popular as Ethereum NFT’s, but the average price is lower, making it easier to get into. The current leading NFT marketplace on Solana is Magic Eden.

Coinbase will also be launching an NFT platform, but there’s no official launch date yet. There’s a theory that when Coinbase’s NFT platform does go live, the price of NFTs will moon… But that may be priced into NFTs already.

Although we don’t recommend beginners buying NFTs, we wrote a piece with some tips for buying NFTs that breaks down how you can begin purchasing them.

What I Would Buy If I were just starting

We decided to make two example cryptocurrency plans that are quite beginner-friendly. None of this is financial advice, of course, they are just designed to be illustrative of how to get started with a portfolio.

With both plans, you can buy all of the mentioned cryptocurrencies on Coinbase.

Note: Unlike stocks, cryptocurrency can be fractionally owned. For example, you don’t need to buy one entire $BTC at a time. You can buy $100 of $BTC if you want and own a fraction of a $BTC.

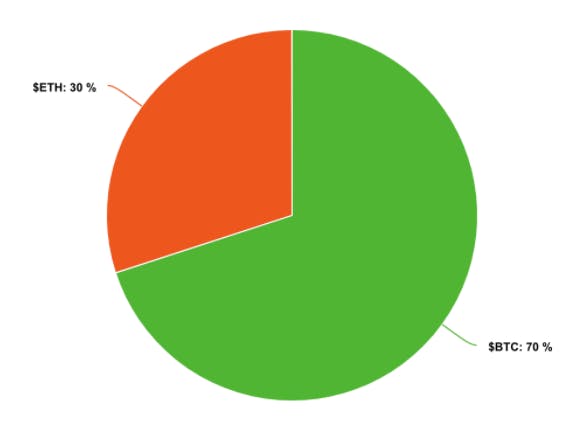

Option #1 – $BTC, $ETH

This plan is just about the safest and most simple cryptocurrency portfolio you could have. It gives you exposure to the two largest cryptocurrencies, both of which are the closest you can get to blue-chip cryptocurrencies.

1. $BTC – Bitcoin – 70%

You know what it is. Probably the safest cryptocurrency to buy as it is the most established. Most beginner-friendly cryptocurrency. Down more than 35% from its all-time high from 2 months ago.

2. $ETH – Ethereum – 30%

$ETH is the #2 cryptocurrency, only behind $BTC. However, $BTC is relatively useless compared to $ETH. $ETH was the first crypto that let you do cool stuff. If you’ve heard of “decentralization”, “decentralized finance (de-fi), “decentralized apps (DApps)”, $ETH is what more or less started this. Down almost 40% from its all-time high.

Example Plan

This plan assumes you have a small amount of money you’re willing to invest into cryptocurrency now (the $300 as seen below), and are willing to invest monthly (the $100/month below).

While the crypto markets can dip down, we believe all of the mentioned coins are good long-term buys. We also believe in time in the market instead of timing the market, which is why both plans involve DCA’ing.

Available cash: $300 initial + $100/month

Plan:

- Invest $150 now (from $300 initial)

- Invest remaining $150 of the initial $300 maybe in 1-2 weeks

- Monthly: $100/month -$70 BTC, $30 ETH

BOOM. That’s it. This plan gives you exposure to cryptocurrency and is as safe as you can be with cryptocurrency investment.

Adjust the numbers as you see fit based on your situation.

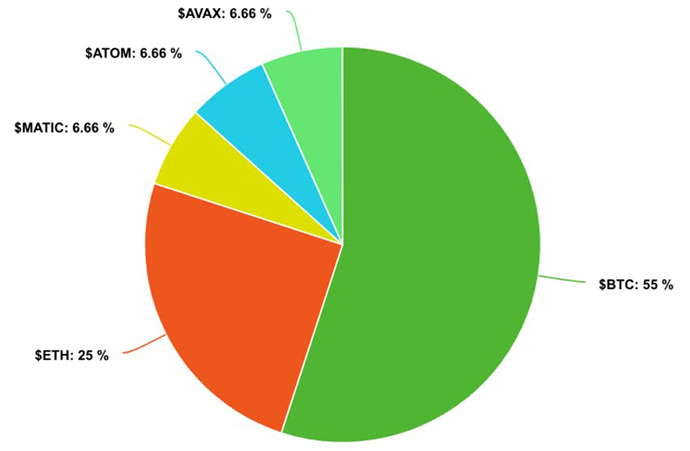

Option #2 – $BTC, $ETH, $MATIC, $ATOM, $AVAX

This plan is a little more aggressive. While there’s a little more risk, we feel that this holds a fair amount of more upside, with $MATIC (Polygon), $ATOM (Cosmos), and $AVAX (Avalanche) having plenty of room to grow while providing real utility.

You know how bullish I am on different chains if you’ve been following this newsletter. $MATIC, which I previously wrote about, $ATOM, and $AVAX are all great chains and serve as great alternatives to Ethereum.

Again, all of the below can be purchased on Coinbase.

1. $BTC – Bitcoin – 55%

For similar reasons to our previous portfolio, you should have some exposure to $BTC. $BTC is our largest hold because it is the safest cryptocurrency to hold, in our opinion.

2. $ETH – Ethereum – 25%

Same reasoning as above.

3. $MATIC – Polygon – 7%, $ATOM – Cosmos – 7%, $AVAX – Avalanche -7%

We’re grouping this all together because the thought process is very similar for all of these projects. They provide real utility and are well-positioned for additional growth, mainly because they’re being developed to improve on ETH or BTC (for example, faster transaction times and/or lower gas fees).

Example Plan

As before, this plan assumes you have a small amount of money you’re willing to invest into cryptocurrency now (the $300 as seen below) and are willing to invest monthly (the $100/month below).

Available cash: $300 initial + $100/month

Plan:

- Invest $150 now (from $300 initial)

- Invest remaining $150 of the initial $300 maybe in a 1-2 weeks

- Monthly: $100/month -$55 into $BTC, $25 into $ETH, $6.66 into $MATIC, $6.66 into $ATOM, and $6.66 into $AVAX

This plan isn’t as simple as the first option, but it’s still relatively straightforward with all of these tokens available on Coinbase. It just takes a bit of time and discipline to follow the structure.

Disclosure: This is not financial advice. This article is for entertainment purposes ONLY. I am also a holder of all projects mentioned.

I’d love to hear your thoughts on this issue. Was it helpful? Are there other coins or investing strategies you’d like to see covered? If this is too basic for you, is it useful as a resource to help out friends/family getting interested in this space?

And don’t forget the Discord invite is always open – with more and more folks joining each day, it’s a great place to ask questions and get answers, whatever your knowledge level.

P.S. Editor’s note – if, like me, you’ve been equally horrified and entertained by the Bitfinex scandal, here’s an amazing Twitter thread of the best memes courtesy of The Milk Road.