September 20, 2022

Read time: ± 6 minutes

Hello and welcome to Alts Cafe! This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

The Big Picture

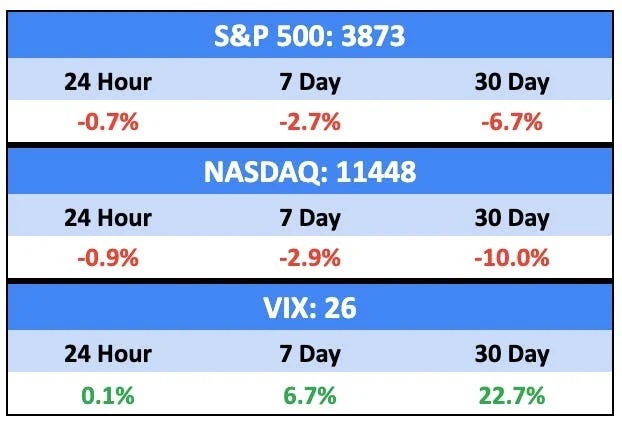

The CPI print rose 8.3% Y/Y in August vs. the 8.1% consensus forecast, while core CPI (stripping out food & energy) rose 6.3%, vs. expectations of 6.1% and July’s figure of 5.9%.

That’s bad.

The print sent equity markets tumbling last week, though they recovered a bit yesterday —

Food is a huge non-discretionary part of inflation and a significant component of geopolitical stability in general. A few terrifying stats (courtesy of Grit Capital):

- At least 40% of the United States has been suffering from drought conditions for 101 consecutive weeks. Overall, this is the worst multi-year megadrought in the country in 1,200 years.

- Europe is currently experiencing the worst drought it has seen in 500 years. In some parts of central Europe, river levels have fallen so low that “hunger stones” are being revealed for the first time in centuries.

- China is facing the worst drought it has ever experienced in recorded history.

Very basic items like eggs, butter, and flour are up over 20% YoY.

Bullish News

- China’s Economy Shows Signs of Recovery as Stimulus Ramps Up.

- Applications for US unemployment insurance fell for a fifth straight week.

Bearish News

- Analysts think there’s around 80% chance of a 75bps rake hike this week in the US — and a 20% chance of a full 100bps.

- Across the pond, analysts expect a 50bps rate hike in the UK, with a small chance of 75bps.

- Excluding autos, retail sales decreased 0.3% for August, below the estimated 0.1% increase.

What are we doing?

Are you a retail investment advisor or wealth manager? Do you want to add more sizzle to your product offerings? We’d love to chat. Just hit Reply and we’ll give you all the inside info.

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

We’re accumulating wine and whisky

Crypto

Here’s what you need to know:

The Ethereum merge happened, and it went pretty well by all accounts.

But crypto is still tied to equity markets, so both ETH and BTC tanked last week —

Bitcoin is now hovering just above a one-year low, and Ethereum is nearly 30% off its August rebound.

Crypto prices will be driven by macro events (the stuff I talk about in The Big Picture above) for the foreseeable future.

If you want to know what’s going to happen to Bitcoin, you’re going to have to predict the equity markets.

Bullish News

- Iran makes first import order using cryptocurrency.

- FTX Is in the lead to buy the assets of crypto lender Voyager Digital out of bankruptcy.

Bearish News

- Terra co-founder Do Kwon faces an arrest warrant in South Korea.

What to do with that info:

Do you like beta? That’s what crypto gives you right now.

Real Estate

Here’s what you need to know:

We keep saying to keep an eye on consumer debt and delinquencies because there’s a cascading effect starting with payday loans, traversing credit cards, and ending with mortgage foreclosures.

Here’s a worrying stat: 15% of buy now, pay later customers are using the service for routine purchases, such as groceries and gas. Unsurprisingly, BNPL delinquencies are on the rise.

Bullish News

- Overall rents were down 0.1% last month. Not really bullish, but it’s nice for renters.

- Titan, an online brokerage, began offering shares of Apollo’s real estate funds. This is (I believe) the first time non-accredited investors have had access to this asset.

Bearish News

- The 30-year mortgage rate has moved above 6% for the first time since November 2008, more than doubling last year.

- As of last week, foreclosures were up 14% from a month ago and up 118% from a year ago. Illinois, Delaware and South Carolina had the highest foreclosure rates.

