Hello and welcome to Alts Cafe

Here’s everything you need to know about what’s happening in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

But first, a few words on hype.

The world is full of “sexy” and “unsexy” companies. Sexy companies get lots of attention and hype. But if you’re a smart, alternative thinker, you look for the unsexy companies that others aren’t talking about.

A few months ago, we did a Deep Dive into a manufacturer of smart shades called RYSE. This company’s patents have allowed it to sell on Amazon with no competition. More people need to know about these guys, the TAM here is enormous.

To be fair, there is some hype. The company was on the TV show Dragon’s Den, and the Canadian government has invested $4 million.

Window blinds aren’t the sexiest industry, but RYSE has a chance to OWN the “Smart Shade” space. Think about it: you’ve got Nest for smart thermostats, Ring for smart doorbells, and Roomba for smart vacuums.

There are only a few big opportunities left in home automation.

RYSE is one of the final missing pieces.

Table of Contents

Macro View

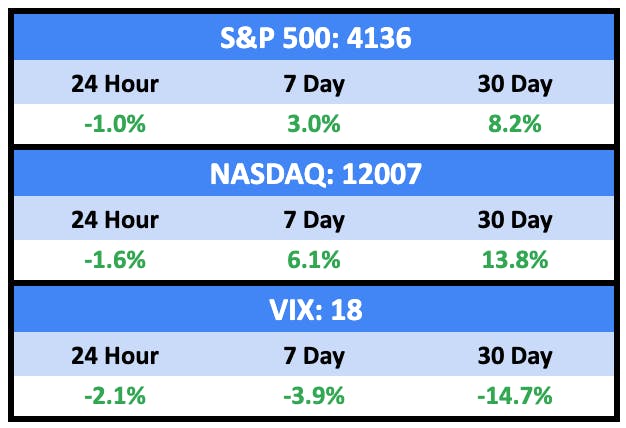

Another positive week across the markets. 2023 is looking up.

Here’s what you need to know:

The Fed issued guidance that inflation is on the right track and future rate hikes will be in the 25bps range, making everyone happy.

That said, Chairman Jerome Powell was cautious: “While recent developments are encouraging, we need substantially more evidence to be confident that inflation is on a sustained downward path.“

That sounds negative to me, but the markets think he’s bluffing. We’ll see.

Bullish News

- Exxon Mobil set a company record and a historic high for the western oil industry with a $56 billion net profit for 2022.

- The UN index of food-commodity costs fell for the 10th straight month.

- Traders are pricing in an abrupt end to global monetary tightening.

- Emerging markets have just seen the highest inflows since 2017.

- Crypto continues its bull run start to 2023.

Bearish News

- The US added 517k in January, the most since July and well above expectations of 185k. The unemployment rate is now just 3.4%, the lowest since 1969. Remember, rate hikes will continue until unemployment rises.

- US Avg Hourly Earnings increased 4.4% YoY in January, the slowest growth rate since Aug 2021, and now the 22nd consecutive month where inflation outpaced the growth in wages (YoY).

- Squeezed by higher prices and short on cash, more Americans are tapping their 401(k)s for financial emergencies at a record pace.

- U.S. Retail Electricity prices remain near all-time highs, up 15% YoY.

What are we doing?

ALTS 1 fund news:

Nothing to report here.

Real Estate

Here’s what you need to know:

Inventory levels are up, and mortgage rates and coming down. 2023 won’t look anything like 2021, but things are starting to thaw out.

Bullish News

- The average 30-year mortgage rate dropped to 6.04%, down nearly 100bps since its high of 7% in November.

Bearish News

- Among the nation’s 400 largest housing markets, 15 are already above pre-pandemic (i.e., 2019) inventory levels.

- Big layoffs are ahead for real estate brokers.

- According to CoreLogic, 391 major housing markets have a high or very high chance of experiencing a year-over-year home price decline in November 2023.

How to invest in real estate right now:

Sit on your hands or chase yield. [Unchanged]

Crypto & NFTs

Here’s what you need to know:

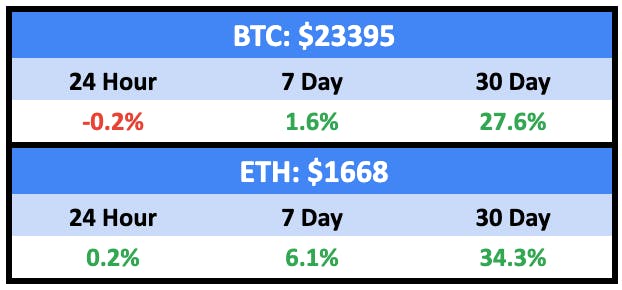

Crypto continues to rip through February.

