Hello and welcome to Alts Cafe

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

The market ripped last week as inflation came in slightly below estimates.

But Fed Chairman Chris Waller warned the market had got “way out in front” post CPI, and he couldn’t stress enough that this is “one data point”, and there is a “ways to go”.

What’s more, markets should now pay attention to the “endpoint” of rate increases, not the pace of each move, and that endpoint is likely still “a ways off.”

Despite the US midterm elections, Meta sacking 11k people, Elon’s slow-motion meltdown on Twitter, and a ripping market, FTX sucked all the oxygen out of the news cycle last week.

So here’s a heartwarming video of Kherson’s liberation in Ukraine to add a bit of perspective.

Bullish News

- The consumer price index increased 0.4% for the month and 7.7% from a year ago, both lower than estimates.

- American President Joe Biden and Xi Jinping, General Secretary of the Chinese Communist Party, met today ahead of the G20 Summit in Bali.

- Ukraine liberated occupied Kherson in what’s been called a strategic disaster for Russian President Vladimir Putin.

Bearish News

- Chinese producer prices dropped more than 1% in October, while inflation there slowed to a five-month low.

What are we doing?

ALTS 1 fund news:

Nothing new this week.

Crypto

Here’s what you need to know:

It’s been a rotten, horrible, no-good week for crypto as FTX imploded, taking $10b with it.

I’m not going to recap it here because that’s been done to death. But:

- Here’s what our CEO Stefan had to say.

- Here’s a good run-down of events (so far).

- This is now the #1 biggest crypto scam of all time

Bullish News

- Ethereum turned deflationary.

- Crypto.com CEO Kris Marszalek says that they’ll be publishing “its audited proof of reserves.” No word about liabilities, though.

Bearish News

- The US midterms are still somewhat up in the air, but if the Democrats take the House, crypto regulation may finally get sorted out in 2023. There are already calls for an inquiry into FTX.

- BlockFi suspended withdrawals amid worries of FTX contagion.

- CoinBase cut more jobs.

- A deep dive into wallet activity on Crypto.com doesn’t look good. But don’t worry, Crypto.com CEO Kris Marszalek says it’s fine.

What to do with that info:

Get all your crypto into a cold wallet ASAP.

Real Estate

Here’s what you need to know:

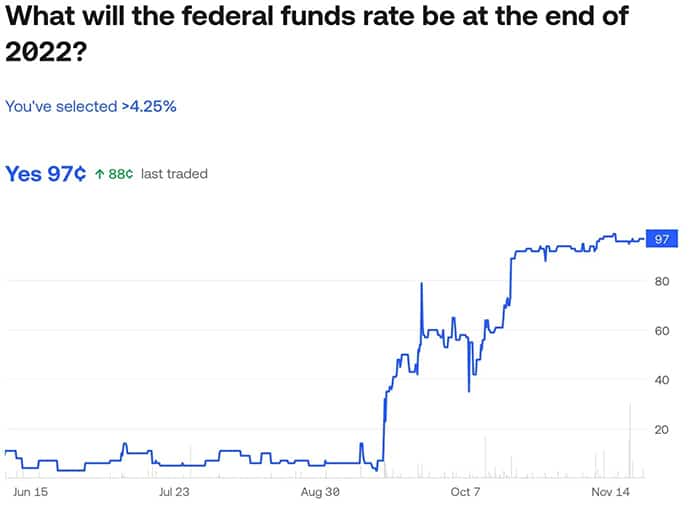

Prediction markets estimate a 97% chance of a 50bps+ hike at the next Fed meeting, but only a 38% chance mortgage rates will climb above 7.5% by the end of the year.

Markets are also giving a 33% chance of less than 2% inflation in November, which feels optimistic.

Bullish News

- Mortgage rates fell sharply on Thursday after CPI came in lower than expected.

- South Korea is launching a $7b real estate bailout.

- Chinese property developers’ share prices surged on Wednesday after regulators forced second-tier banks to lend out an additional $56B. Short term bullish… long term???

Bearish News

- WeWork is still super unprofitable.

- Redfin laid off 13% of its staff and closed its home-flipping business.

What to do with that info:

Look for yield.

NFTs

Here’s what you need to know:

The FTX meltdown last week throttled NFTs partly because people lost a lot of money and partly because the two markets are super correlated.

Nearly five months’ worth of gains were wiped out last week, and there’s no sign of the decline slowing down.

It could get ugly.

Bullish News

- Lots of the biggest titles in the Web3 gaming space have seen increases in the number of unique active wallets (UAW) interacting with their dapps, compared to last week.

Bearish News

- FTX.

What to do with that info:

If you believe in NFTs long-term, we’re looking at five-month lows here.

Startups

Here’s what you need to know:

That sucking sound you’re hearing is the sound of every dev who joined a web3 company in the last two years sprinting toward the nearest AI startup.

Azeem Azhar summed up the implications of FTX nicely in his newsletter this week:

For tech crypto, it’ll turn off the money spigot for now. Many developers will find themselves much poorer. More parsimonious management will be required to get to product-market fit. It might be that the enforced discipline will finally lead to the development of useful services.

If you’re a VC or Angel investor, by how much have you written down your web3 investments this year? This week?

Bullish News

- Sequoia thinks generative AI can be a trillion-dollar industry (I agree).

Bearish News

- AI & machine learning semiconductor startups outside of China saw a 69% decline of VC funding this year.

- Meta laid off 11k people, and Zuck’s headset is shitty.

- PE and VC strategies lost an average of 3.2% and 2.3%, respectively in Q2.

- The Bank of Mexico hiked rates by 75 bps to a record 10% and hinted at future hikes.

- Electric vehicle startup Arrival SA warned on Tuesday it may not have enough cash to keep its business going towards the end of next year.

- SoftBank’s Vision Fund reported a $7.2 billion loss in Q2 and will write down its entire $100m stake in FTX to zero.

What to do with that info:

Get a job in AI.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – let us know.

Cheers,

Wyatt