November 21, 2022

Read time: ± 6 minutes

Hello and welcome to Alts Cafe

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

The equities market continued to climb last week, despite ending on a slight low.

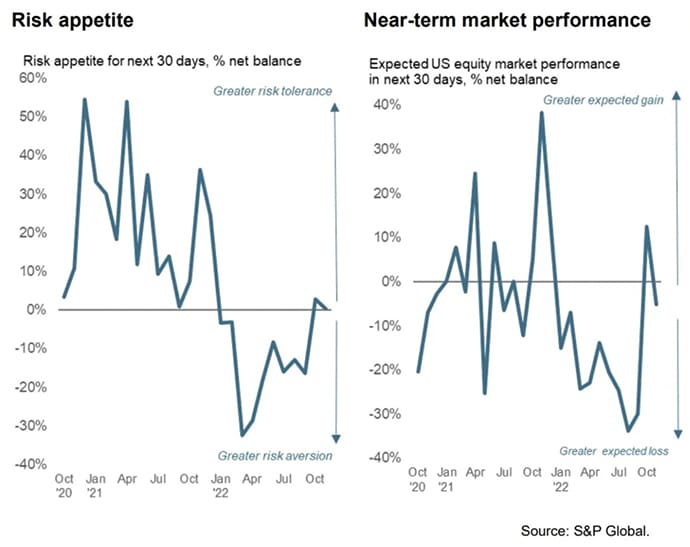

Prices are up, volatility is down, and maybe that’s why the risk trade is coming back after spending 2022 in the doldrums.

Bullish News

- Jobless claims fell again, despite tech layoffs.

- US retail sales increased 1.3% in October.

- The Atlanta Fed boosted its fourth-quarter GDP growth estimate to a 4.4% annualized rate from a 4.0% pace.

Bearish News

- The UK has its highest level of taxation since WWII, a record fall in the living standards, whilst rates are set to rise further (potentially to around 4%). Inflation just pointed above 11%.

- Production at US factories barely rose in October, and output in the prior two months was not as strong as initially thought.

- The Russian economy shrunk 4% in the third quarter, according to official estimates (DYOR).

What are we doing?

ALTS 1 fund news:

We exited a crypto stablecoin yield position and moved our existing BTC and ETH allocations to a cold wallet.

Crypto

Here’s what you need to know:

The fallout from the FTX drama continues as its contagion spreads.

Bitcoin has hit a two-year low, while Ethereum remains around 10% above its late spring nadir.

It’s looking to go lower, though.

Bullish News

- As with NFTs (below), now is a great time to buy if you believe in crypto. I’d wait until the rest of the FTX ETH is dumped on the market before buying, though.

Bearish News

- FTX CEO John Ray declares Sam Bankman-Fried’s management a “complete failure”.

- The Ethereum price has dropped by 7.5% in the past 24 hours, as proceeds from last week’s FTX ‘hack’ have begun being dumped on the market.

- Given the size of the hacker’s remaining wallet, Eth prices could easily plummet another 20% to 30%.

What to do with that info:

Some advice from last week:

Get all your crypto into a cold wallet ASAP.

Real Estate

Here’s what you need to know:

The stats are out for October, and they’re not good:

Year over year, there were 30.7% fewer closings, 36.8% more homes for sale, and the average home took nearly a week longer to sell, at 35 days on market. As a result, the Median Sales Price was pushed down 0.3% to $399,000 from September’s $400,000 – the third straight month of decline.

There are also several macro indications that the real estate market still has plenty of room to drop.

The real house price index, the house price to rent ratio, and the house price to income ratio are all expected to be higher in 2022 than they were in 2006.

Real House Price Index: 2022 > 2006

— Lance Lambert (@NewsLambert) November 17, 2022

House price to rent ratio: 2022 > 2006

House price to income ratio: 2022 > 2006

We got bubbly—again. pic.twitter.com/cLvdZk0g67

Bullish News

- Homeowners are still spending on renovations, as home equity remains at high levels. Good news for Lowe’s and Home Depot.

- The US plans to bring microchip production back to the US, which is a boon to several tech-based markets.

- There are still buyers out there — PE firms are swooping in with all-cash offers for homes worldwide.

- US mortgage rates posted the biggest drop since 1981, falling to 6.61%

Bearish News

- The iBuyer experiment has failed , and it’s devastating the SW real estate market.

- US home sales fell for 9th month in a row in October.

- U.S. homebuilding fell sharply in October, with single-family projects dropping to the lowest level in nearly 2-1/2 years.

- Homebuilder sentiment dropped to a decade low

What to do with that info:

Wait for prices in the SW to crash, then pick up the iBuyer’s scattered remains.

NFTs

Here’s what you need to know:

Everything in NFT Land is on sale right now, with loads of blue chip projects (and VeeFriends) at or near 2022 lows.

Given the price action, we’ve added that stat to the bottom of our NFT Index chart (below).

The best picks here for me are Moonbirds, Doodles, and The Currency (ALTS 1 owns a copy of the Currency).

Bullish News

- If you’re a buyer, this is a great time to buy.

Bearish News

- FTX is smash-hammering NFTs in two ways: 1) confidence in the sector is at an all-time low, and 2) the price of ETH is going to continue to fall until the hacker’s unwound his wallet.

- Ronaldo is launching an NFT.

What to do with that info:

There’s probably more room for prices to fall over the week, but keep an eye out for opportunities.

Startups

Here’s what you need to know:

While layoffs continue apace, there are green shoots out there for everything not called web3 or crypto.

I’m seeing lots of anecdotal reports that the ecosystem is healing, builders are building, and funding is dripping back in.

AI is, of course, where it’s at right now, and I see dozens of new applications for the tech launching each week. This all feels very early days. Do we really need twenty five AI-powered tools to help improve your writing? How long until Grammarly snaps up the best one or two and the rest pivot or perish?

If you’re investing in AI-powered tools, the watchword is moats.

What can this company do that no one else can? Are they a pretty face painted on top of GPT-3?

Bullish News

- Plaid is moving into payments.

- Nu Holdings, the Warren Buffett–backed Brazilian banking firm that offers credit cards and personal loans and that is more commonly known as Nubank, posted a nearly threefold jump in Q3 revenue. Nu’s total revenue in Q3 reached $1.3 billion, up 171%, while profit climbed to $427 million, up 90%.

- Revolut hit 25 million customers globally as the firm prepares to expand into new markets, including India, Mexico, Brazil, and New Zealand.

- There’s a new credit card out there for startup creators.

- US banks are going shopping for fintech startups.

Bearish News

- 72% of startup founders are affected by mental health issues.

- The global charge card market is expected to grow from $1.91 billion in 2021 to $1.96 billion in 2022 at a compound annual growth rate (CAGR) of 2.9%. The market is expected to grow to $2.04 billion in 2026 at a compound annual growth rate (CAGR) of 1%.

- RIP Evernote.

What to do with that info:

Due diligence.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – let us know.

Cheers,

Wyatt