And sentiment follows. The F&G index is the highest it’s been for eleven months.

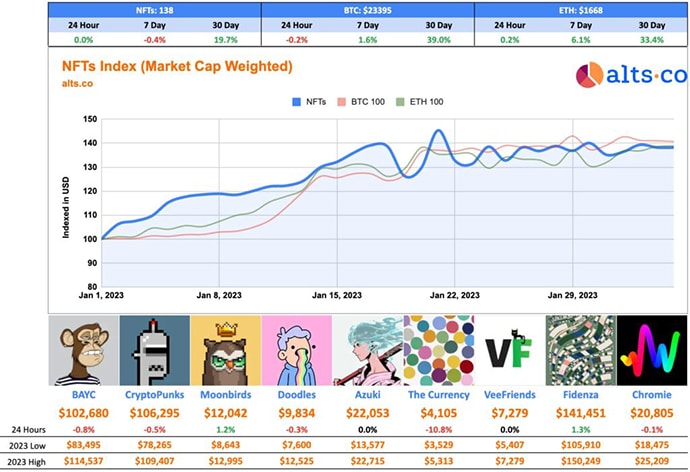

NFTs, which led the way up to begin the year, have leveled off over the last several weeks. They’re lagging behind ETH and BTC now.

Bullish News

- Coinbase COIN shares pumped more than 20% after a class-action lawsuit against the exchange was dismissed Thursday.

- L2 tokens are rallying, and so are major projects on L2s.

Tokens of decentralized computing protocols are also rising, likely concerning ChatGPT’s viral takeoff.

- Twitter’s upcoming payments tool will initially support only fiat currencies, but potentially support crypto.

- Bitcoin NFTs are here.

Bearish News

- Mark Wahlberg is making a documentary on FTX and Binance. Yay.

- Things are getting ugly between NFT marketplaces Opensea and Blur.

How to invest in Crypto & NFTs right now:

Dollar-cost averaging if you’re bullish.

Startups

Here’s what you need to know:

The back half of 2023 into early 2024 will create a “mass extinction event” for startups, according to a brutal but well-reasoned thread by IVP GP Tom Loverro last week.

PREDICTION: There’s a mass extinction event coming for early & mid-stage companies. Late ’23 & ’24 will make the ’08 financial crisis look quaint for startups. Below I explain when, why & how it will start & offer *detailed advice to founders* on surviving the looming die-off. /1

— Tom Loverro (@tomloverro) January 31, 2023

Some key points:

- Many startups raised ~2 years of cash in 2021 and 2022. They cut burn in H2 2022 to extend that. But they’ll need to raise again in late 2023 and 2024.

- Four in five early-stage startups had less than 12 months of runway in early 2022

- This will result in a flood of startups looking for cash later this year, but they’re going to run straight into a buzzsaw of timid VCs unwilling to invest capital.

- The idea that loads of VCs are sitting on casks full of dry powder that needs deploying is false. They’re in no rush to call capital from their LPs.

Some tips for founders:

- Cut costs, then cut some more. Nice-to-have needs to go.

- Raise now, before the flood, even if it’s a down round. Surviving is more important than your ego.

- Focus on profit over growth.

And (for me) his best piece of advice:

6. Play your cards right, survive & go on OFFENSE. The best time to build & take market share is when your competition is dead/in retreat. 2021 felt like the best year to build a startup but it also felt like the best year to buy high-growth stocks 😉 Now is the time! /20

— Tom Loverro (@tomloverro) January 31, 2023

Bullish News

- By 2027, managed assets in the global private capital market are expected to climb 20% to $13 trillion from 2021 levels.

- The first big Twitter alum startup has been funded. Spill, a social app founded by Phonz Terrel, who led the 27-person Twitter Social & Editorial team, raised $2.75m in a pre-seed round.

- VC firms announced $8B in capital commitments last week.

- Australia became the first country to recognize psychedelics as medicines.

Bearish News

- VC investment in autonomous vehicles companies during Q4 plunged 47% on an annual basis to $1.4 billion.

- Tiger Global says India returns have ‘sucked historically.’ They remain bullish (I agree).

- SAAS companies were raising rounds at 114x ARR in 2021. That’s 5x to 6x multiples from 2017 to 2021. A valuation crash is coming.

- 27 on-site massage therapists were among the workers laid off by Google at its California offices.

- VCs think the majority of unicorns aren’t worth $1 billion anymore.

How to invest in startups right now:

Consolidations are coming, and you’ll be able to get into some great companies at fire sale prices soon.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions, or concerns – let us know.

Cheers,

Wyatt