Today we’re exploring the intersection of crypto and real estate.

As the NFT drumbeat continues, a growing chorus of voices complain the technology is ultimately a hammer in search of a nail. These claims are countered by crypto bulls who claim, “Chill out; we’re still early!”

Both groups have a point. Sure it’s cool to buy Bored Apes, Cool Cats, or Debonair Dachshunds (Okay, I made that last one up, and I had to make sure it wasn’t a real project). But NFTs have the potential to be much more. They could change how business is fundamentally done in all sorts of industries.

Real estate is a perfect example. New RE platforms are incorporating the blockchain into their operations to modernize what has traditionally been an extremely monolithic and slow-moving industry.

So today, we’re turning our attention to the world of tokenized real estate.

Table of Contents

The Crypto & Real Estate Summit

Last month, crypto real estate company Propy hosted the Crypto & Real Estate Summit in Miami (where else?)

Miami was the logical choice. Florida is already America’s #1 destination for foreign real estate buyers, and Miami Mayor Francis Suarez has been vocal about making the city the world’s Bitcoin hub. Miami is also hugely appealing to international real estate investors, who gobbled up $5.1 billion worth of real estate in 2021.

The goal of the gathering was to merge the past with the future and move the goalposts forward. It featured prominent VCs, hedge fund managers, blockchain bulls, and real estate thought leaders.

It was a great meetup with industry leaders. But when the summit was over, a consensus was reached that, well, there weren’t many tangible ideas to come out of the conference. The ideas were interesting, sure. But real estate is one of the world’s most entrenched and regulated industries. How likely is it to embrace the blockchain? And why does it need to?

But to its credit, Propy’s vision that NFTs are disrupting real estate isn’t far-fetched. A month earlier, Propy actually orchestrated the first sale of a home as an NFT.

Selling property as an NFT

The first home in the US to be auctioned off as an NFT was a 4 BD, 2.5 BR “Spanish-inspired” estate in Pinellas County, FL. It was sold for $654,310, or 210 ETH.

Propy conducted the auction, and while the sale was as much about publicity as it was about NFT’ing a house, it did provide a case study on how NFTs could work with home sales in the future.

The biggest benefit for the sellers was that they had multiple channels. The home was on sale through the NFT auction and traditional real estate channels.

But there were also some serious disadvantages.

First, NFT bids had to take priority over traditional agent-submitted offers. Since the NFT bids met the reserve price, the sellers had to accept them, even though the agent-submitted offers were higher! Regular buyers who put in higher bids were shut out because they didn’t participate in the NFT auction.

