Hi

Welcome to our Crypto Insider for February 18th, 2022 – FREE edition. By popular demand, we’re bringing you the smartest insight, analysis, and investing tips for all things Crypto.

Today’s is another special issue. Having gone pretty deep on a few coins (check out those issues here), today’s read is intended to give you an overview of WTF Ethereum really is.

Table of Contents

But first, for your listening pleasure

Horacio sat down with Alexander Valtingojer, Co-founder and CEO of Coinpanion. Coinpanion is an investment platform based in Austria offering different cryptocurrency portfolios curated for a range of risk tolerances. They use a dynamic asset allocation framework to build their CO2-neutral portfolios with weekly rebalancing.

The rise of Ethereum, Smart Contracts, and DeFi

Ethereum is the 2nd largest project in cryptocurrency by market cap, second only to Bitcoin. While many consider $BTC to be the digital equivalent of gold, $ETH is often considered to be the digital equivalent of silver.

While we are bullish on $ETH and the Ethereum network, we won’t analyze Ethereum from an investment perspective in this issue.

Instead, we’ll discuss why Ethereum grew so quickly, its impact on cryptocurrency, and its connection to smart contracts and decentralized finance (DeFi), which we’ve mentioned before in previous issues. This is the sort of background knowledge that helps inform your own investment strategy.

Smart Contracts

Smart contracts are what make DeFi possible.

Smart contracts are code written on the blockchain that runs when certain conditions are met. They automate the execution of an agreement so that everybody involved understands what the outcome is.

There is no point in negotiating, and no higher power to veto or alter an outcome. Once the smart contract is agreed to, it no longer involves anyone’s involvement, and the code just runs, executing actions when conditions are met.

Smart contracts operate on the principle of if-then. For example, you can use a smart contract to send 1 $ETH to your brother each year on his birthday. IF today is his birthday, THEN 1 $ETH will be sent to your brother, assuming there is enough $ETH to send.

There is nothing he can do to get more $ETH sooner.

Risks

Since smart contacts are programs written in code, there can be bugs and exploits. Hackers can exploit flawed logic in the code to find an exploit in the smart contract and, for example, steal all of the $ETH before it gets released to your brother. This is rare, but it happens.

Decentralized Finance, Or DeFi

Decentralized finance is a financial technology that uses smart contracts. It has no central authority and removes third parties in financial transactions.

An example of centralized finance, or CeFi, includes banks, which have people involved in decision-making.

For example, if you want to get a loan through CeFi you have to go through an entire process [Editor’s comment, as anyone who’s bought a house knows, this process is actually much, much more painful IRL]:

- Apply to a lender

- Provide documentation

- The loan goes through an underwriter for approval

In DeFi, all you need to do is meet the loan criteria, which is always spelled out for you in a smart contract.

For example, if the smart contract says you can borrow $10,000 if you provide 1 $BTC, then all you have to do is supply 1 $BTC, and you get the $10,000. This process can take seconds rather than potentially taking weeks, which happens quite often in CeFi. You can find real examples of Defi here.

Risks

We mentioned earlier there could be vulnerabilities in smart contracts. Since DeFi runs on smart contracts, any app or framework based on those contracts could be at potential risk of exploitation.

What’s this got to do with ETH?

Bitcoin was, and basically still is just a store of value – a digital currency that you can send and receive, and that’s it. There are no applications and smart contracts that could be built on the Bitcoin network.

While sending and receiving money is cool, Ethereum created the ecosystem to actually do things with cryptocurrency.

Many cryptocurrency beginners just understand Ethereum and $ETH as an investment opportunity. While it can certainly be seen as a store of value, the currency’s real value lies in its utility – it facilitates decentralized finance.

You can think of a blockchain network, or network, as a software platform that developers can use to create new applications using smart contracts.

Founded in 2013, Ethereum was the first cryptocurrency network, and it’s still the largest.

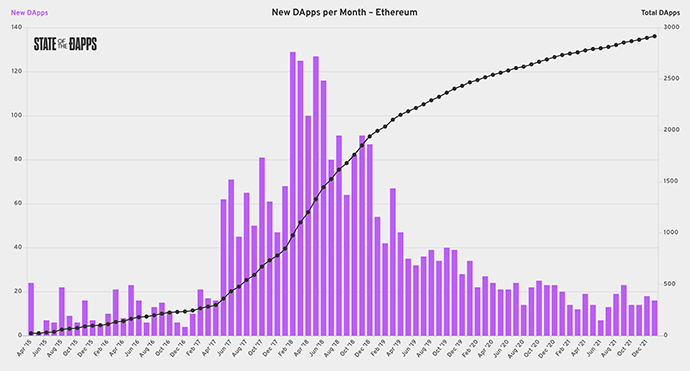

As developers flocked to blockchain programming, better smart contracts were created. Because of this, application development exploded. As better and more applications became available, user adoption quickly rose on the Ethereum network. Increased user adoption encouraged even more applications to be built, which attracted even more users, thus creating a cycle of more applications and more users.

Essentially, Ethereum became popular because it was the first cryptocurrency that let you do cool things in the crypto world. Naturally, as the network grew, the token’s value did as well. In fact, in 2015, it was as low as about $.54 according to Coin Market Cap, and in 2021 passed $4,500.

Continued momentum

The Ethereum network continues to thrive as applications and smart contracts get more sophisticated to meet the needs of the growing user base.

Smart contracts on the network are also used in real-world applications such as supply chain management and storing health records. Many companies use the Ethereum network for smart contract development and even buy and hold $ETH.

How to purchase Ethereum

There are multiple ways to do this – we’ll go over the route that we imagine most beginners would go through. We will not be going through crypto safety best practices in this section. It is your responsibility to keep your information safe and secure.

The easiest way to buy $ETH is through a centralized exchange (CEX) such as Coinbase or Crypto.com. Once you have your account, it is very simple easy to purchase – all you need is a supported fiat currency such as $USD and $EUR.

Disclosure: This is not financial advice. This article is for entertainment purposes ONLY. I am also a holder of $ETH and $BTC.