Read time: 6 min

October 11, 2022

New here? Read up on our past Real Estate issues to get the most from this email.

ISSUE HIGHLIGHTS:

- Yes, it’s bad. But how bad will it get?

- Where are the safe havens?

- Two investment opportunities to consider

Let’s go!

Table of Contents

Real Estate in 2022

It’s getting boring saying “things are bad” over and over again, so let’s try to re-focus on how bad they’ll get. At least that’s sort of useful (maybe).

Realtor.com put out a piece last week full of scary forecasts for the US residential real estate market.

Here are the highlights (lowlights):

The money quote

“There’s going to be a coast-to-coast downturn in the housing market. It’s going to be brutal,” says Mark Zandi, chief economist at Moody’s Analytics. “No part of the market is immune.”

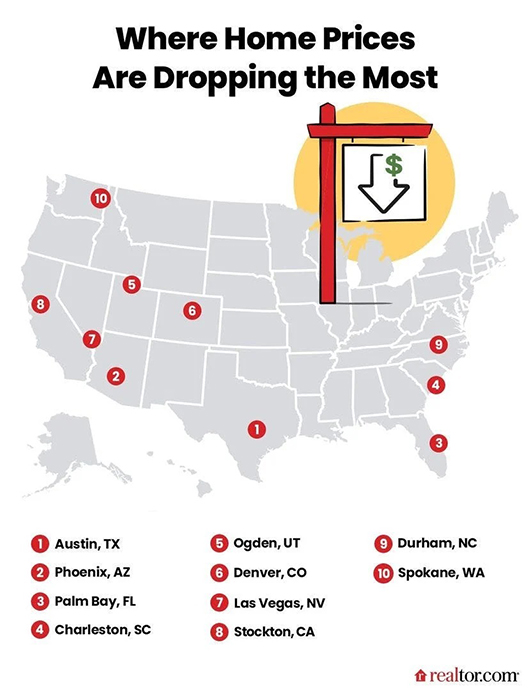

Where are things already bad?

A number of markets have already seen prices come down 8% to 10% since June.

Austin is the biggest loser so far, which makes sense. It saw a significant influx during the pandemic and has been hit hard by tech layoffs (more on that below). Durham, Stockton, Spokane, Charleston, Ogden, and Denver are in the same boat — they were all big beneficiaries of pandemic migration.

The 2008 story is repeating for Phoenix, Las Vegas, and Florida. These markets seem to always be at the forefront of real estate trends. The first to rise, and the first to crash back down.

Most of these markets climbed 25% to 35% during the pandemic, so it’s likely they’ve got room to fall farther.

The riskiest markets going forward

The most at-risk markets are metros that have seen big run-ups over the last year & that are now facing increasing unemployment:

- New York metro (incl NJ)

- Philadelphia

- New Jersey

- Inland California (e.g. Riverside)

These markets haven’t been hit as hard yet, but they’re likely to be next.

Safer geographies

The inverse is true when looking for safer locations.

The south and midwest (other than Chicago) saw smaller run-ups than their neighbors above.

They’re also less reliant on tech jobs, which have seen a swathe of layoffs in 2022.

How bad will it get?

Most experts (“experts”) are saying there’s likely to be a 10% to 20% drop across the board.

I think the top of that range is probably close to the truth.

Here’s some quick napkin math:

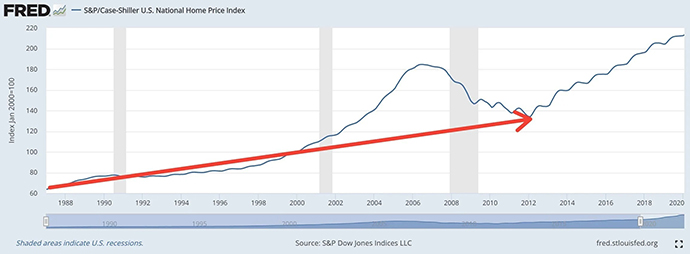

- The median US home was worth $256k in Summer 2020. It was valued at $356k in August 2022.

- Nationwide, home values have increased by around 40% over the last two years. That’s about 18% annualized, compared to historic averages of around 5%.

If the market had been “normal” the last two years, the median home would be valued at $282k today.

That implies a 21% correction is due.

That number will vary wildly depending on local geographies, but the principles remain the same, more or less:

- Find the historic growth rates.

- Adjust for new info like big employers coming to town or increased/decreased interest rates.

- Figure out what homes should be selling for.

- Profit.

Yeah, it’s overly simplistic, but buying and selling homes can be emotional. This sort of framework may help.

Opportunities this week

We’ve found two investment opportunities focusing on the southern US that either have a downturn baked in, or may be immune to it:

Cottages at Foley Farms by RealtyMogul

- Total offering: $17,186,242

- Targeted CoC: 8.4%

- Estimated Annual Appreciation (our estimate): 4.2%

- Target IRR: 12.6%

Baldwin county, Alabama, a suburb of Mobile, is one of the geographies mentioned above that didn’t see a spike in home values over the last couple of years.

- According to Redfin and Zillow data, it’s been plugging along at between 4% and 5% home appreciation per year since 2014.

- The county itself is slow and steady too, growing 2% to 3% per year since 2011.

- Rent has also been remarkably flat over the last year.

That’s the kind of boring but predictable growth I love in this market. This is also the only recent project we’ve assigned an appreciation value to.

The RealtyMogul site forecasts something closer to 8% growth per annum to arrive at their 19.2% target IRR, which we think might be a bit optimistic.

Magnolia by Here.co

- Total offering: $946,869

- Projected annual cash flow: $144,612

- Projected cash on cash (net of fees): 11.3%

There’s a lot to like about this opportunity.

The CoC isn’t as high as some other offerings in the holiday rental space, but it’s very solid, even including Here.co’s 25% management fee.

But what I like most is the price. The home was originally listed at $1,250,000, but Here.co are offering it at a 25% discount to that, even including their service fees, repair costs, etc.

The vast majority of four-bed homes listed nearby are still at $1m+, which is also reassuring. Nearby schools (often a value driver) are pretty awful, but that won’t matter for a holiday home.

The Oklahoma property market is softening for sure, but baking in a 25% decline gives me some comfort.

That’s all for this week.

Have you seen a real estate deal, fund, or opportunity you’d like to share with the community?

Cheers,

Wyatt