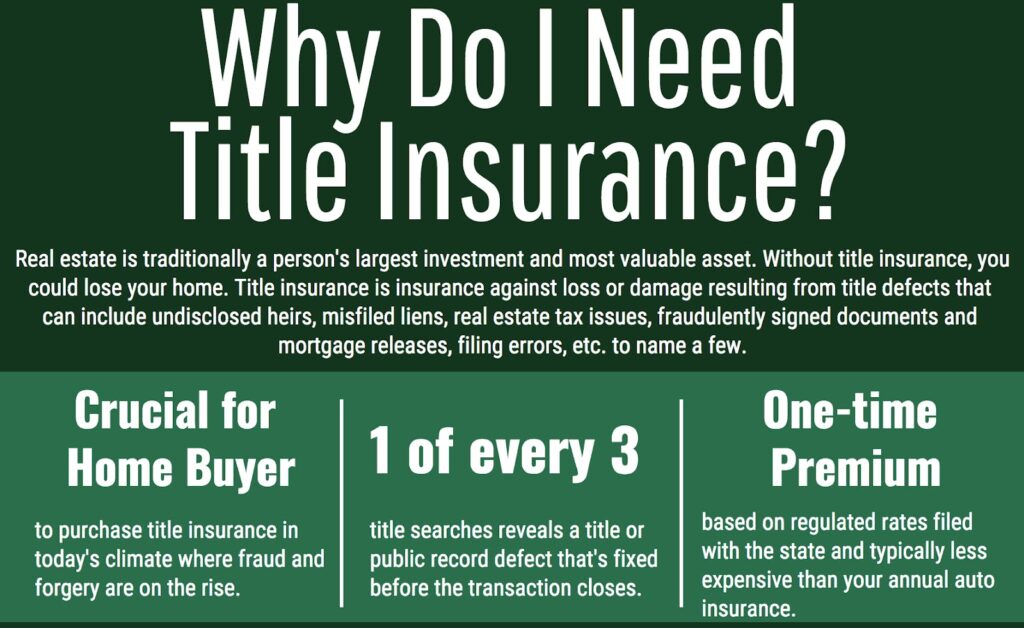

Second, no Florida title search company would sign off on title insurance. 😅 Because of this, the sellers conducted the title search themselves. It’s not totally unheard of for sellers to do this, but most buyers would (understandably) want assurance from a licensed company.

Third, the house could not have been sold as an NFT if it had a mortgage. 😲 So, if the seller was still making payments, they’d be out of luck.

Fourth, the process involved parties not typically consulted in the home buying and selling process, including crypto-specific law firms, NFT developers, and auction houses.

Fifth, all bidders had to prove that they had enough cryptocurrency to buy the home — essentially vetting them as cash buyers. For this home, it meant having $632k in cold, hard crypto. Not a lot of people fall in that bucket.

The seller owns an NFT business, and figured that selling the home on the blockchain would bring more attention to their business. (In that sense, mission accomplished!)

But it seems like the whole process was more of an experiment. The NFT transfer itself was purely symbolic; a parallel process of transferring the title deed by paper had to be done anyway.

Real estate crypto companies

Clearly the process still needs some work. But there’s good news. New companies are working hard to streamline the tokenization of real estate transactions.

The first four of these companies offer investors the opportunity to invest in real estate (both full and fractionally) through tokens that represent sole ownership.

Let’s get into what these companies do.

Propy

Propy is going wide. They’re looking to use blockchain technology to automate all parts of real estate transactions.

Founded in 2017, Propy started out focusing on real estate record-keeping. But it has since evolved into selling residential homes as NFTs.

It’s leading the way as a connector and influencer for the adoption of blockchain in real estate. In 2018, it helped pass legislation in Vermont to use blockchain technology to store land sale records. The company’s crypto real estate event in Miami was their first, and they already have another one planned for October.

Bitcoin is used as a borderless currency, and Propy sees a future of borderless real estate transactions. In fact, they brokered the first piece of real estate ever sold as an NFT: A condo in Ukraine owned by Techcrunch founder Michael Arrington.

Propy wants to make buying a house NFT as easy as buying a book on Amazon. It’s a bold ambition, and there’s a ways to go. But you gotta start somewhere.

Lofty

Lofty is a fractional crypto real estate platform open to retail investors. Focused on US commercial and residential real estate, investors buy a token representing fractional ownership of a unique LLC created for each property on the platform.

Investors can buy fractions of a property with Algorand ($ALGO), or through a credit card or bank transfer. As properties appreciate, so does the value of each token.

For example, let’s say you buy a token linked to a property for $100. If a property appreciates by 2% per year, the token is worth $102. The value of each property is updated once a month through the HouseCanary Automated Value Model.

Lofty is currently working on a secondary market for its tokens, and rental income is transferred to a bank account or a digital wallet.

Anyone can browse Lofty properties and see details for each investment. You don’t need to go through KYC (Know Your Customer) or even sign in to the site.

HoneyBricks

HoneyBricks focuses on a category of US real estate it calls Core Plus multifamily buildings.

Core Plus properties are “high-quality, stable assets in good locations” that offer a moderate rate of return ranging from 8 to 12%.

The onboarding process is relatively straightforward; create an account, connect your digital wallet, and buy tokens representing fractional ownership of an asset. Through this arrangement, HoneyBricks can deliver rent payments back to your wallet in your choice of cryptocurrency.

HoneyBricks token holders can also take out loans up to 60% of the value of their tokens. But at the moment, HoneyBricks is only open to accredited investors.

RealT

RealT was incorporated in Feb 2019 — making them very early to this game. They tokenized their first property in June 2019, and were the first to find a way to use a Security Token in a DEX (namely UNISWAP) in November 2019.

RealT fractionalizes ownership of real estate properties worldwide, using what they call Real Tokens. Each property on the platform has a unique Real Token associated with it. These tokens are on the Ethereum blockchain and act as proof of ownership of the LLC related to each property.

