Welcome to our very issue of Farmland Insider — the free version.

We analyze deals across FarmTogether, AcreTrader, FarmFolio, and other platforms.

This issue was written by our new analyst, Brian Jacques, who did a phenomenal job analyzing this offering.

(New here? Read our primer on farmland investing)

Today, we look at the Tehama Olive Ranch — an olive & walnut farm in Tehama, California.

Let’s go

Table of Contents

Offering at a Glance

- Platform: AcreTrader

- Available: November 10th at 1pm CST

- Location: Tehama County, CA

- Crop type: Permanent

- Crops: Olives (150 acres), Walnuts (60 acres)

- Capital being raised: $4,000,000

- Acres: 246

- Price per Acre: $16,260

- Price per Farm Acre: $19,048

- Min. Investment: $25,000

- Average Net Cash Yield: 4.20%

- Net Annual Return: 8.40%

About the farm

The ranch currently grows Arbequina olives on 150 acres and Chandler walnuts on 60 acres. Both crops had trees first planted in 2010 and have reached crop-producing maturity.

Olive and walnut trees have 30 projected years of fruit-bearing life, so the initial trees currently have 67% of their estimated lives remaining.

Olive trees are drought resistant and require 50% less water than almonds and some other nut trees. They require 1.75 to 2.25 acre feet of water and can grow in less than ideal soil conditions. Well-managed olive orchids generally produce 5 to 6.5 tons per acre at time of maturity.

Both walnuts and olives are permanent crops which are planted once and then grown to maturity unlike annual crops such as corn and soybeans which are replanted each year.

Good growth conditions for walnuts are more strict than olives. They require class 1,2, or 3 soils to grow best and 3.5 acre feet of water. Mature walnut orchids can yield 4,700 to 6,000 pounds per acre.

There is a higher risk to permanent crops due to the time required to grow to maturity (4 to 6 years for olives and walnuts). Loss of the trees to drought, fire, or other factors can have an outsized impact since the clock essentially starts over at year 1 with the planting of new trees.

The crop revenue split is 60% olives and 40% walnuts.

SUMMARY: The benefits of the favorable growth profile of olives is offset by the water needs of the walnut acres and the higher risk of permanent crops.

Geography

California produces nearly all of the olives in the US. The farm is located in Tehama County which is one of the top producing olive counties in California.

The soils at the Tehama Olive Ranch are classified as Class 2 and 3. Class 2 soils have moderate limitations that reduce the choice of plants or require moderate conservation practices, while Class 3 soils have several limitations or require special conservation practices. (Learn more about soil classification)

Tehama County is in the northwestern end of California’s central valley with average rainfall of 24.49 inches per year. This is double the average annual rainfall that the middle and southern portions of the central valley receive.

