Today, we a look at investing in franchises through the lens of an important new company called Franshares.

We’ve been following the Franshares journey closely, and they’ve come a long way since we first covered them two years ago.

We go into the history, benefits, and economics of franchise investing.

I hope you enjoy it!

Let’s go!

Table of Contents

The “F” word

Kenny Rose knows what people first think of when you mention the word “franchise,” an often misunderstood industry that typically conjures up images of greasy burgers and french fries.

But Rose has made it his job – yes, literally – to educate people about the variety of franchising opportunities available and that it goes far beyond fast-food restaurants.

It’s an industry that in 2020 had more than 750k establishments in the United States, contributing $670 billion of economic output.

Few people understand franchises like Kenny does. He knows the economic opportunities and diversity of industries that franchises represent. His experience extends from founding a successful franchise brokerage to becoming Founder and CEO of Franshares, an SEC-registered investment platform fractionalizing shares of a franchise fund.

Franshares is an SEC-approved way to invest in franchise businesses. Their first fund opened in May 2022.

Today we’ll take a deeper look at franchises’ performance during the pandemic and analyze what makes this a compelling alternative investment.

The franchise model

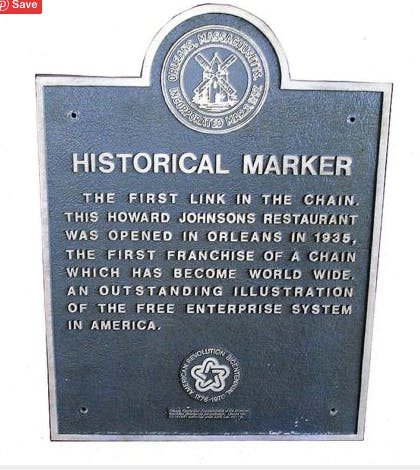

The first modern franchise was established by Howard Johnson, who replicated the operations of his successful restaurant in Quincy, MA. Copying a restaurant and opening up in another location was a novel concept back in 1935.

Under the new model, Howard Johnson sold the rights to use his name and logo while also agreeing to ship the same food products to a different location.

The basic franchising agreements that Johnson forged in the early days of his franchise remain largely unchanged.

The crux of an agreement is that a franchisor allows a small business owner, or a franchisee, to use their logo, brand, and materials to begin their own independently-owned business.

In return, the franchisee pays a one-time investment for set-up fees and costs, with a minimum cash requirement set by the franchisor. In addition, franchisees pay annual fees and royalties to the franchisor.

The franchisee gets:

- Use of copyrighted materials

- Access to critical distribution networks

- Support from headquarters

Franchisees can expect routine inspections from corporate HQ to ensure they meet standard operating procedures.

Franchises today

In 2020, franchises accounted for roughly 3.5% of the country’s GDP. Nearly 7.5 million Americans were working for a franchise.

Then covid happened.

The effects of the pandemic on job numbers and small businesses are complicated in some parts because bad news in one area was related to good news in another.

Take, for example, the number of small businesses during the pandemic. By one estimate, the pandemic was directly responsible for the permanent closure of 200k small businesses. Nearly one-third of all small businesses were either permanently or temporarily closed at one point.

