Welcome to Cultural Assets Insider – FREE Version.

We use Moneyball tactics to discover undervalued, mispriced, and hidden gems in Fractional Investing.

Table of Contents

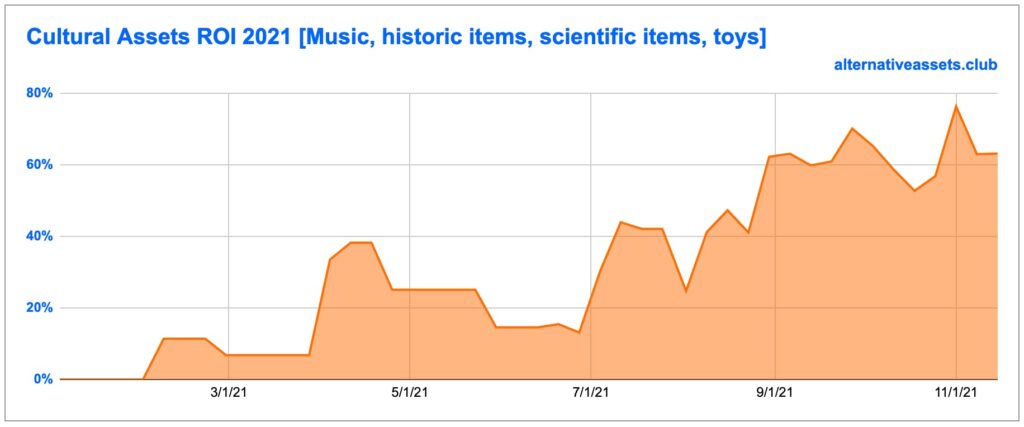

Cultural assets performance 2021

It’s been a strong year for cultural assets as toys in particular have led the way. Cultural assets look to gain further prominence as Goldin expands into the market.

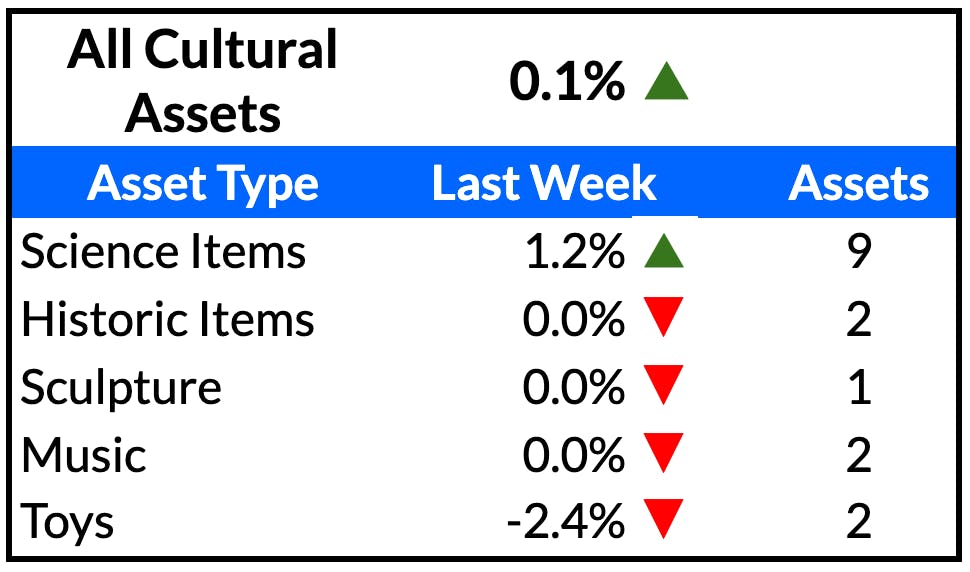

Last week’s performance

Fractional secondary markets

Pretty flat overall with nothing making any big moves.

This Week

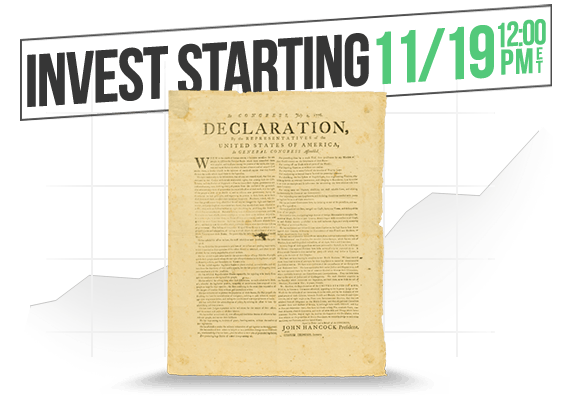

The week fractional owners have been waiting for – the IPO of a copy of the US Declaration of Independence. It’s one of several copies so not THE Declaration, but it’s a cool asset nonetheless. Shame it’s not a good investment.

New Hampshire broadside of the Declaration of Independence

- Market Cap: $2m

- Inferred Value: $1m

- Drop: 11/19/21 on Rally

- Recommendation: [Insiders Only]

Secondary markets

Two assets trade in the secondary markets this week on Rally.

Albert Einstein Signed Letter on God

- Market Cap: $80k

- Inferred Value: $55k

- Trading: 11/16 on Rally

Abraham Lincoln Signed Portrait – 1864

- Market Cap: $100,400

- Inferred Value: $64,000

- Trading: 11/17 on Rally

At Auction

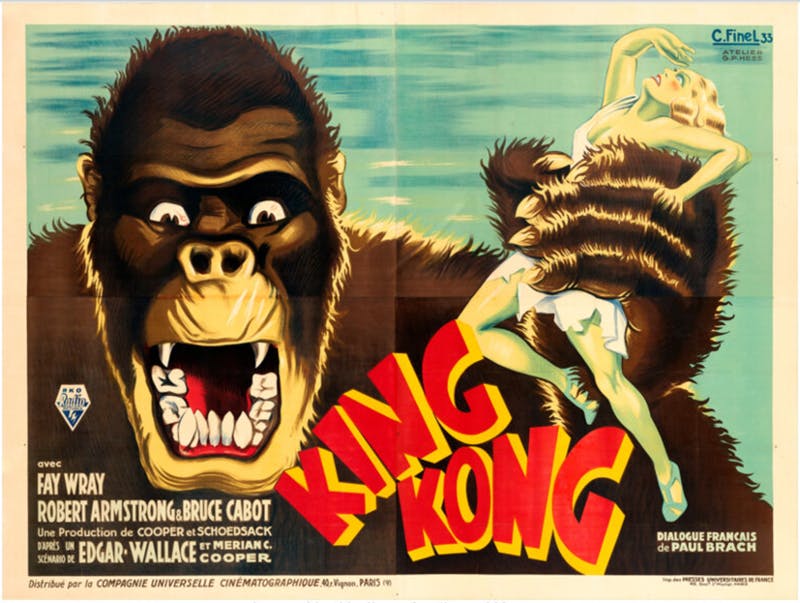

There’s an extraordinary film poster auction this week at Heritage. Film posters are one of the last pieces of nostalgic memorabilia yet to have a grading certification service (oddly concert posters do). Film posters are still relatively cheaper than concerts as well.

Top lots like King Kong (above) are expected to fetch $80k+, but there are many many classics that should go for an achievable price:

- Breakfast at Tiffany’s (1961): Current Bid: $2,500

- The War of the Worlds (1952): $2,100

- 2001: A Space Odyssey (1968): $1,980

- Star Wars (1977): $1,560

- Lawrence of Arabia (1962): $4,000