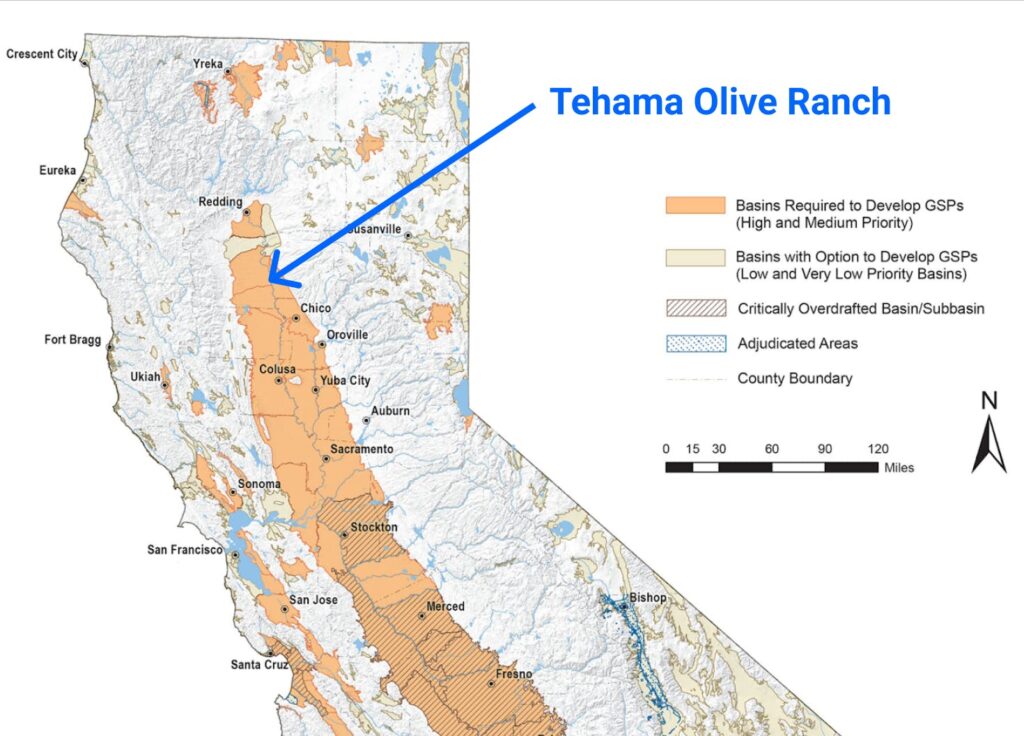

California divides the state into 515 water basins, with some of these basins being further divided into sub-basins. A priority of high, medium, low, and very low is assigned to each basin which affects groundwater sustainability plans (“GSPs”).

The Tehama Olive Ranch is located in the Red Bluff Water sub-basin which has a high priority. Unfortunately, drought conditions have still occurred in the Ranch location over the last few years.

SUMMARY: The ranch is a good house in a bad neighborhood. It has a better climate than other areas in the Central Valley, but is experiencing the same drought conditions plaguing the rest of California.

Water Rights

A well on the property that drilled in 2010 gets flows of 2,600 gallons per minute (gpm). The farm requires just 1,000 gpm for proper irrigation.

The ranch also has 128 acres located in the El Camino irrigation district with water draw rights, which they have not previously used.

As part of the ranch acquisition, an independent study was performed by environmental consultants – they estimated that, should they be enacted, provisions of the Red Bluff Water basin GSP would add an annual cost of between $2.50 to $13.50 per acre. The ranch’s projected operating costs per acre in 2022 are approx. $2,500 per acre so this added cost represents an increase of less than 1%.

SUMMARY: Water infrastructure is sufficient for current needs with additional water sources available if needed.

Capex + Access to Infrastructure

The farm is currently producing both crops so no initial expenditures will be required for harvesting or infrastructure purposes. Roads, facilities, and a well are already present. Harvesting machines will be owned and provided by the farm management company, EAS, as further discussed below.

SUMMARY: Farm is currently producing so cash outflows will be for normal operating expenses and management agreements.

Owners + Management

This section is for Insiders only.

Unlock the Full Version →

Economics of the Deal

Purchase Price

The farm is being purchased for $5.3 million. This equals $25,238 per farmable acre or $21,544 per acre.

There are 36 acres of land that include six houses and a portion of the walnut acreage is sub-leased to tenant farmers. The price per acre is in line with other nearby olive farms currently up for sale:

SUMMARY: Purchase price per acre is in line with other olive farms on the market. ????

Cash Flow + Projections

This section is for Insiders only.

Unlock the Full Version →

Other financial considerations

The company is assuming debt as part of the purchase of the ranch. A $1 million 30 year term loan at 4.6% will be secured to use for the sale closing and for initial operating costs.

This results in a Loan to Value Ratio (LVR) of 18%. Interest payments will average $18,000/year and should be easily supported by projected cash flows.

A 1% annual management fee will be paid to each of ACOP and EAS for their oversight of the farm (2% combined). The 2% combined fee is higher than other offerings on fractional platforms, which tend to range between .75% – 1.3%. The higher fee may be partially justified by the expertise required for growth and harvest of olives (specialized olive harvesters can cost as much as $500,000).

Initial distributions to shareholders are projected to start in 2023 and will average 4.66% annually through 2030. Upon the projected sale of the farm in 2031, investors will average 8.44% annual returns or an approximate doubling of their initial investment.

Recommendation

Recommendation is for Insiders only.