- Total mortgage application volume was down 1.2% last week and down 29% YoY.

- China’s home price slump is now a year old. The bad-loan ratio there has climbed to 29.2%, and real estate debt is down 70%.

- Bank of America has a new plan to help close the affordability gap for first-time homebuyers. The bank will drop the down payment, credit score, and closing cost requirements for eligible buyers. This trial program, called the Community Affordable Loan Solution, is already running in a handful of major cities, including Dallas, Los Angeles, and Miami, with more soon to come.

- Property prices are decreasing globally.

- Residential real estate marketplace Sundae last week conducted its second layoff this year. About 28% of the team — mostly sales and support staff — were laid off.

What to do with that info:

I’m pretty surprised rents are down month over month; that was one of the bright areas for real estate investors so far this year. It’s not too late to short real estate.

NFTs

Here’s what you need to know:

Crypto’s not volatile enough for you? Try NFTs!

NFTs are still some way off their 2022 lows, but another week like last week will just about do it.

Both punks and apes are below $100k, and Moonbirds are off 36% over the last 30 days.

Bullish News

- NFT project Doodles raised $54m, which values the company at over $700m. They say they’re going to use the money to bring on 18 new hires. I hope some other stuff too.

- Seongnam, the 12th most populated city in South Korea, is creating a metaverse version of itself and will offer digital citizenship.

Bearish News

- Metaverse land cap (the value of all land in the biggest metaverse projects) was up 2% last week in ETH terms but off 23% in USD — a loss of $385m. This is in line with the rest of NFTs.

What to do with that info:

🤷

Startups

Here’s what you need to know:

There’s more pain to come from startups who’ve raised big over the last year but haven’t got a path to profitability.

Bullish News

- Figma got all the headlines last week, which papered over general weakness in the sector. Adobe bought the design startup for $20B.

Bearish News

- Global venture funding reached $25.2b last month, the lowest monthly funding amount in two years.

- Google canceled half the projects at its internal R&D group Area 120.

- Twilio laid off roughly 11% of its workforce — somewhere between 800 and 900 people.

- Vox issued a staggering takedown of Launch House, a prominent live-in incubator funded by a16z.

What to do with that info:

I keep saying it, and I’ll say it again — now is a great time to invest in seed and series A companies with a clear path to revenue.

Quick Hits

Art

Sotheby’s wrapped up a nicely-timed prints and multiples auction last week led by two Andy Warhol pieces featuring the recently-deceased Queen Elizabeth II.

All Warhol pieces (aside from one) beat their estimates.

Sports Memorabilia

The big news last week was Michael Jordan’s record-setting jersey sale. The “last dance” uniform, which he wore during game one of the 1998 NBA Finals, sold for $10.1m.

That broke the previous record: the kit Diego Maradona wore for his “hand of God” goal, which fetched $9.3m just a few months ago.

In slightly related news, MLS jersey sales were up 12% last year as the sport continues to gain popularity in the US.

Sports Cards

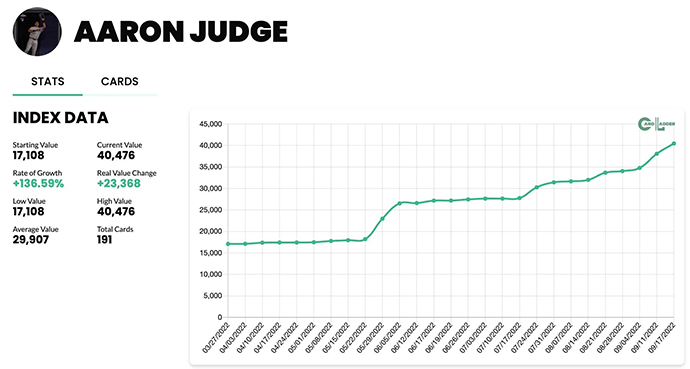

While modern sports cards (in general) are having a horrible 2022 (down 28%), Aaron Judge pieces continue going up and to the right.

The slugger is currently (as of Monday morning) at 59 home runs on the season — only three away from breaking the single-season record for home runs by players who didn’t use steroids.

Wine & Spirits

India’s growth over the last several years has been remarkable, and now that’s starting to be felt through their wine consumption.

India’s wine market was up over 29% from 2021 to 2022.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt