Today we have a deep dive into trading card assets IPO’ing on Collectable:

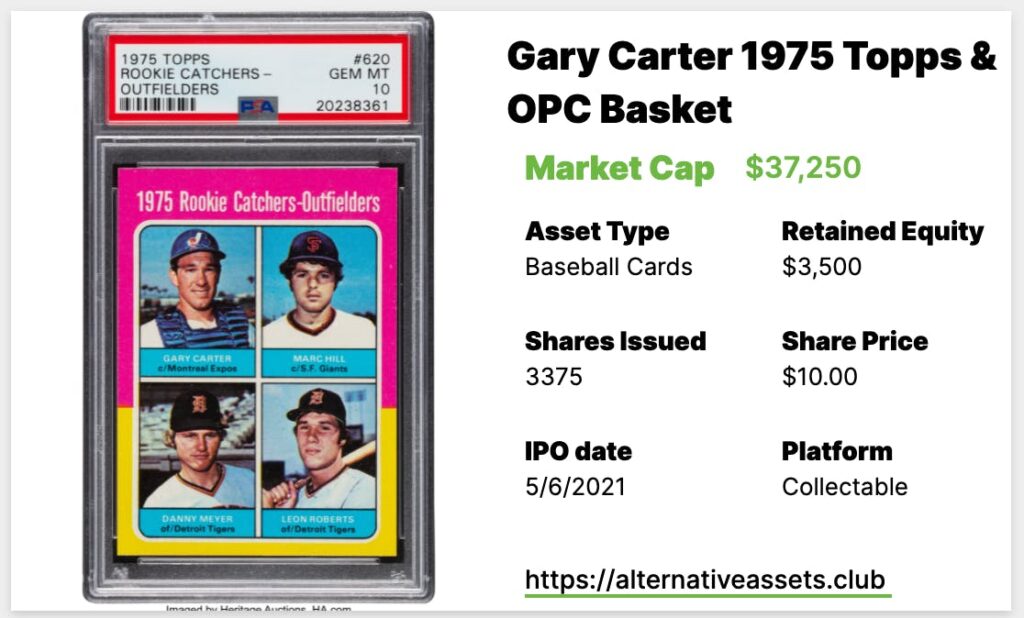

- Gary Carter 1975 Topps & OPC Basket – Thursday 6th April 2021 on Collectable

- Patrick Mahomes 2017 Panini Immaculate /1 PSA Auth – Friday 7th April 2021 on Collectable

Think you can do a better job of writing these up than we can? Please get in touch! We’re looking to add a sports cards analyst to our team.

Table of Contents

What is the Gary Carter 1975 Topps & OPC Basket?

This is a pair of rookie cards for Hall of Fame catcher Gary Carter. One is from the 1975 Topps set, and the other is from the O-Pee-Chee set from that year.

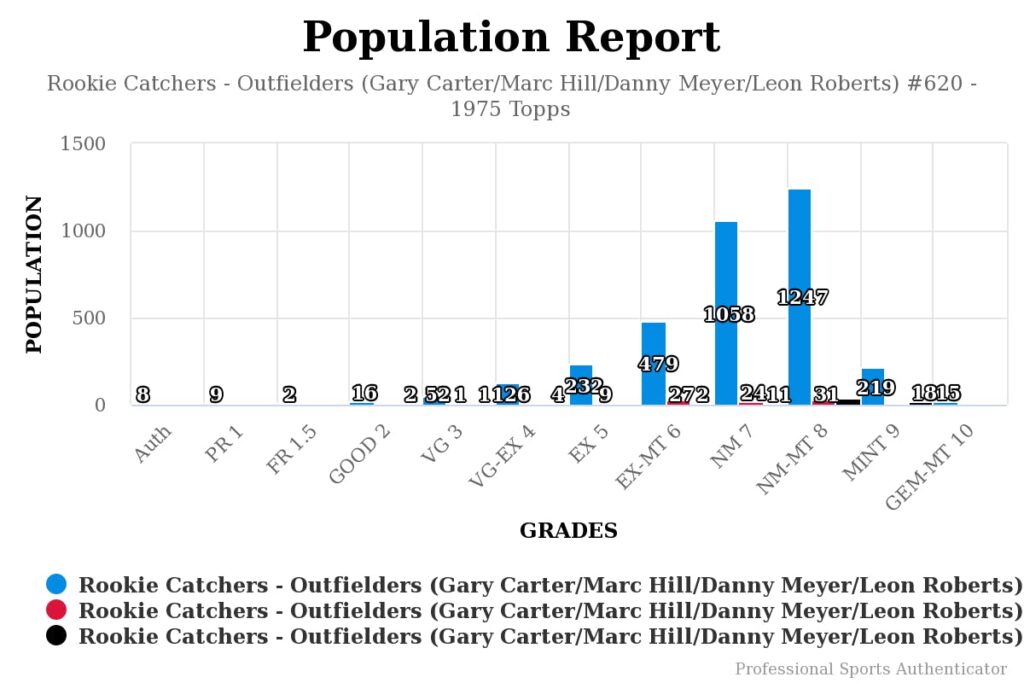

First the Topps card:

This is one of only 15 PSA 10’s of the over 3,500 submitted to PSA. The set struggled with poor centering, chipping along the coloured edges, and print defects.

