Hello and welcome to Alts Cafe

I’m keeping things brief with this week’s Alts Cafe as I’m away celebrating my ten year anniversary.

TLDR:

- S&P and NASDAQ are up

- BTC was down for the first time this year, as people took money off the table

- Money is flowing into India-based startups (KRR invested $250 million into an India-based decarbonisation platform)

Caffeine up and let’s go, Alts fans.

Wyatt

Table of Contents

Macro View

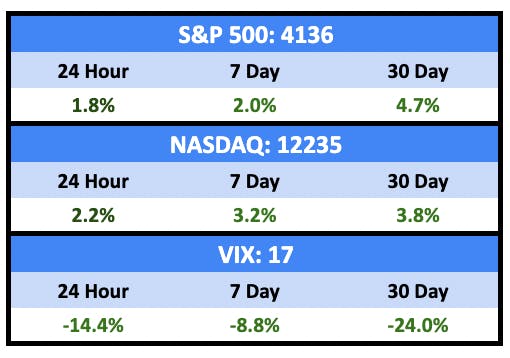

It was a quiet week overall, which lifted equities and squashed volatility.

Bullish News

- The Eurozone grew slightly in Q1.

- The Dow had its best month since January.

- U.S. job openings fell for a third straight month in March, and layoffs increased to the highest level in more than two years.

Bearish News

- First Republic became the second-largest bank failure ever.

What are we doing?

ALTS 1 fund news:

No news here.

Real Estate

Bullish News

- The largest undeveloped waterfront parcel in downtown Miami was sold to a local real estate owner for roughly $1.2 billion.

Bearish News

- Short sellers have ramped up bets against commercial mortgage REITs.

- The annual spring home selling boom hasn’t materialised this year.

- Citi publicly admitted what we all already know – offices are dead.

- Blackstone limited REIT investor redemptions again in April.

- UK housing inventory is way up.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

Bitcoin showed its first weekly loss in 2023 as investors consolidated gains.

Sentiment dipped slightly along with prices.

NFTs actually outpaced crypto for the first week since January.

Bullish News

- Mastercard is expanding further into crypto.

- Coinbase is opening a derivatives exchange in Bermuda as part of an international expansion plan.

Bearish News

- Coinbase execs and VCs have been accused of dumping $1 billion in shares before the stock tanked.

- Crypto exchange Polinex agreed to a $7.6 million fee to settle accusations of violating SEC rules.

- The SEC fined Seattle-based Coinme and related defendants nearly $4 million for conducting an unregistered and misleading offering of a crypto asset called UpToken.

- The White House is pushing a 30% tax on crypto mining.

How to invest in Crypto & NFTs right now:

Keep it simple and clean. Avoid anything risky and stick with top-tier coins.

We’ve talked about Roots before, a REG A REIT that allows anyone to build wealth through real estate.

Their asset class is single-family, and they have a unique model where residents of the properties can get invested into the fund through a security deposit, and earn quarterly rebates for taking care of the properties and being good neighbors. It’s a win-win.

Best of all, I’m delighted to say they’re up 16% in the last 12 months. Super impressive.

We’ve been working closely with these guys, and one of the co-founders has opened up his calendar to Alts readers so you can schedule a 1:1 call. It’s a great opportunity to ask questions and get a feel for what they’re doing.

Book a call today.

Startups

Bullish News

- META raised $8.5 billion via a debt offering at less than 2% above treasuries.

- American PE giant KKR invested $250 million in Serentica Renewables, an Indian decarbonisation platform.

- OpenAI raised $300 million at a $27 billion valuation.

- IBM says they’ll replace jobs with AI.

Bearish News

- Lyft is bringing employees back to the office as it tries to shore up flagging results.

- The backlash against AI as an investment opportunity has reached the mainstream.

How to invest in startups right now:

Have a look at India. It just passed China as the world’s most populous country, and institutional capital is flowing in.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Fans of what we do here? Please send this email to five friends. We appreciate it.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at sliceNote and Roots

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.