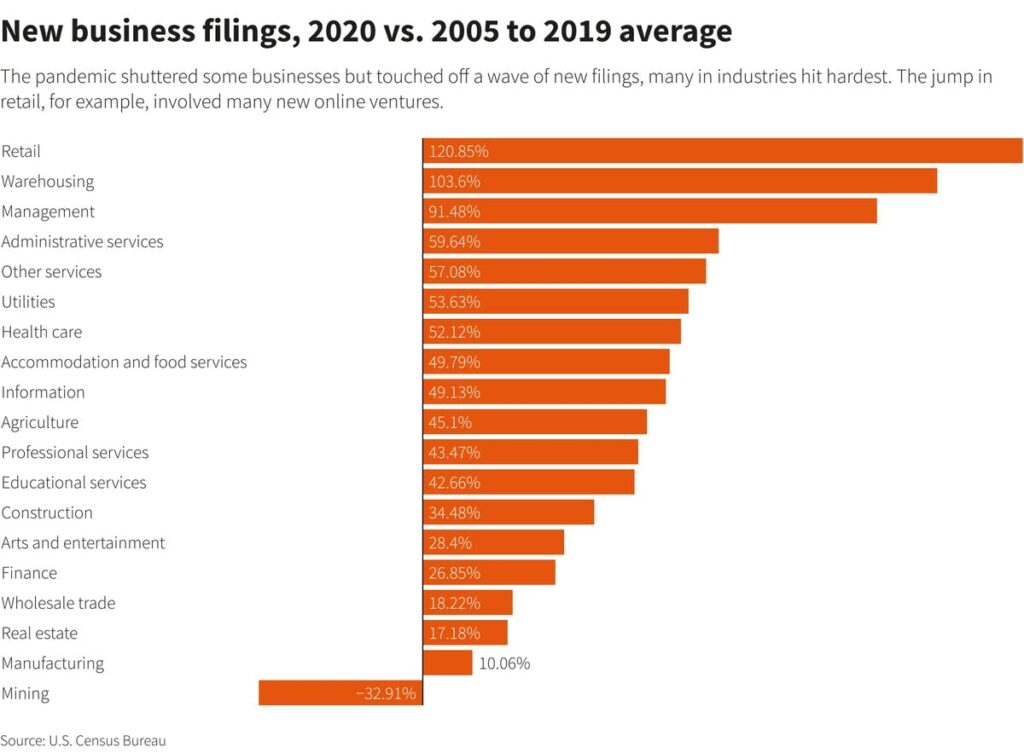

But on the other hand, fillings for employer identification numbers in the U.S. went up by 57% in 2020 compared to the average number for the previous 15 years. The 2021 numbers appeared to mirror those of 2020.

Some explanations for this include small businesses having to formalize paperwork to receive federal aid; another reason could be good old-fashioned fraud. A study in April 2021 by the Federal Reserve Board also found that permanent closures are “likely to have been lower than widespread expectations from early in the pandemic.”

To further complicate the issue, a record number of employees have taken part in the “Great Resignation,” or the nearly 33 million Americans that have quit their jobs since the spring of 2021.

This suggests that many in the workforce have decided to change where and how they work, reassessing their lives during a once-in-a-lifetime pandemic. Often, they have chosen to work for themselves.

When considering what kind of businesses to start, many entrepreneurs were introduced to franchises for the first time. According to the International Franchise Association (IFA), more than 26,000 franchises opened in 2021.

Franchises as a whole have fared better than independent small businesses, due to the support from franchisors who provide networks, strategies, and consultants to ensure franchisees succeed.

Benefits of franchising

There are a ton of benefits to owning a franchise.

I’ve always said that buying a business is effectively like “buying time.” One of the primary benefits is the ability to fast-forward five years, skipping the growing pains of getting a new business off the ground.

Franchisees can also tap into a valuable network of fellow franchisees. A lot of the scaling of a business is done for the franchisee from the beginning. This was a key factor for the continued existence of many franchises.

But franchises also have one major barrier. They often require a lot of capital to get started, sometimes as high six figures and into the seven figures. Here are the startup costs for some of the most recognizable franchises:

- McDonald’s: $2.3 – $1.3 million

- Dunkin’: $465k – $1.6 million

- Jamba Juice: $270k – $500k

Of course, there are several franchises with much lower startup costs. The average startup costs for a franchise range from $50k to $100k. But it helps to go through vetting franchisors with a franchise broker.

A broker is an expert in the field, knowledgeable about costs, locations, and businesses best suited to a potential owner’s strengths and weaknesses.

This is where Kenny Rose comes back in with his expertise.

How Franshares got started

Kenny Rose is one of the foremost experts on franchising. He started Semfia, a franchise brokerage that connecting potential franchisees to specific businesses within more than 300 industries.

As he developed his expertise, Kenny thought about the potential of bringing fractionalized shares of a franchise fund to the masses. When President Obama signed the Jumpstart Our Business Act in 2012 (JOBS Act), businesses were allowed to begin ‘crowdfunding’ to issue securities — in effect legalizing anonymous fractional investment.