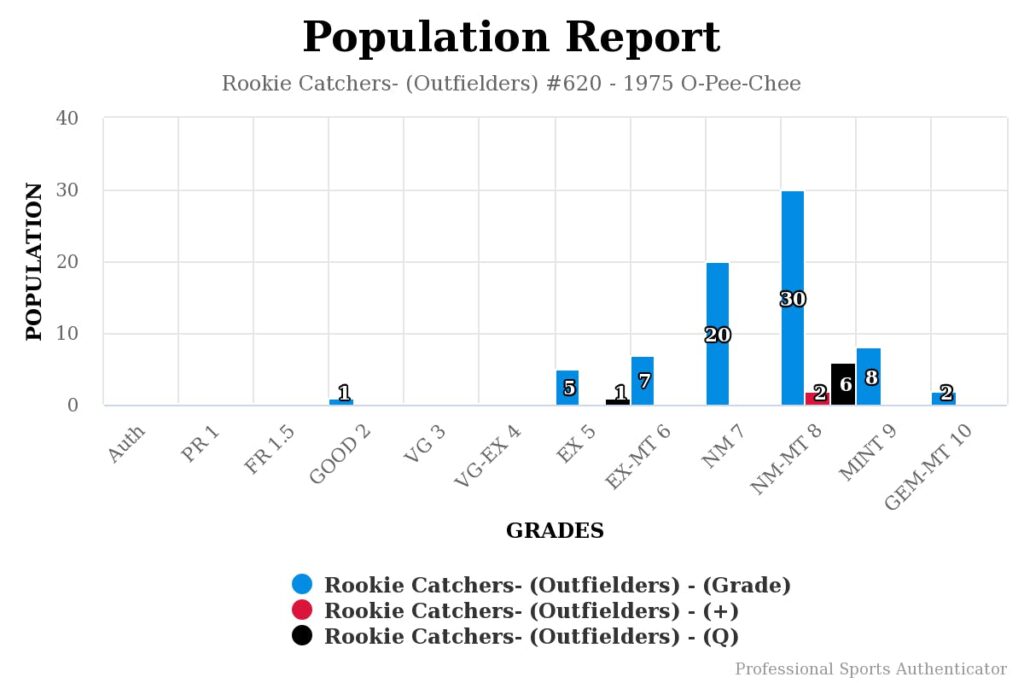

And the O-Pee-Chee:

This is one of only two PSA 10’s out of 73 submissions.

If the cards look similar, it’s because they are. O-Pee-Chee was a Canadian company that licensed Topps artwork, design, etc. Basically everything. The main difference between the two is that the OPC version is bilingual on the back.

While the OPC version is much rarer, it’s also less desirable.

Like the other basket IPO’ing today, the retained equity element here is slightly confusing (to me at least).

- $10 / share

- $3,725 shares available

- $37,250 market cap

All good so far.

But also, according to the SEC filing:The price that the seller/consignor has established for this asset is $35,000. The seller will contribute the asset to the Series in exchange for 350 Interests in the Series, which represents 10% of the agreed-upon value of the Underlying Asset. The amount set forth in the table represents 90% of the agreed-upon price ($31,500) of the asset.

And because the use of proceeds figure tots up to $37,250 with no further mention of those 350 shares, one of two things is possible:

- Total market cap is actually $37250 + $3500 = $40750, or

- The consignor is keeping 350 of the 3,725 shares listed as available

Again, I’ve reached out to Collectable for clarification and will confirm via Twitter if I hear anything back.

It IPOs on Collectable at 8pm EST 6th April 2021.

Add IPO to calendar

Cultural Relevance

Gary Carter’s career spanned nineteen years across four different teams. While he spent a couple years with the Giants and Dodgers (one of more than 200 who have sickeningly played for both), he spent most of his time with the Expos and Mets.

Carter came up clutch twice in the 1986 postseason with key singles in extra innings during both the NLCS and the World Series.

Originally a shortstop, the Expos converted him into an excellent catcher. He won three Gold Glove Awards in Montreal and had a fielding percentage comfortably over 99%.