Today RealT is:

- 210 tokenized properties; or about 1,000 units

- 9,800 active tokenholders across 135 countries

- Over $50 million+ in tokenized assets

- About $3.7 million in stablecoins distributed to token holders from rental income

It is also the first Tokenized Real Estate Lending platform in the world (RMM) with a market of $5 million. RealT benefits from extremely active secondary markets, from OTC on Telegram, to Swapcat, to DEXes. They are currently present on two blockchains: Ethereum (where we started), and Gnosis.

Keep your eyes on these guys. They are crypto experts who were early to this market (they helped define the market, really) and are definitely ones to watch 👀

Benefits of tokenized real estate

One benefit of using NFTs in real estate could be improving the transfer of ownership.

Closing on a home today involves a huge cast of people, including real estate agents, attorneys, and title closers. In theory, NFTs could help do away with the paperwork and waiting (oh my, the waiting) of closing on a home.

Transfer of ownership could be as easy as sending cryptocurrency from your Coinbase account to a self-custodial digital wallet that pays for the property in a one-click transaction.

Once a home’s title has been tokenized, DeFi could open up entirely new dimensions and possibilities around refinancing, home equity loans, and reverse mortgages.

Big barriers to adoption

The biggest barrier to adoption here isn’t likely to be technology or even end-user confusion, but rather hesitation within the industry itself.

For decades, real estate agents have enjoyed very high fees for what is, let’s face it, essentially a pretty simple job. (I’m sure I’ll get some flack for this comment! I apologize in advance.)

Downward pressure on these fees continues, and real estate agents have already been hammered by companies like Zillow, Trulia and dozens of others. These sites (which have become the way we all browse properties) often have lower agent fees and inaccurate info — making agents’ lives harder.

Naturally, there are worries among agents, title companies, and MLS services over how the blockchain could disrupt the industry. These groups hold a lot of sway, and the last thing any of them want is to lose relevancy. Convincing them to adapt to a completely new purchasing protocol will be a pretty massive uphill battle.

Title insurers probably stand to lose the most from adopting the blockchain in real estate. A title insurer’s main function is to ensure that a seller is legally entitled to sell their property to a potential buyer. These experts go through volumes of dusty municipal records to ensure a property is not entangled in litigation, does not have a lien, etc.

The blockchain has the potential to reduce the heavy lifting — or perhaps eliminate this job completely. In theory, anyone could sift through real estate smart contracts (public blockchain code) to understand each title. New blockchain title companies could sprout up to make this easier.

One of the final barriers is simply the grey area in which crypto exists. Up to this point, NFTs have been treated like securities, including taxation on gains and losses realized.

So if a home with a title wrapped in an NFT is sold within a year, how does it get taxed? Does it fall under the same tax laws as traditional real estate, or would it count as a short-term capital gain?

Companies like Propy have shown a willingness to lobby politicians to shift real estate transactions to the blockchain. But it’s not just Vermont making crypto-friendly policies. Somewhat surprisingly, Wyoming was the first state to recognize and allow LLC registration of DAOs, and Tennessee just joined the party, becoming the second state to pass DAO legislation.

The future of crypto & real estate

If there’s one industry where smart contracts can transform an industry’s “business as usual” mentality, it’s real estate. Contracts mean everything from home inspections and financing to the power of attorneys and purchase agreements — frequently to the detriment of the buyers and sellers.

With new companies, conferences, and attention paid here, the crypto real estate movement is pushing forward and gaining steam.

Yes, Propy’s first NFT property sale (the condo in Ukraine) was messy and complex:

- The ownership of the property was actually held and recorded in Ukraine as a US LLC (?!)

- The auction winner became the owner of the NFT that gives the rights to the LLC

- Arrington had to sign proprietary-developed legal papers for NFTs to transfer ownership to all future buyers.

- Propy had to partner with the Seen Haus to conduct the bidding and Helio Lending to secure financing to future real estate NFT owners.