This is what led to Regulation A, and the surge in fractional investment platforms you see today.

The tipping point came during the 2020 covid pandemic when Kenny read an article about people gambling on the stock market because there were no sporting events to bet on. He knew he could offer a much better investment opportunity, so the wheels got rolling.

What Franshares offers is a single fund, consisting of over 50 franchises in multiple industries, personally curated by Kenny across different geographies. When asked if the pandemic had caused him to change franchises in his fund, Kenny replied with a swift, “no.”

According to Kenny, covid had zero impact on the businesses in his fund. The companies he vetted had either one or two of the following characteristics:

- Experienced owners with prior franchising experience

- Franchises that proved to be pandemic-resilient

The economics of Franshares

When considering a fund, it’s important to consider its economics. How does Franshares make money? How do investors see a return?

When franchisors search for someone to open a new store, they’ll often go to a franchise broker to conduct a search. When the right franchisee is identified, franchisors pay a broker fee. In this model, Franshares acts as the broker, where franchisors pay a fee to get into the fund.

When a franchise is brought into the fund, they often (but not always) co-invest. For example, 80% of the startup costs are crowdfunded by investors, while the remaining 20% is funded by Franshares. The result is that Franshares is often a co-investor with other fund investors.

Investors have the potential to get a return on their investments in a few ways:

- Franshares pays out proceeds as dividends. The amount of dividends depend on the fund. In some cases there may not be any dividends in the first 12 -18 months of the fund’s existence, to allow franchisees to build up capital. In other cases it could be sooner or even immediate.

- As sales increase, so does the value of each franchise. This means franchises become more attractive to private equity firms that may purchase them outright.

The minimum investment required is $500 — low enough to allow broad participation, yet high enough to draw in a group of serious investors.

The Franshares fund

Every franchise in the fund is subject to an Item 19 Financial Performance Representation, which is a statement made by the franchisor about the company’s financial position. Franshares uses Item 19 to rigorously vet all franchises.

Kenny has also stated that many well-known franchises are reaching out to him to be included in the fund. He is confident that he has chosen the right mix of approximately 50 companies across different regions and industries.

In addition, Franshares has partnered with franchise management companies that provide experienced teams that have worked with and bought out other franchises. The management companies will help keep track of financial documents, operations, and hiring.

Social mission

One of Kenny’s first points when discussing Franshares is his desire to provide opportunities for upward mobility for employees from within the fund. He references the Chick-fil-A model, which chooses employees who work in the restaurants as future franchisees.

The lucky employees (and deserving) that get chosen can start their own Chick-fil-A for $10,000. This is quite a steep discount from what has otherwise been calculated to cost anywhere from $800k – $1.3 million.

His vision is to give someone who starts as a line cook in a restaurant an opportunity to become an executive at Franshares or become a franchisee of a new business in the fund.

While Franshares will initially offer one diversified fund, the goal is to localize the model, allowing people to invest in the very businesses within their community.

While many people won’t view franchises in the same way as ‘mom and pop’ operations, franchise owners are small business owners and just as much a part of the community.

Podcast

Check out Horacio’s podcast with Kenny Rose if you’d like to learn more.

Horacio and Kenny go deeper into Franshares and franchise investing in general. Check it out on Spotify, iTunes, or YouTube:

Closing thoughts

At first glance, the Franshares model is rather simple.

Think of it like a mutual fund of franchises. There’s one portfolio made up of multiple franchises that you can invest into.

But as we analyze this particular new asset class, it’s clear that putting together this kind of fund takes time, patience, and industry knowledge.

It’s important to note the rising popularity of franchises in the wake of the pandemic, and the passive income their fund will potentially provide.

If you have a spare $500 to invest, Franshares provides a great opportunity to invest in a swath of American small businesses.

Disclosures

- Franshares is an Alts sponsor; this was a paid deep dive.

- We have no investments in Franshares through ALTS 1.

- I am personally invested with Franshares.

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Franshares. Franshares has agreed to offer an unconstrained look at its business & operations. Franshares is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.