An eleven-time All-Star, Carter is a top-ten hitting catcher ranking seventh in both home runs and RBIs. He’s fourth all time for games played by a catcher, and his 810 base runners caught stealing is still the most since the dead ball era.

His 121 WARP is second only to Johnny Bench, and he had five seasons where he was worth at least ten runs above a replacement player.

Carter was elected to the Hall of Fame on his sixth go with 78% of the vote.

Carter was a great player, but most people (and collectors) underrate him to some degree, which hurts him.

Inferred Value $30k +

[Detailed Valuation for Insiders Only]

Category Strength

The Sports Cards category had a 60% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Asset Growth TTM

Growth Outlook and Future Catalysts

There’s not much left for Gary Carter. He’s still underrated, but I’m not sure what might change that.

Asset Liquidity

This will have a roughly 90 day lockup period then will trade daily.

Platform Risk

Intangibles

He turned down a football scholarship from Notre Dame. Good on him.

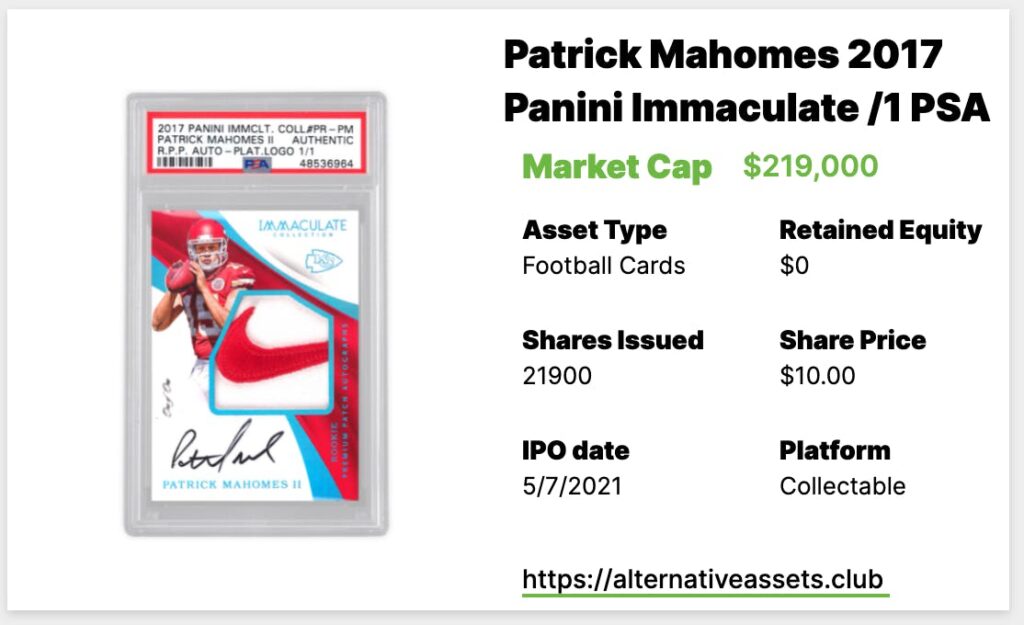

What is the Patrick Mahomes 2017 Panini Immaculate /1 PSA Auth?

This is a 1/1 rookie card for NFL quarterback Patrick Mahomes II. It features both an autograph and game-worn patch.

The card, unusually, is graded PSA AUTH rather than a numerical score. When PSA grades a card as AUTH, they give it a code to explain why. In this case, the code was N0. This is what PSA says about N0 cards:N-0 Authentic Only – This means that PSA is only certifying that the item is genuine, without a numerical grade. This may be due to the existence of an alteration, one with malice or otherwise, a major defect or the original submitter may have requested that PSA encapsulate the card without a grade. The “Authentic” label means that the item, in our opinion, is real but nothing more.

It’s worth noting a significant fraction of these Immaculate 1/1 cards were given the AUTH grade, so it might just be something to do with this type of card.

I reached out to Collectable to confirm what’s up with the card, but they’ve not yet responded. if they do, I’ll send an update via twitter.

It IPOs for $219k on Collectable 1pm EST 5/6/2021. There is no retained equity.

Add IPO to calendar

Cultural Relevance

There have been several Mahomes IPOs, so we’ve written about him quite a lot. Check out his 2020 highlights.

Inferred Value – $200k

[Detailed Valuation for Insiders Only]

Category Strength

The Sports Cards category had a 60% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Asset Growth TTM

Growth Outlook and Future Catalysts

While Mahomes obviously suffered a bit of a setback this year, he’s well on his way to being the best quarterback of his generation. He has a lot of room to run.

Asset Liquidity

This will have a roughly 90 day lockup period then will trade daily.

Platform Risk

Intangibles

I’m slightly nervous about the PSA AUTH rating. It could absolutely be nothing, but for now, I don’t know.