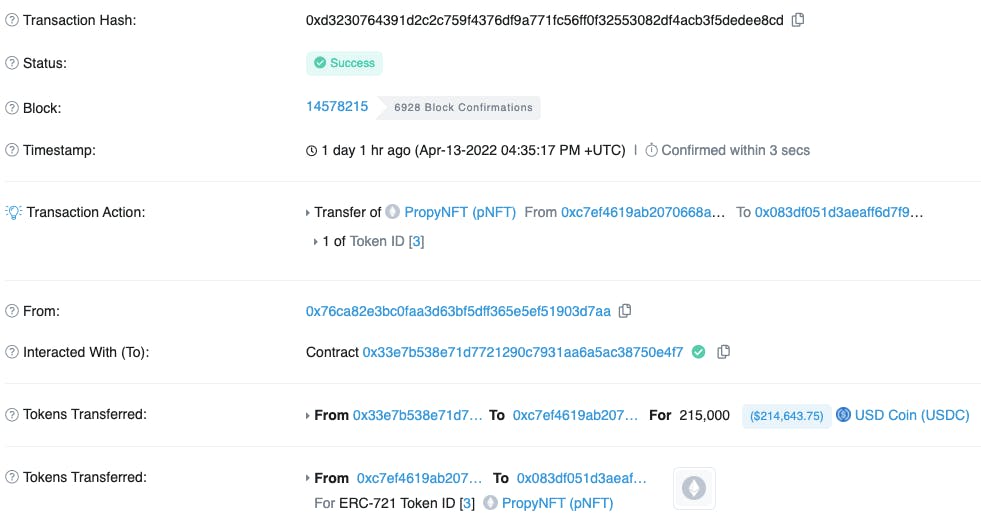

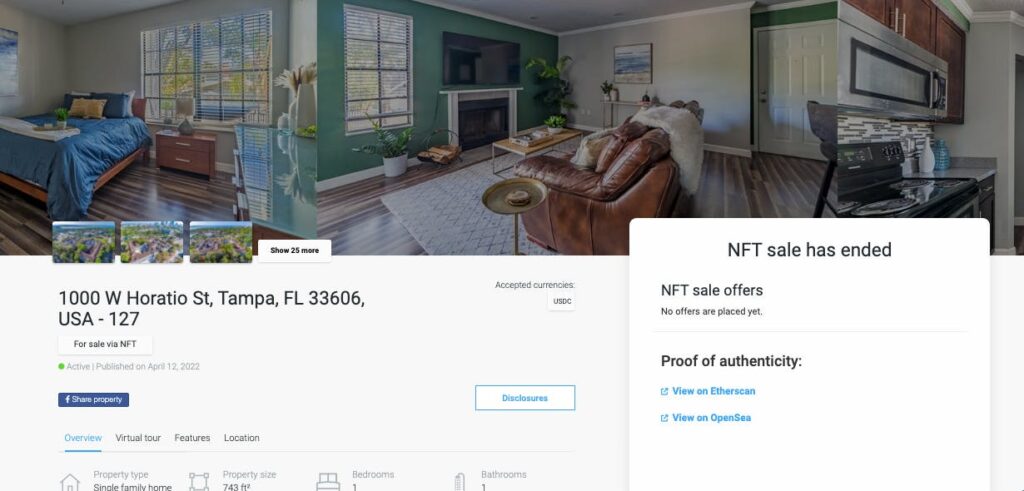

But it’s getting better! In fact, just three days ago, Propy auctioned off their second US property as an NFT. The condo in Tampa, Florida had a market value of $230k, and the final sale price was $215k USDC (United States Digital Coin).

This buying process was simpler: Buyers had to register with Propy to get pre-approved to then bid on the condo by connecting a digital wallet. That’s not too far off from buying on eBay.

Perhaps having some friction in home buying is a good thing. Crypto is the land of “buyer beware,” and homes are literally the biggest investments most people ever make. With crypto scams and rug pulls, many people want the pricey hand-holding. Not everything should be one-click!

It’s also easy to get starry-eyed on this stuff and forget just how fragmented and archaic real estate buying can be. For example, in Los Angeles, homeowners cannot even search for old records online. Forget the blockchain, we’re talking about millions of home records that have yet to be digitized! So yeah, we have a long way to go.

But if tokenized real estate can reduce at least some of the friction and cost involved in buying property, I think that’s a good thing.